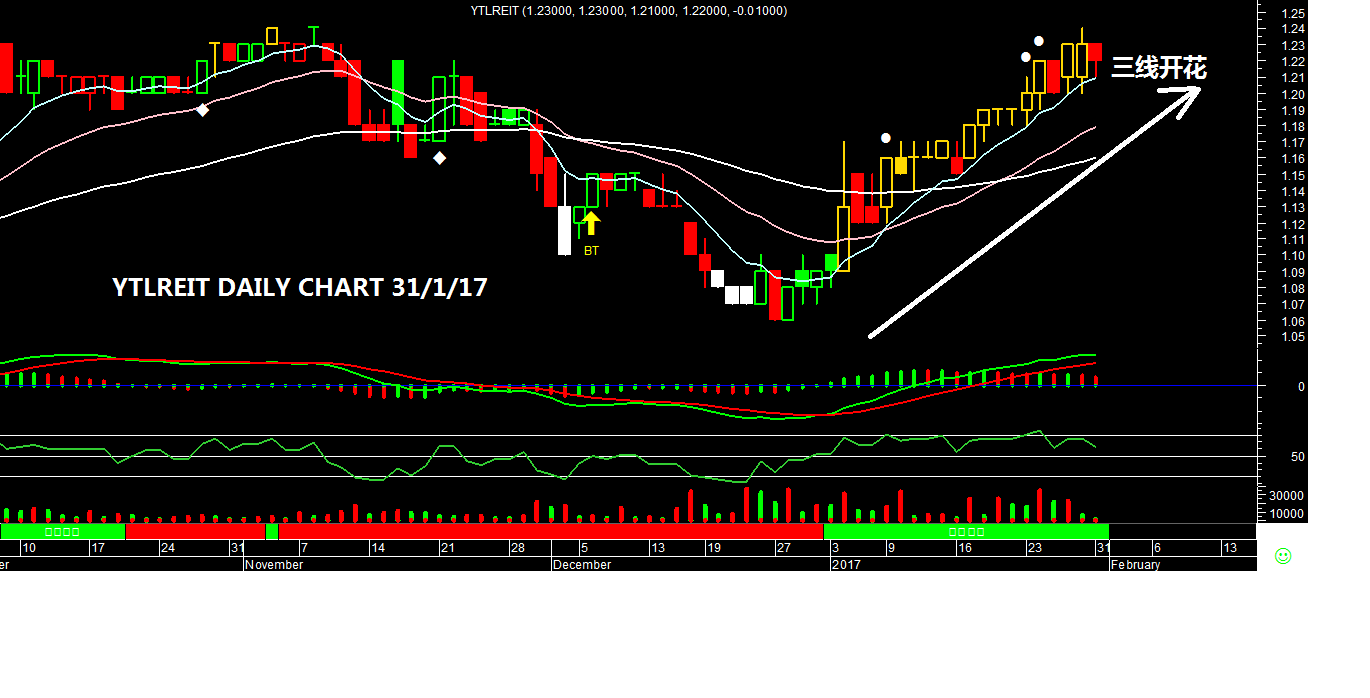

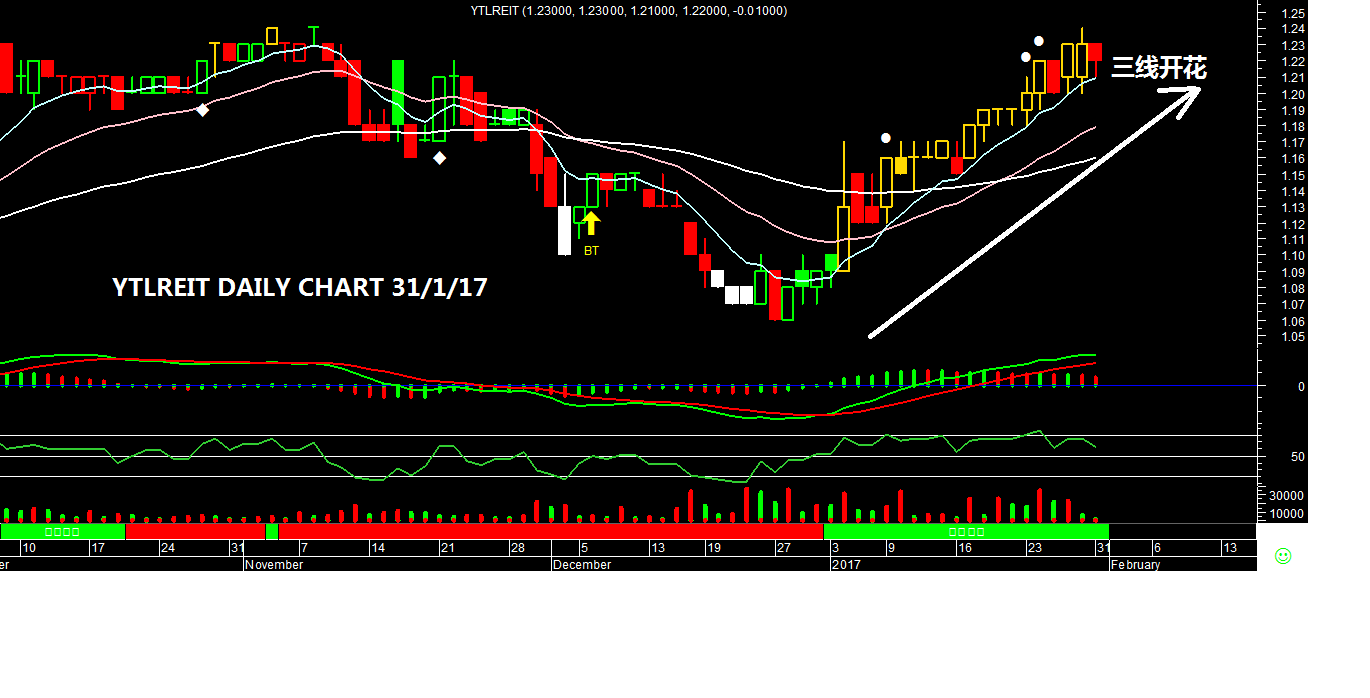

Starting from 28-12 up to now, from 1.06 to 1,24

