Trading With A View

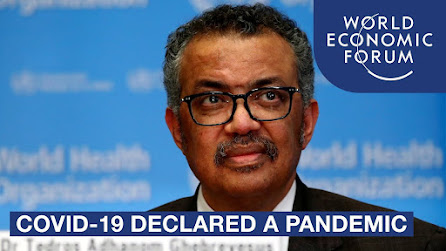

(Tradeview 2021) - A Reflection on Covid-19 Pandemic, Being A Fundamentalist Saved Me

tradeview

Publish date: Thu, 21 Jan 2021, 03:25 PM

If 2020 has taught me anything, it is never to take things for granted in life. The global pandemic have upended even the most normal of life and reshaped people's perspective in life. It has given me lots to think about, to reflect upon and to look forward to. My generation is very fortunate to not have to go through World Wars 1, 2 due to a long period of peace and prosperity. This has made many complacent about life. Think about it, in a way, the fight against Covid-19 is a form of global war, it is World War 3, except, we all have a single common invisible enemy.

As an investor, when we talk about war times, it is a time of great volatility and uncertainty, followed by a sustained period of recovery and growth post-war. Most wars last several years, at times decades. Spanish Flu lasted from January 1918-April 1920 (2.3 years). During the start of Covid-19 in 2020, many investors would have thought the best thing to do is to stay away, lock up all the funds and save it for rainy days. If indeed investors have done that in 2020, then it would be a great loss not forgetting missing out on some unbelievable action.

Recently, a prominent investor who always promote "The Golden Rule", suddenly flipped and said fundamental investing led to his investment losses and price chart is the way. I unequivocally reject this notion and would like to put it on record, fundamental investing is the best if not the safest form of investing in the stock market. This has proven to be true by many who walked the path before us, like Peter Lynch, Warren Buffet, Dr Neoh Soon Ken, Mr. Fong Siling and others. These individuals are successful consistently over a prolonged period of time. They are not one hit wonders.

I cannot speak for others but I can speak for myself. I am thankful to have invested in 2020 and took the biggest position in my lifetime during the "March Plunge". This set up 2020 to become the best investment year on record. Some argue this is due to luck, guts, or risk taking. On the other hand, I believe it is a culmination of years of investing mistakes, experience and a strong belief in fundamental investing. Think about it, when Bursa as a whole lost RM 190 billion in market cap from the stock exchange in the span of 1 month in 2020, who in the right mind would throw money to buy and hold? Only a fundamentalist. This is because fundamentalist see stocks not for its price but the value behind the company.

Entering 2021, many have asked me what is my outlook for the year. Unlike some, I am unable to give an accurate view at the start of the year. Just imagine, 6 days into a new year, the US Capitol was stormed by rioters due to Trump. Who could have seen that coming? I do however hold certain view firmly, I believe Covid-19 wont be eradicated overnight and looking at recovery thematic stocks especially in the area of airlines, tourism and retail is too premature. I said that 3 months ago. This is because structural damage has been caused to these sectors which requires time to recuperate. If one would like to look at recovery play, the best considerations are still banks, utilities, telcos and select FMCG /Consumer stocks.

As I am writing, I see many pockets of irrationality in terms of valuation. Not only the overvaluation but also undervaluation. I see the local tech sector to be severely overvalued (highly dangerous) and the banks, gloves, utilities, select consumer/FMCG to be undervalued. I also see polarising view between "expert opinions" & "research analysts". For instance : those glove "gurus" or bulls last year are now weary about promoting glove stocks. Interestingly, they advocated "all in" to glove stocks last year against a diversified portfolio. Similarly, the "recovery theme" gurus talking about airlines, hotel, tourism and retail loudly end of 2020 suddenly became quiet once MCO 2.0 was announced. I find this perplexing because confidence can just evaporate overnight due to the price action of stock price. This is the power of the stock market.

"Ignorance", "overconfidence" and "greed" are 3 most devastating traits for investors. On the contrary, "patience", "prudence" and "conviction" are 3 most valuable traits for investors. Going contrarian doesn't always mean investors would make money. However, buying fundamental stocks in terms of value will almost always lead to success. The difference? Horizon. Timeline. There is no point being a preacher on fundamental investing as investors mostly learn from experience. If you are doing well with your investment style, then do what that suits you. If you are not doing well, why not give what I have written some thoughts, try it for awhile and let the results show after some time. Try extending your investment horizon, sit on it and wait for the results to show you. If its too painful to sit for a long time on stocks, separate your investment capital into 2 baskets,

1. short term active trading basket

2. long term value pick baskets.

Compare the results after 2-3 years and let the results show you. If there is a good time to start, the time is now. Let 2021 be a year of new resolutions, realisation and aspirations. If US can hit reset with President Biden after 4 Years of Donald Trump, investors can reset their investment mindset too.

_______________________________________________________________

Telegram channel : https://telegram.me/tradeview101

Website / Blog : https://www.tradeview.my/

Facebook : https://www.facebook.com/tradeview101/or

Email me at : tradeview101@gmail.com

Food for thought:

More articles on Trading With A View

NST Business x Tradeview No.3 - Adam Yeap, Owner of 212 Hospitality and co-founder of Wonderbrew

Created by tradeview | Oct 18, 2021

NST Business x Tradeview No.2 - Muzahid Shah, CEO of SteerQuest Sdn. Bhd.

Created by tradeview | Sep 28, 2021

News Straits Times Business x Tradeview - Sharing Stories of Retail Investors & the Stock Market

Created by tradeview | Sep 15, 2021

Tradeview (2021) - Peterlabs Holdings Berhad Long Term Value Stock (Update)

Created by tradeview | Jun 01, 2021

Tradeview Commentaries - The Glove Surge, A Mirage or A Path To Oasis?

Created by tradeview | Apr 08, 2021

(Tradeview 2021) - Are Research Analysts' Reports Worth Their Salt?

Created by tradeview | Mar 17, 2021

.png)

CynicalCyan

"Ignorance", "overconfidence" and "greed" are 3 most devastating traits for investors.

2021-01-26 11:56