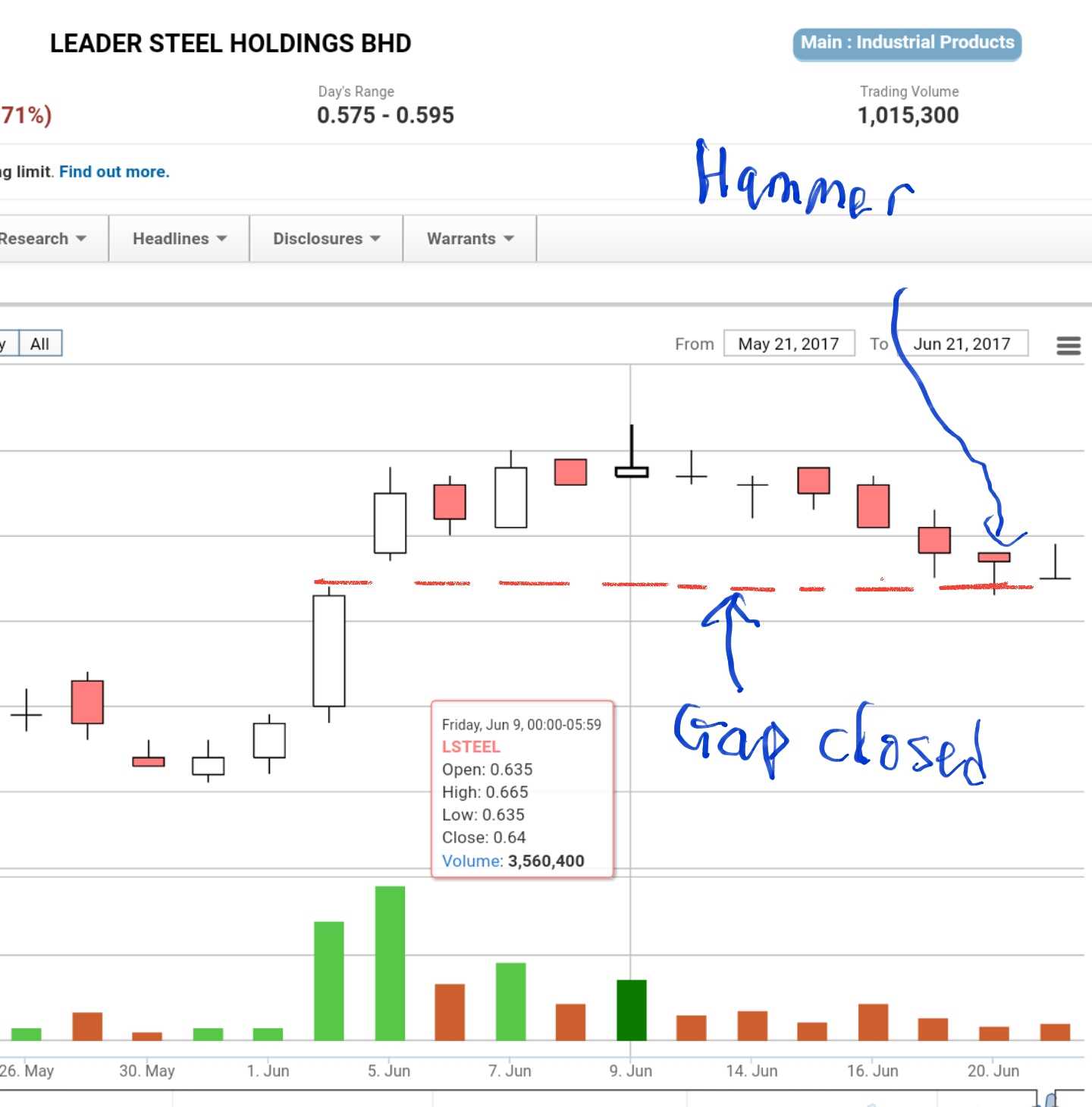

LSteel 9881- Hammer and Gap Closing Pattern

bali

Publish date: Wed, 21 Jun 2017, 10:26 PM

LSteel price has been running side way since break out from 0.53 sen level, on 20-6-17, a significant technical analysis has been formed which signal the bullish reversal candlestick pattern. A hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies later in the day to close either above or near its opening price. This pattern forms a hammer-shaped candlestick, in which the body is at least half the size of the tail.

A hammer occurs after Lsteel price has been declining trend, Hammers are most effective when they are preceded by at least three or more consecutive declining candles, possibly suggesting the market is attempting to determine a bottom and simply indicates that the bulls are strengthening. The true confirmation of the hammer candle can only be made when the very next proceeding candle closes with a higher low than the hammer candle.

A Gap occurs when Lsteel price breakout at 3/6/17. The gap is being filled on 20-6-17. A gap closing mean the continuation of previous uptrend pattern shall persist, this shall further stiffer the further upside of Lsteel price in near future.

We shall continue monitor the price movement for the next few days

Bali

21/6/17

More articles on sharenews

Created by bali | Apr 30, 2021

davkitz

Any indication for today's closing? 22 June 2017

2017-06-22 17:08