AFTER a brutal 2018 in which equity markets took a turn for the worse, market watchers turned more cautious with their outlook

for the first half of 2019. Dark clouds of uncertainty continued to loom over earnings prospects and global investor interest.

The Edge Financial Daily picked its portfolio based on various themes, including several stocks that have been battered down and now command more attractive valuations. While economic conditions are seen to potentially worsen next year, growth driven by domestic private consumption is another factor that could support corporate earnings. Malaysia has also been highlighted as an early beneficiary of the US-China trade war, such as its technology and manufacturing sectors, if trade talks do not deteriorate.

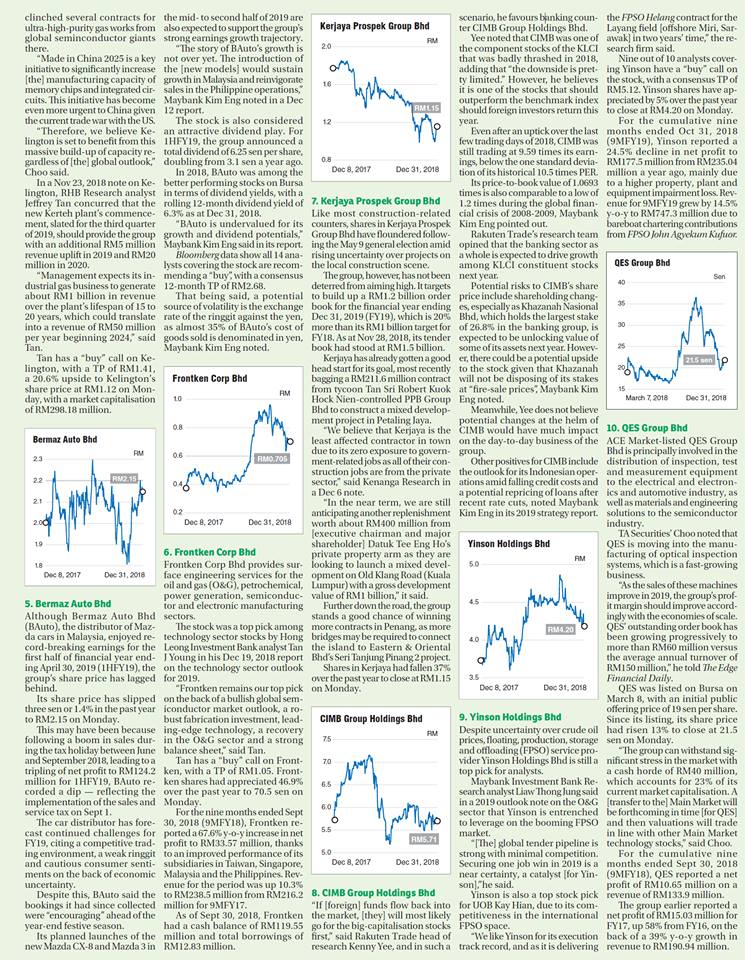

1. AirAsia Group Bhd

At a price-earnings ratio (PER) of 3.48 times, AirAsia Group Bhd is currently one of the cheapest stocks on Bursa Malaysia. After having touched a record RM4.60 in early February, it fell steadily to as low as RM2.38 in late October. The stock closed 2018 unchanged at RM2.97 on Monday.

Rising fuel prices, which sent AirAsia’s core net profit for the nine months ended Sept 30, 2018 (9MFY18) tumbling some 33% to RM805.08 million, may have been one of the reasons investors avoided it last year. In fact, CIMB Research downgraded the stock to “sell” after it posted a disappointing set of results for 9MFY18. A weaker ringgit against the US dollar compounded the low-cost carrier’s woes.

That being said, shareholders enjoyed a bumper dividend of 40 sen per share from AirAsia after the third quarter due to the group’s disposal of its stake in online travel agency Expedia and its leasing unit, Asia Aviation Capital Ltd. The carrier is expected to continue paying dividends as over 60 sen per share were initially estimated to be disbursed from the billion-dollar disposal.

