THE TRIPPLE SUPER BULL ON THIS GLOVE!!!

sparta

Publish date: Mon, 12 Oct 2020, 03:25 AM

LETS JOIN KIM'S STOCKWATCH GROUP?

DATE : 12 October 2020

Hello, sorry to those asking me why did'nt come again blog lately. So now, I think the right time to comeback and look foward to Glove Sector. Which is my Top Pick's Top Glove.

WHAT I WANT TO SAY?

TOP GLOVE WILL FLYING TOMORROW!!

"I have no doubt after 3 month went through more details on this ship. I did called my crew to onboard. Lets see tomorrow to SKYROCKET!!!"

"Do you believe it?

"From my perspective view in a long-term. With Covid-19 flash point still happening around the globe, I believe Top Glove will continue to do well and amazing skyrocket!!!"

The escalation in Covid-19 cases worldwide is not show any signs of abating. Furthermore without concrete vaccine timeline, demand for gloves should sustain.

I would like to highlight my 3 facts, which it will boost Top Glove :

1. NO SIGN OF SLOWDOWN AND IT'S SKYROCKETING! (GOING TO 50M GLOBAL)

- The US hit a two-month high in new infections on Friday with over 58,000 new cases reported and ten of the 50 states reporting record day-on-day rises.

- Brazil surpassed the grim milestone of 150,000 coronavirus deaths on Saturday.

- Europe records 100,000 daily coronavirus cases for first time.

