ONBOARD! THIS PROPERTIES STOCK STILL UNDERVALUED!!!

sparta

Publish date: Sun, 12 May 2024, 01:04 AM

WANT JOIN KIM'S STOCKWATCH?

TO JOIN KIM'S PREMIER GROUP (KPG)

Kindly msg Kim HERE.

__________________________________________

12 May 2024

STOCK NAME : LAGENDA (7179)

LAGENDA PROPERTIES BERHAD, an investment holding company, engages in the property development business in Malaysia. It is also involved in building construction; property management and other business management activities; and trading of building materials and hardware products. The company was formerly known as D.B.E.

Gurney Resources Berhad. The company was incorporated in 2001 and is based in Seri Manjung, Malaysia. Lagenda Properties Berhad is a subsidiary of Lagenda Land Sdn Bhd.

KEY'S PROFILE

- Lagenda signed a shareholders’ agreement with Sime Darby Property’s wholly-owned Seed Homes to set up Seed Homes Lagenda, a 50:50 joint venture to develop affordable homes.

- Seed Homes Lagenda is set to embark on its first affordable township project in Gurun, Kedah via the acquisition of a 249-acre of land from Sime Darby Property for RM50mil.

- The estimated gross development value (GDV) is expected to be RM750mil. The project will be developed over a span of 3-4 years.

- The township is anticipated to comprise 3,000 units of single-storey terrace house, with an average selling price of not more than RM250K/unit.

- Lagenda plans to launch the first phase of this Gurun project by end of FY24 or in early 2025.

- The land price of RM50mil translates to RM4.61 psf and implies a land cost-to-GDV ratio of 6.6%, which is lower than the industry’s average land cost-to-GDV ratio of 15%-20%.

- The projected net development profit margin of 20% for the Gurun project mirrors that observed in Lagenda’s existing matured projects in Setiawan and Teluk Intan.

- Collaboration between Lagenda and Sime Darby Property, potentially allowing Lagenda to capitalise on Sime Darby Property's extensive landbank in Malaysia for further development in its affordable housing segment.

- Lagenda's ongoing township in Kedah, which includes 1,924 units, has experienced a remarkable response, attaining a take-up rate >99% for phase 1 and 2. The collaboration comes at an opportune moment to address high demand for affordable housing in Kedah.

- The company’s niche in underserved landed affordable housing developments in second-tier states with a large population of B40 and M40 income groups.

KIM'S VIEW

- Strong exposure in the affordable housing segment which is strongly aligned with the mass market demand. Demand for affordable housing, particularly units priced below RM500,000, is projected to remain resilient and is supported by various government initiatives.

- Lagenda is supported by unbilled sales of RM855 million, providing earnings visibility over the next 12 months.

- Lagenda Properties rebounding in FY2024 on record-high unbilled sales, Johor expansion.

- The group's current higher confirmed sales of RM289 million, expects Lagenda's unbilled sales to climb and reach a record high of RM855.1 million, which will provide revenue visibility until 2025.

- Expects 2024 to be a vibrant and exciting year for the group, as it plans to launch over 8,000 units of affordable homes, more than doubling the figure from 2023.

