Stock Pick Year 2014 - kcchongnz - KUCHAI

Tan KW

Publish date: Mon, 23 Dec 2013, 12:21 PM

Kuchai Development: A value stock or a value trap?

“The margin of safety investment framework starts with assessing risks and the downside before focusing on potential returns.”

An Arbitrage Opportunity?

I will be going to see a friend working in a bank to borrow RM150 million from him to do this.

|

Table 1: Arbitrage (figures in millions) |

|

|

Borrow money and buy all Kuchai shares |

150 |

|

Liquidate all equities except Sg Bagan |

153 |

|

Cash in balance sheet |

36 |

|

Total cash available |

189 |

|

Pay loan |

-150 |

|

Pay 6 month interest at 5% rate |

-3.8 |

|

Pay other expenses |

-2.2 |

|

Pay all liabilities |

-1 |

|

Total liabilities paid |

-157 |

|

Balance cash to pocket |

32 |

I will withdraw and pocket the balance cash of 32 million Ringgit and go enjoy myself. Besides I still own an shop house in Singapore worth 23m in Singapore which I can collect a rental income of RM780,000 a year. I will also own 26% stake in Sg Bagan worth RM101 million at the market price of RM3.22 now. This time I am going to be a very rich man. Wait a minute. Is there such a big fat frog jumping around, and how come nobody catch it? Why me, God?

The fact is that nobody, not even Warren Buffet can do the above unless he is prepared to pay a sum closed to or above the net asset backing of Kuchai of RM2.76 a share. The shareholding of these three companies, Kuchai, Sg Bagan and Kluang Rubber are intertwined. 60% of Kuchai’s outstanding shares are held by related parties. Nobody would be able to make a hostile takeover without the consent of the Lee brothers. This leave us with another choice, that is to invest in the shares of the company following the negative enterprise value investing strategy.

http://klse.i3investor.com/blogs/kianweiaritcles/43313.jsp

What is the investment thesis in Kuchai?

You can buy Kuchai from the open market at RM1.20 per share now. Below is what is owned by you as a shareholder of the company.

|

Assets |

Amount 000 |

Per share, RM |

|

Cash |

36065 |

0.30 |

|

Equity investment |

153052 |

1.27 |

|

Market value of shares in Sg Bagan (26%) |

50644 |

0.42 |

|

An investment property in Singapore |

22201 |

0.18 |

|

Total assets |

261962 |

2.17 |

You own hard cash, liquid shares mainly in Great Eastern listed in Singapore, 26% shares in Sg Bagan (Book value 122m) which itself is more than 50% undervalued, and a shop house at Emerald Hill Road, Singapore. The total market value of these assets is worth 262 million Ringgit, or RM2.17, 82% more than what you pay. Kuchai has no debt and negligible liabilities.

The above assets provide Kuchai with the stable incomes from interest income, dividend income and rental return. This amount to about 6 million Ringgit a year. Its annual expenses amounts to about one million a year. There is no other way of burning cash. How much downside is there investing in Kuchai?

“If you were to distill the secret of sound investment into three words, we venture the motto, MARGIN OF SAFETY.” Benjamin Graham

What are the pitfalls in investing in Kuchai?

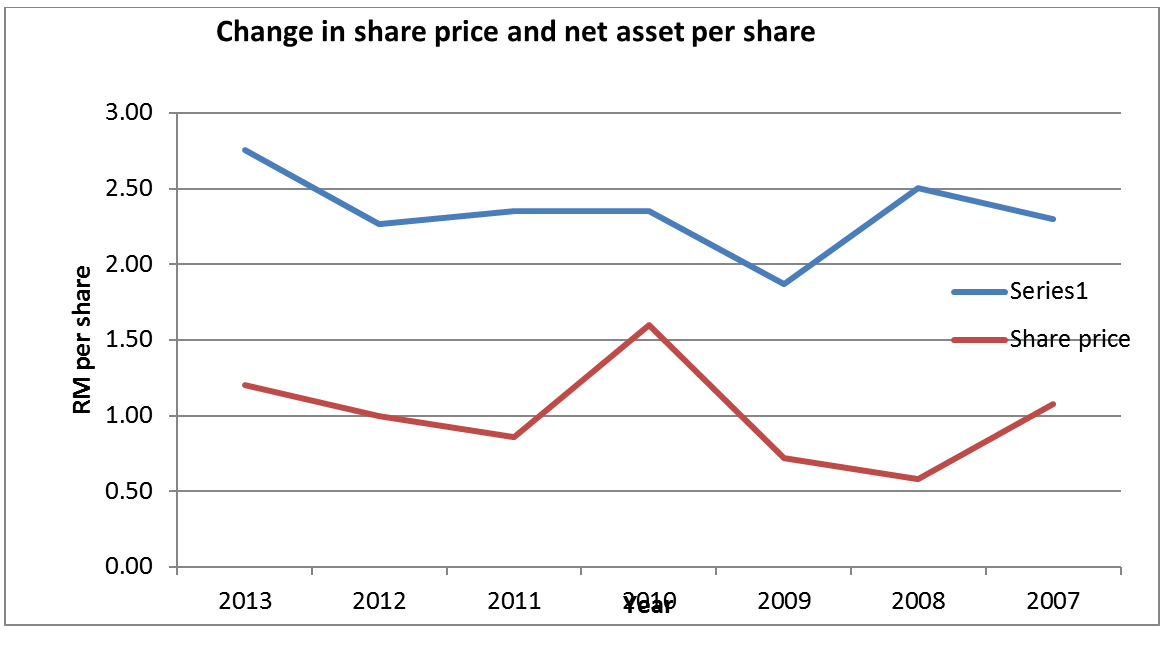

The following figure shows that Kuchai share price has always been traded below its net asset backing (NAB) per share by a wide margin. There was a significant narrowing of the margin some three years ago when the share price rose to above RM1.50 when its NAB was about RM2.35, or a discount of 32% compared to 56% now.

