THIS LEADER OF CONSTRUCTION - NOW ITS TIME TO SOAR & SKYROCKET!!!

sparta

Publish date: Sun, 24 Sep 2023, 01:14 AM

LETS JOIN KIM'S STOCKWATCH?

24 September 2023

STOCK NAME : GAMUDA (5398)

GAMUDA BERHAD, an investment holding company, engages in the civil engineering construction business in Malaysia, Vietnam, Australia, Singapore, Taiwan, the United Kingdom, India, Bahrain, and Qatar. It operates in three segments: Engineering and Construction; Property Development and Club Operations; and Water and Expressway Concessions. The company constructs highways and bridges, airfield facilities, railway, tunnel, water treatment plants, dams, power plants, as well as offers general and trading services related to construction activities; develops residential and commercial properties; and operates clubs.

It also engages in management of water supply; tolling of highway operations; rental of properties; management, operation, and maintenance of dams and water treatment facilities; manufacturing and installation of prefabricated concrete panels for construction of buildings; supplying and planting of landscaping materials; provision of landscaping services for property development; road surfacing and tunneling works; and manufacture and supply of concrete, beams, and surfacing materials. In addition, the company operates as an insurance agent; hires, distributes, and repairs plant, machinery, and equipment; manages gated residential townships, including a clubhouse, golf course, and other common properties; trades in construction materials; offers sub-structure and geotechnical works; and provides mechanical and electrical, and medical laboratory and healthcare services. The company was incorporated in 1976 and is based in Petaling Jaya, Malaysia.

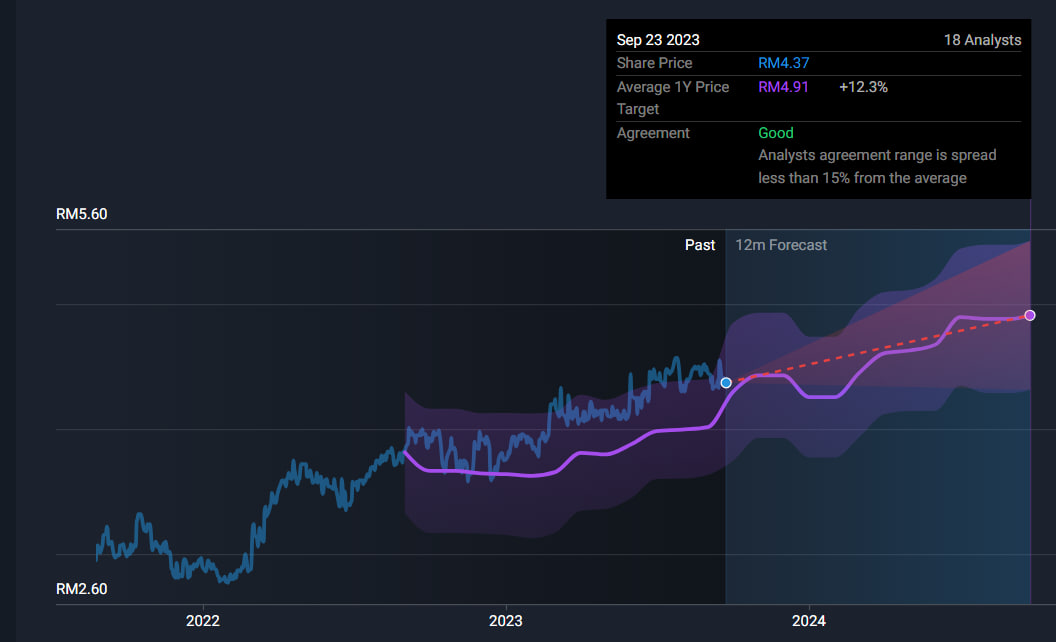

KIM'S TARGET PRICE

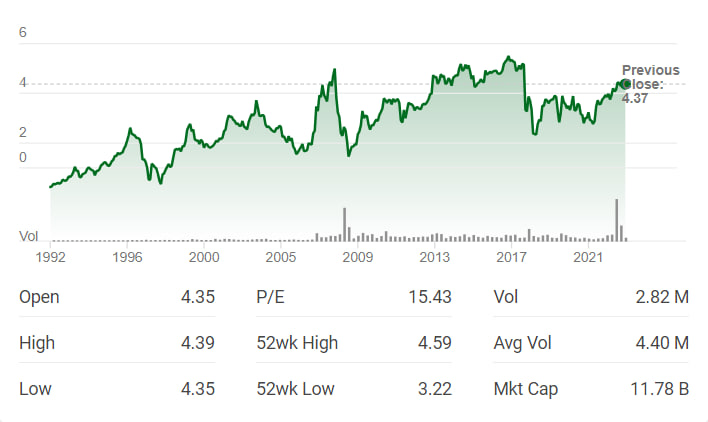

Current Price : RM4.37

IMD TP : RM4.80++ (On the way this week)

