THIS ANOTHER GEMS READY TO SKYROCKET!!! - MAJOR DEVELOPER IN PENANG

sparta

Publish date: Wed, 08 May 2024, 01:45 AM

LETS JOIN KIM'S STOCKWATCH?

07 May 2024

STOCK NAME : E&O (3417)

EASTERN & ORIENTAL BERHAD an investment holding company, provides construction and building contract works primarily in Malaysia. Its activities also include development and investment in residential and commercial properties, and also management and operation of hotels and restaurants. The company is based in Kuala Lumpur, Malaysia.

E&O’s activities are driven by four main growth engines in Kuala Lumpur, Penang, Johor’s Iskandar Malaysia and Central London.

In Kuala Lumpur, E&O is known for its portfolio of distinctive properties like The Mews, St Mary Residences, Dua Residency, Idamansara and Seventy Damansara, all located in the most prestigious neighbourhoods of the capital city. Currently in development are Conlay in Kuala Lumpur City Centre and The Peak in Damansara Heights.

In Penang is Seri Tanjung Pinang (STP), a 240-acre masterplanned seafront development that celebrates the best of island living. Following its launch in 2005, the award-winning STP has grown into a vibrant international community of 3,000 homes and over 30 nationalities, and is today hailed as Penang’s most desired residential address.

KEY HEADLINE :

- Eastern & Oriental Bhd (E&O) has proposed to pay RM46.95 million to purchase the remaining 40% equity interest in E&O-PDC Holdings Sdn Bhd from Penang Development Corporation (PDC), to enable E&O to wholly own the Seri Tanjung Pinang reclamation and development concession.

- E&O-PDC owns 30% of Tanjung Pinang Development Sdn Bhd (TPD), while the remaining 70% is held by Permaijana Ribu (M) Sdn Bhd, a wholly-owned indirect subsidiary of E&O.

- Seri Tanjung Pinang (STP) is a seafront development masterplan on the northeast coast of Penang island. The 240-acre first phase, Seri Tanjung Pinang Phase 1 (STP1), is fully reclaimed and close to completion.

KIM'S VIEW

- E&O expects better quarters ahead on higher sales, stable property market. Premier lifestyle property developer Eastern & Oriental Bhd (E&O) anticipates an improvement in earnings in the coming quarters, driven by its encouraging sales performance and a stable market environment. Speaking at a media and analysts' results briefing on Wednesday (Aug 23), E&O managing director Kok Tuck Cheong said that Malaysia's property market is anticipated to improve especially in strategic locations which bodes well for the group's outlook.

- Analysts believe that developers with industrial projects on Penang Island and the peninsula are better investment options. Other large developers focus on the Klang Valley and the southern Iskandar area. Therefore, Evergrande Land (TAMBUN, 5191, main board industrial stocks) and E&O (E&O, 3417, main board industrial stocks) have an advantage. The two companies are regarded as major developers in Penang.

- Fundamentally, we like E&O as it stands to benefit from the Penang LRT project. With recent cabinet approval and slated for completion by 2030, the LRT project is poised to enhance Penang's connectivity and uplift property sentiment.

KIM'S TARGET PRICE

Current Price : RM1.06

IMD TP : RM1.12

TP1 : RM1.20

TP2 : RM1.50

WARRANT :

