See Jovin

VIVOCOM: V-SHAPE RECOVERY, REBOUND, RESURGENCE

seejovin

Publish date: Sat, 05 Dec 2020, 04:09 PM

This will be my last post on Vivocom on a twice a day basis because to continue to do so a daily basis is just too time consuming and mentally exhausting to the extent that I have not been home to see my family now for over a month.

My mentor once said to me that to pursue one’s hobby or passion, one must love it and run it at one’s free time and leisure.

One must be mindful and not let one’s passion or hobby RUNS ONE’S LIFE.

Otherwise it becomes an obsession and no more fun and joy.

Another reason is also simply because I respect all the technical traders out there too much and believe they’re better at their own analysis and so they should do their charts reading independently and trust their own drawings.

Whilst all my past articles have been based purely on my TA charting and the comments I have shared were based on my past experiences and intuitions as a trader, and even though the substance of what I have expounded are 99.9% correct I must admit the timing have not been so flawless and accurate. It’s shows that I’m only human and that the market is always more right than any EW chart reading or TA.

Timing is everything in trading and investing so I have decided that this will be the last post that I shall share on Vivocom on a twice a day basis. Phew looking back I wondered about the super human efforts I have mustered to do that, haha.

Nonetheless I wish to point out and emphasise that Vivocom is still a stock worth betting on for the long term.

The SuperBull is still there and raring to Rally again. It will storm through the gates and soar again when you least expect it.