TP1 : RM5.20

TP2 : RM5.60

WARRANT : Any warrant suitable and good prospect

GAMUDA CHART

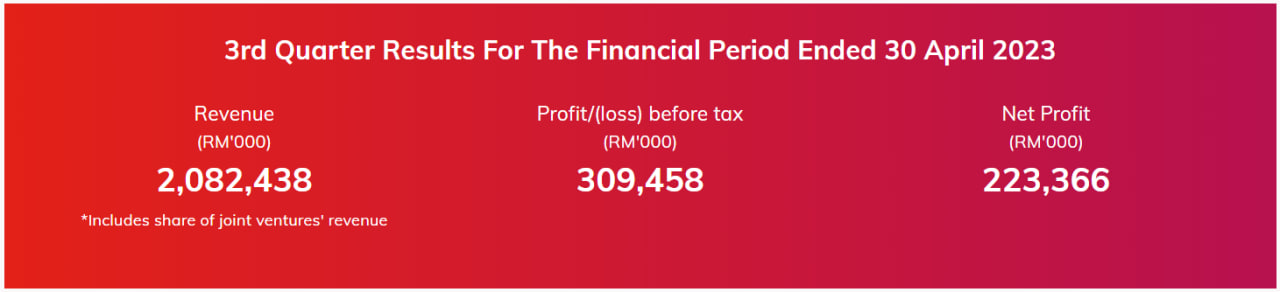

GAMUDA was buoyed by progress billings from projects in Australia and Taiwan. GAMUDA reported a strong performance in 3QFY23, primarily propelled by their Australian construction projects. This has resulted in a remarkable growth in overseas revenues which has surpassed domestic revenues.

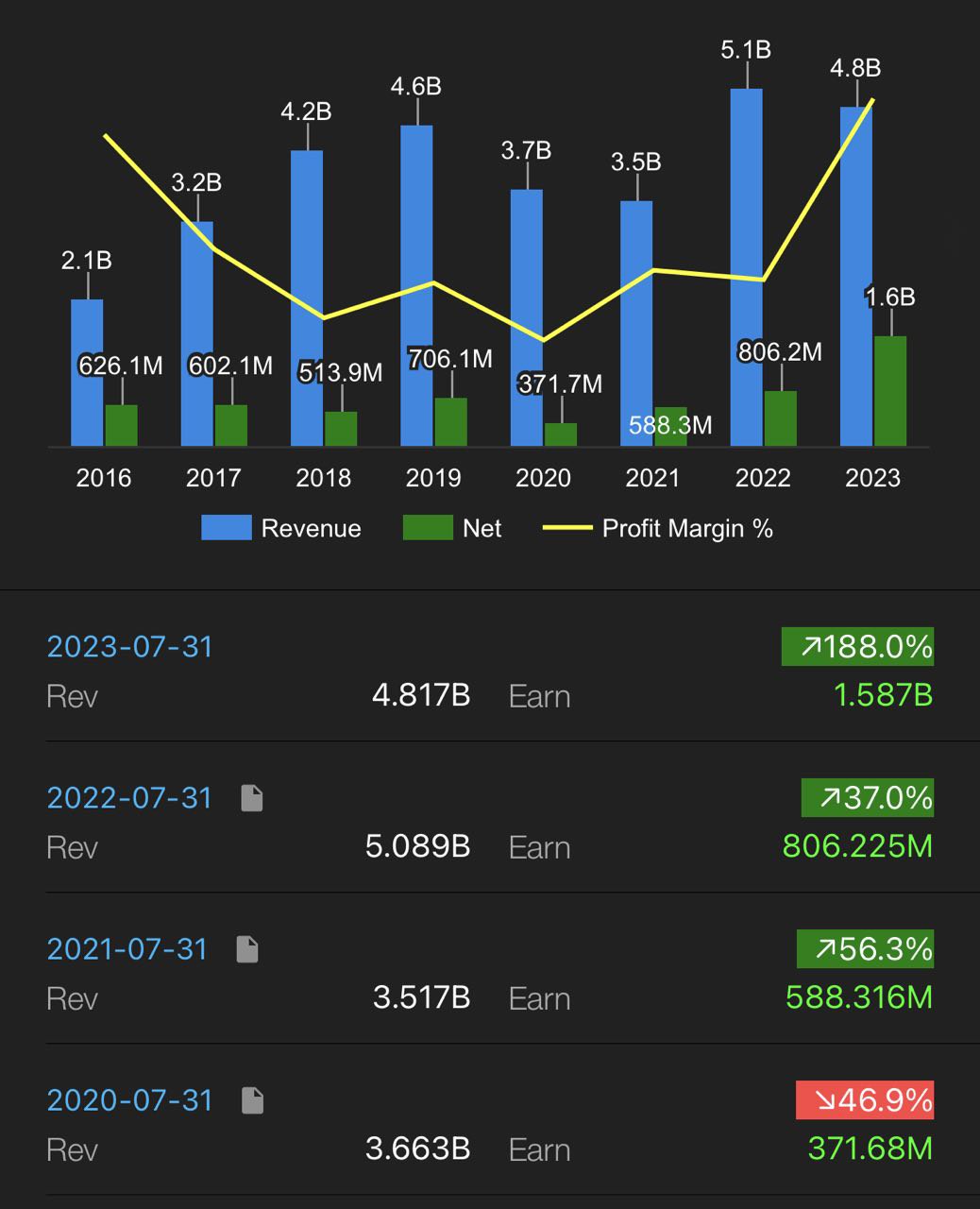

GAMUDA FINANCIAL HIGHLIGHTS

QUATERLY | ANNUALY |

|  |

Gamuda posts new record high quarterly earnings of RM1.2 billion as overseas earnings grows 2.5X