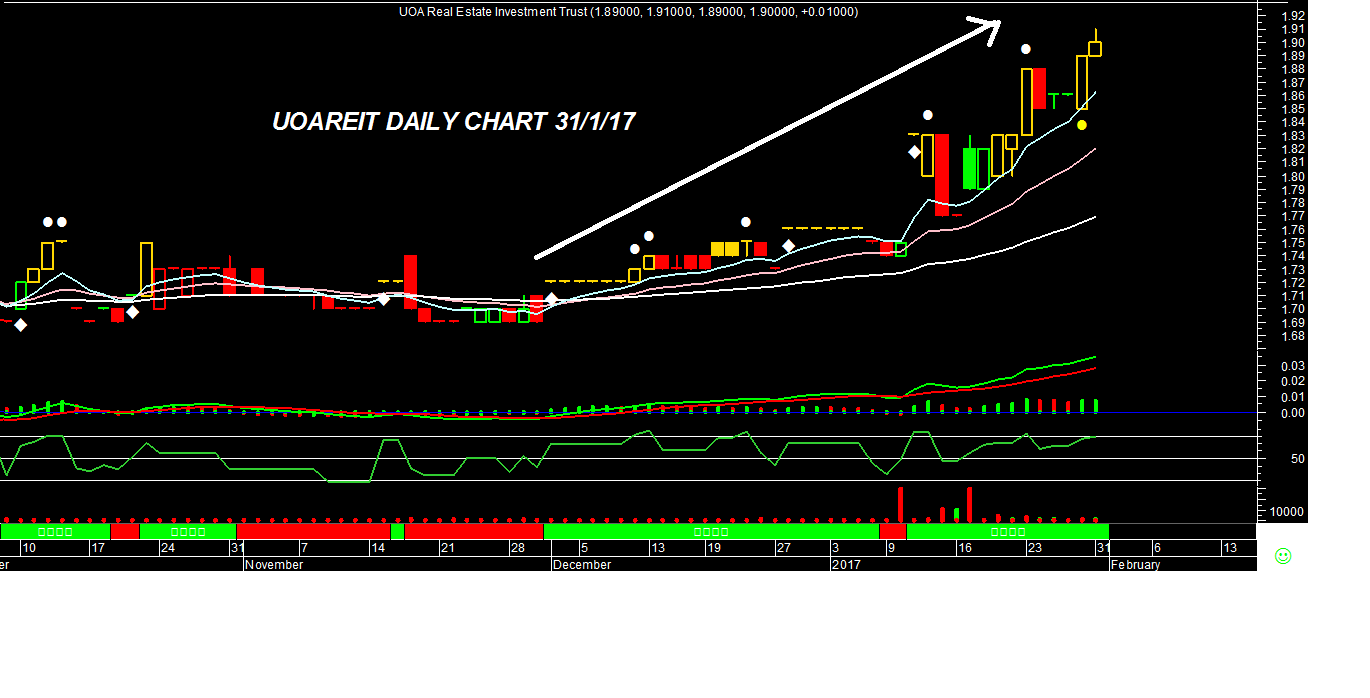

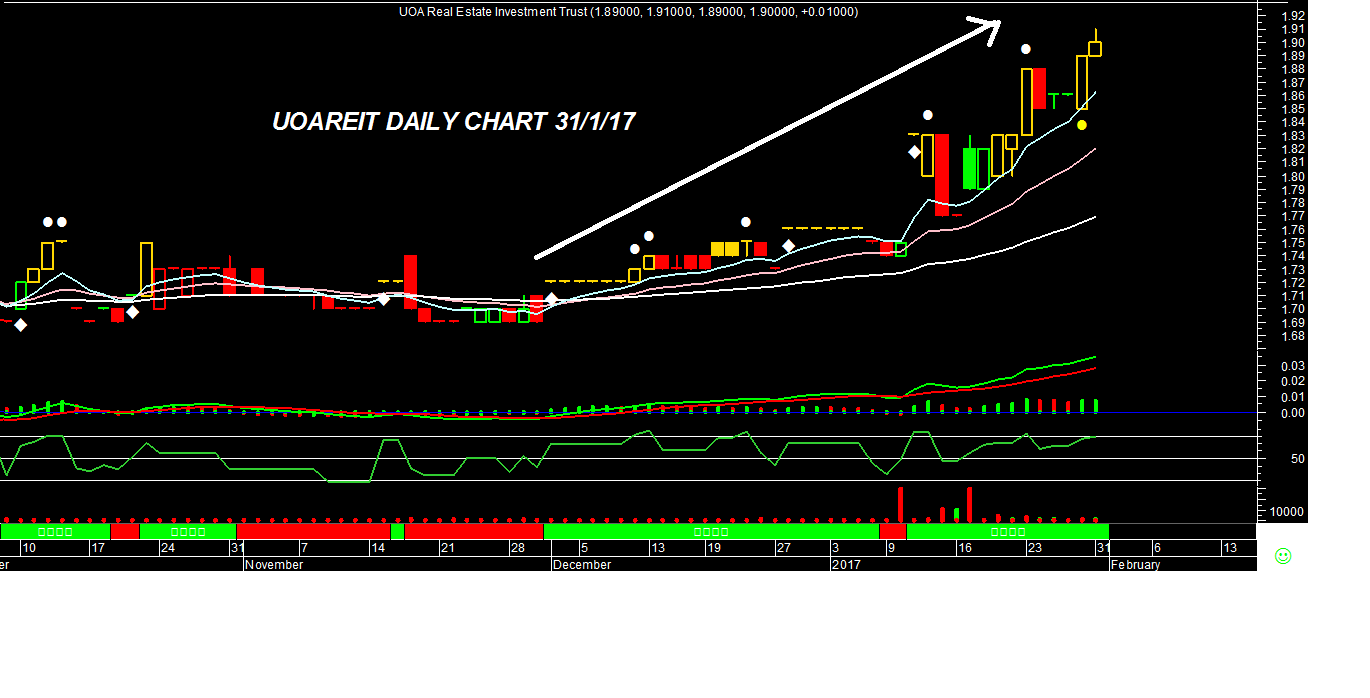

2 UOAREIT

