Karex - CEO's statement FY 2014

ss20_20

Publish date: Fri, 07 Nov 2014, 01:39 PM

Operational Review

By 2018, global condom consumption is projected to be 38.2 billion pieces registering a compounded annual growth rate of 9%. The condom market is largely driven by emerging economies such as Asia, Middle East and Africa. The robust economic activity, young demographics and limited condoms users in these regions provides ample opportunities for growth. In addition, the two most populated countries in the world such as China and India are growing rapidly on the back of a steady economy.

The lower latex price and strengthening of US Dollar (“USD”) against Ringgit Malaysia (“RM”) have benefited Karex in terms of margins improvement for the financial year under review.

During the financial year under review, we have expanded our manufacturing capacity from 3 billion pieces per annum to 4 billion pieces per annum via our Port Klang, Selangor and Hat Yai, Thailand factories. Port Klang being our smallest factory with a manufacturing capacity of 300 million pieces of condom now have 500 million additional capacity.

We have purchased the plant next door for expansion purposes and currently our Port Klang factory stands on a 87,120 sq ft land. Over at Hat Yai factory, we have also expanded next door, installing 500 million additional capacity bringing current manufacturing capacity to 1.2 billion pieces per annum from 800 pieces previously on 135,141 sq ft of land.

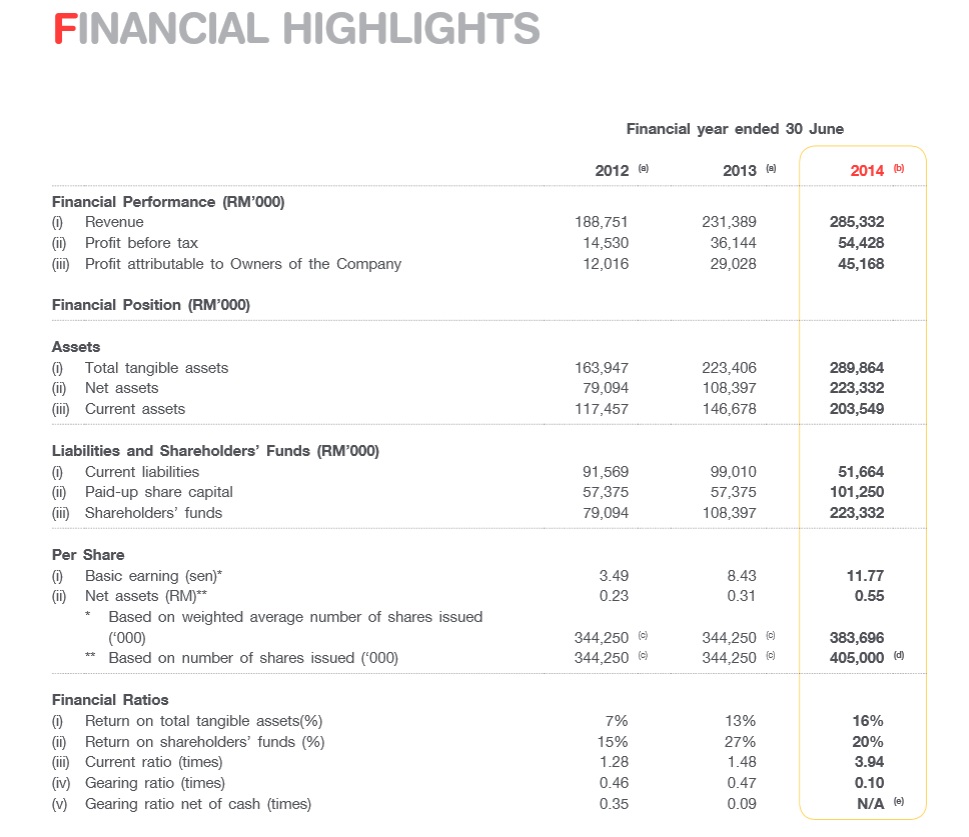

FINANCIAL REVIEW

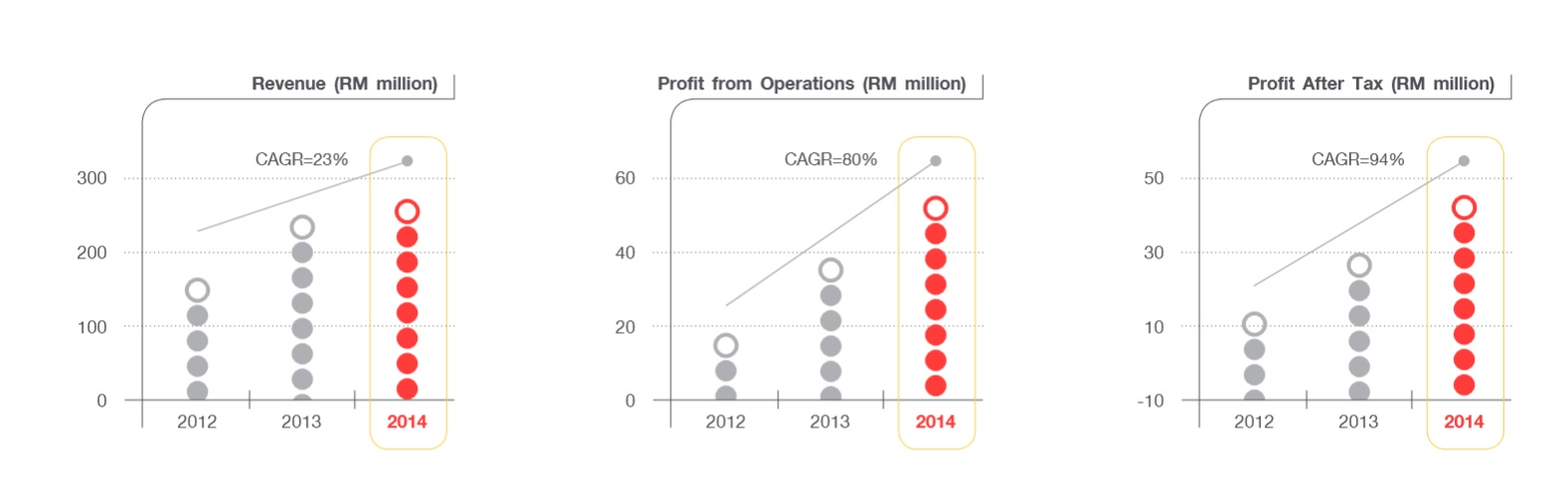

Karex posted a strong FYE 2014 performance, with revenue growing from RM231.4 million to RM285.3 million, increasing by 23.3% year-on-year, while the Group recorded a profit from operations of RM55.2 million in the current year, representing a 43.4% increase from RM38.5 million in the last financial year. The Group recorded an outstanding 3 years CAGR of 23% on its revenue, 80% on its profit from operations and 94% on its profit after tax. Condoms remain as the dominant revenue contributor over the last 3 years, contributing towards more than 90% of revenue. For FYE 2014, condoms contributed 93% of revenue while contribution from catheters decline to 3%, revenue from probe cover and lubricating jelly stood at 4% as compared to the preceding year. Sales of probe cover remained stable, while sales of lubricating jelly has been on an upward trend as it serves as a complementary product to condoms.