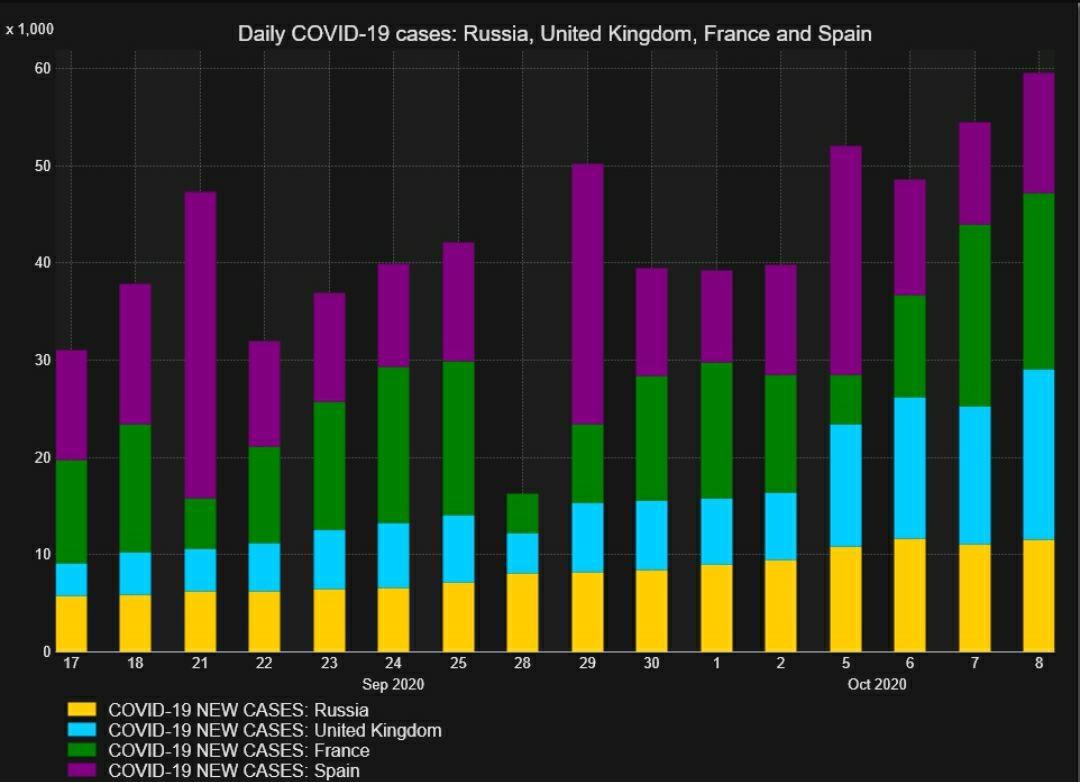

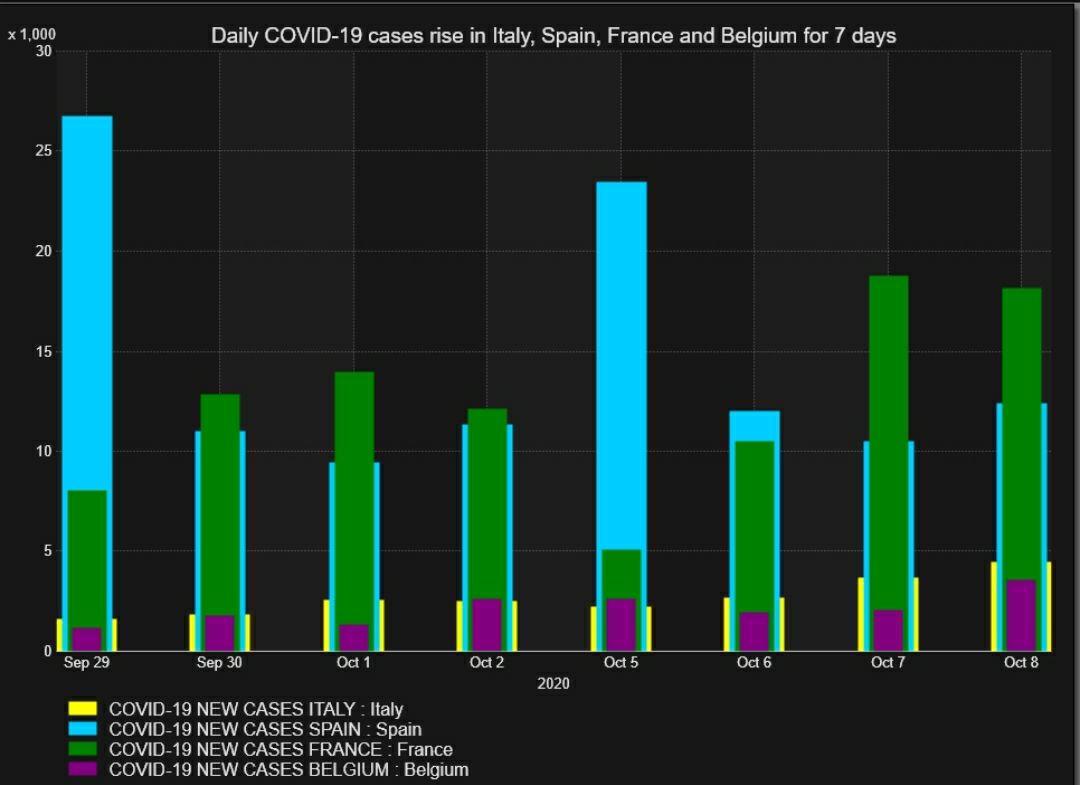

- Europe surpassed 100,000 daily reported COVID-19 cases for the first time on Thursday, after countries such as Russia and United Kingdom saw no respite in the mounting number of infections every day in the past five days.