请按这个LINK 加入我们的TELEGRAM获取既时免费分享资讯

https://telegram.me/mplusbentong

Starting from 28-12 up to now, from 1.06 to 1,24

2 UOAREIT

Created by chansifu | Nov 18, 2018

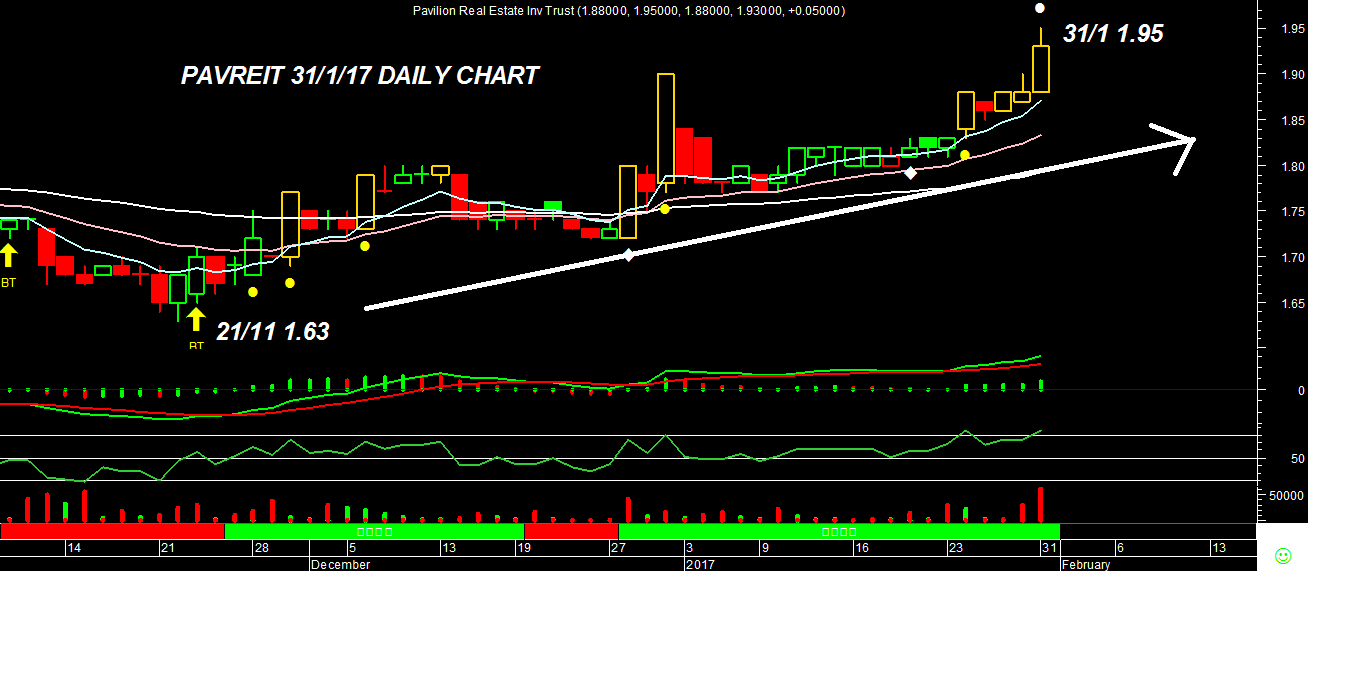

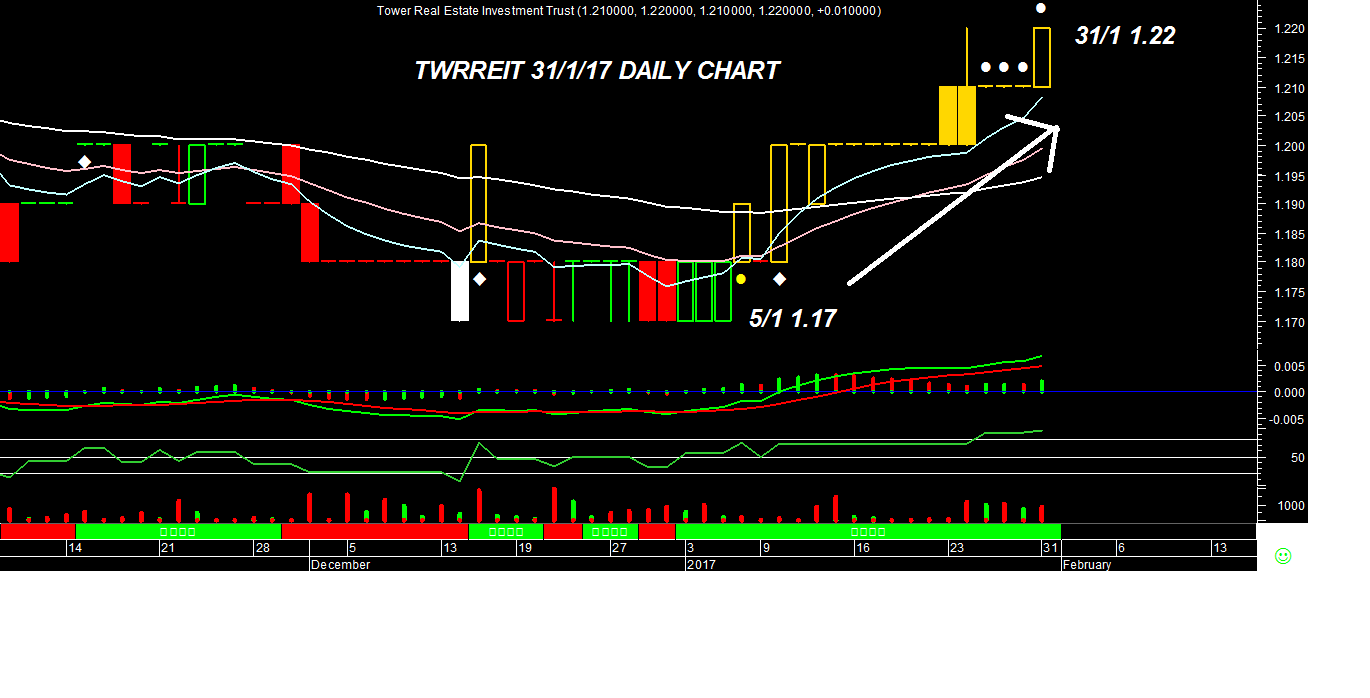

