(TapDance) Low Risk High Return – Salutica Bhd

tapdance

Publish date: Wed, 20 Jan 2021, 02:51 PM

- Summary

Salutica’s earnings profile is on inflection point for its True-wireless Stereo (TWS) headset/earbuds earnings to surface in the coming months – which coincides with the sizzling consumer electronic demand season.

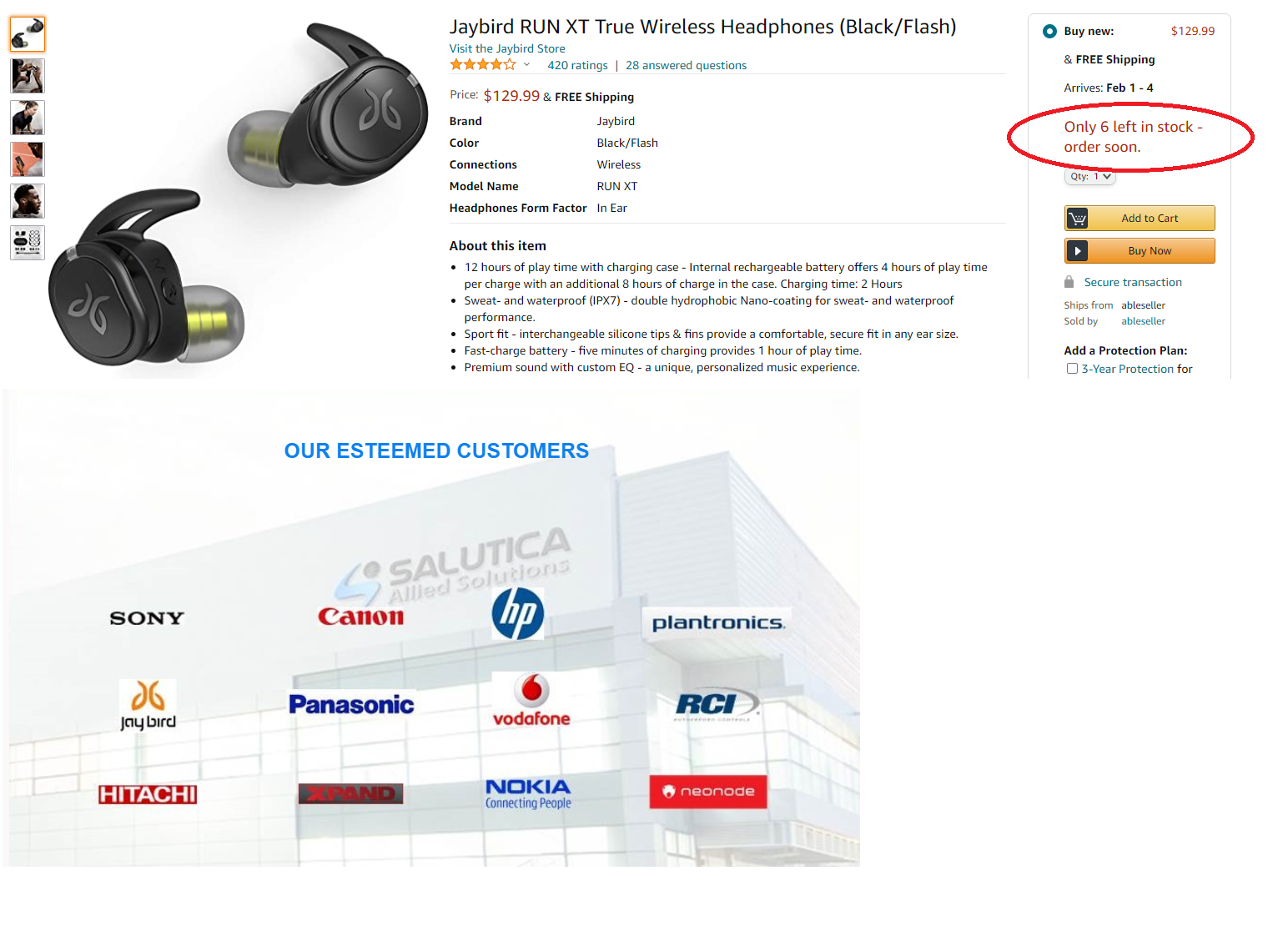

TWS earbuds is on trend. Hearable gadgets are one of the top search shopping items in Amazon. And Jaybird’s (manufactured by Salutica) TWS earbuds’ quality is ranked better than Airpod’s.

Meanwhile Salutica has improved its facilities, secured 6 more new clients, hiring ~200 more staffs, all during the movement control months.

When most (if not all) EMS and Tech related stocks had their fair share of run-up in recent months, Salutica was a forgotten candidate – until 2-weeks ago. Risk-reward is exceptionally attractive especially given the visible growth catalyst in sight.

The tepid market interest perhaps is due to weak expectation to the coming 4QCY20 result (to be announce in Feb’21) – which is widely known to be the last set of weak quarterlies before the potentially nicer looking ones’ surface in CY21. After which should be on gradual up-trend. Potential upside risk explains below.