Figure 1: Kuchai share price Vs net asset backing

Secondly Kuchai’s management has been notorious for being stingy and annual dividend has been meagre at about one sen or one and a half sen every year. Last year a special dividend of 4.7 sen was declared, and with the 1.2 sen normal dividend, a total dividend of 6 sen was distributed, or a dividend yield of 4.5%, not bad at all.

Secondly Kuchai’s management has been notorious for being stingy and annual dividend has been meagre at about one sen or one and a half sen every year. Last year a special dividend of 4.7 sen was declared, and with the 1.2 sen normal dividend, a total dividend of 6 sen was distributed, or a dividend yield of 4.5%, not bad at all.

Thirdly, there is no chance of hostile takeover from any party and hence unlocking its value as 60% of its shares is held by related party. The board is tightly controlled. Minority shareholders have no say at all and have to depend on the mercy of the major shareholders.

Fourthly the management appears to be lazy with no significant business carried out. There is little prospect of growth of its assets and shareholder value enhancement.

What can minority shareholders hope for?

- The narrowing of the gap of the share price with the quality net asset backing of the share. Long-term Investors with say a 5-year horizon may have a good chance to achieve this. In investing, patience is the virtue.

- Meanwhile investors can ride on the return of investment of Kuchai’s investments, and the increase in book value, and hence the corresponding share price of Kuchai.

- Hopefully the management continue to pay good dividend which commensurate with the return from fixed income.

- Selling off an investment asset, such as some equity in Great Eastern, some shares in Sg Bagan etc and cash distributed to shareholders.

- Corporate exercise to unlock the value of the company such as merging of the three companies of Kuchai, Sg. Bagan and Kluang Rubber, maintain a viable business operation, and distribute some significant cash to shareholders.

- Privatization of the company with general offer price close to net asset backing.

A total return of the company’s investments of 10%, plus a narrowing of the gap of the share price and NAB of 10% a year would yield a total return of about 20% for the shareholders. I would be very happy with this return with little undue risk as Buffet says:

Rule No. 1: Don’t lose money

Rule No. 2: Don’t forget Rule No. 1.

This boring defensive strategy is my thesis and goal for investing in Kuchai. However, isn’t investing with the aim to grow wealth supposed to be a boring stuff like what this guy said?

“Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $100,000 and go to Genting Highland.”

“Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $100,000 and go to Genting Highland.”

– Paul Samuelson

I have added Kuchai as a defensive stock in my portfolio.

KC Chong (21 December 2013)

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Stock Pick Year 2014 - kcchongnz

Discussions

I find Kuchai is a very straightforward case. It is purely a holding and investment company, nothing else. I didn't look at the other two companies initially. Just glanced through Sg Bagan, and it seems to have more work to do to present a case like what I did for Kluang.

I think the other two companies are equally undervalued. However, as Kuchai really has no viable business at all and it is most likely subject to some corporate exercise like prioritization, or SC may come hard to them to do something. That could unlock its value.

What make a buy a good one?

1. Price is low relative to the value

2. Potential return is high relative to risk

All the three companies nicely meet the above criteria.

2013-12-23 18:14

kcchongnz, these 3 co. has stingy bosses helming, difficult to get dividend from them, hope sc comes hard on them soon, esp kuchai thus unlocking its huge asset, the question is when. any sketches

2013-12-23 19:05

kuchai is really very straightforward.

can i use my RM1.2 to buy your RM2.7? thats exactly what kuchai is about. good stock to hold. i feel some corporate activities is in the pipeline

2013-12-24 10:35

kuchai really has no point of being listed. its either capital repayment or injection of business

2013-12-24 10:36

High chances of greateaster being privatised. Major shareholders holding 89%. Share price highly illiquid. Rumours were they tried to privatise but kuchai is not willing to sell their share. If they offer a higher price, kuchai might agree. Let's say kuchai wiling to let to at sgd20. It's 155m cash!!!!

2013-12-25 17:43

But then again. Kuchai has been like that for a decade or so. Very passive board of directors.lets hope something will happen in the near term . My top 5 pick of 2014

2013-12-25 17:47

Very speculative in nature..

Mpcorp, dgsb

I'm bullish on Hong Kong. So bank of China. And rexlot for world club theme.

I speculate for Malaysia market, for fundamentals I go for the Chinese market. There you go, my top 5 picks

2013-12-25 21:19

houseofordos

KC, nice analysis.

A few questions :-

1. Why do you prefer Kuchai over SBAGAN or KLUANG ? Is the discount the widest for Kuchai among these 3 companies ?

2. Do you see any unwanted RPT in your study on this company ?

2013-12-23 12:46