Target Invest - We Target, We Invest

PCCS garment manufacturing department to see windfall from Myanmar political coup which affect the garment industry supply

targetinvest

Publish date: Wed, 24 Mar 2021, 12:03 AM

For latest information, can join us at

Blog https://targetinvest88.blogspot.com

Telegram https://t.me/targetinvest88

We are heading into the 4th month of 2021, battling the Covid-19 pandemic for more than 1 year. The local market is finding it's new balance after a period of rebound, and I believe that a lot of major fund are reallocating their assets after a conclusion of financial year end 2020. Good performing companies will continue to see investment coming in, bad performing companies will see funds paring down their exposure.

The latest global news hitting the papers would be the escalating tension in the political situation in Myanmar. A coup d'etat in Myanmar started in the morning of 1st February 2021, when democratically elected members of Myanmar's ruling party, the NATIONAL LEAGUE FOR DEMOCRACY (NLD) were deposed by the Tatmadaw - Myanmar Military- which vested power in a stratocracy.

The situation had gone from bad to worse, and with the current outlook, from worse to worst. The tension had protestor going from attacking military into burning factories.

Myanmar is known for it's cheap labour for the global garment industry. The garment industry is valued at USD 6 billion (RM 24 billion) per annum. The current coup is starting to get fashion company in a scrambling effort to secure production supply elsewhere.

Source news during month of February 2021

https://asia.nikkei.com/Spotlight/Myanmar-Coup/Myanmar-coup-clouds-future-of-country-s-crucial-garment-industry

Entering March 2021, protestor had began torching and burning garment factory.

Source

https://www.washingtonpost.com/world/asia_pacific/china-myanmar-coup-military/2021/03/17/39989378-86c2-11eb-be4a-24b89f616f2c_story.html

HOW WILL THIS SITUATION TURN INTO MAJOR BENEFITS FOR PCCS IN THE NEXT COMING YEARS ?

Myanmar is one of the main production output for popular fashion wear companies such as H&M, Mark and Spencer, C&A and other brands. The current political mess and coup d'etat already putting in the option that EU will potentially withdraw of EBA arrangement on Myanmar. EBA - Everything but Arms will provide duty free access to the EUROPEAN UNION.

Industry analyst are positive that fashion retailer will shift new sourcing from other region, potentially towards Cambodia and Vietnam. Cambodia is a high likely destination as Cambodia had EBA arrangement with the EUROPEAN UNION.

Reference source

https://www.just-style.com/analysis/clothing-sector-likely-major-loser-from-myanmar-coup_id140644.aspx

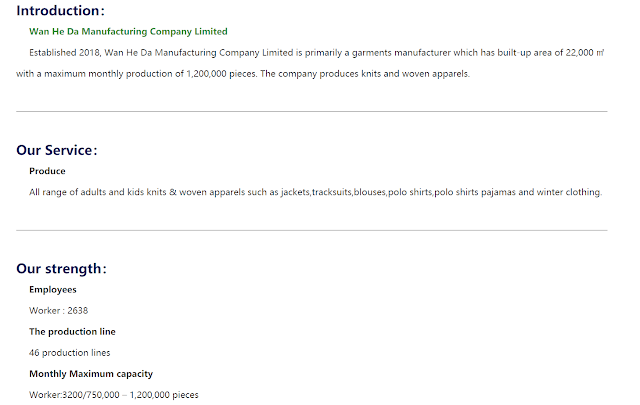

PCCS had strong footing in the garment industry in CAMBODIA. Their newly build factory "WAN HE DA MANUFACTURING COMPANY LIMITED" which completed in 2018 will be able to swing into full capacity soon. Capacity is 1.2billion pieces per month.

In addition, PCCS also have existing business with the affected fashion retailer (H&M, M&S, C&A) at Myanmar, hence industry expert will be seeing more orders from fashion retailer for PCCS garment factory at Cambodia.

I had to informed all my readers that I had vested interest in PCCS. If you are reading my earlier blog post, I am invested to PCCS for it's new business expansion into medical healthcare. However, the current situation happening in Myanmar could be just landing a big immediate windfall for PCCS current business operation in the garment industry.

My personal opinion is that the current situation in Myanmar will not end soon, just as how HongKong protest can drag into more than 6 months. As the current situation become more violence, fashion retailer will possibly sever ties with Myanmar.

With demand looking to pick up in Q2 2021, there will be higher DEMAND and lesser SUPPLY due to the sudden shortage of production factory. Existing OEM manufacturer will be able to command better pricing and profit margin.

Will this situation turn the table upwards for PCCS, potentially going towards RM 1.50 ?

IMPORTANT NOTICE

Please be informed, I am not a professional or certified analyst. I am not a licensed consultant, just a normal retail investor. I am just sharing my ideas and opinion on the market outlook. Any company mentioned should not be interpreted as a buy/sell/trade call. Please do your own research and buy/sell/trade at your own risk.

For latest information, can join us at

Blog https://targetinvest88.blogspot.com

Telegram https://t.me/targetinvest88

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Target Invest - We Target, We Invest

HWATAI - FROM SELLING BISCUIT TO SELLING LAND FOR HSR BATU PAHAT ?

Created by targetinvest | Apr 05, 2024

CENSOF GROWTH OPPORTUNITY WITH COMPULSORY E-INVOICE IMPLEMENTATION

Created by targetinvest | Dec 18, 2023

Discussions

Be the first to like this. Showing 0 of 0 comments