Daily Brief - 2 Apr 2024

sectoranalyst

Publish date: Tue, 02 Apr 2024, 11:03 AM

Investors Lift Market as Trade for 2Q Begins

Strength in consumer, oil & gas and plantation heavyweights helped lift the local blue-chip benchmark index higher on Monday, even as regional markets stalled on mixed economic data and the Good Friday and Easter Monday holidays. The FBM KLCI gained 7.95 points to close at 1,544.02, off an opening low of 1,537.07 and high of 1,544.71, as gainers led losers 577 to 465 on modest trade totalling 3.18bn shares worth RM2.13bn.

Resistance at 1,559/1,580; Support at 1,527/1,504

The local market should be buoyed by investors that are returning to bargain hunt as the market begin trading for the second quarter for the year. Stronger index supports cushioning downside will be at 1,527 and 1,504, the respective rising 50-day and 100-day moving averages, with better support seen at 1,480. Immediate resistance remains at the recent 21-month high of 1,559, followed by 1,580, with stronger upside hurdle seen at the 1,600 level.

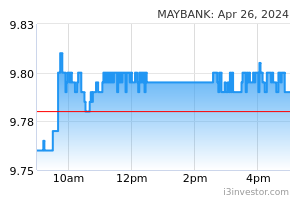

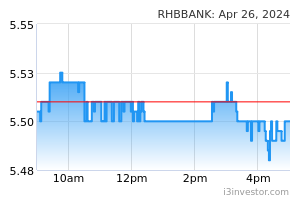

Bargain Maybank & RHB Bank

Maybank need breakout confirmation above the 138.2%FP (RM9.79) to extend higher and aim for the 150%FP (RM9.97) and 161.8%FP (RM10.14) ahead, while uptrend support from the rising 30-day ma (RM9.44) and 50-day ma (RM9.24) cushion downside. RHB Bank will need to overcome the 123.6%FP (RM5.75) to target the 138.2%FP (RM5.90) and 150%FP (RM6.02) going forward, with the 200-day ma (RM5.52) providing key uptrend support.

Asian Markets Mixed as Traders Digest Economic Data

Asian markets traded within tight ranges on Monday as investors assessed latest economic data from the region. Factory activity in many Asian economies weakened in March but there were some brighter signs in China and South Korea, surveys and data showed on Monday, offering a mixed picture on the once fast-expanding, key driver of the global economy. China's Caixin/S&P Global manufacturing purchasing managers' index (PMI) rose to 51.1 in March from 50.9 the previous month, a private survey showed on Monday, expanding at the fastest pace in 13 months with business confidence hitting an 11-month high. Separate data showed South Korea's exports rose 3.1% in March year-on-year, marking the sixth straight month of increase thanks to robust demand for chips.

In Japan, first-quarter Tankan survey showed that business optimism among large manufacturers fell, with the gauge at +11 compared with +12 in the last survey. However, optimism among non-manufacturers rose, with the Tankan gauge at +34 compared with +30 in the fourth quarter and beating Reuter’s expectations of +33. Japan’s Nikkei 225 fell 1.40% to 38,803.09, while the broad-based Topix dropped 1.71% to 2,721.22. South Korea’s Kospi inched up by 0.09% to 2,747.86 and the Shanghai composite gained 1.20% to 3,077.52. Australian and Hong Kong markets are closed for Easter Monday.

The Dow Fell as Bond Yields Jump

The Dow Jones Industrial Average fell overnight after stronger-than-expected manufacturing data pushed Treasury yields higher. The Dow Jones Industrial Average fell 0.60% to settle at 39,566.85. The S&P slid 0.20% to close at 5,243.77, while the Nasdaq Composite added 0.11% to finish at 16,396.83. The weakness on Wall Street came as traders expressed uncertainty about whether inflation is slowing quickly enough to guarantee the interest rate cuts expected by the Fed. Data released overnight showed the US manufacturing sector is in its strongest position since 2022, raising questions over whether the economy is accelerating and its impact on the Federal Reserve's path on interest rates.

US bonds sold off as the benchmark 10-year Treasury yield rose 12 basis points to 4.32%, inching toward its highest level of the year. Traders will get more clarity on the U.S. central bank's thinking this week, with 13 of 19 Fed officials speaking. The majority of S&P 500 sectors were lower, with the real estate, healthcare, and utilities among the worst hit. The energy sector gained along with stronger crude oil prices. The technology sector also rose, along with an index of semiconductors.

Source: TA Research - 2 Apr 2024

Related Stocks

Market Buzz

2025-01-07

MAYBANK2025-01-07

MAYBANK2025-01-06

MAYBANK2025-01-06

RHBBANK2025-01-03

MAYBANK2025-01-03

MAYBANK2025-01-03

MAYBANK2025-01-03

MAYBANK2025-01-03

RHBBANK2025-01-03

RHBBANK2025-01-02

MAYBANK2025-01-02

MAYBANK2025-01-02

RHBBANK2024-12-31

MAYBANK2024-12-31

MAYBANK2024-12-31

MAYBANK2024-12-31

RHBBANK2024-12-30

MAYBANK2024-12-30

RHBBANKMore articles on TA Sector Research

Created by sectoranalyst | Jan 03, 2025