Why Steel Stock prices are rising? Koon Yew Yin

bali

Publish date: Thu, 06 May 2021, 02:25 PM

Uncle is start observing the Steel Counter especially Flat Steel company, Steel company for flat steel category not yet touch by Uncle KYY will be Tashin, Prestar, Leader Steel, Eonmetal and Choo Bee.

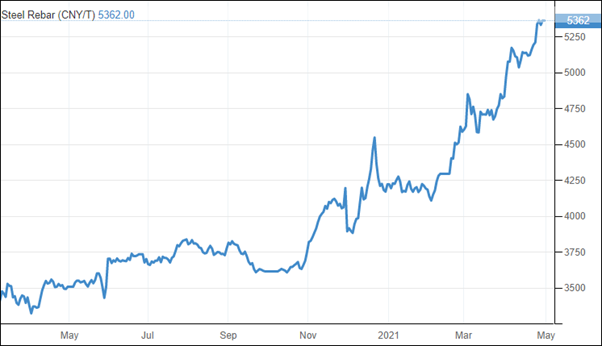

China is the biggest steel producer in the world. Since China wants to reduce the use of coal to reduce air pollution, it has reduced steel production. As a result, the price of steel has been going up as shown on the price chart below. It has gone up about 50% in the last 12 months.

All the steel products makers will benefit because their steel stocks and manufactured goods have also gone up in price. That is why all the steel stock prices have been going up.

Profit growth prospect

Among all the stock selection criteria such as NTA, dividend yield, cashflow, EPS, PE ratio, debt or healthy accounts etc, profit growth prospect is the most powerful catalyst to move stock price.

When a company reports increased profit, its stock price should go up. That is why all the steel stock prices are going up.

|

Name |

Price |

Latest EPS |

4 X EPS |

PE |

|

Leon Fuat |

Rm 1.20 |

5.84 sen |

23.4 sen |

5.1 |

|

Hiap Teck |

66 sen |

2.21 sen |

8.84 sen |

7.5 |

|

Melawa |

71.5 sen |

3.21 sen |

12.8 sen |

5.6 |

|

CSC Steel |

Rm 1.90 |

5.80 sen |

23.2 sen |

8.2 |

|

Astino |

Rm 1.66 |

6.34 sen |

25.4 sen |

6.5 |

Leon Fuat Bhd

The table above is a comparison of steel stocks. Leon Fuat is the cheapest in term of PE ratio.

Leon Fuat Bhd is engaged in the provision of management services through its subsidiaries. It operates through three segments: Trading of Steel Products, Processing of Steel Products, and Others. It mainly involves in the buying and selling of flat and long steel products and also offers value-added services to flat and long steel products in the form of cutting, levelling, shearing, profiling, bending, and finishing as well as production of expanded metal and Other segment includes steel materials such as tool steel and non-ferrous metal products such as bronze, brass, aluminium, and copper. It operates in two geographical areas; Malaysia and Republic of Singapore. The majority of the company's revenue is derived from the Trading of Steel Products and Processing of Steel Products.

More articles on sharenews

Created by bali | Apr 30, 2021

ahbah

All steel counters are gold mine counters now !

Sapu kuat kuat !

2021-05-06 14:44