(Tradeview 2016) - I am New, How Can I Make Money from Share Market?

tradeview

Publish date: Sat, 12 Nov 2016, 09:09 PM

Dear fellow readers,

Once again, these writings are just my humble view, feel free to have some intellectual discourse on this.

To join my telegram channel : https://telegram.me/tradeview101 or

visit my blog at tradeview101@blogspot.com or

email me at tradeview101@gmail.com to be private subscriber.

Facebook : https://www.facebook.com/tradeview101/_____________________________________________________________________________

Recently, an interested reader of my past articles emailed me with the question titled above. He said he want to make 20% per annum and ask me can I guarantee him, if not he won't join my private group. I did not say too much to him but gave a few simple words of advice.

I shall illustrate just 5 points for other readers out there who are new to equities investing and may have the same question in mind or same investment goal.

1. No one can guarantee you anything

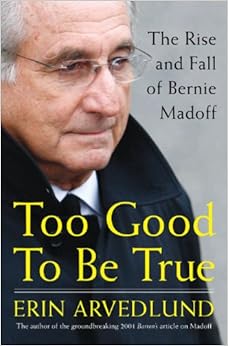

The reason why I post the above picture is because of the man. Bernie Madoff is probably the most powerful man on Wall Street in his heydays and will always be remembered as the most notorious Ponzi Scheme mastermind of the modern century. Bernie is extremely powerful by virtue of his position, reputation and connection in wall street. He was one time executive chairman of NASDAQ and notable celebrities like Steven Spielberg, Russian Mafia and many others are among his top clientele. His firm is one of the top market makers and he was senteneced to 150 years imprisonment. Estimated loss caused by Bernie's Ponzi scheme is around $65 Billion. Actual losses is around $18 Billion. The reason I am sharing about him is because I hope that all new investors will understand that, NO ONE can ever guarantee investment returns. If ANYONE tells you that they can guarantee you a certain % of return, please note the red flag and run away. Investing should be a voluntary decision made with a clear mind with regards to the risk and reward behind the decision. If one cannot suffer losses, one should not invest and just placed the money FD / in a MILO tin.

2. Start with the basics (FA)

What is FA? Why do I need basics to invest? My friend told me this counter can enter, getting project soon. If the above is the attitude one adopts in investing, I can 100% say the person will make losses in the market sooner than later. It goes without saying in whatever we do, we must focus on basics. Investing 101 is all about fundamentals and hence understanding how to analyse counters from a basic standpoint is key to sustenance in the market. Adopt few simple metrics such as Price Earnings Ratio (PER), Net Tangible Assets(NTA), Dividend Yield (DY), Return on Equity (ROE) etc. To understand these basic concepts, there are several good authors out here that shares it. If not, there is always investopedia. Like an example of a FA stock I look to acquire :YSPSAH

It meets my metric at current price of RM2.15

PER : 10x

NTA : RM1.90

ROE: 10

DY : 3.7%

And other qualitative and quantitiave factors which I have researched to arrive at the conclusion to enter. Of course there is more beyond simple metrics like these, but this is just a basic for you to start off and do your own personal stock screening.

3. Be patient and ready sit out

This year is an unprecedented year. All the most unlikeliest events occur. It is the year where rationale and logic failed to stay its course. If one were to sit through the year of 2016, the volatility and turmoil is beyond what your usual chart and graphs can tell you. Many seasoned investors and traders lost money. My advice to new investors is to stay out and be patient once you decde to be in the market. The market is always there. However, your money is not. You can lose opportunity to make money only to come across another. But without money, you cant take advantage of opportunity that arises. Never be afraid to sit out when you are not sure what is going on. Never be afraid to wait. If you are not able to do both of these, you are not prepared to enter the market.

4. Be cautious and ruthless

My only advise to all my readers, be ruthless when cutting loss and taking profit. Be cautious when riding profit. On a long term and stable environment, riding profit long is the right thing to do. However, in current market, any profit is good. Once it hits your own personal TP, avoid being greedy. If you are not sure what to do, sell half hold half. Anything else is a bonus.

5. Read widely to understand Macro of the World

The world is big. Today it is around 7 billion in population. Information travels quick due to the proliferation of technology and advancement in science. Civilisation across the globes improves. As we get interconnected, every bit of information may have repercussion across the world. The only way one can be able to succeed in the market is to read widely and consistently update oneself. The quest for learning should not end just because you earn your 1st million. The only way to stay on top of your game is to continuously pursue the information and understand how macro / micro affects your stock picks be it the company itself or the sector as a whole. Ex: The market was pricing in a Clinton win, as a result of her policies, pharma companies fell significantly. Simiarly, the moment Trump, there was a selloff in Mexican Peso due to his hard stance against latino immigrants and Mexico. These actions has impact across the world as well towards Asia, emerging markets and all. If one is blindly investing in the market without a wordly view, there is no way one will go far.

I believe with 5 of this simple reminder, new investors may find themselves in a better off position to invest. As long as one is discipline, I am sure the market will give opportunities to you.

To join my telegram channel : https://telegram.me/tradeview101

Email me at : tradeview101@gmail.com

Blog : http://tradeview101.blogspot.my/

Food for thought:

More articles on Trading With A View

Created by tradeview | Oct 18, 2021

Created by tradeview | Sep 28, 2021

Created by tradeview | Sep 15, 2021

Created by tradeview | Jun 01, 2021

Created by tradeview | Apr 08, 2021

Created by tradeview | Mar 17, 2021

Discussions

I am a season retail investor, how can I not lose $ from share market? Never never chase a stock if already move up..by let says 30% above 52 weeks low..take profit if own TP met..just my 2 sen worth.

2016-11-12 22:36

Raider see most of the 5 points highlighted by author is very good loh......!!

However item 4 , raider like to highlight an important modifications;

Be fast to cut loss but slow to take profit loh....!!

Let your winners run and cut your losses short mah...!!

2016-11-12 22:52

Raider like export stock very much....!!

Great potential....but most price not really run up loh...!!

2016-11-12 23:57

Who is this guy to call ppl newbies....mgs, gii can guaranteed you on return for 10,20yrs. So saying govt is ponzi scheme also? Biadap.

2016-11-13 16:56

.png)

yfchong

Market is irrational., just simple take care of the down side....., the up side will be taken care off..., fr famous gurus....,

2016-11-12 22:01