MY OPINION OF SCGM

Just88

Publish date: Sun, 18 Feb 2024, 01:56 PM

The New SCGM

After disposing off plastic business to the Japanese, SCGM becomes a PN16 Cash company with a cash pile of around RM120 millions sitting in a designated bank account. Under the listing rules, SCGM has to regularise its operation within 12 months or face delisting and cash pile returned to shareholders. SC has approved 6 months extension to 1st March 2024. I believe SCGM will apply for another 6 months extension to complete the acquisition of Eramas group, a coconut products producer.

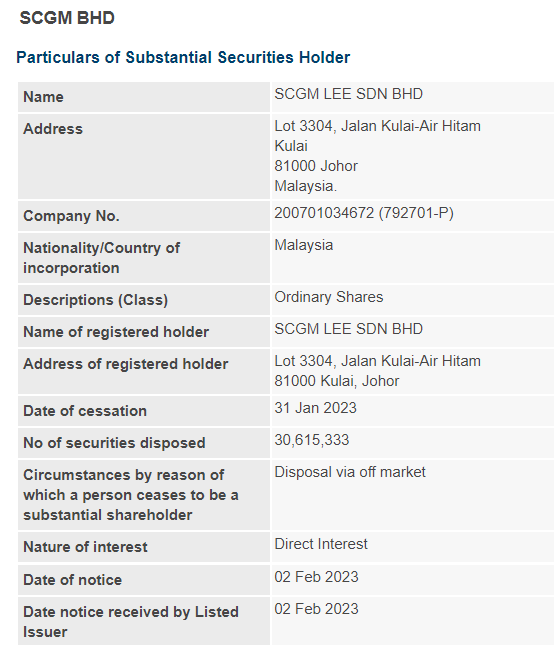

After distribution of RM2.21 per share to its shareholders, SCGM's largest controlling shareholder, SCGM LEE SDN BHD, sold its shareholding of around 31 millions shares to Chin Kok Tian and wife at RM0.65 per share which is 3 cents above its Net asset value. In other words, the listing status of SCGM was sold for merely RM5.7 millions.

The edge has earlier reported that a clean main board company's listing status can fetch a market price ranging from RM30 to RM60 million ( https://theedgemalaysia.com/node/680426 ).

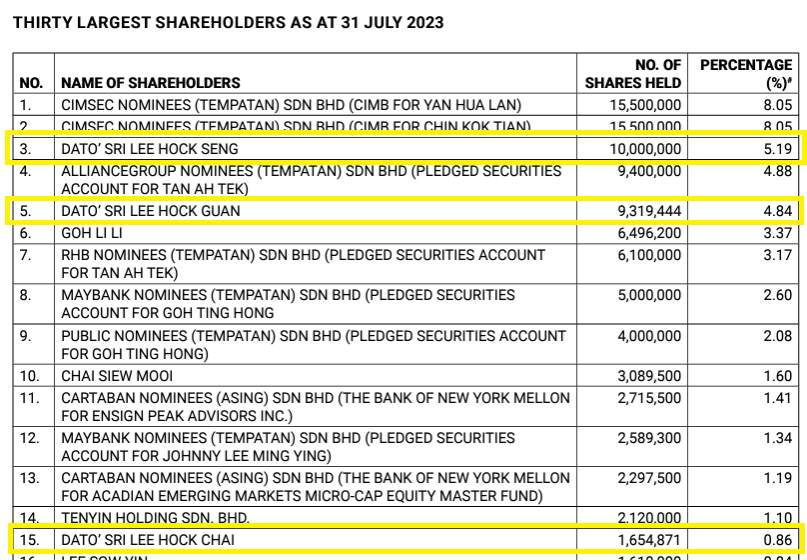

Why is Dato Sri Lee hock seng willing to let go the company he founded at such a low price and yet retained 5.19% stake in the company. His brothers Dato Sri Lee hock Guan and Dato Sri Lee hock chai also retained 4.88% and 0.86% respectively ?

Founders giving up control and retain a minority stake is a very unusual case in the Malaysian corporate market. One of the logical explanation is that the founders acknowledge the management and leadership of the new shareholders and see the future potential of the new businesses. Hence, lowered the asking price to attract the acquiree company and negotiated to retain a minority stake in the company.

The entry of new major shareholders has attracted other new significant shareholders such as Goh Ting Hong, Goh Li Li, as well as foreign shareholders Ensign Peak Advisors Inc and Acadian Emerging Market Micro-Cap Equity Master Fund.

To qualify for reverse take over or back door listing, SC stipulates that the applicant needs to have an uninterrupted profit of three to five full financial years, with an aggregate after-tax profit of at least RM20 million as well as an after-tax profit of at least RM6 million in the most recent financial year. Therefore, SCGM will see immediate profit contribution of at least RM6 millions from the new assets injected. This will benefit the existing shareholders of SCGM.

Please tell me your opinion.

Thank you.

Just88

*** I do own the stock. This is not a buy call and buy at your own risk.

Alibone

Just88, thanks for sharing.

2024-02-18 19:26