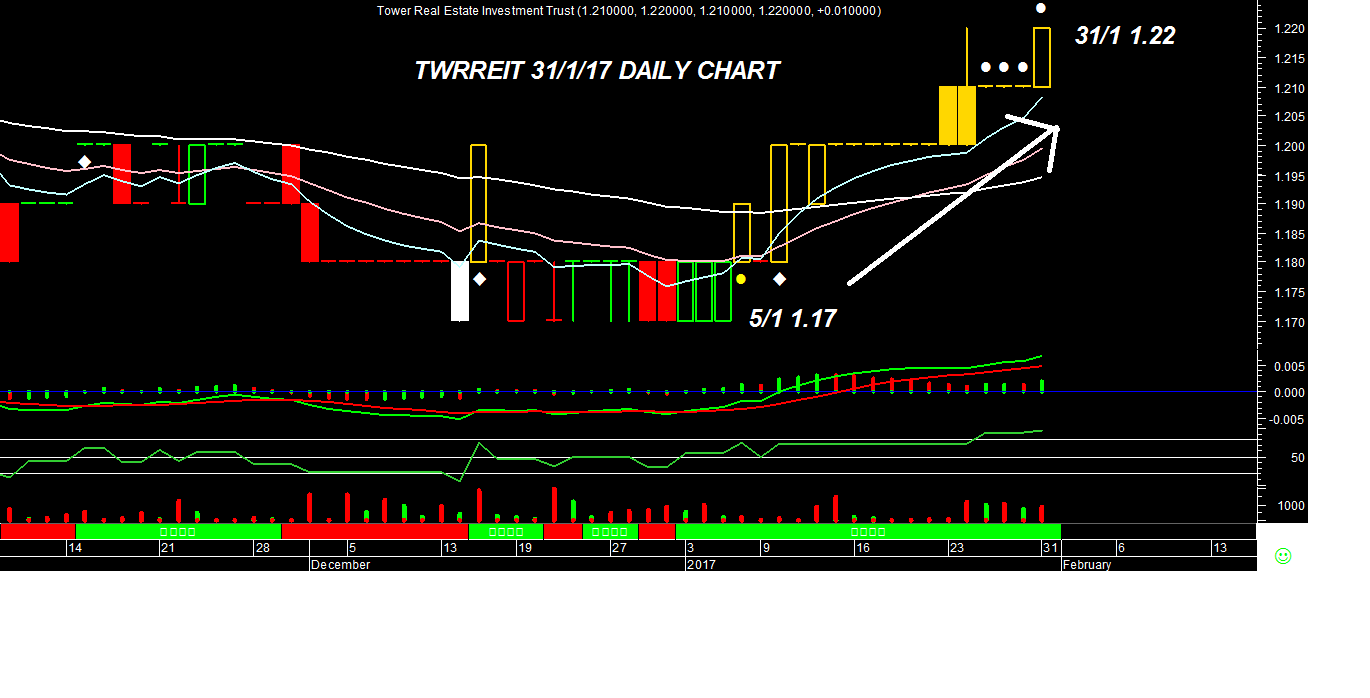

Maybe now is not the right time to buy these counters, target KIP REIT next week.

