Supermax at its Peak of being Undervalued

InvestingPlaybook

Publish date: Wed, 02 Mar 2022, 05:07 PM

Supermax's Back Story

Unless you were sleeping under the rock for the past 2 years, you should have heard about the exceptional roller coaster that glove counters had experienced over the past 2 years. The stock I think deserves our special attention is Supermax Bhd. In 2020, the counter shot up a massive 1,462% due to the explosion of glove demand due to the COVID-19 pandemic. To put in a simple perspective, if you had invested RM1,000 in the counter at the start of 2020, you would have ended up with RM14,620 at its peak. Besides its stock price, the company’s earnings had a phenomenal jump. In the financial year ending June 2021, the company achieved a record earnings of RM3.8bil on a RM7.1bil. That year’s earnings alone was equivalent to 38 years of earnings of the company as the company’s average annual earnings is approximately RM100mil.

The company’s balance sheet underwent an overnight transformation, one that’s probably worthy of the records book. At its financial year end 2019, the company had a net debt of about RM200mil. That figure took a massive change at its financial year end of 2021, where it recorded a supernormal net cash of RM3.50billion! It basically could pay back its debt 17.5 times over!

|

Balance Sheet |

FY2019 (RM' Million) |

FY2021 (RM’ Million) |

|

Total Assets excluding cash |

1,669 |

3,618 |

|

Cash |

173 |

3,776 |

|

Total Liabilities excluding loans |

315 |

2,242 |

|

Loans & Borrowings |

391 |

257 |

|

Equity |

1,134 |

4,894 |

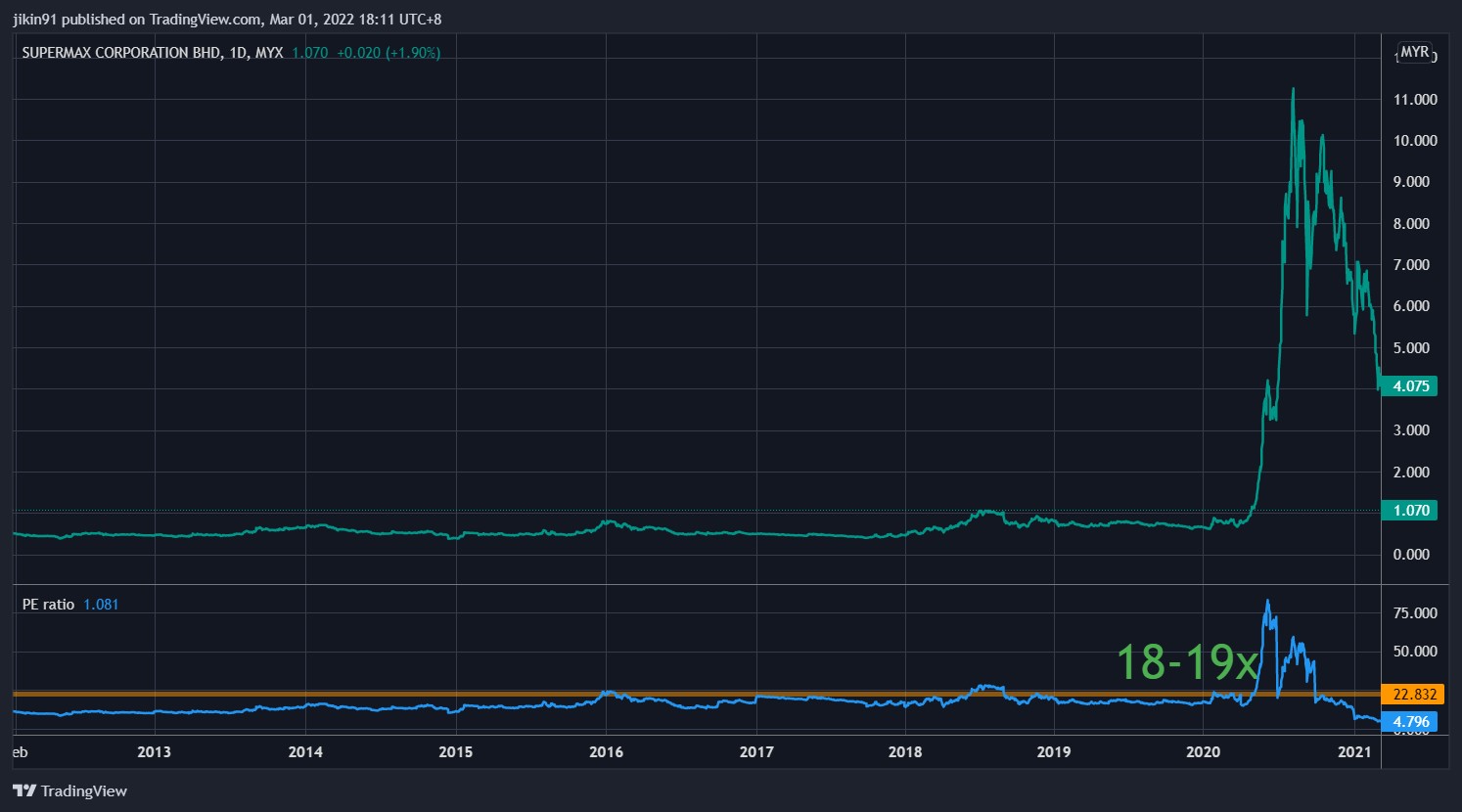

Unfortunately, and of course, definitively all great bubbles must come to an end. After achieving its peak around Aug-Sep 2020, the share price of the counter started its long & steady decline. Almost 18 months from the start of its decline, the share price has fallen 90% of its peak. So is this selling rational and is the valuation assigned logical?

MOST DEFINITELY THE VALUATION ASSIGNED IS IRRATIONAL!

Headwinds:

Before we head into the discussion of the irrationality of today’s valuation, let’s first address the headwinds the company will see.

