Star Media should take a leaf of Singapore Press’ book & double shareholders’ value

InvestingPlaybook

Publish date: Thu, 03 Mar 2022, 06:07 PM

Singapore Press’ Strategy to Reward Shareholders

In year 2021, Singapore Press Holdings Ltd, the largest media company in Singapore, announced a bold move that was received positively by its shareholders. The company announced that it would spin off its media business and sell the remaining parts of its business to another conglomerate in Singapore. Shareholders of the company liked the idea and sent its stock price up 58% between the start of the year and spin off announcement.

Star's Value Destruction for Shareholders

Now back across the causeway, an almost equivalent to Singapore Press Holdings Ltd is our very own The Star Media Group Bhd. This Bursa-listed company owns a range of media assets which includes its crown jewel “The Star” publication and a whole range of real estates.

Despite being one of the leading media companies in the country, shareholders have not been rewarded for being owners of the group.

Since its peak in late 2010, shareholders owning shares in the company would have lost a heavy & painful 92% of its investment.

Drop in the Star's Financial Performance

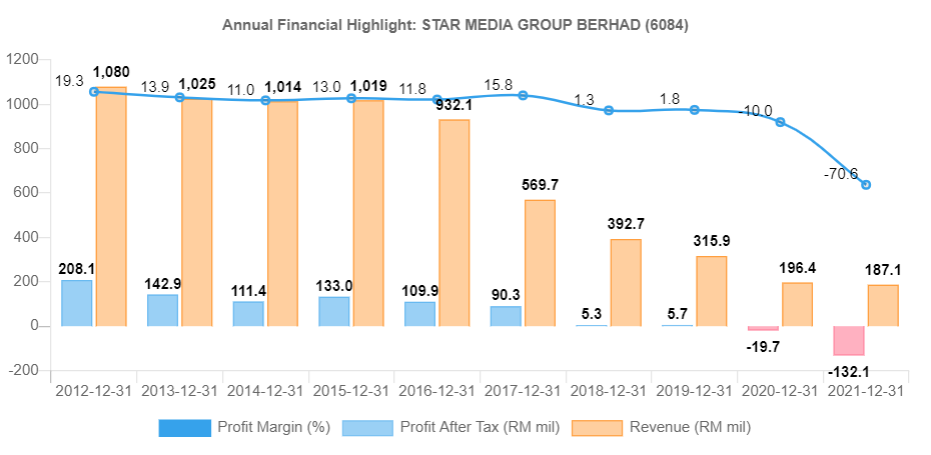

The destruction of the company’s market capitalization isn’t unusual when looked together with the company’s financial performance over the years.

Over the past 10 years, the company’s revenue & profit has been consistently declining, in fact, the rate of decline has accelerated in recent years to the point that its incurring annual losses. The decline in performance has been caused by:

- Decline in quality & independence of journalism perceived by its readers

- Increased in media competition from players like MalaysiaKini, Free Malaysia Today & independent journalists such as the Sarawak Report

- Increased advertising space competition from global players like YouTube & Facebook

- Increased advertising space & media competition from Astro, another media powerhouse in the country.

While these factors existed years ago, based on the current trend, these factors are unlikely to abate and instead will become bigger headwinds for the Star. So in summary, the company’s prospects for improvements & turnaround is very bleak!

Financials of The Star

If you analyse the latest FY2021 financial statements of the company, specifically its Statement of Financial Position:

|

Balance Sheet as at 31st Dec 2021 |

RM ’mil |

|

Total assets excluding investment properties & cash equivalents |

274 |

|

Investment properties |

146 |

|

Cash & equivalents |

342 |

|

Total liabilities* |

117 |

|

Equity |

645 |

|

03-03-2022 Market Capitlization |

232 |

*All liabilities are trade-related and there is no borrowings maintained in the company’s balance sheet

It is evident that the company has RM146mil in investment properties and RM340mil in cash equivalents. If the Star decides to take a leaf of SPH’s books, the company can spin of all assets and liabilities related to the media business and have the listed company retain only its investment properties & cash equivalents. Since the company does not have any significant liabilities to pay for, shareholders are left with an unencumbered RM486mil in real estate & cash equivalents.

What Shareholders Stand to Gain

The corporate exercise for The Star could be carried out in 3 steps:

- Sell transfer all media assets & liabilities to a New Company (“New Co”). Have the NewCo transferred or sold for nominal sum to any interested party. This transfer can be done without requiring any purchase consideration to facilitate the spin off

- Revalue & sell all investment properties owned by the Group. The net book value of the investment properties stands at RM146mil as at 31st Dec 2021. However, almost all these properties were last revalued in early 2000s. Since almost 20 years have passed, it’s safe to assume that these properties should have gained at least 15%. This should conservatively value the investment properties at approximately RM170mil

- Disburse all cash equivalents & real estate sales proceeds to the shareholders of the listed company.