Current Quarter (August 2022 - October 2022)

Gamuda's first half-year core earnings rose 17%, overseas earnings surged as construction and property replaced highway earnings

Year To Date (August 2022 – January 2023)

Gamuda's overseas revenue triples as overseas construction earnings replaces highway earnings

Year To Date (August 2022 – April 2023)

Current Quarter (February 2023 – April 2023)

KIM'S KEYNOTE

- Laggard of leader construction player. Get a ticket before it's too late.

- Incoming SUPERB RESULT 4Q this week. Watch it and hold it.

- All property developers reported increasing profit in the last 4 quarters after recovering from Covid 19 pandemic. Home prices are increasing.

- The housing market in Malaysia is likely to be affected by the rising construction costs as well, as there has been a lot of fluctuation in building material prices due to uncertainty in the supply chain for the past 12 months. According to the Real Estate and Housing Developers Association (REHDA), if the cost of construction continues to rise and builders can no longer absorb the increased costs, it will likely be passed to end-users. Since the cost of construction materials accounts for 50% to 60% of the total development value of a project, a 20% increase in construction cost will lead to a 10% rise in house prices.

- Maintain and remain upbeat on the construction sector, premised on the lifting of the political overhang post state elections. Moving forward, the Federal Government may now be able to focus its efforts to roll out big-ticket infrastructure projects, in addition to implementing institutional reforms. As such, not discount the possibility of any of the infrastructure projects making a debut in 4Q23 at the earliest.

- The value of construction works done in 2Q23 reached MYR32.4bn (+8.1% YoY). In the same period, the economic output of the construction sector grew 6.2% YoY, marking the fifth consecutive quarter of YoY growth. The ample supply of labour, combined with receding material cost pressures, put contractors in a good position to not just ramp up the progress of their projects, but also be ready to accept new jobs that may boost earnings visibility.

- There was a slight sequential deterioration in earnings delivery by the sector in the recently-concluded 2QCY23 results. However, the sector’s earnings should improve in 2HCY23 as work progress gathers momentum. Also, the job flow should pick up in 2HCY23 underpinned by the roll-out of MRT3, Penang LRT, various flood mitigation projects, and other public infrastructure projects earmarked for implementation under Budget 2023, as well private-sector building jobs particularly for new semiconductor foundries and data centres.

- It was buoyed by progress billings from projects in Australia and Taiwan.

- Reported a strong performance in 3QFY23, primarily propelled by their Australian construction projects. This has resulted in a remarkable growth in overseas revenues which has surpassed domestic revenues.

- With the anticipation of a consistent policy environment following the recent state election, we look forward to several significant upcoming projects. These projects encompass the revamped MRT3 with a budget of RM45bn, expect Gamuda to emerge as the primary beneficiary. Additionally, Gamuda's extensive expertise positions them to potentially win the RM2bn Sg. Rasau Water Supply Scheme Phase 2. This put Gamuda on the right track to expand its orderbook to more than RM25bn from current RM21.5bn.

- Furthermore, expect positive cascading impacts to extend from the Pan Borneo Sabah highway, the Bayan Lepas LRT project in Penang, and the resurgence of the KLSingapore High-Speed Rail (HSR). Notably, Phase 1 of the RM25bn National Energy Transition Roadmap (NETR) offers opportunities, particularly in solar power plants and renewable energy zones.

- Expects a stronger 2H as work progress gathers momentum, coupled with: (i) the roll-out of the RM45b MRT3, and RM9.5b Penang MRT projects and six flood mitigation projects reportedly to be worth RM13b, and (ii) an accelerated disbursement of the massive RM97b gross development expenditure budgeted under Budget 2023 (+35% YoY over RM71.6b a year ago). Similarly, there are opportunities in private-sector building jobs underpinned by massive investment in new semiconductor foundries and data centres.

Disclaimers: The research, information and financial opinions expressed in this article are purely for information and educational purpose only. We do not make any recommendation for the intention of trading purposes nor is it an advice to trade. Although best efforts are made to ensure that all information is accurate and up to date, occasionally errors and misprints may occur which are unintentional. It would help if you did not rely upon the material and information. We will not be liable for any false, inaccurate, incomplete information and losses or damages suffered from your action. It would be best if you did your own research to make your personal investment decisions wisely or consult your investment advise.

More articles on Follow Kim's Stockwatch!

Created by sparta | May 08, 2024

Created by sparta | May 07, 2024