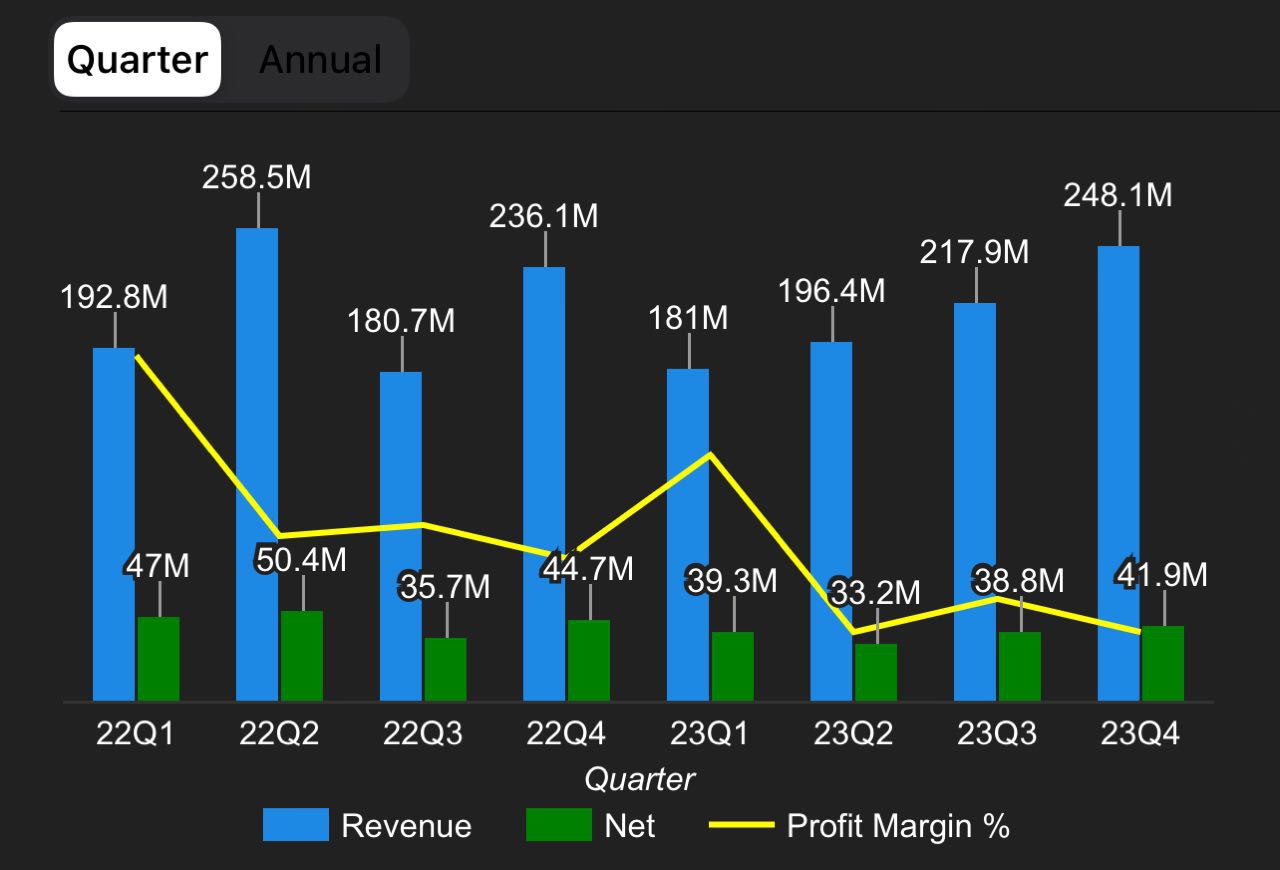

- Its net profit for the fourth quarter ended Dec 31, 2023, stood at RM41.85mil, compared with RM44.65mil in the previous corresponding period. Revenue rose to RM248.09mil from RM236.07mil a year earlier.

- Incoming Q4FY24 I assume and predict at RM50 - RM60 million.

KIM'S TARGET PRICE

CP : RM1.64 (Current Price) - UNDERVALUED

IMD TP : RM1.75

TP1 : RM1.88 (Fair Value)

TP2 : RM2.10

WARRANT :