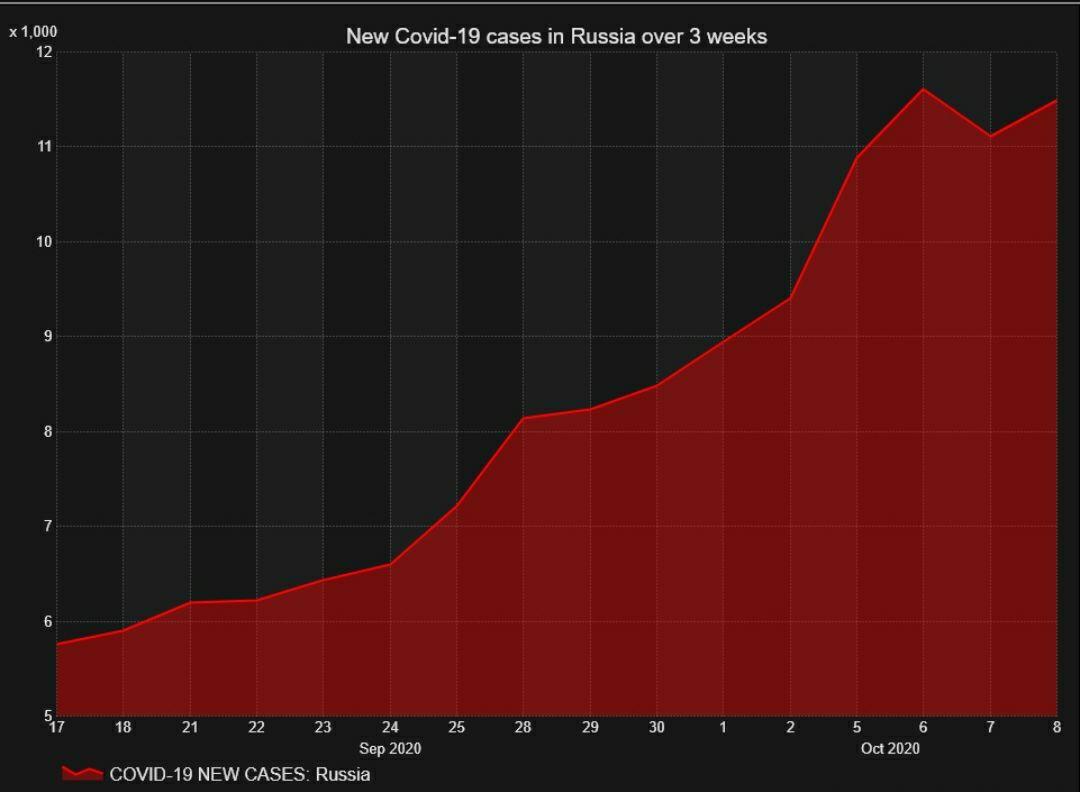

- Russia reported its highest daily coronavirus cases ever since the last record in May on Friday, prompting Moscow authorities to mull closing bars and nightclubs.

Charts Cases :

- Britain has been reeling under a double whammy of coronavirus cases skyrocketing and an alarming case-to-fatality rate of 7%, among the highest in the world. More than six of every 10,000 people have died due to the virus in the country.

- Among the 10 countries in the region, including Ukraine, Russia and the Czech Republic, eight posted record increases in cases in the past week.

- In Europe, daily cases averaged around 78,000 cases for since the beginning of October, compared with an average of 47,500 cases in September.

- India's coronavirus infections cross 7 million ahead of festivals. India’s coronavirus caseload topped 7 million on Sunday when the health ministry reported 74,383 new infections in the previous 24 hours, with a rise in infections in southern states offsetting a drop in western regions.

- Iran made mask-wearing mandatory in public in Tehran on Saturday with violations punishable by fines, after the daily death toll from Covid-19 peaked at 239 this week.

- New York hospitalised with the coronavirus continues to rise, the state has closed schools and nonessential businesses in those areas and limited gatherings.

- Portugal reports 1,646 new cases of coronavirus, highest daily figure since start of pandemic.

Mike Ryan, the World Health Organization’s emergency operations chief, told the global agency’s executive board . “Our current best estimates tell us that about 10% of the global population may have been infected by this virus,”. The estimate means based on the current world population of 7.8 billion people, about 780 million people may have already infected with Covid-19. That’s certainly more than the 35.2 million cases reported last week. If it’s true that 1 in 10 people worldwide have had the virus, it also means the actual number on the ground is more than 20 times of the official statistics.