- New Capacity from incumbents and new players: The pandemic had led to an enormous boom in demand for gloves as medical practitioner needed to change gloves more often and non-medical practitioner picked up the habit of using gloves. The excessive demand led to supernormal pricing and profits for the large glove counters. This profit attracted incumbent players to layout plans for major capacity growth and also led to new entrants who felt that the industry was a basically a legal license to print money. From Mah Sing Bhd to Hong Seng Consolidated Bhd, new players started pouring into the industry. With all these new capacity and declining demand, competition will definitely grow stiffer for Supermax. That could even mean stagnating or even declining sales volume for Supermax compared to years prior to COVID.

- Lower selling price from declining demand & new capacity: With the pandemic slowly transitioning to an endemic, the demand for gloves will inevitably have to ebb. Couple the ebbing demand with increased capacity from the industry, Supermax will definitely have to reduce its pricing to maintain customer demand. This will lead to lower Average Selling price, revenue & ultimately profit.

Why Should it Be Considered Undervalued Despite the Headwinds.

To highlight the massive undervaluation, let’s first discuss the company’s future earnings. Instead of having to having to do our own projections, let’s leverage on work done by experts in the field. The following is the latest list of analyst estimates for Supermax’s earnings for the next 2 financial years.

|

Brokerage |

FY2022 |

FY2023 |

|

Kenanga (22/2/22) |

788 |

221 |

|

BIMB (18/11/21) |

1010 |

460 |

|

AffinHwang (6/5/21) |

2470 |

1323 |

|

CGS-CIMB (6/5/21) |

2550 |

1590 |

|

KAF (5/5/21) |

1492 |

1164 |

|

MIDF (6/5/21) |

1880 |

1260 |

|

Average |

1698 |

1003 |

The average of the earnings estimate calls for Supermax to earn RM1.7bil in net profit for FY2022 and RM1bil for FY2023. So in our valuation, let’s be conservative and apply a 30% discount to the projection. That means the likely profit for Supermax in FY2022 is RM1.2bil in FY21 and RM700mil in FY23.

This figure translates to an earnings yield of 41% based on its market capitalization of RM2.91bil! If the company maintains its dividend payout ratio of 20% in FY21, this will translate to a dividend yield of 8% in FY22 and 4.8% in FY23. Even with so much of discounting baked in, the potential yield is still above average compared to most counters in Bursa Malaysia.

But that’s NOT the best part. Let’s value the company based on historical metrics.