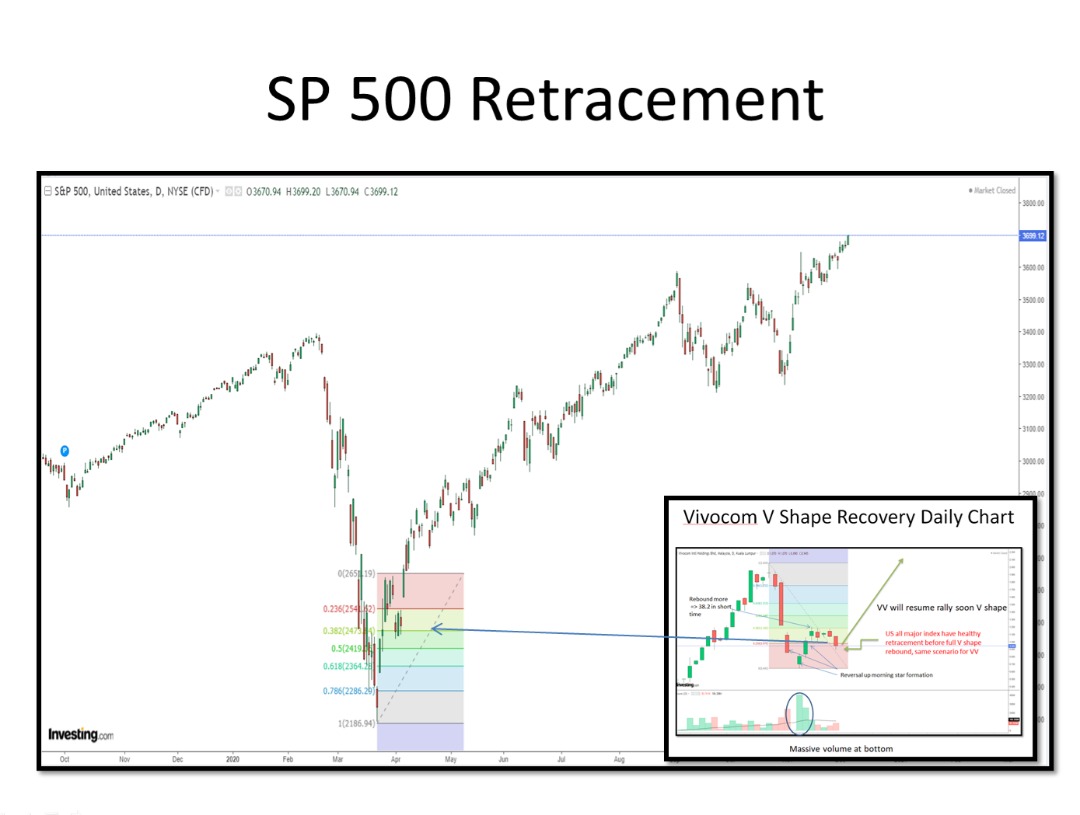

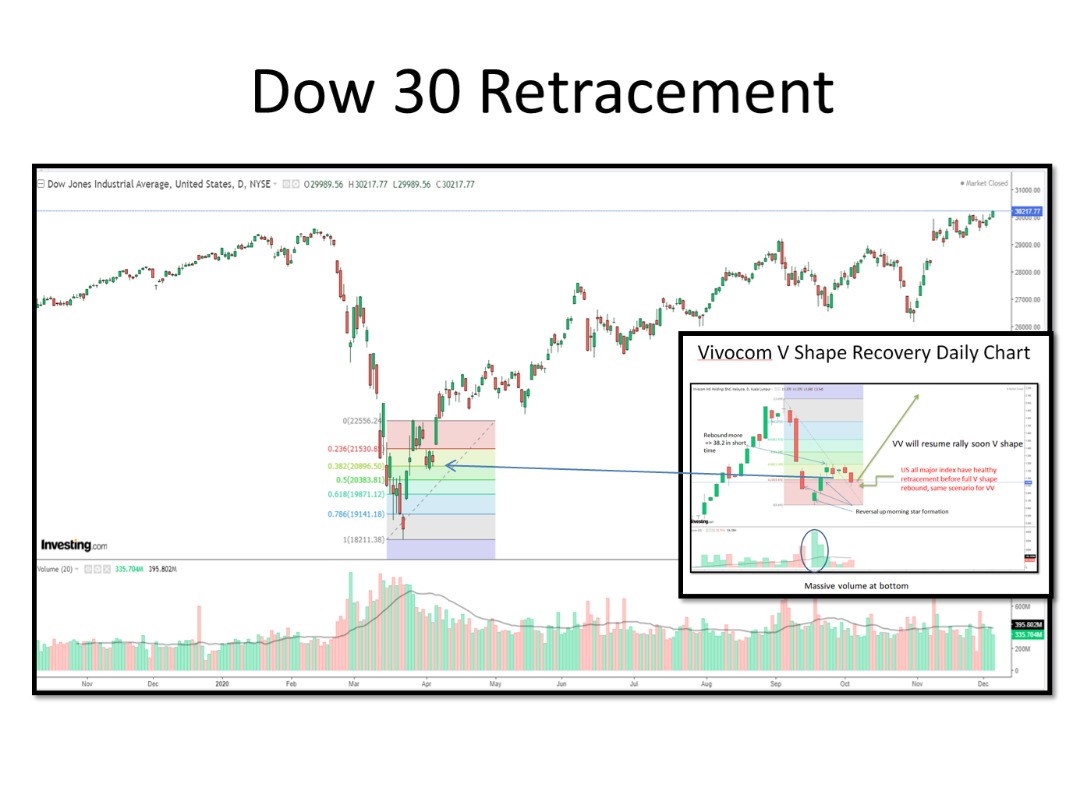

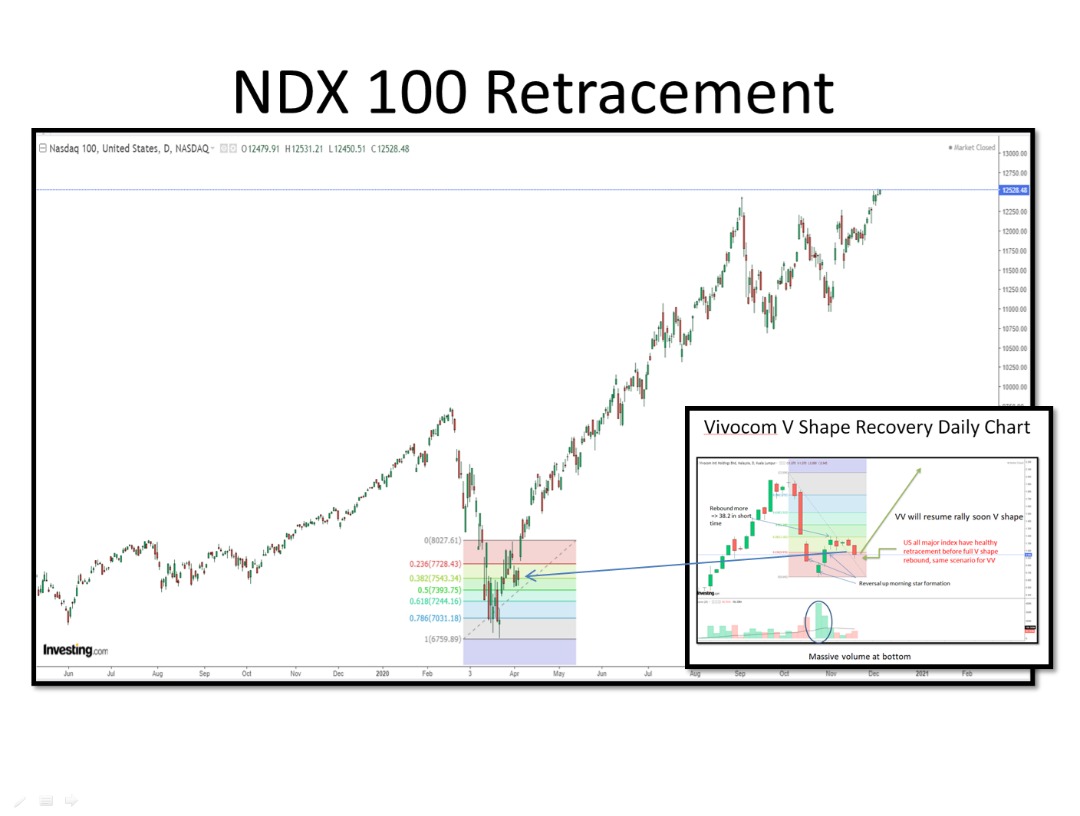

