VIVOCOM: INTRINSIC VALUE

seejovin

Publish date: Mon, 01 Mar 2021, 02:39 PM

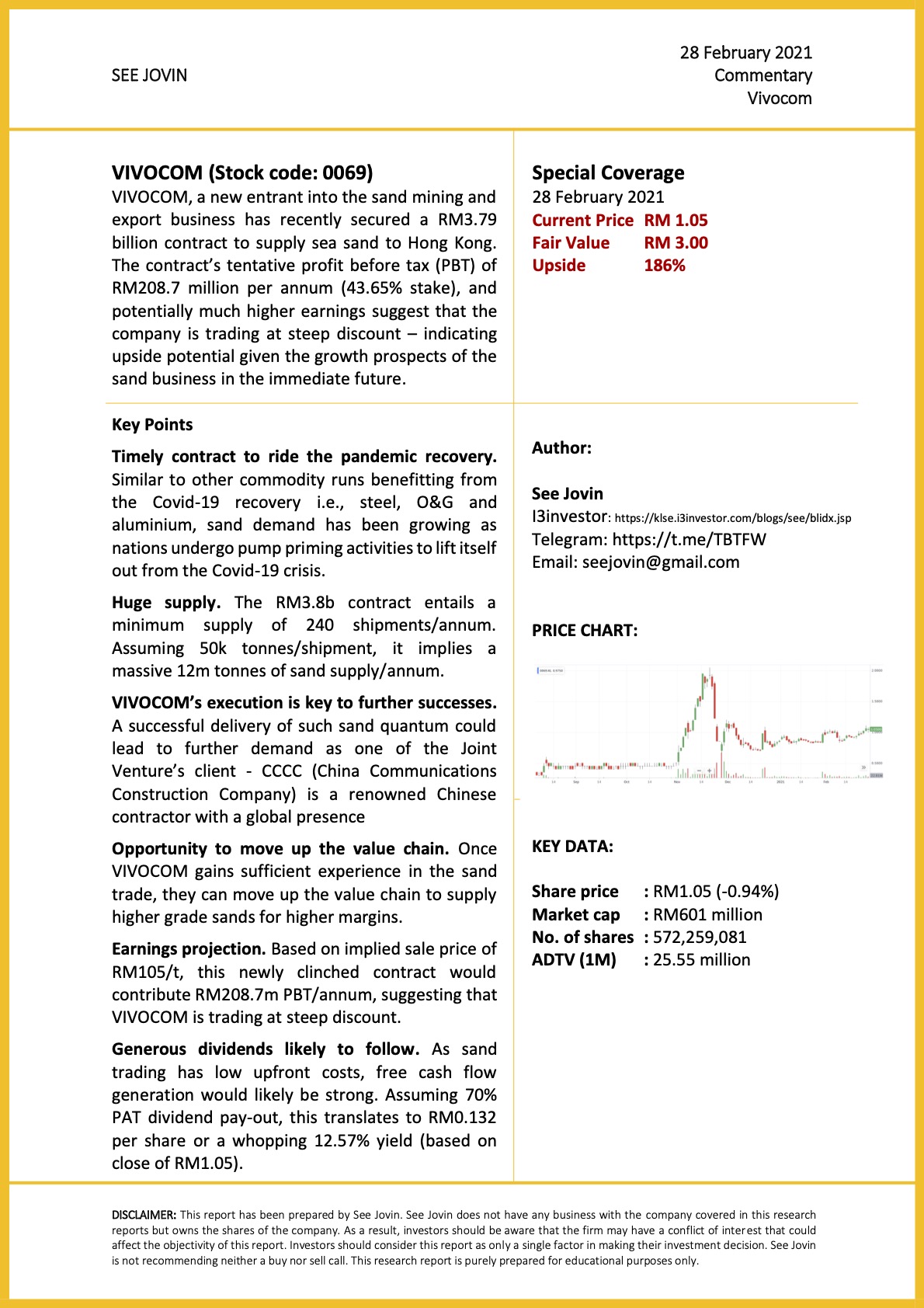

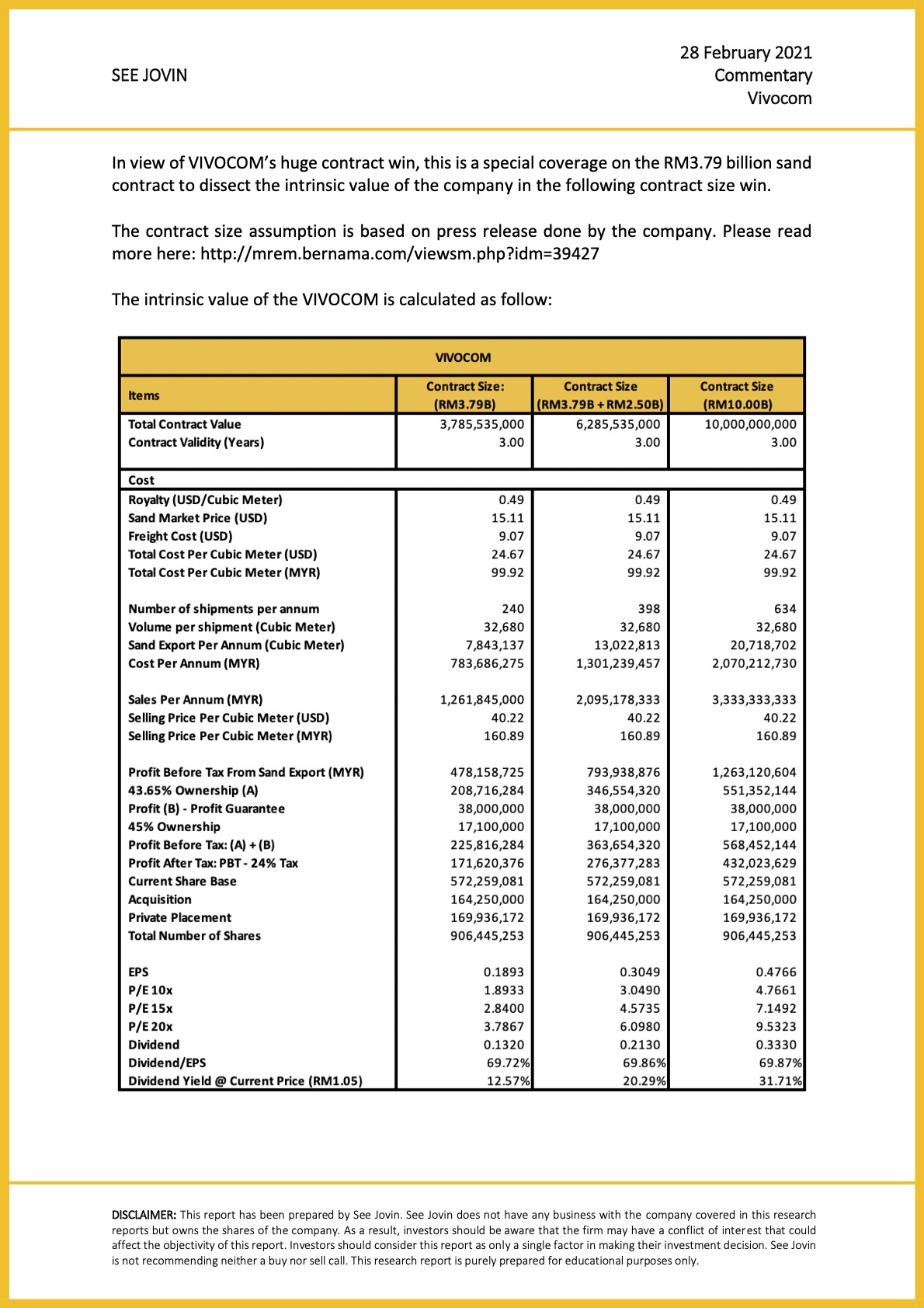

VIVOCOM, a new entrant into the sand mining and export business has recently secured a RM3.79 billion contract to supply sea sand to Hong Kong. The contract’s tentative profit before tax (PBT) of RM208.7 million per annum (43.65% stake), and potentially much higher earnings suggest that the company is trading at steep discount – indicating upside potential given the growth prospects of the sand business in the immediate future.

SEE JOVIN

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on See Jovin

Created by seejovin | Dec 02, 2020

Discussions

Vivocom got AP already? I heard few years back one company also awarded huge sand project, but ultimately talked kok only after they didn’t get sand export AP..... lol

2021-03-02 00:01

TFP Solutions volume surged to new high this year as investors pour in

Shares in ACE Market-listed TFP Solutions Bhd have been gaining traction among investors, with their price rising over 50% in the last 3 weeks

The share price, which has consolidated from its earlier high of 25.5 sen in Jan 5 earlier this year, gained 17% to close at 20.5 sen in March 2 along with a significant rise in volume of 144 million shares traded, which is its highest this year

2021-03-02 18:39

Haha this report very funny. Include the fengsui of ceo face. Brilliant. No one can come out this kind of report other than seejovin

2021-03-02 21:27

First enlarge the company shares than shrink the shares , a lot of investors lost money loh! beware!

2021-03-03 10:13

harvey0909

welcum bek

2021-03-01 14:55