This corporate exercise should net the shareholders a total sum of RM510mil conservatively. When compared to its market capitalization as at today of RM232mil, this simple corporate exercise will net investors a cash proceed of RM2.20 for every RM1 invested in the company stock. This translates to a quick returns of 120%.

What could Complicate this Exercise

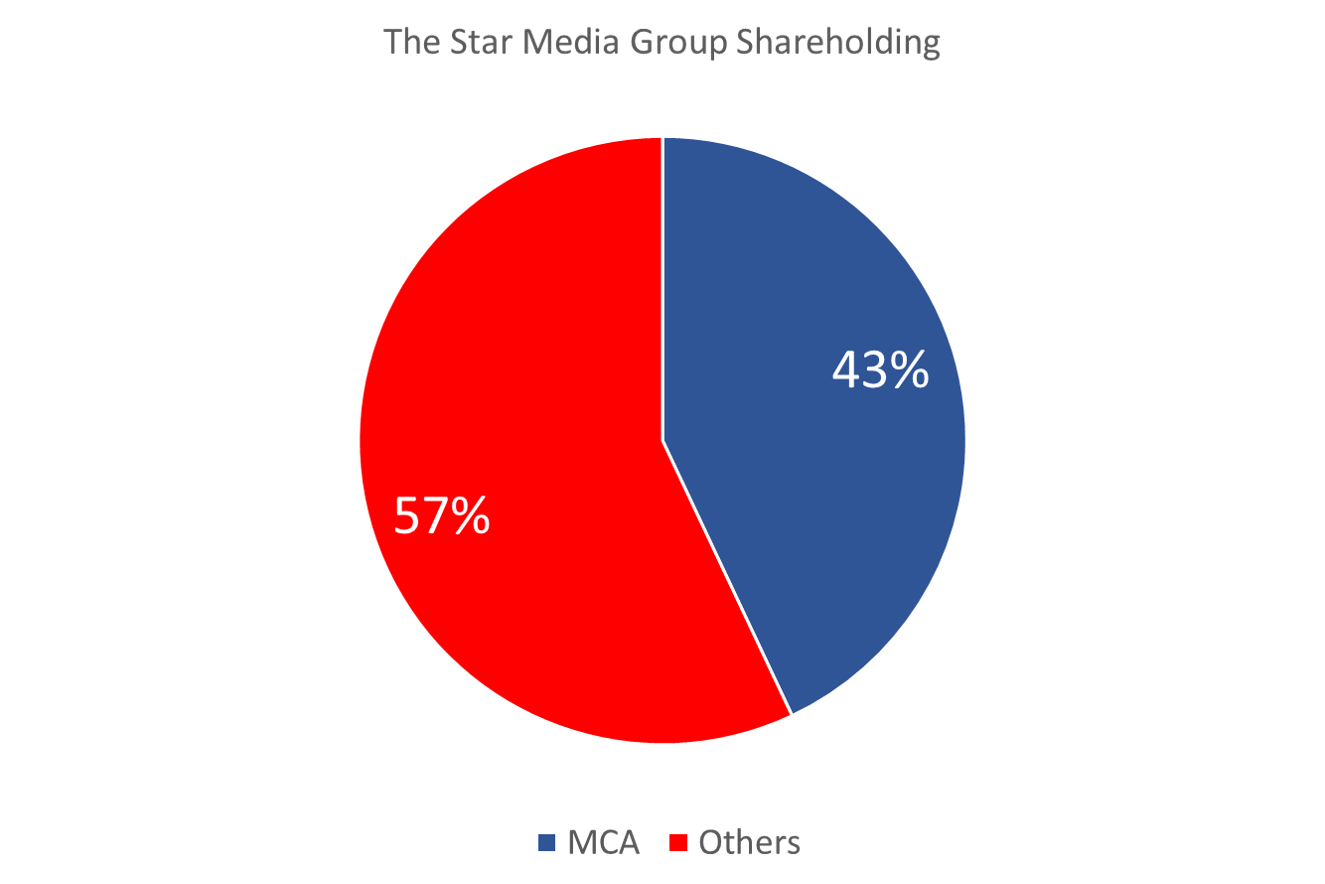

One of the obvious hindrance to this whole exercise is the influence the Star media has. With almost 11 million regular reach across its online and offline channels, the influence the media asset has is of great political value to its ultimate major shareholder, the Malaysian Chinese Association (MCA).

This could be a major reason for MCA to not spin off the company in order to retain its influence. An alternative to this view is to have the media assets spun off to MCA while proceeding with this exercise. Based on MCA’s shareholding of 43% in the group, MCA stands to net a cool RM220mil from the exercise. This allows MCA to retain its influence through full control of the media assets and have an additional cash coffer of RM220mil, a major win for both MCA and the remaining shareholders!

For readers who are in the investment banking line, time to prepare your pitch decks! Let's double Shareholders' Value Today!

More articles on Undervalued Gems in Bursa Malaysia

Created by InvestingPlaybook | Apr 08, 2022