E&O-C16 : 0.095 sen

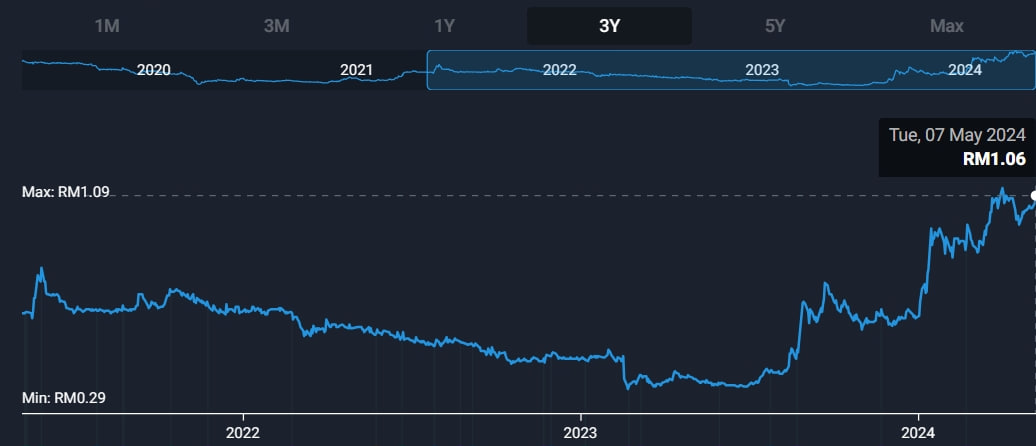

E&O CHART

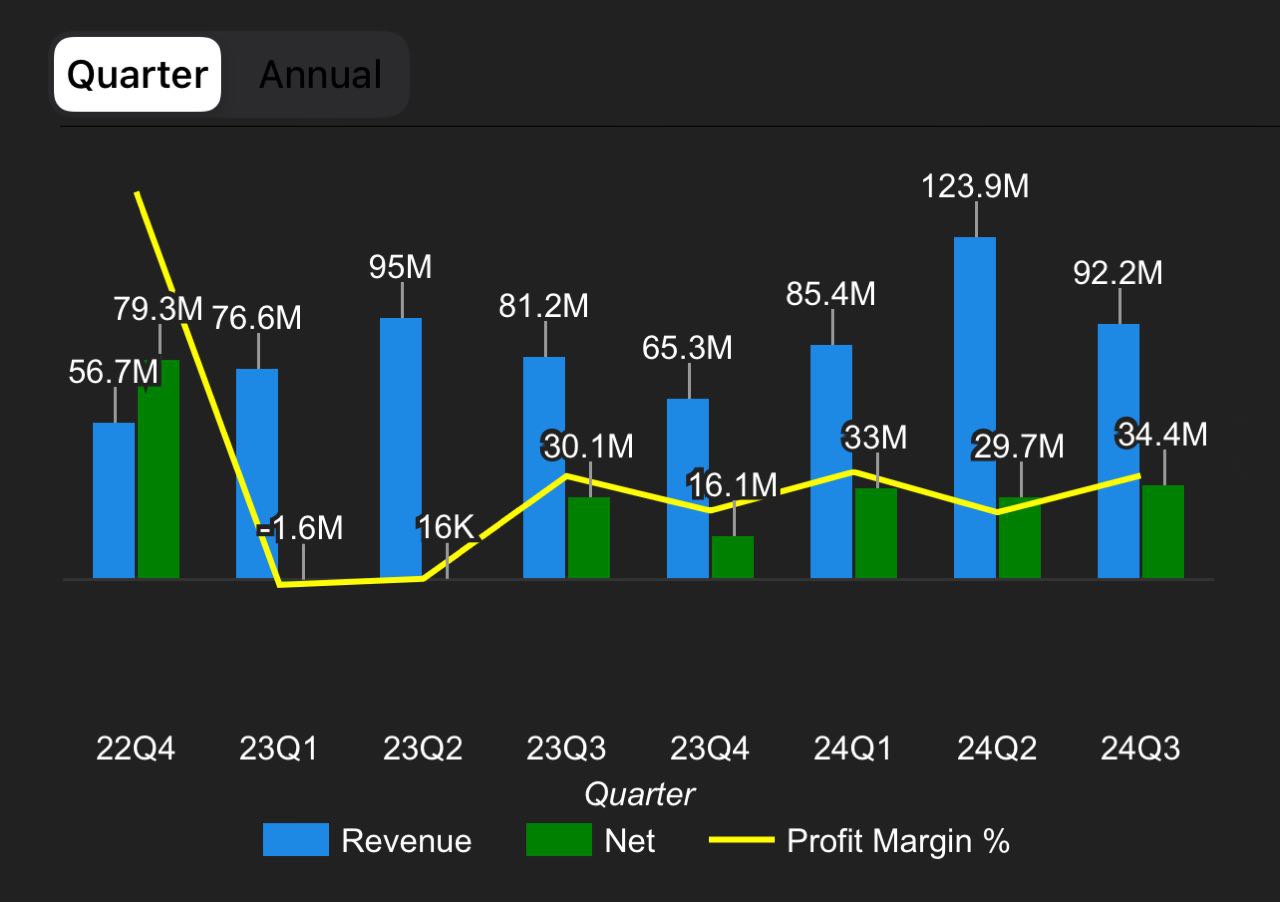

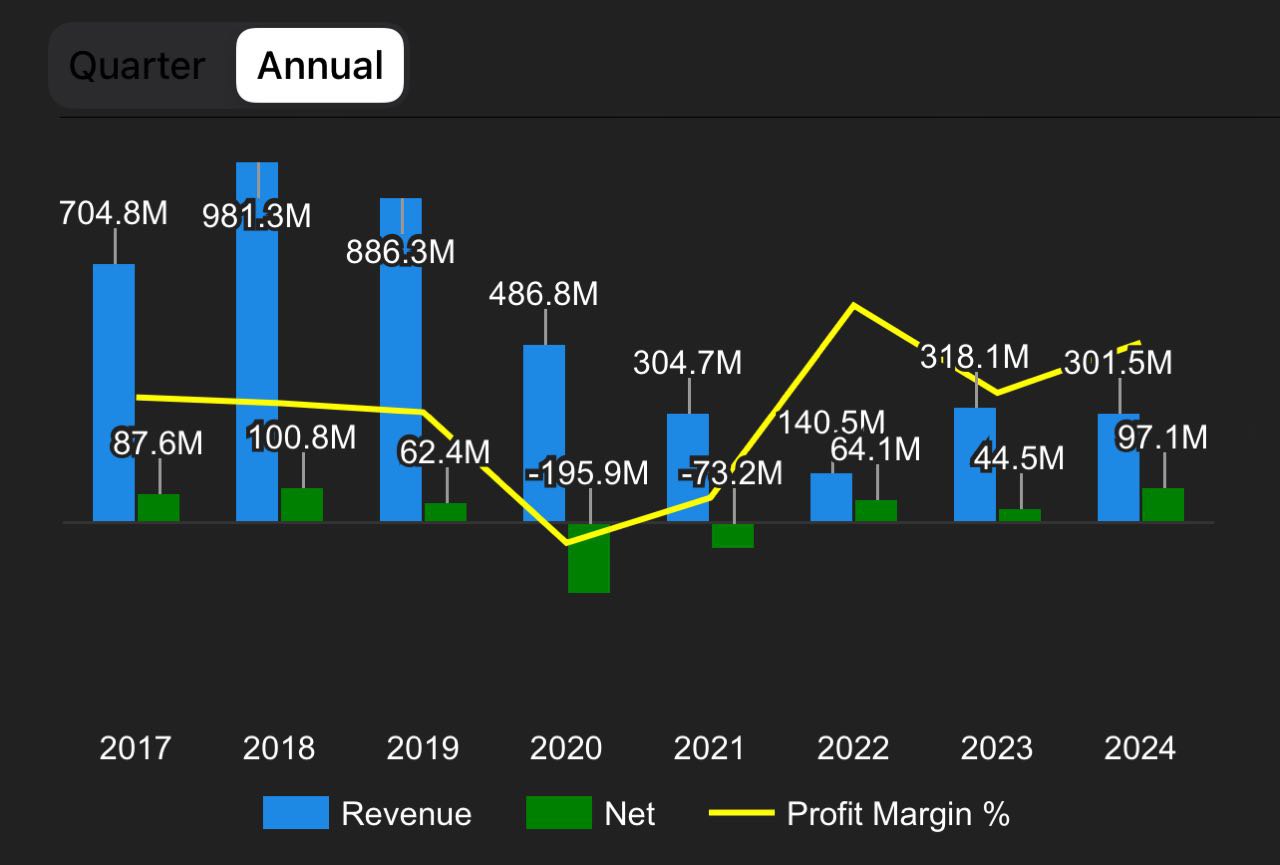

EARNING & REVENUE GROWTH FORECAST

E&O FINANCIAL HIGHLIGHTS

QUATERLY | ANNUALY |

|  |

Heightened demand for Penang's real estate with LRT, airport expansion

- Property developers operating on both Penang Island and the mainland are poised to experience heightened demand for properties in the near future.

- Market analysts have noted a shift towards a buyer's market in Penang since early last year, particularly evident in the high-rise segment where bargain hunting is prevalent. Landed units, on the other hand, are considered favourable for capital investment.

- Demand for Penang properties remains robust, particularly among Singaporeans, Hong Kongers, Indonesians, and Taiwanese. Market observers attribute this to factors such as favourable exchange rates and the perceived value for money in Penang's property market.

- In the first nine months of 2023, property transactions in Penang continued to rise, with 17,953 units changing hands compared to 17,297 units in the same period the previous year, amounting to RM13.21 billion and RM9.51 billion, respectively.

LETS JOIN KIM'S STOCKWATCH?

Disclaimers: The research, information and financial opinions expressed in this article are purely for information and educational purpose only. We do not make any recommendation for the intention of trading purposes nor is it an advice to trade. Although best efforts are made to ensure that all information is accurate and up to date, occasionally errors and misprints may occur which are unintentional. It would help if you did not rely upon the material and information. We will not be liable for any false, inaccurate, incomplete information and losses or damages suffered from your action. It would be best if you did your own research to make your personal investment decisions wisely or consult your investment advise.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Follow Kim's Stockwatch!

Created by sparta | May 07, 2024