(TapDance) Coastal Contracts - rides on a RM50bn opportunity

tapdance

Publish date: Wed, 17 Mar 2021, 11:15 AM

Summary

Coastal – a seasoned local shipbuilder arms with proven track record and solid balance sheet, stands to benefit from Petronas’ 100 OSVs procurement opportunity.

The OSV construction opportunity alone worth ~RM5bn (~RM50mn per standard OSV). Contracts are explicitly stated for LOCAL shipyards and financial institutions only.

Many shipbuilders have left the industry after a decade long grueling slump. Remaining players are either drowning in debt crippled to seize opportunities in any significant manner, or waiting to be taken over.

The industry backdrop is a great setup for Coastal in the coming years. Coastal has been all out making strategic investments including acquiring liftboat for offshore windfarm and Gas Sweetening Plant contract in Mexico, supported by its own sturdy stream of cash flow. And now a potential windfall from Petronas’ 100 OSVs procurement contract opportunity.

Coastal offers one of the best asymmetric payout profile in the market now. The undergoing macro to micro industry dynamic shift is broadly unnoticed. If any, it is deemed a crude oil correlation trade. Expectation at the low pairs with sizeable opportunity is a dream-team combo.

Investors do not need an ultra-high oil price to justify an investment in Coastal although it helps solidifies the thesis.

Fairly large MHB ran up by ~75% within 1.5 months since the February article was first published. The obscure Coastal shouldn't take lesser or longer.

Description & Growth factors

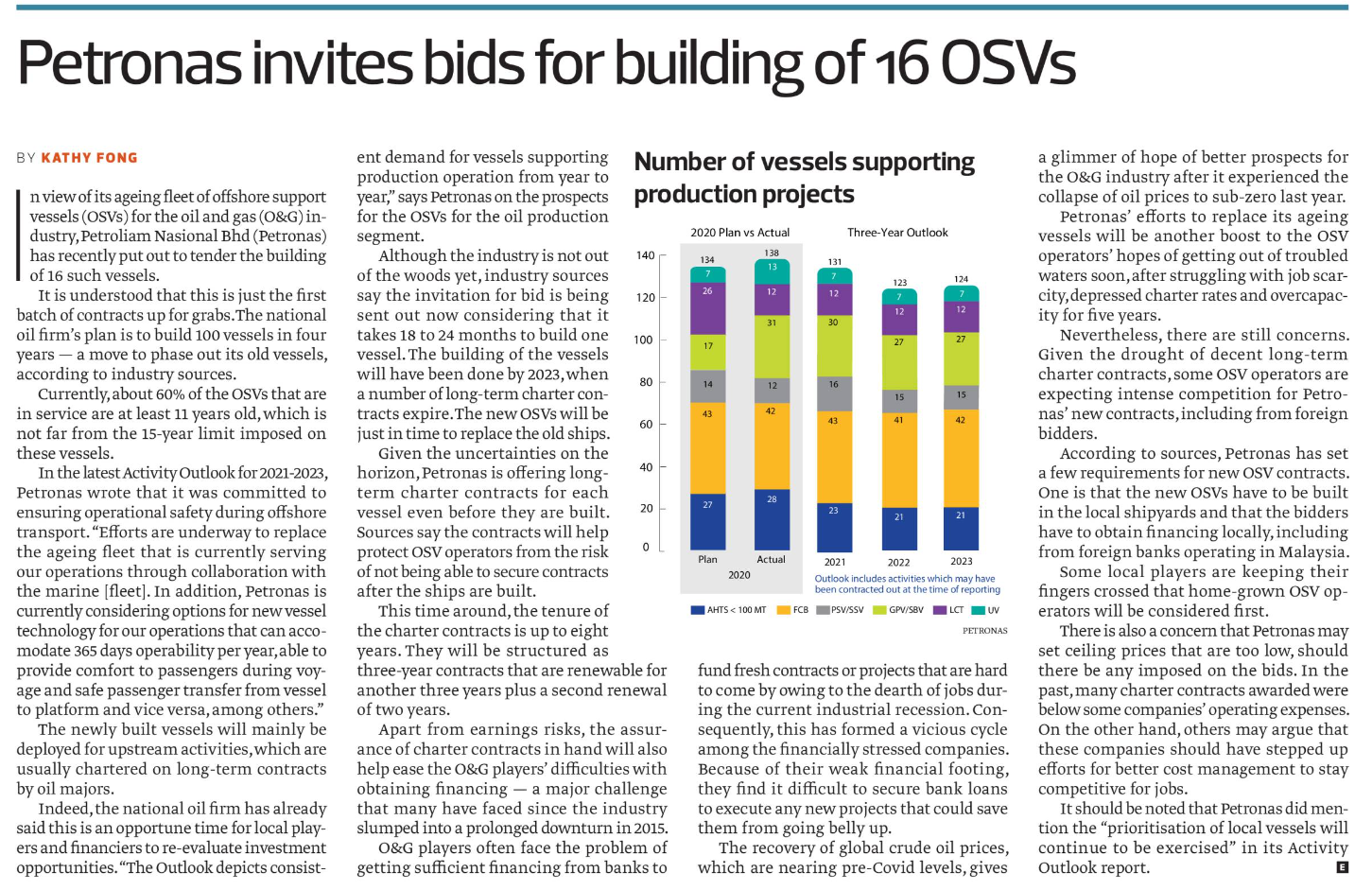

- Petronas needs 100 OSVs in four years

Petronas plans to build 100 OSVs in four years. Coastal – a seasoned local shipyard arm with proven track record and a rock solid balance sheet – huge differentiating element from its peers (read ‘BHIC’) – stands to benefit from the opportunity.

