(TapDance) Only World Group (OWG) - riding on promising secular trend with (extremely) low market expectation

tapdance

Publish date: Thu, 21 Mar 2019, 02:11 PM

Summary

OWG is at an inflection point after a two year sell-down (~-75%) of which was triggered by temporary (suspend Genting Highland operation to give way for GITP) and extraordinary factors (Genting vs. Twentieth Century Fox world theme park dispute).

As the investment cycle’s gestation period is finally coming to an end, it is the beginning of a multi-year growth phase. The latest 2Q19 result is already showing signs of turning around.

For a start, a modest 1x PB translates to ~50% upside.

Description

Background info: Genting Integrated Tourism Plan (GITP) is a multi-year RM10.4 billion capital investment program to revamp Genting Highland as a tourism hotspot – which includes a Twentieth Century Fox (TCF) world theme park costing RM2 billion alone. The program, initially budgeted at RM5 billion and doubled with conviction, expects to push number of visitors to Genting Highland to 30m by 2020 from 20m pa. currently.

In late 2018, shock wave was sent across the market when Disney decided to cancel TCF’s original theme park planning after Disney acquired TCF. Disney does not want to be associated with Casino activities.

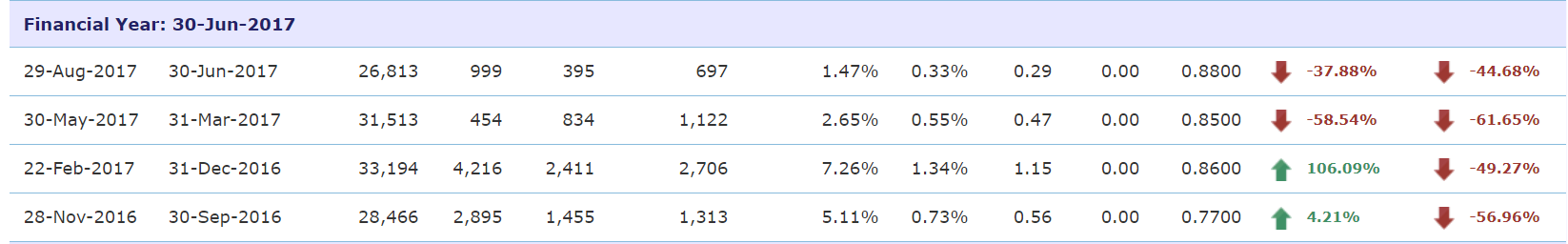

Cause of sell-down: OWG’s performance was halved in FY17 and remained lackluster in FY18 after giving way for GITP’s development.

OWG will stand to benefit from Genting Integrated Tourism Plan (GITP). Instead of recognizing the promising investment cycle, market refuses to look-through the gestation period AND penalizes it by shredding -60% of its market value (2017 to mid-2018).

The TCF theme park dispute triggered another round of sell down on OWG. Essentially a double penalty. By now OWG market value has declined ~ -75% (2017 to end of 2018).

The bearish sentiment was severe. GITP started rolling out new entertainment attractions were completely ignored. Attractions includes Genting Premium Outlet, indoor theme park (Skytropolis), hundreds of retail and F&B outlets in SkyAvenue and SkyCentral, SkySymphony performance, Awana Skyway – new cable car system, new hotels etc.

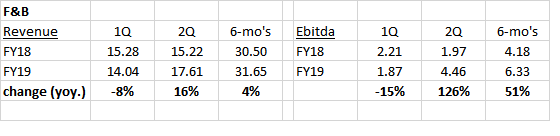

Signs of turning around: In its 2Q19 result, OWG commented that the indoor theme park opening in December 2018 has led to an increase of its F&B operation performance. A comparison table is presented below.

Let’s still call it a 1-month effort – actual operating hours likely lesser because of opening preparation works etc. The F&B division registered a sterling +126% growth in earnings for the whole quarter, on the back of a mere +16% revenue growth as operating leverage effect kicks in.

The ‘Other Services’ segment – operates retail and beauty salon outlets at SkyAvenue experienced similar improvement. Losses narrowed from RM6.8m to just RM1.4m in a single quarter i.e. +79% yoy.

The ‘Amusement and Recreation’ segment could be a drag. But let’s focus on the big picture – which is the Genting Highland’s side of operation.

The performance is certainly sustainable, supported by the continuous role out of entertainment attractions from Genting. Visitor growth is gaining momentum. Operating leverage elevates bottom line significantly, which in turn (eventually) leads to multiplier effect on the co.’s share price.

Legwork confirmation: Cross channel checks confirmed numerous highland F&B outlets are indeed nationwide high sales outlets – all within a short span of few months.

Outlets with lower price-points has no peak/off-peak period apparently. They are well supported by the highland workers (from retail, F&B, casino, construction, renovation, marketers etc.). Holiday season or not is irrelevant. And lower price point is OWG’s forte.

There are more than enough videos circulating about the crazy amount of crowds at the highlands during the 2019 Chinese New Year period. The (likely) significantly positive impact has will be captured in the coming quarterly result.

Commonsense says oversold: Genting targets to launch its outdoor theme park in 2H-2019 originally. It could delay because of the TCF debacle. Nonetheless as a sensible business operator, an indefinite launching postponement (which costs billions) simply for the sake of a brand-name theme park is unfathomable. I believe there’ll be a contingency plan. Commonsense usually prevails.

Secular trend: The real beauty about OWG is its long runway. That is at least until the outdoor theme park effect sizzles. Imagine Genting Highland as a holiday idea in the local tourism industry until the whole GITP matures. It will take many years. Institution investors will commit sizeable investment sum for a sustainable business trend.

Insider buying cum risk removal: Insiders scooped up some shares during the Genting/Disney dispute sell down. Transacted price around RM0.50/share. While the support is certainly a vote of confidence, it also removes substantial risk for public shareholders that insiders could be plotting to privatize the co. at the cheap.

Risk-reward and payout odds: Whatever the outcome of the outdoor theme park, OWG is undergoing an inflection point. The significant improvement in the underlying business performance will surface in the coming months. Couples with the ultra-low market expectation and identifiable cause of a 2 years’ sell-down makes it a very compelling investment case.

I must confess that my range of earnings estimates is simply too wide to be of useful. Nonetheless I reckon it is conservative to expect at least 1x price-book from a high cash generative business with a promising outlook and other attributes mentioned above.

OWG is trading at 0.65x PB thus translates to ~55% upside. Hopefully OWG discloses more information as the valuation gap closes, to better appraise its intrinsic value.

Catalyst

· December 2018 figure showing signs of turning around.

· Chinese New Year’s significant higher visitor volume to be reflected on coming quarterly report

· GITP comes to fruition bringing in more visitors

. Sell side coverage increase - currently none of the large research team is covering OWG explains why the opportunity

Questions and constructive comments are welcome. You are encouraged to bring fresh perspective so I can reexamine my logic.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|