GDEX WILL ROCK LOGISTICS MARKET!!!

sparta

Publish date: Mon, 16 Nov 2020, 02:08 AM

LETS JOIN KIM'S STOCKWATCH GROUP?

DATE : 16 November 2020

WHAT I WANT TO SAY?

"E-Commerce: A Game Changer for Logistics Industry in Malaysia"

The e-Commerce industry is growing exponentially within the Southeast Asia region particularly in Singapore, Malaysia, Indonesia, Thailand, Philippines and Vietnam. BMI Research in 2018 reported that these ASEAN countries are set to contribute an estimated of USD64.8 billion (RM257.9 billion) in 2021 from online shopping market activity, a giant leap from USD37.7 billion recorded in 2017. Malaysia‘s share of total online retail sales was at 2.7%, positioning Malaysia second in the region.

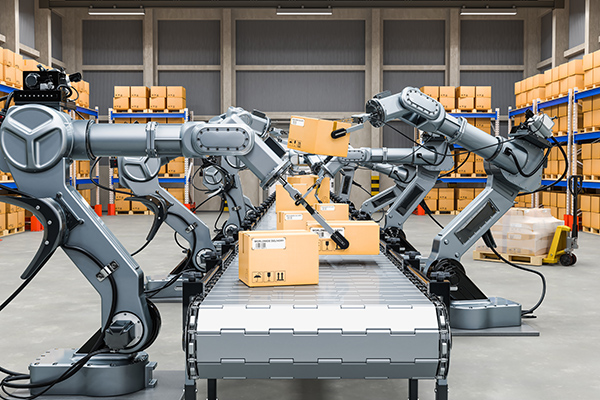

The rapid growth of e- Commerce industry, particularly in Malaysia today has created many positive outcomes such as technology adoption among communities and industry players, The increasing trade and supply chain activities, growth of SMEs and talent development. These positive outcomes had encouraged many SMEs to expand their business and Malaysian logistic players adopting technological infrastructure within its business operation.

In 2018 that the e-Commerce value-add and contribution to the gross domestic product in Malaysia continuously improved over a period of seven years to RM85.8 billion in 2017 from RM37.7 billion in 2010, with an average annual growth rate of 12.5%.

The booming growth of e-Commerce industry had impacted the logistics industry in Malaysia to go through a series of evolution in their operation to form seamless fulfilment hubs in the country. Companies are looking forward to establishing its regional fulfilment operations in Malaysia to serve their global supply chain activities due to Malaysia’s strategic geographical location and the increasing adoption of technology in the country makes the supply chain process seamless and efficient.

Zalora, Asia’s leading online fashion destination which was founded in 2012, consolidated it’s fulfilment operations across six countries into a single operations hub in Malaysia. The company had spent a total of USD4.2 million (RM20 million) in 2017 to establish its regional e-Fulfilment hub in Malaysia which handles 100% orders from Singapore, 99.7% of which are fulfiled on the same day.

ABOUT GDEX

GD Express Carrier Bhd (GDex) a local Malaysian courier service provider established in 1997 has increased its daily parcel sorting capacity from 78,000 parcels per day in 2016 to 85,000 parcels per day in 2017. The company is expanding its current warehouse facility and expects to increase its capacity to 100,000 parcels per day by the end of 2017 and 130,000 per day in 2018 making them the regional champion in providing e-Fulfilment services.

The launch of Digital Free Trade Zone (DFTZ) in 2017 had provided e-Commerce companies with a seamless platform for trading activities and to fulfil the logistics requirements. The e-Fulfilment hub, Kuala Lumpur Airport Cargo Terminal (KACT1) located in the old Low-Cost Carrier Terminal (LCCT) facility was hence developed.

This is in line with the Government initiatives led by the Malaysian Investment Development Authority (MIDA) under the National e- Commerce Strategic Roadmap (NESR) which intends to position Malaysia as the regional e-Fulfilment hub. Under this initiative, MIDA plays a key role in facilitating logistics companies to build their capabilities in operating e-Fulfilment hubs to cater to the diverse needs of the e- Commerce industry.

WHY THIS GDEX BECOME MY GEMS NOW?

1. STRONGER EARNINGS PROSPECT

- Stronger earnings prospects for in FY21F-22F, due to heightened demand from the e-commerce space.

- Transport and logistics companies are only expected to return to profitability in 2021, as business volume will need time to recover from the current Covid-19 pandemic.

- Lower fuel costs and positive regional expansion.

- anticipates 44.5%-owned Indonesian associate SAP Express to record further rise in margins in tandem with its rapid growth traction in Indonesia.

- Since the general lockdown in mid-March, many consumers, businesses, and merchants have turned to online trading, which significantly increased the use of express delivery services. While the demand for such services increased dramatically, the cost of operations has also gone up in tandem, as express carriers adapt to the numerous structural adjustments by increasing workforce, acquisition of new vehicles, enhancement of systems and processes to accommodate the expansion of demand.

2. FREEZE ON NEW COURIER LICENCES FOR 2 YEARS

- Malaysian Communications and Multimedia Commission (MCMC) will not issue any new courier licences for two years.

- A new action plan will be drafted by the National Postal and Courier Laboratory Laboratory (NPCIL) to propose measures to support the strategic development of the new postal and courier industry.

- The freezing of new courier licenses will run from Sept 14,2020 until Sept 15,2022.

- NPCIL results are important for this industry, which is at the core of e-commerce activities and digital economic development. the process of drafting a new action plan by NPCIL will take three weeks, from Nov 2 to Nov 22, subject to the conditional movement control order (CMCO) by the government.

