The reasons why 80% of my portfolio are in THIS one stock…

theonestock

Publish date: Tue, 12 Apr 2022, 04:55 PM

The reasons why 80% of my portfolio are in THIS one stock…

Is recession coming?

Majority of investors must be pondering around this question – and if you are not, probably you are very confident in your stock picks, or you are just plain ignorant.

That being said, investors would still need to allocate their cash somewhere. As for me, this somewhere was well represented by this one company – SERN KOU RESOURCES.

There are several reasons as to why I pick this company, and now we would dive deep into each of them.

Bright Prospects up to 2025

The government had forecasted that the value of wood-based products, including furniture to reach RM19 Billion by 2025. For the benefit of those who do not know, SERN KOU is mainly involved in the processed wood industry, which we are seeing huge demand coming from the furniture industry.

A documentary by Wall Street Journal had very well stated what had caused the exacerbated demand for furniture. You can see the full video here -

https://www.youtube.com/watch?v=1KtTAb9Tl6E&t=1147s

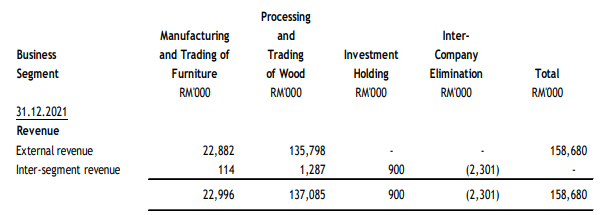

And despite the revenue generated by SERN KOU on its furniture division is not as significant as its wood processing segment, one must not forget that the company will be benefiting from the increased demand, too.

*The revenue of the company was impaired by another MCO. We expect much better results from the company soon.

Strong Share Price Momentum

As compared to any other furniture players in the industry, SERN KOU did demonstrate a very strong share price performance for the past few trading months. This indicates a continuing buying interest into the company despite the market was down significantly in March.

Even for now, the strong momentum of the share price is looking to breach the RM0.795 to RM0.800 key resistance level. I believe that once the resistance is broken, SERN KOU could inch up even further.

Free From ESG Issues

Investors are also now ESG-savvy after the ATA IMS saga that had crumbled in share price. However, the furniture industry is very unlikely to be targeted and even if they were to be targeted, the top players such as LII HEN, POH HUAT RESOURCES would be the first few that were investigated.

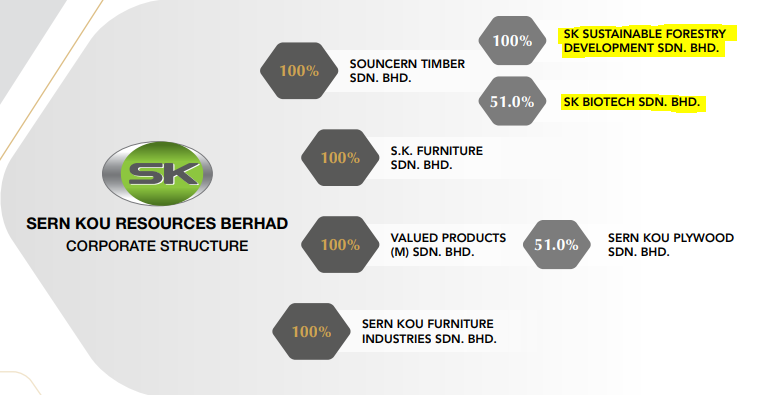

If you would spend the time to look into the annual report, SERN KOU had two new companies, namely SK BIOTECH and SK SUSTAINABLE FORESTRY DEVELOPMENT.

The stories are very much aligned if you think in this way – improving financial performance of the company, strong share price following good results and ESG theme in place. What does this suggest to you?

In my opinion, this is a strong buy signal and investors should not ignore it. SERN KOU is one of the best place you could put your money in for 2022, and you do not want to miss this boat!