LAGENDA-CD : 0.11 sen

TP : 0.25 - 0.35 sen

KIM'S PRICE TARGET FORECAST

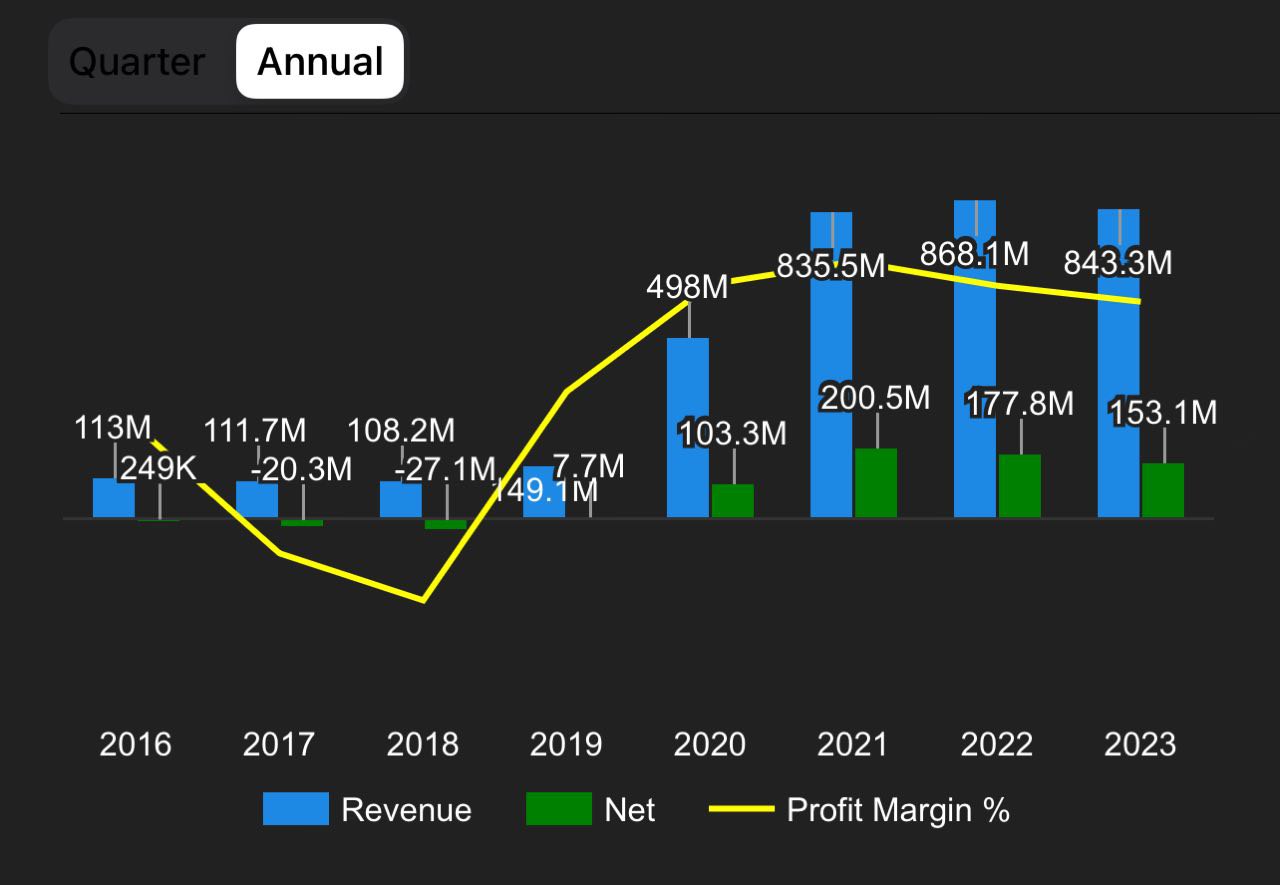

- LAGENDA's forecast to grow earnings and revenue by 21.1% and 20.1% per annum respectively. EPS is expected to grow by 17.3% per annum. Return on equity is forecast to be 18.3% in 3 years.

- LAGENDA's earnings (21.1% per year) are forecast to grow faster than the MY market (11.9% per year).

- LAGENDA's earnings are expected to grow significantly over the next 3 years.

- LAGENDA's revenue (20.1% per year) is forecast to grow faster than the MY market (5.9% per year).

- LAGENDA's revenue (20.1% per year) is forecast to grow faster than 20% per year.

LAGENDA FINANCIAL HIGHLIGHTS

QUATERLY

ANNUALY

WANT JOIN KIM'S STOCKWATCH?

TO JOIN KIM'S PREMIER GROUP (KPG)

Kindly msg Kim HERE.

Disclaimers: The research, information and financial opinions expressed in this article are purely for information and educational purpose only. We do not make any recommendation for the intention of trading purposes nor is it an advice to trade. Although best efforts are made to ensure that all information is accurate and up to date, occasionally errors and misprints may occur which are unintentional. It would help if you did not rely upon the material and information. We will not be liable for any false, inaccurate, incomplete information and losses or damages suffered from your action. It would be best if you did your own research to make your personal investment decisions wisely or consult your investment advise.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Follow Kim's Stockwatch!

Created by sparta | Dec 06, 2024

Created by sparta | Jul 12, 2024

Created by sparta | May 08, 2024

Created by sparta | May 07, 2024