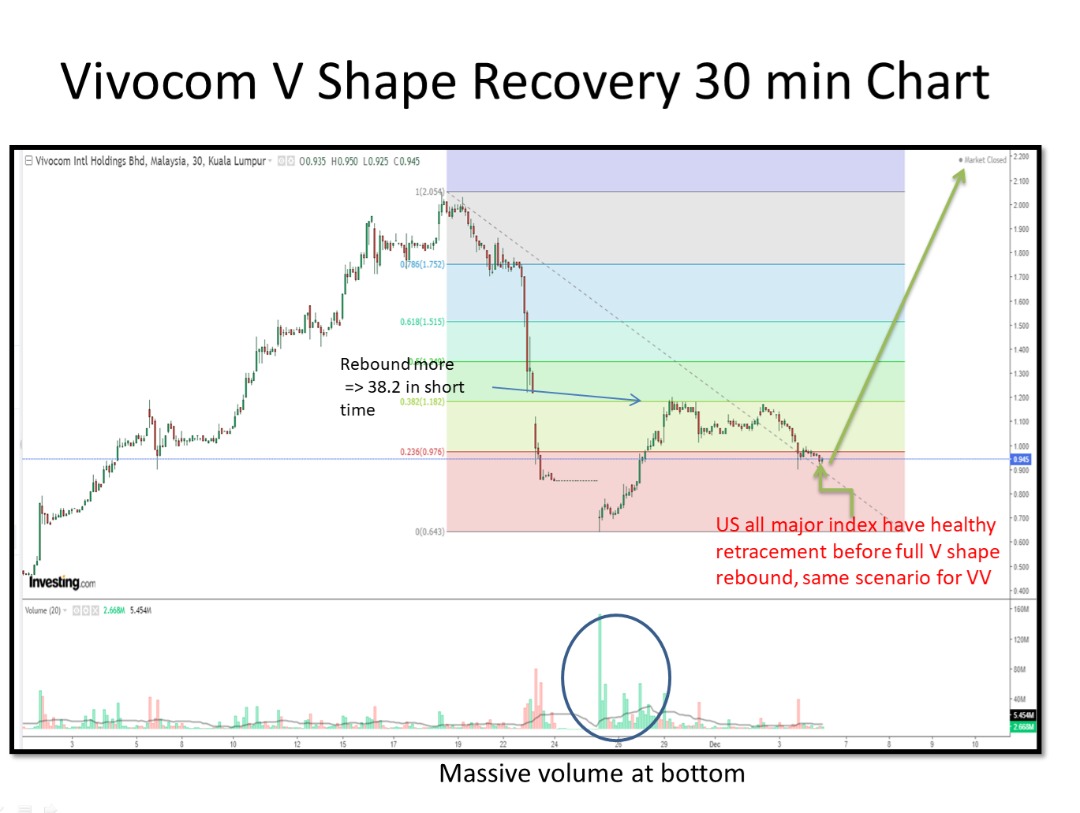

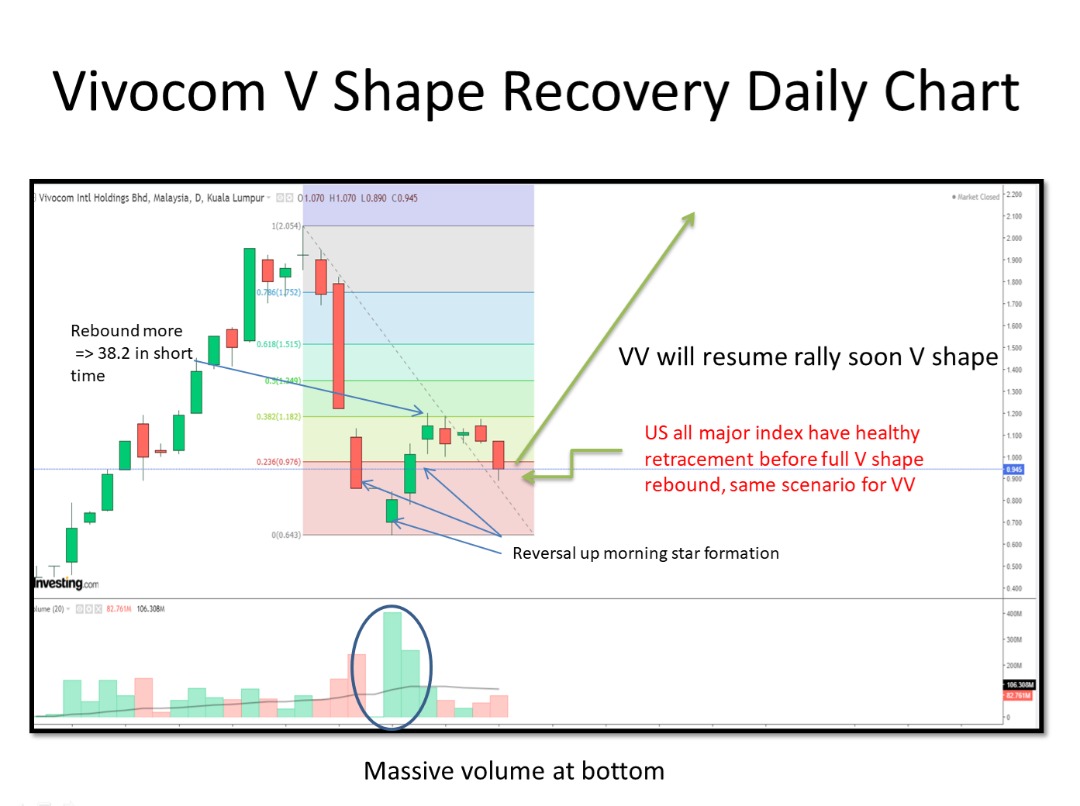

I have reproduced below four charts to show that despite its recent few days retracements, the V-Shape Recovery of Vivocom is still very much alive and healthy.