Construction value alone is a ~RM5bn opportunity (~RM50mn per standard OSV).

Petronas is demanding. OSVs are typically imposed with 15-year operating limit. Currently 60% of the OSVs that are in service are at least 11 years old. Thus explains the opportunity.

Contracts are explicitly stated for LOCAL shipyards and financial institutions only. So, only for locals, no dodgy middleman deals, no work for unqualified builders. … hence there simply aren’t many qualified candidates left.

- Positive industry dynamic shift

Market equilibrium for shipyards are improving after 2008 GFC, the O&G industry bust back in 2014 and early 2020. Large number of vessels laid up during the downturn may not return to service due to high reactivation costs and the reluctance of oil companies to contract vessels which have been out of service for longer period of time. The dynamic favors shipbuilders tremendously as it removes supply overhang.

Amongst its peers, Coastal is one of the most financially sturdy shipyard and OSV player. Its Jack up gas compression unit (‘JUGCSU’) is chartered to the National oil company of Mexico, generating sturdy streams of cash flow.

- Gas Sweetening plant in Mexico

Supported by its track record in Mexico, Coastal is joint-venturing into a gas sweetening processing plant announced in February 2021. The plant is expected to complete within 120 days and contracts for a firm period of 32-months, with a maximum value of RM258mn. It will elevate near term performance.

- Liftboats for offshore windfarm

Liftboats employment for offshore oil fields is boring, for offshore windfarm though will be interesting.

Also announced in February 2021, Coastal acquired an 80% interest in a liftboat chartering business. Management shares that the strategy for liftboat is to position towards the offshore windfarm industry.

Coastal says:

“Governments and energy companies across the globe, especially in Asia-Pacific, are looking into the huge business and investment opportunities in the offshore wind sector. With strong year-on-year (y-o-y) growth prospects expected for the years to come, offshore wind farms are one of the world’s fastest-growing energy sources which has the opportunity to replace traditional energy sources,”

"We believe that there are great future growth prospects for the wind farm renewable energy sector as liftboats are the most preferred and cost effective options for installation and maintenance of offshore wind farms, which shall continue to be a big part of the world’s renewable energy transition.

"With our current strong balance sheet, we are looking forward to capitalize on more acquisition opportunities with quicker paybacks; we believe that the value of some offshore assets has emerged,"

A quick search shows that Korea is to build world’s largest offshore windfarm by bringing its own wind capacity to 17.7GW from 1.8GW currently, by 2030. That’s 9.8x in 9 years.

China, Japan and even Philippines are investing in offshore windfarms.

Valuation

Coastal share price slumped by ~90% since its peak back in 2014 because of the disappointing P&L performance which is the result of its lifeless shipbuilding activities.

Profit is an opinion, cash is fact. The co.’s real economic value i.e. cash generation ability, is masked. It is FCF positive for the last 4 years as oppose to the losses recorded in its P&L. It has pile up RM200mn net cash.

Net cash is ~50% of its market cap; trading at 0.4x PB with all the promising qualities mentioned above. No point looking at PE because that’s not where the selling point is now, but perhaps later.

Why the opportunity

Ugly bottom-line, industry overcapacity, boom-bust OSV and shipbuilder stigma, low sell-side coverage and East Malaysia domiciled. Blends those factors together, one has a disgusted investment idea.

Checked with a senior bank officer friend of mine, many banks shun the shipbuilding industry for financing altogether.

With uncompetitive players leaving the industry, many walking dead(s) drowning in debt, handful of fit and running operators will have the whole industry (in this case a RM5bn opportunity!) all by themselves.

Catalyst

Petronas ~RM5bn worth 100 OSVs procurement opportunity

Liftboat for offshore windfarm

Gas Sweetening plant in Mexico an aid for near term performance

Net cash RM200mn war chest to support mgmt.’s strategic initiatives

Inflationary pressure on crude oil price – a bonus

Risk

Management buy-out (at the cheap of course)

*** ***

Disclaimer: The material provided herein is for informational purposes only. It does not constitute an offer to buy or sell any securities. We accept no liability whatsoever for any direct or consequential loss arising from any use of information in this report.

I do not hold a position with the issuer such as employment, directorship, or consultancy.

I and/or others I advise may buy/hold/sell the mentioned securities at any time without further notice.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

.png)