So, today the reported number of Covid-19 cases worldwide was 37.6m with 8.3m active cases and a death with 1.0m. The spread rate per subsequent 1m cases currently hovers between 3-4 days, more rapid than the initial 2 weeks when the pandemic first broke out.

Highest active cases thus far would be from the US with 7.9m cases to date, with a death 219k; moreover US being the largest glove consumer (The CBP is the key for Top Glove. Its on settling the issue) , we can use this as an indicator for demand of gloves to rise. In US, while Covid-19 cases declined in Jul, it started to pick up again in the early-Sep. This coincides with the beginning/ transitioning of season to autumn in the Northern Hemisphere, which also usually marks the beginning of flu season (especially come winter, more cases are expected). Risk of rising Covid count amid the colder weather, alongside the “flu season” should sustain the upward demand trajectory for gloves.

About the vaccine development. Researches are currently testing 44 vaccines in trials on humans with at least 91 preclinical vaccines are under active testing on animals. While work on vaccine started back in Jan 2020, and more intensely in April, there are still none that have yet to receive full use approval.

Even big pharmaceutical giants like AstraZeneca faced hiccups and had to halt vaccine trials due to an unexplained illness in their voluntary study. While optimists expect a vaccine discovery by year end, we reckon that this seems like a longshot. Looking back in history, the fastest vaccine to be developed and approved was for mumps, which took 4 years. Past experience has shown that even with vaccine discovery, demand for gloves did not fall immediately, as rollout for mass immunisation would take time. In addition, gloves will still be needed for testing and administrating the vaccine

So my conlcusion on vaccine related to gloves, it's will be move together and not at against side like previously. Both will dominate the movement of KLCI ( Gloves & Healthcare).

2. Top Glove Strong Profiles and Future Prospects (My Prediction : Q1FY21 - 3.5b PBT)

- Believe that global demand for gloves will continue to be robust, growing by 25% in 2021, especially given the current pandemic. Average Selling Prices (ASP) have also been increasing monthly, along with higher raw material and operating costs. They have since allocated 30% of their total capacity for spot orders and are fully sold for the next 3 months. (My estimation & prediction on next quater is 3.5b (PBT). This is Triple Super Bull. Please remark my estimation & prediction)

- Earmarked a capital expenditure of RM10 billion for the next 5 years to be invested in several key areas including new capacity expansion, enhancement of existing manufacturing facilities, a Nitrile latex plant, a gamma sterilisation plant, land bank for future expansion, industry 4.0 initiatives and improve workers’ facilities.

- Adopt a 50% dividend payout policy with payment on a quarterly basis, and we have committed to a payout ratio of 51% for FY2020.

- Have grown exponentially in 30 years to be the world’s largest manufacturer for Nitrile Rubber gloves, Rubber gloves and Surgical gloves.

- Have a balanced product mix, allowing them to tap on a wider range of customers globally across medical and non-medical sectors. Now serve 2,000 customers worldwide and export to over 195 countries, and no single customer contributes over 4% of their revenue.

- Their operations risk is also lower and diverse as they operate in various countries, including Malaysia, Thailand, China, United States, Germany, Brazil and Vietnam.

- About Top Glove’s financial performance over the past few years. Top Glove has seen steady growth over past 20 years, with Revenue CAGR grown 23.1% and profit after tax (PAT) CAGR grown 28.6%. Top Glove delivered strong growth in FY2020 with new highs in revenue of RM7.24 billion (+51% YoY) and profit of RM1.9 billion (+417% YoY). With more upside in glove demand expected, they look forward to fresh highs in FY2021.

- Will continue to expand their capacity to meet with the rising global demand for gloves. As global demand is now estimated to grow at a much faster pace by an estimated 25% in 2021 and 15% post-pandemic, Top Glove will continue to expand more intensively by adding 100 billion pieces of gloves per annum by 2025.