In terms of geographical breakdown, Asia region continue to be the revenue driver contributing around 30% of the Group’s total revenue in the last 3 years. Revenue from Europe, America, Africa and Asia regions were 9%, 23%, 33% and 35% respectively for FYE 2014. The America region registered the highest growth rate among all the regions, growing by 52.8% from the previous financial year as a result of the new product launch in conjunction with the 2014 FIFA World Cup.

MOVING FORWARD

Our capacity expansion plan, will continue throughout 2015 and 2016. By then, we expect our manufacturing capacity to reach 6 billion pieces per annum.

To facilitate the expansion plan, we have acquired a piece of 18 acres land in Pontian, Johor to build a new factory to cater for the expansion plan. This new factory will embrace environmental and sustainability measures far beyond those required by state or national laws.When the new Pontian factory is completed, it will be our largest factory in the Group with a manufacturing capacity of 4 billion pieces per annum. Machines from the old Pontian factory will be moved to the new Pontian factory in stages to avoid disruption in our operations. The remaining 2 billion manufacturing capacity will be from Port Klang, Selangor and Hat Yai, Thailand factory respectively.

We made announcement on August 2014 to acquire a 55% stake in Global Protection Corp. (“GP”). GP is the owner of the ONE brand condoms, the fourth largest brand in the US. With over 1,000 customers and access to more than 25,000 stores in the US and Canada, we believe that the acquisition of GP will serve as a complement to our existing own brand manufacturing products. In addition, thedistribution agreement will grant Karex the exclusive rights to become the sole distributor of ONE brand condom as well as selected condom brands in certain countries in Asia (including China), North Africa and selected countries in the Middle East.

I am now pleased to inform that Karex has successfully completed the acquisition on 3 October 2014. ONE is an established brand in US and Canada since 2004, and has been very well-received especially by the younger generation today due to its unique product innovations and creative marketing techniques. We are very excited to be given this opportunity to work along with GP, we believe that this is only the beginning towards a greater journey for us in Karex.

Karex Bhd Annual Report 2014 07 Nov 2014

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Karex Bhd

Created by ss20_20 | Mar 12, 2015

Created by ss20_20 | Mar 03, 2015