- By freezing applications, it will be easier to assess the current situation and decide on the necessary conditions to be implemented for the industry to self-regulate.

3. THE NEW NORMS AND REALITY BOOSTING THEIR SALES

- The coronavirus pandemic necessitated the implementation of preventative measures to curtail physical interaction such as social distancing, wearing of face masks and hand gloves.

- The Movement Control Order has ushered in a new reality to the way business is conducted. Many companies now require their workers either to work from home or to rotate between the office and home.

- Businesses are conducted online via social media, skype, zoom, and other similar applications.

- Many months before the outbreak of COVID-19, the company had embarked on a significant programme to revamp its operations, expand and innovate on its product offerings, revitalised its workers, and strengthened its logistical support capabilities and facilities.

- The rethinking was required given the evolving economy, rapid growth in E-commerce and increasingly competitive nature of the business and changes in consumer preferences, and emerging trends such as greater adoption of E-commerce, online trading, and E-payment gateways.

4. INESTOR ADDED E-COMMERCE STOCKS IN THEIR PORTFOLIOS

- E-commerce stocks have been on a rally since mid-March, when millions of people were confined to their homes as a result of the coronavirus pandemic. The MSCI World Internet & Direct Marketing Retail Index, which tracks most of the large e-commerce players, has registered a return of 93.27% since its low on March 12 (as at Aug 21) — triple the 32.93% return of the MSCI All Country World Index.

- Investment experts say e-commerce stocks are expected to continue their outperformance as more people shop online for the foreseeable future.

- The Covid-19 crisis has dramatically accelerated the demand for online groceries and other essentials, as well as e-commerce as a whole. The crisis has attracted an older age group to make their purchases online and has broadened the categories of e-commerce spending for households in general.

- Even prior to the Covid-19 outbreak, the sales volumes of physical retail outlets were going down and e-commerce platforms were seeing healthy inflows of visitors and shoppers.

- If you are a long-term shareholder, you want to invest in companies that have a long-term upward trajectory with clear intent. For that purpose, e-commerce stocks are close to a safe haven because e-commerce is the future, and there has been a structural shift in the economy towards this sector.

- Double-digit returns of e-commerce stocks can be attributed to the various quantitative easing measures implemented by central banks globally.

5. MIDA APPROVES SECOND ROUND OF TAX INCENTIVE FOR GD EXPRESS

- GD Express Carrier Bhd (GDEX) said its wholly-owned subsidiary GD Express Sdn Bhd (GDSB) has received an approval letter from the Malaysian Investment Development Authority (MIDA) for a second round of integrated logistics services (ILS) tax incentive.

- GDEX said GDSB will be eligible for income tax exemption, via pioneer status, of up to 70% on statutory income for each year of assessment for a period of five years.

- The board of GDEX is of the opinion that the ILS incentive would contribute positively to strengthening the group's operations and future earnings.

6. RCEP : ASIA-PASIFIC COUNTRIES FORM WORLD'S LARGEST TRADING BLOC

- Fifteen countries have formed the world's largest trading bloc, covering nearly a third of the global economy.

- The Regional Comprehensive Economic Partnership (RCEP) is made up of 10 Southeast Asian countries, as well as South Korea, China, Japan, Australia and New Zealand.

- The pact is seen as an extension of China's influence in the region.

- The deal excludes the US, which withdrew from a rival Asia-Pacific trade pact in 2017.

- The RCEP is expected to eliminate a range of tariffs on imports within 20 years.

- It also includes provisions on intellectual property, telecommunications, financial services, e-commerce and professional services.

- But it's possible the new "rules of origin" - which officially define where a product comes from - will have the biggest impact.

- Already many member states have free trade agreements (FTA) with each other, but there are limitations.

- "The existing FTAs can be very complicated to use compared to RCEP," said Deborah Elms from the Asian Trade Centre.

- Businesses with global supply chains might face tariffs even within an FTA because their products contain components that are made elsewhere.

- A product made in Indonesia that contains Australian parts, for example, might face tariffs elsewhere in the Asean free trade zone.

- Under RCEP, parts from any member nation would be treated equally, which might give companies in RCEP countries an incentive to look within the trade region for suppliers.

- Under this RCEP and Trade deal, I foresee the logistics sector will be most beneficiary for deliveries all goods around the countries and of course GDEX will be the one of its.

- With this 6 points added, I foresees there is good and strong reasons this sector will get boost and rally as soon as possible this year.

- GDEX big volumes recently are signalling and generating given a confidence and ready to breach and break the records to go back previous highest soonest.

- Lets wait and see my new GEMS performing this November till end of the year 2020.

LETS FLY & LETS ROCK!

Lastly, don't forget to click on our telegram link above and join us. Let us give you the latest update on the stock market and our group development. We hope you enjoy reading our blogs and give us your support.

Disclaimers: The research, information and financial opinions expressed in this article are purely for information and educational purpose only. We do not make any recommendation for the intention of trading purposes nor is it an advice to trade. Although best efforts are made to ensure that all information is accurate and up to date, occasionally errors and misprints may occur which are unintentional. It would help if you did not rely upon the material and information. We will not be liable for any false, inaccurate, incomplete information and losses or damages suffered from your action. It would be best if you did your own research to make your personal investment decisions wisely or consult your investment advisor.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Follow Kim's Stockwatch!

Created by sparta | Jul 12, 2024

Created by sparta | May 08, 2024

Created by sparta | May 07, 2024