- They also continue to expand through mergers and acquisitions as part of their growth strategy. Aside from expanding their capacity, the will also continue to focus on innovation, automation, digitalisation and artificial intelligence, towards improving their productivity and efficiency.

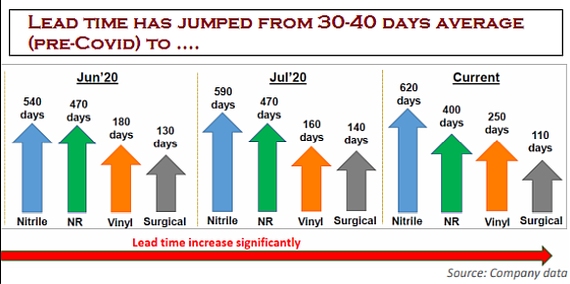

- About Top Glove’s order book over the next 12 months. Pre-pandemic, they had a lead time of around 30 to 40 days. Given the increased demand, their current lead time has extended to 620 days for nitrile gloves, 400 days for natural rubber gloves, 250 days for vinyl gloves and 110 days for surgical gloves.

-

The lead time for natural rubber gloves has shortened since July 2020, following new natural rubber glove production lines coming onstream and the switching of some surgical glove production lines to produce natural rubber gloves.

- Top Glove’s plans to increase its manufacturing production capacity. They will continue to expand their capacity to ensure that we are well-positioned to fulfil global glove demand, which is expected to grow from a pre-COVID-19 level of about 10% per annum, to about 15% per annum postCOVID-19, on the back of increased usage in both the medical and non-medicalsectors.

- Top Glove’s have earmarked RM10 billion of capital expenditures over the next 5 years from FY2021 to 2025, to provide them with additional capacity of 100 billion pieces of gloves. Factory F41, which is the Group’s first factory in Vietnam, is expected to come onstream in October 2020, the initial production capacity for which is approximately 2.4 billion pieces of gloves from its 10 production lines.

- About research & development (R&D) plans. Top Glove continues to focus on R&D, invest in talent by recruiting researchers to develop more automation and artificial intelligence, and embark on industry 4.0 digitalisation. They are now have 752 researchers and 6 R&D centres as at September 2020. Also employ 1,500 graduates and experienced talents annually to ensure a strong staff force.

- Over the years, they have improved their productivity by 80%, reducing from 8.4 Workers Per Million (WPM) pieces of gloves to the current 1.8 WPM and expect this number to continue to decrease. Also will continue to invest in R&D towards enhancing the Group’s productivity and efficiency, hence Top Quality and Top Efficiency.

- About The Group’s current dividend policy. Top Glove has a dividend payout policy of 50% of PAT after minority interests. For FY2020, they have a dividend payout ratio of 51%, with 8.5 sen final dividend to be paid on 3 November 2020.

- They have revised the dividend payments to be on a quarterly basis effective FY2021 in January, April, July and November, and we will review the policy going forward.

- About Top Glove’s value proposition to its shareholders and potential investors. They have seen steady growth since our listing in 2001, with Revenue CAGR grown 23.1%, PAT CAGR grown 28.6%, average PAT margin grown 12.2%.

- They achieved stellar performance in FY2020, with strong growth in sales quantity of 17% and added additional 21 billion pieces of capacity with production utilization of above 95%. They also saw higher operational efficiency from ongoing upgrading and productivity enhancement, and higher ASPs in line with strong market demand.

- About the prospects. Top Glove is committed to delivering sustainable economic performance and generating attractive returns for our shareholders. They have taken steps to ensure that their internal supply chains are sustainable, by establishing their own plants and factories which include 2 latex concentrate plants, 3 chemical factories, a glove former factory and 2 packaging material factories.

- They have a nitrile latex plant and a gamma sterilisation plant in their pipeline, as they work towards establishing a comprehensive in-house supply chain. This integrated supply chain will enable them to be more competitive in the industry.