On top of that, the price of Brent crude oil has been on a downward trend since October 2018, to below US$60 (RM247.80) per barrel in mid-December.

“We believe that jet fuel prices will follow suit, and AirAsia and AirAsia X Bhd will be able to take advantage by hedging more on the declining trend of oil price[s]. As such, we expect these two airlines will be able to reap the benefit in 2019,” MIDF Research said in its 2019 strategy report dated Dec 17, 2018.

MIDF Research is one of the 14 out of 20 analysts covering the stock that is bullish on AirAsia’s prospects, according to Bloomberg data.

“[Despite the unfavourable fuel price environment], AirAsia’s short-haul business model proved to be defensive with [its] earnings before interest and tax margin standing close to 20% during the period,” the research house said.

On top of that, MIDF Research does not expect the new departure levy effective June this year to be a strong dampener on travellers, but to encourage more travel within Malaysia instead.

“Sensitivity towards increases in passenger service charges for international destinations has always been historically minimal,” the research house said.

Also, AirAsia has planned to expand capacity by adding 10 fuel-saving aircraft to its fleet in financial year 2019 (FY19) on top of a planned increase in international routes.

The group’s recent RM3.22 billion sale and leaseback of 25 aircraft to US-based private investment firm Castlelake LP was also viewed as a positive development.

“The proposed disposal concurs well with AirAsia’s digitalisation efforts,” MIDF Research said in a Dec 26 report, highlighting that this will raise the group’s cash pile and result in annual savings, which will help partially offset rental expenses.

2. FGV Holdings Bhd

FGV Holdings Bhd seems to be an unlikely choice for a stock pick, given the bout of bad news surrounding the global agri-business giant last year.

But TA Securities chief investment officer Choo Swee Kee opined that FGV had suffered enough in the past year and is now on the path of redemption.

“It has gone through weak management, poor risk control, declining crude palm oil (CPO) prices, bad acquisition [decisions] and recently a substantial write-off to the tune of almost RM800 million.

“With FGV being government-linked, new management and better policies have been put forward to turn the company around. It is critical the government gets it right this time as this may have implications for thousands of Felda settlers. Investors’ expectations are low and any sign of improvement will be taken as positive,” he told The Edge Financial Daily.

For the nine-month financial period ended Sept 30, 2018 (9MFY18), FGV reported a net loss of RM871.15 million, compared to a net profit of RM80.49 million a year ago, largely due to impairment losses of RM798 million. The bulk of the impairment stemmed from goodwill on the acquisition of Asian Plantations Ltd.

Year-to-date, CPO prices, which play a significant role in FGV’s plantation business, had declined by 21% to RM1,903 per tonne on Dec 26, 2018.

Choo noted a reprieve for FGV’s current depressed share price as the value of its assets and land.

“FGV is trading at a [more than] 30% discount to its net tangible assets. It owns about 350,000 hectares of plantation land,” he said.

Choo views FGV as a recovery play, and has a “buy” call on the stock, with a target price (TP) of RM1 per share.

FGV shares lost 60% or RM3.96 billion of its market value in the past year. It closed at 71.5 sen on Monday, with a market capitalisation of RM2.61 billion.

3. Serba Dinamik Holdings Bhd

Last year, Serba Dinamik Holdings Bhd was one of only two gainers in The Edge Financial Daily’s portfolio of top picks. The oil and gas solution’s provider remained a bright spot on Bursa despite volatility in both the equity market and oil prices in 2018.

The group’s share price has maintained its upward climb since its listing on Bursa in February 2017 at RM1.53. As at Dec 31, 2018, the counter had closed at RM3.78, up 17.4% over the past year and more than double its listing price.