2017-02-01 22:15

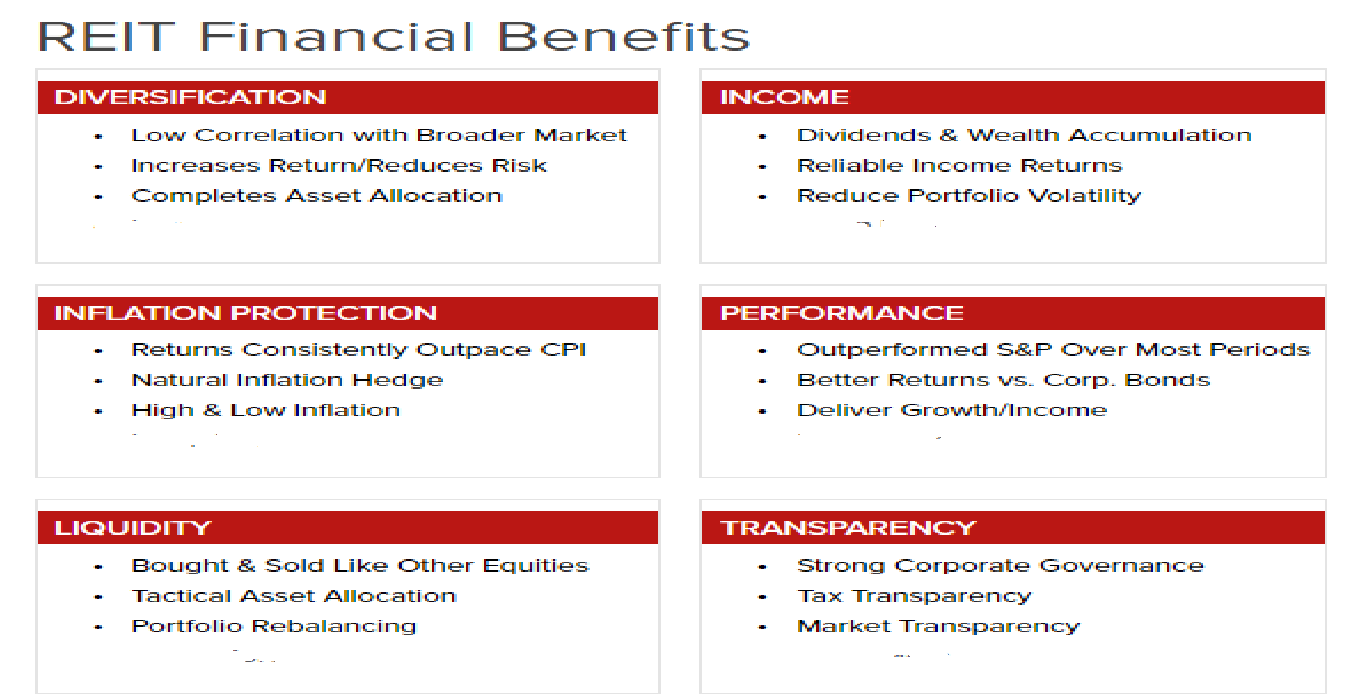

From what I understand, all dividends received from REIT required to file for income tax. Am I right?

2017-02-02 00:05

dividend from reit no need file for income tax.. when you received is net of tax.. 10% withholding tax.. non-claimable for refund.. if you plan to hold for long term or just want fixed return, then you may invest in reit.. return is higher than FD rate.. average return like 4%-6%.. depending on what price you go in..

2017-02-02 23:42

For me, now is the time u should avoid REIT in Malaysia. Try to compare Malaysia and Singapore REIT.

2017-02-05 17:34

L2invest

Ya oh, funny that the trend has not been in line with stock trend in general. More people feel that interest rate will remain suppressed for an extended period?

2017-02-01 19:43