- As a healthcare products manufacturer, I believed that they are well able to increase their product range in terms of medical gloves, face masks and dental dams to cater to the very strong global demand for personal protective equipment and continue to expand their capabilities in producing healthcare related products.

- Top Glove mulls raising US$1 bil in Hong Kong listing. They is considering raising more than US$1 billion from a listing in Hong Kong. This I believed will boost more confident investor to take part and come to invest in Top Glove. From now I believed "No more Cheap Price for Top Glove".

- Touch on CBP issue. There are remediation amount has been finalised and I am foresees the Ban uplift may trigger further Bullish in price (+3.00 MYR). Also that RM136m with no adverse impact to it's financial.

3. EPF CONTRIBUTED & MY FAVOURITE 2 INSTI'S TARGET PREDICTION

- The raging bulls that have powered the uptrend momentum in the stock market are now in hibernation mode after an impressive speculative run that was fuelled by ample liquidity which brought retail investors back to the market.

-

Over the past few weeks, the Employees Provident Fund (EPF) has been a net buyer of some glove stocks on Bursa Malaysia and on the Singapore Exchange (SGX).

-

Taking on a conservative assumption where the EPF buys low and sells high, it has spent close to RM500mil just on rubber glove counters over the past month.

-

It has raised its stake in Top Glove to 5.46% from 5.09% a month ago and inched up its holdings in Kossan by more than 1% to 8.53%, spending an estimated RM364mil and RM102mil respectively in those buys.

-

The provident fund has also emerged as a substantial shareholder in two Singapore-listed Malaysian rubber glove companies, namely UG Healthcare Corp Ltd and Riverstone Holdings Ltd.

-

-

-

There are some valid reasons why the provident fund is picking up shares in some of the glove stocks. For starters, there is a lot of earnings visibility for rubber glove companies, at least in the next few quarters.

-

I do agreed that some of equity analysts for the sector are expecting the revenue and earnings of glove makers to continue growing over the next few quarters as demand outstrips the supply and the average selling prices (ASPs) are still on the rise.

-

They are bullish on rubber glove stocks. And for the very reason that there is earnings visibility, the ASPs will not be tapering off any time soon.

- My plan still maintained as glove sector the potential and beneficiaries from this pandemic till next year FY21-FY22.

- I do not agree that the current valuations are fully reflected. It depends on the growth and upcoming earnings. I told too many times in my Premium Group (KGT). That's the key for Top Glove's now on it's on "Profits Growth". Even the pandemic stop, the profits still growing huge and rapidly.

- Perhaps, there may still be value in glove makers, which gives EPF the confidence to continue pumping money into the sector.

- CITIBANK with TP RM16 & CREDIT SUISSE with TP RM16.20

- Talking about CBP Issue. I am foresees all is over and just wait the good announcement coming at the right timing. The remediation amount has been finalised, the Ban uplift may trigger further Buliish in price (+3.00 MYR respectively). RM136m with no adverse impact to it's financial due to strong demand. I am predict earning momentum expected (Incoming QR with RM3.5b PBT) and it's a TRIPLE SUPER BULL QR RESULT in history!!!

GOOD LUCK & HAVE A FAITH ON WHAT YOU HAVE INVESTED!

Disclaimers: The research, information and financial opinions expressed in this article are purely for information and educational purpose only. We do not make any recommendation for the intention of trading purposes nor is it an advice to trade. Although best efforts are made to ensure that all information is accurate and up to date, occasionally errors and misprints may occur which are unintentional. It would help if you did not rely upon the material and information. We will not be liable for any false, inaccurate, incomplete information and losses or damages suffered from your action. It would be best if you did your own research to make your personal investment decisions wisely or consult your investment advisor.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Follow Kim's Stockwatch!

Created by sparta | Jul 12, 2024

Created by sparta | May 08, 2024

Created by sparta | May 07, 2024