That being said, analysts are still upbeat on Serba Dinamik’s prospects. Ten Bloomberg analysts with an eye on the stock, all recommended Serba Dinamik as a “buy”, with an average 12-month TP of RM4.91.

“Prospects to grow its engineering, procurement, construction and commissioning segment remain promising, with ample hydropower and utilities projects up for grabs,” said Affin Hwang Capital in a report on Dec 26, 2018.

The group’s earnings growth is expected to be driven by its Terengganu water treatment plant as well as its overseas ventures, the research firm said. These include a 30-megawatt power plant in Laos, a contract with New Thunder Technical Services in the United Arab Emirates and a chlor-alkali plant the group is building in Tanzania via a joint venture.

On Dec 10, 2018, Serba Dinamik said it targets to achieve an order book of RM10 billion by end-2019. On top of that, a more bullish outlook for Petroliam Nasional Bhd’s 2019-2021 downstream plant turnaround activities could potentially boost the group’s contributions from Malaysia, said Affin Hwang Capital.

Serba Dinamik recorded a 21.4% increase in net profit to RM278.61 million for 9MFY18 on the back of strong growth in its operation and maintenance activities. Revenue was up 20% year-on-year at RM2.31 billion for 9MFY18.

4. Kelington Group Bhd

Kelington Group Bhd serves industries requiring ultra-high-purity gases and chemicals in specialised applications.

TA Securities’ Choo said the barrier to entry is rather high in industries where Kelington serves as the provider, so one would need to have a good safety track record and trust among clients.

“We like Kelington as it has a proven business with multinational clients. The group’s financial year ending Dec 31, 2020 earnings growth will come from its new [liquid] carbon dioxide plant [in Kerteh, Terengganu], with a capacity of 50,000 tonnes. [The] break-even capacity is estimated at 30% and the company already has unofficial take-up of 30% to 40% for its capacity.

“Conservatively, we target [for Kelington’s] share price to grow 25%, mirroring its earnings growth,” he told The Edge Financial Daily.

The group also has a growing clientele in China, having clinched several contracts for ultra-high-purity gas works from global seminconductor giants there.

“Made in China 2025 is a key initiative to significantly increase [the] manufacturing capacity of memory chips and integrated circuits. This initiative has become even more urgent to China given the current trade war with the US.

“Therefore, we believe Kelington is set to benefit from this massive build-up of capacity regardless of [the] global outlook,” Choo said.

In a Nov 23, 2018 note on Kelington, RHB Research analyst Jeffrey Tan concurred that the new Kerteh plant’s commencement, slated for the third quarter of 2019, should provide the group with an additional RM5 million revenue uplift in 2019 and RM20 million in 2020.

“Management expects its industrial gas business to generate about RM1 billion in revenue over the plant’s lifespan of 15 to 20 years, which could translate into a revenue of RM50 million per year beginning 2024,” said Tan.

Tan has a “buy” call on Kelington, with a TP of RM1.41, a 20.6% upside to Kelington’s share price at RM1.12 on Monday, with a market capitalisation of RM298.18 million.

5. Bermaz Auto Bhd

Although Bermaz Auto Bhd (BAuto), the distributor of Mazda cars in Malaysia, enjoyed record-breaking earnings for the first half of financial year ending April 30, 2019 (1HFY19), the group’s share price has lagged behind.

Its share price has slipped three sen or 1.4% in the past year to RM2.15 on Monday.

This may have been because following a boom in sales during the tax holiday between June and September 2018, leading to a tripling of net profit to RM124.2 million for 1HFY19, BAuto recorded a dip — reflecting the implementation of the sales and service tax on Sept 1.

The car distributor has forecast continued challenges for FY19, citing a competitive trading environment, a weak ringgit and cautious consumer sentiments on the back of economic uncertainty.

Despite this, BAuto said the bookings it had since collected were “encouraging” ahead of the year-end festive season.

Its planned launches of the new Mazda CX-8 and Mazda 3 in the mid- to second half of 2019 are also expected to support the group’s strong earnings growth trajectory.

