Why BIOHLDG become my FIRST investment in Malaysia stock market? (Part 1)

TheInvestDiary

Publish date: Sat, 13 Oct 2018, 03:38 PM

This week, I made my debut in stock investing after virtually following the stock market for about 1 year. I bought in BIOHLDG and it became my FIRST ever investment in Malaysia stock market.

I believe many may argue that now is not the best time to get into the stock market, especially making a decision to acquire a counter that did not drastically drop during the recent selldown. However, I decided to buy in considerable amount of BIOHLDG at RM0.24 and I will continue to add if attractive price appeared again in the market.

WHY?

Let me explain the rationale behind my decision to choose BIOHLDG among 900+ listed companies in Malaysia.

Background

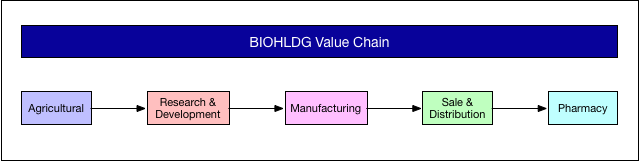

To start, Bioalpha Holdings Berhad ("BIOHLDG") is an integrated herb-based health supplement company principally involved in agricultural, research and developments, manufacturing, sale of HALAL certified food and health supplement products (ODM and under the Company’s proprietary house brands) as well as operation of Constant pharmacy. In short, BIOHLDG involves in the whole value chain of herb-based supplement business.

Upside

1) The ONLY One in Malaysia

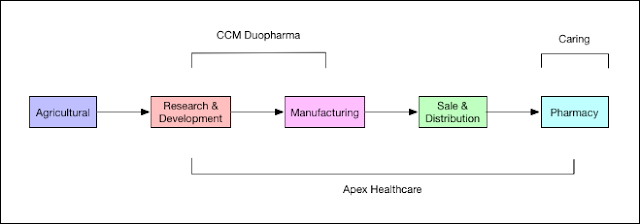

BIOHLDG is the only company in Malaysia that involved in the whole value chain of herb-based supplement business. From raw materials to R&D to manufacturing to distribution to pharmacy, this business model has made BIOHLDG to achieve the highest net profit margin among its peers.

Net profit margin (as of FY2017)

Apex Healthcare (Manufacturing + Distribution + Pharmacy) : 7.2%

CCM Duopharma (Manufacturing): 9.1%

Caring (Pharmacy): 3.6%

BIOHLDG: 14.8%

2) HALAL market penetration

According to its 2017 Annual report, nearly half of its revenue contributed by Malaysia, the rest equally shared by China and Indonesia. While all of BIOHLDG’s products are HALAL certified, it is clear that BIOHLDG is currently working hard to penetrate the high muslim population markets such as Indonesia and West China.

3) Expand through partnership

In Indonesia, BIOHLDG partnered with local company to manufacture its brand products for local consumers. This approach has helped to expedite the medical approval process. In China, a new subsidiary BIOHLDG HK will facilitate R&D activities via collaboration with local HK universities, in order to strengthen its presence its China. (Note that BIOHLDG has already established partnership with other university in Malaysia and Taiwan)

Despite the fact that BIOHLDG demonstrated poor performance in these two countries this recent quarter due to longer than expected medicine approval, we can expect strong revenue once they received approval for its new medicine products.

4) Plant expansion programme

Currently, BIOHLDG main production plant in Bangi, Selangor is reaching an utilisation rate of 80% by end of this year. While refurbishment and expansion for this plant has already began, a new production plan in Pasir Raja (next to the agriculture land) will commence its operation by 1Q 2019. These two expansion are expected to increase 50% of current capacity over the next 2-5 years.

(You can access to Part 2 in i3investor or https://theinvestdiary.blogspot.com)

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on TheInvestDiary

Created by TheInvestDiary | Oct 13, 2018

Discussions

Hi Booyeah. As of today, CCM and Caring market cap are 2x of BIOHLDG, whereas Apex is about 4x of BIOHLDG. I personally think that once BIOHLDG become bigger, it can improve further its profit margin due to the economic scaling effect.

2018-10-13 20:58

bro good luck in buying biohldg

i already bought for 3 years and my profit is 0%

biohldg is not a company u will earn in short term

be prepapre to hold until at least 2020 , or maybe even longer then u expected

2018-10-14 17:58

Forget about retail.. just look at their own product . It have more bright future instead of concern on their retail. Pharmacy market is a war... margin reducing. Price war

2018-10-14 18:33

To add, based on their latest quarter report, their pharmacy segment revenue has increased ~80% Y-Y, despite did not aggressively increase the number of pharmacy. (The pharmacy segment now reached around 30% of total BIOHLDG revenue)

2018-10-14 18:49

congrat for those keep adding ,selling ur own holding here..... and they are buying...:p

2018-10-15 10:52

Booyeah

company too small to even compare for now..

2018-10-13 20:00