Is bailout needed for Sapura: Anti-graft NGO, netizens say flat out no!

savemalaysia

Publish date: Sun, 15 May 2022, 07:36 PM

WITH the debate raging over whether embattled Sapura Energy Bhd (SEB) should be bailed out or not, several netizens took to Twitter to exchange ideas on how to go about it.

While many offered several ideas on how to resolve the problem, most of them agreed on one thing; no bailouts!

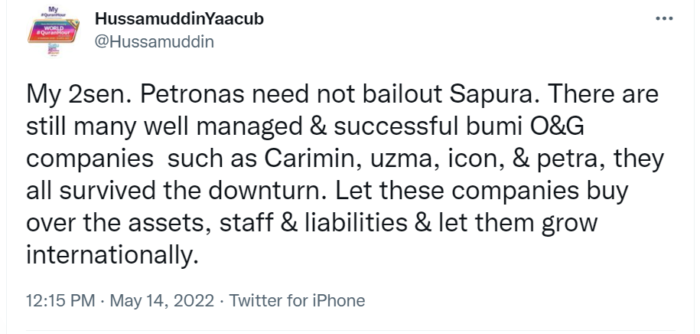

Leading the conversation was anti-graft NGO, Rasuah Busters founder Datuk Hussamuddin Yaacub who said that there is no need to bailout SEB as there are many other successful bumiputera-owned oil and gas (O&G) companies in the country.

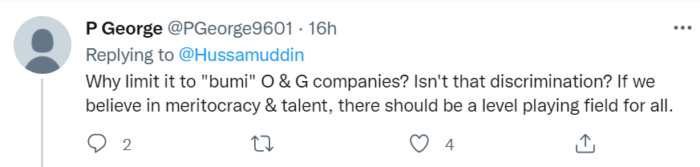

His statement then prompted a question from user George, who asked why bailouts were being “reserved” for bumiputera O&G companies alone, which reeks discrimination.

To that, Hussamuddin replied: “I mentioned bumi companies, bcos The narrative was calling petronas to bail out the bumi company. Thus my suggestion. Nothing more.”

However, George continued that despite whatever being said, the elites are continuing with the narrative and questioned when one should draw the line when it comes to bailout.

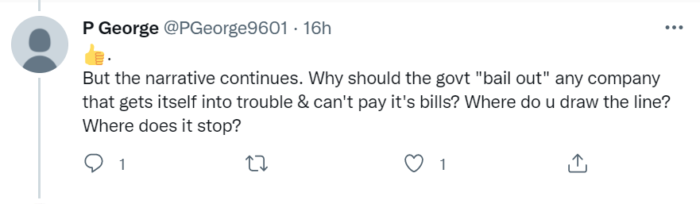

Replying to George, Hussamuddin quipped:

On May 12, former prime minister Datuk Seri Najib Tun Razak suggested for Petronas to acquire SEB to avoid the company from being declared insolvent.

He added that Petronas has the expertise to revitalise the company. The Pekan MP also mooted for SEB to be given a Government-guaranteed bank loan.

“After Petronas has acquired SEB, the national oil company can guarantee its RM7 bil worth of contract and resolve it, in addition to providing a solid working capital for the O&G company.

“Once SEB has been rejuvenated, Petronas can sell it off. When that happens, Petronas and Amanah Saham Bumiputera will benefit,” Najib said, during a debate with Opposition Leader Datuk Seri Anwar Ibrahim.

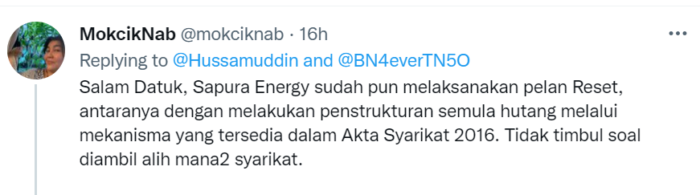

On that note, user Mokcik Nab said that SEB does not need a bailout as its group CEO Datuk Anuar Taib himself had told Berita Harian, in an interview in April, that the company was embarking on a “reset plan”.

(Greetings, Datuk. SEB is already working on its “reset plan”. Among others, it is restructuring its loans through means made available through the Companies Act 2016. So, why are we still talking about bailouts?)

Mokcik Nab continued:

Why treat Petronas like personal piggy-bank?

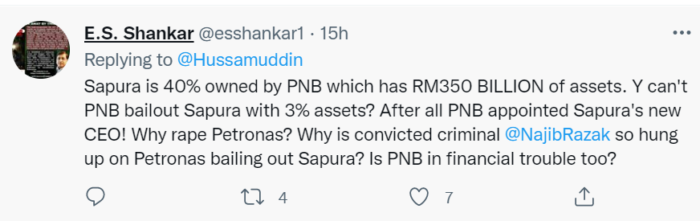

User ES Shankar questioned on why Najib was seeking Petronas to help SEB, given that Permodalan Nasional Bhd (PNB) owns 40% shares of the beleaguered company.

“Sapura is 40% owned by PNB which has RM350 BILLION of assets. Y can’t PNB bailout Sapura with 3% assets? After all PNB appointed Sapura’s new CEO! Why rape Petronas? Why is convicted criminal @NajibRazak so hung up on Petronas bailing out Sapura? Is PNB in financial trouble too?”

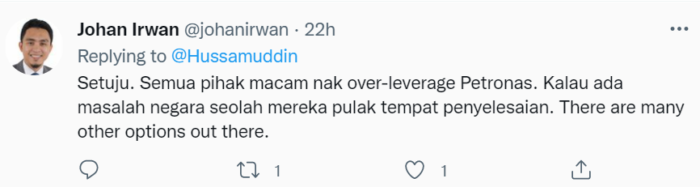

Netizen Johan Irwan remarked:

(I agree. Everyone wants to over-leverage on Petronas. Every time there is problem, they seek Petronas. There are many other options out there) – May 15, 2022

https://focusmalaysia.my/is-bailout-needed-for-sapura-anti-graft-ngo-netizens-say-flat-out-no/

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on save malaysia!

Created by savemalaysia | Aug 26, 2024

Created by savemalaysia | Aug 26, 2024

Created by savemalaysia | Aug 26, 2024

Created by savemalaysia | Aug 26, 2024

Created by savemalaysia | Aug 26, 2024

Created by savemalaysia | Aug 26, 2024

Created by savemalaysia | Aug 26, 2024

Created by savemalaysia | Aug 26, 2024

Created by savemalaysia | Aug 26, 2024

Discussions

u say No, but market reaction is Yes to bailout

just look at Sapnrg, up 78%. Action speaks louder than Words.

2022-05-17 14:43

Integrity. Intelligent. Industrious. 3iii (iiinvestsmart)$€£¥

It is wonderful to have local companies that are profitable. They contribute to nation building and certainly to the tax revenues of our country.

Very sad to see companies that are not run well and losing money. Doubly sad when they have to be bailed by public money.

2022-05-17 20:18

.png)

henry888

Definitely 'no' to bail out Sapura. This is a endless rescue with "bottom less" debt albeit the crude oil prices is in its highest ever in the history whilst the company is unable to attain a positive returns.

2022-05-16 08:34