Regardless, Salutica to generate +50% ROI just by returning to pre-covid levels – during which those 6 new clients were not secured yet. And if only Salutica is allow the full trend of TWS hearables…

The above explains why now – when market is still tepid - and until the share price falls after a potentially ugly looking 4QCY20 result announcement, is the best time to accumulate.

- Description

Salutica is well known as a contract manufacturer for Logitech’s mouse/keyboard, Bluetooth headsets and recently launched (August 2019) TWS earbuds. The TWS business was gaining traction pre-covid then things came to an abrupt halt.

On pre and post 2018 boom-bust

Salutica Bluetooth headset performed marvelously pre-2018 until its business edge diminishes as new competitors emerged – mainly from China.

The intense competition drove management to slowdown the Bluetooth business and develop TWS headsets. Underlying business (so as share price) performance suffered during the transition period.

Fast forward 3 years, Salutica has an edge over the mass majority of its competitors on TWS earbuds now. There are hardly any competitors around the region, thus far. Obviously existing competition dynamic shouldn’t hold forever. Nonetheless, conservatively estimate, Salutica should have ~3 years of honey moon period.

On proprietary tech and scalability vs. typical EMS model

Salutica actually possess its own proprietary technology and market its own product i.e. OBM, in addition to its contract manufacturing operation. Therefore, on top of leveraging on its clients’ brand and distribution network, Salutica could scale its proprietary tech on other areas/industry.

For an example, Joshua (CEO) hinted its intention to penetrate into the hearing-aid industry during a recent interview.

The hearing-aid is a USD15 billion market, and growing exponentially. It is said that future hearing aid will run on AI and integrated sensors and is the first device to trace cognitive health and physical activity as measured by hearing aid for utilizing in social situations. Ref.

On Trade war

For Salutica, Western country clients couples with China competitors sounds like the best combo during the trade war era.

Salutica’s amazing pace in securing multiple clients over a short span of time is also likely a trade war effect. If Salutica is lucky then honey moon period can be further extended.

On recent chip shortage

Joshua confirms to have access to ‘certain’ chipset exclusively during an interview back in November 2020. Risk of production disruption is minimal – not nil.

Joshua was actually quite excited about 2020 before MCO. (P/S: LEESK’s MD Dato Eric said the same thing…).

- Growth factors

Salutica first secured contract from Jaybird (associate company of Logitech) and subsequently added 6 more clients in 2020. Jaybird markets fairly premium earbuds globally – price points ~$150, though main market is in North America.

Salutica upgraded its facilities during the pandemic months in anticipation of the brighter prospect. The earlier mentioned 6 new contracts are ready for 2021.

Earbuds is one of the top search items in Amazon. A casual search over various online shopping portals indicates that the Jaybirds earbuds are hot selling items. Most platforms are left only with limited amount of inventories or either out-of-stock. Reviews are pretty positive. It is said the headset quality is better than Airpod.

Salutica is on rapid hiring mode – management confirms its intention to hire ~200 more staffs. The development suggests promising production volume.

Ref.

- Valuation and Why-the-opportunity?

The business value is difficult to quantify for TWS potential has yet to surface.

Salutica share price rose from RM0.30 to RM1 in June 2019 to Feb 2020 (i.e. 3x in 8 months) amidst the TWS launch. The trend was quickly brought to heel by the pandemic.

At RM 0.65, investors will reap a rewarding 50+% if returns to RM1 range.

On a personal note, market expectation is certainly not high for a promising investment venture with visible growth catalyst before us, trading at 1.6x PB with RM40m (i.e. 20% of market cap) net cash.

The tepid market interest perhaps is due to weak expectation to the coming 4QCY20 result (to be announce in Feb’21) – which is widely known to be the last set of weak quarterlies before the potentially nicer looking ones’ surface in CY21.

There could be (upside) risk for 4QCY20 result though. Logitech has been raising its annual sales and earnings targets – demand for its video conferencing devices and computer gaming peripherals soared as more people worked from homes, while gaming console sales jumped as a result of shut down of cinemas and other leisure facilities. My understanding from Joshua (CEO) is that the existing Logitech contract is more of an operation to cover expenses i.e. not a profit centre. So (upside) risk probability is low.

- Catalyst

TWS business (Jaybird + 6 new clients) contribution to surface in coming months

TWS headset/earbud on sustainable trend

Robust consumer electronics related spending

Coming US stimulus

Higher sell-side coverage and institutional investors following

*** ***

Disclaimer: The material provided herein is for informational purposes only. It does not constitute an offer to buy or sell any securities. We accept no liability whatsoever for any direct or consequential loss arising from any use of information in this report.

I do not hold a position with the issuer such as employment, directorship, or consultancy.

I and/or others I advise may buy/hold/sell the mentioned securities at any time without further notice.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

dawchok

Hi TapDance : do you know how much TWS business contributes to its net profit ? TQ

2021-01-20 15:08