The V-Shape Recovery is still ongoing as you can see the close similarities in the 4 charts - SP500, Dow Jones, NDX and Vivocom.

Vivocom I must stress again is truly a pure market driven momentum stock. It was pure market momentum which drove Vivocom share price to its peak at RM2.05, so again it will be the same pure market forces which will restore it back to RM2.00 and beyond when it sees fit and when all the Stars align for it to do so.

The Masses simply refuse to be rushed or bullied and be dictated to by any outside artificial forces. It will pick its own time and pace, but there’s no doubt in my mind it will happen again despite all the naysayers.

Vivocom is definitely not a Pump & Dump play as its trade velocities and tremendous liquidities are too perfect to be orchestrated by any artificial interferences or manipulations.

Vivocom has an average trading range of 16c to 20c with a beta of 4.6 times higher volatility than the average Bursa Malaysia stocks.

As a result it’s a favourite of day traders, remisiers, PDTs, IVTs, technical traders, contra players, punters, speculators, gamblers, opportunist investors and even share operators who likes its wide and even wild swings of several times within a day whereby they can enter and exit with ease to make a fast quid.

In my honest humble opinion and with the highest of respect to all, Vivocom is most certainly not a Pump & Dump play because the recent Limit Downs were self induced by weak players who panic sold their shares and created a snow balling effect which consequently turned into wholesale panic selling.

Unlike other Pump & Dump plays where its share prices were artificially pumped up and subsequently dumped by insiders.

In the instance of Vivocom, it actually proved the might of the Masses which when it turned against you for the sole purpose of profits taking it can be so ruthless and merciless.

Because a Pump & Dump play would be game over by now, yet Vivocom’s stunning turn around with its V-Shape Recovery is still very alive and healthy kicking, raring to surge again when the time is right for the Masses or pure Market forces to show its magical power and might to drive Vivocom’s shares back to its November’s high of RM2.05 or higher.

Like I said at the outset this will be my last post on a daily basis but I will still continue to track Vivocom and should I detect anything exciting and interesting about the share, I promise you I will most definitely share my reading with you.

I want my life back and run my hobby or passion at my own pace and leisure. And not let my passion RUN MY LIFE, where I don’t even have time to go see my family or go for a leisurely run to unwind. Does it make sense to you haha.

Well I miss my mom and she has been asking me when I can go home to see her, next weekend I have promised her haha. Because this weekend I still have some unfinished Vivocom report to attend to such as this present one. You think so easy to write reports aar...

So until the next time, here are the technical highlights for Vivocom’s shares :-

1. V shape rebound still intact ? Looking at and comparing all the charts, absolutely without a shadow of doubt.

2. I believed many traders and investor were faced with huge capital loss early this year when US market (Dow30, NDX100 & SP500) crashed down starting from 20/2/2020 to 23/3/2020.

3.Many were talking about V, L, W shape rebound. At the material time I had no position on either US and Malaysia market, reason was I was still monitoring and waiting for the index price action developments

4.I started to Enter back into the market aggressively only when US Market major index showed evidence of a V shape rebound and many of my friends took smarter action and partook in the V shape rebound/retracement period much earlier.

5.Below is the US’s market index and Vivocom V shape Recovery pattern criteria

A. Massive volume traded at the bottoming, such as buying sizzling.

B. Formed morning star candle stick pattern,

C. Continue formed 3 bullish candle/3 white candle/solders

D. Rebound more => 38.2% of the sell down without any retracement.

E. After reaching 38.2% and retracement take place which allowed smart investors better entry level

These are all present in Vivocom’s DNA and V-Shape Recovery Charts. Only the timing I shall leave it to you to decide for yourselves.

Vivocom, The SuperBull Still Very Much Healthy & Alive, Raring To Rally Again To Its November’s Peak RM2.05 or higher.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on See Jovin

Vivocom’s Steady and Calm Rally to RM1.12 Today. Will It Surge to Break RM1.22 Soon?

Created by seejovin | Dec 02, 2020

CUTLOSS

1.22 where? If not CL bigger loss?

2020-12-07 11:59