“The story of BAuto’s growth is not over yet. The introduction of the [new models] would sustain growth in Malaysia and reinvigorate sales in the Philippine operations,” Maybank Kim Eng noted in a Dec 12 report.

The stock is also considered an attractive dividend play. For 1HFY19, the group announced a total dividend of 6.25 sen per share, doubling from 3.1 sen a year ago.

In 2018, BAuto was among the better performing stocks on Bursa in terms of dividend yields, with a rolling 12-month dividend yield of 6.3% as at Dec 31, 2018.

“BAuto is undervalued for its growth and dividend potentials,” Maybank Kim Eng said in its report.

Bloomberg data show all 14 analysts covering the stock are recommending a “buy”, with a consensus 12-month TP of RM2.68.

That being said, a potential source of volatility is the exchange rate of the ringgit against the yen, as almost 35% of BAuto’s cost of goods sold is denominated in yen, Maybank Kim Eng noted.

6. Frontken Corp Bhd

Frontken Corp Bhd provides surface engineering services for the oil and gas (O&G), petrochemical, power generation, semiconductor and electronic manufacturing sectors.

The stock was a top pick among technology sector stocks by Hong Leong Investment Bank analyst Tan J Young in his Dec 19, 2018 report on the technology sector outlook for 2019.

“Frontken remains our top pick on the back of a bullish global semiconductor market outlook, a robust fabrication investment, leading-edge technology, a recovery in the O&G sector and a strong balance sheet,” said Tan.

Tan has a “buy” call on Frontken, with a TP of RM1.05. Frontken shares had appreciated 46.9% over the past year to 70.5 sen on Monday.

For the nine months ended Sept 30, 2018 (9MFY18), Frontken reported a 67.6% y-o-y increase in net profit to RM33.57 million, thanks to an improved performance of its subsidiaries in Taiwan, Singapore, Malaysia and the Philippines. Revenue for the period was up 10.3% to RM238.5 million from RM216.2 million for 9MFY17.

As of Sept 30, 2018, Frontken had a cash balance of RM119.55 million and total borrowings of RM12.83 million.

7. Kerjaya Prospek Group Bhd

Like most construction-related counters, shares in Kerjaya Prospek Group Bhd have floundered following the May 9 general election amid rising uncertainty over projects on the local construction scene.

The group, however, has not been deterred from aiming high. It targets to build up a RM1.2 billion order book for the financial year ending Dec 31, 2019 (FY19), which is 20% more than its RM1 billion target for FY18. As at Nov 28, 2018, its tender book had stood at RM1.5 billion.

Kerjaya has already gotten a good head start for its goal, most recently bagging a RM211.6 million contract from tycoon Tan Sri Robert Kuok Hock Nien-controlled PPB Group Bhd to construct a mixed development project in Petaling Jaya.

“We believe that Kerjaya is the least affected contractor in town due to its zero exposure to government-related jobs as all of their construction jobs are from the private sector,” said Kenanga Research in a Dec 6 note.

“In the near term, we are still anticipating another replenishment worth about RM400 million from [executive chairman and major shareholder] Datuk Tee Eng Ho’s private property arm as they are looking to launch a mixed development on Old Klang Road (Kuala Lumpur) with a gross development value of RM1 billion,” it said.

Further down the road, the group stands a good chance of winning more contracts in Penang, as more bridges may be required to connect the island to Eastern & Oriental Bhd’s Seri Tanjung Pinang 2 project.

Shares in Kerjaya had fallen 37% over the past year to close at RM1.15 on Monday.

8. CIMB Group Holdings Bhd

“If [foreign] funds flow back into the market, [they] will most likely go for the big-capitalisation stocks first,” said Rakuten Trade head of research Kenny Yee, and in such a scenario, he favours banking counter CIMB Group Holdings Bhd.

Yee noted that CIMB was one of the component stocks of the KLCI that was badly thrashed in 2018, adding that “the downside is pretty limited.” However, he believes it is one of the stocks that should outperform the benchmark index should foreign investors return this year.

Even after an uptick over the last few trading days of 2018, CIMB was still trading at 9.59 times its earnings, below the one standard deviation of its historical 10.5 times PER.

Its price-to-book value of 1.0693 times is also comparable to a low of 1.2 times during the global financial crisis of 2008-2009, Maybank Kim Eng pointed out.

Rakuten Trade’s research team opined that the banking sector as a whole is expected to drive growth among KLCI constituent stocks next year.

Potential risks to CIMB’s share price include shareholding changes, especially as Khazanah Nasional Bhd, which holds the largest stake of 26.8% in the banking group, is expected to be unlocking value of some of its assets next year. However, there could be a potential upside to the stock given that Khazanah will not be disposing of its stakes at “fire-sale prices”, Maybank Kim Eng noted.

Meanwhile, Yee does not believe potential changes at the helm of CIMB would have much impact on the day-to-day business of the group.

Other positives for CIMB include the outlook for its Indonesian operations amid falling credit costs and a potential repricing of loans after recent rate cuts, noted Maybank Kim Eng in its 2019 strategy report.

9. Yinson Holdings Bhd

Despite uncertainty over crude oil prices, floating, production, storage and offloading (FPSO) service provider Yinson Holdings Bhd is still a top pick for analysts.

Maybank Investment Bank Research analyst Liaw Thong Jung said in a 2019 outlook note on the O&G sector that Yinson is entrenched to leverage on the booming FPSO market.

“[The] global tender pipeline is strong with minimal competition. Securing one job win in 2019 is a near certainty, a catalyst [for Yinson],”he said.

Yinson is also a top stock pick for UOB Kay Hian, due to its competitiveness in the international FPSO space.

“We like Yinson for its execution track record, and as it is delivering the FPSO Helang contract for the Layang field [offshore Miri, Sarawak] in two years’ time,” the research firm said.

Nine out of 10 analysts covering Yinson have a “buy” call on the stock, with a consensus TP of RM5.12. Yinson shares have appreciated by 5% over the past year to close at RM4.20 on Monday.

For the cumulative nine months ended Oct 31, 2018 (9MFY19), Yinson reported a 24.5% decline in net profit to RM177.5 million from RM235.04 million a year ago, mainly due to a higher property, plant and equipment impairment loss. Revenue for 9MFY19 grew by 14.5% y-o-y to RM747.3 million due to bareboat chartering contributions from FPSO John Agyekum Kufuor.

10. QES Group Bhd

ACE Market-listed QES Group Bhd is principally involved in the distribution of inspection, test and measurement equipment to the electrical and electronics and automotive industry, as well as materials and engineering solutions to the semiconductor industry.

TA Securities’ Choo noted that QES is moving into the manufacturing of optical inspection systems, which is a fast-growing business.

“As the sales of these machines improve in 2019, the group’s profit margin should improve accordingly with the economies of scale. QES’ outstanding order book has been growing progressively to more than RM60 million versus the average annual turnover of RM150 million,” he told The Edge Financial Daily.

QES was listed on Bursa on March 8, with an initial public offering price of 19 sen per share. Since its listing, its share price had risen 13% to close at 21.5 sen on Monday.

“The group can withstand significant stress in the market with a cash horde of RM40 million, which accounts for 23% of its current market capitalisation. A [transfer to the] Main Market will be forthcoming in time [for QES] and then valuations will trade in line with other Main Market technology stocks,” said Choo.

For the cumulative nine months ended Sept 30, 2018 (9MFY18), QES reported a net profit of RM10.65 million on a revenue of RM133.9 million.

The group earlier reported a net profit of RM15.03 million for FY17, up 58% from FY16, on the back of a 39% y-o-y growth in revenue to RM190.94 million.