Since 2016 till early 2020, the company’s average PE ratio has been hovering around 18-19x. If we applied the same PE ratio for the company based on FY23 earnings, the company’s valuation will be as the following:

|

Valuation Metrics |

Value |

|

FY23 earnings |

RM700mil |

|

Discounted P/E ratio [47% discount] |

10x |

|

Valuation |

RM7bil |

|

Net cash |

RM3.5bil |

|

Cash + Valuation on PE Ratio |

RM10.5bil |

Using the company’s historical PE ratio, after applying a 47% discount to its PE ratio, the company’s future earnings should be valued at RM7bil! If you include the current net cash balance, the company should be worth at least RM10.5bil. That’s a massive 3.6x of current market capitalization!

Let’s compare today’s financial ratios to before:

|

Key Ratios |

Pre Covid (28/2/2019) |

Today (1/3/2022) |

|

Market Capitalization |

RM2200mil |

RM2910mil |

|

Net cash |

-200mill |

3500mil |

|

Equity |

1134mil |

4894mil |

|

Equity excluding net cash |

1134mil |

1394mil |

|

Market cap excluding net cash |

RM2200mil |

-RM600mil |

|

P/B Ratio net cash |

2x |

-0.43 |

|

Earnings |

123 |

700 |

|

P/E Ratio |

17.89x |

4.14x |

|

P/E Ratio excluding net cash |

17.89x |

-0.85 (negative because net market cap is negative) |

If you look at the figures above, the market capitalization of the company is lower than its net cash by RM600mil! That means you are paid RM600mil to take a company that is supposed to generate RM1.2bil in earnings for FY2022 and RM700mil in FY2023! HOW RIDICULOUS IS THAT??

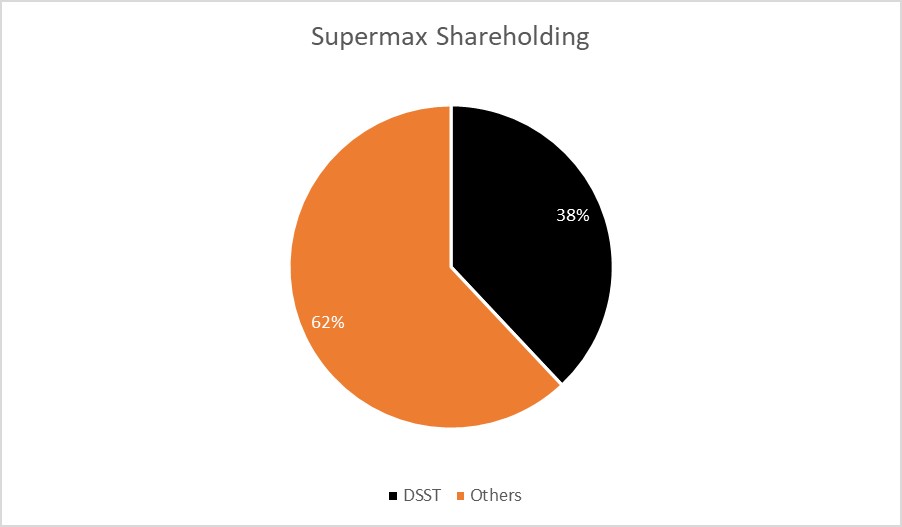

What can Datuk Seri Stanley Thai (“DSST”) Do?

Tan Sri Stanley Thai currently holds 38% of Supermax. That means the market value assigned to shares not owned by him is RM1.8bil. If he offers a simple 50% premium to market capitalization, his cost of acquiring shares not owned by him will be RM2.7bil. That will leave him with a net cash of RM800mil and a company generating RM1.2bil in FY2022 and RM700mil in FY2023. That essentially means a 50% premium takeover now will net him a free RM2.7bil by end of next year!

With this massive undervaluation, one must wonder, what does he have in store and maybe, you could profit from it.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Undervalued Gems in Bursa Malaysia

Created by InvestingPlaybook | Apr 08, 2022

Created by InvestingPlaybook | Mar 03, 2022

Discussions

Supermax has committed RM1.39 billion for new plants in Malaysia and USD350 million in the US. That's almost RM3 billion. So the company's cash is gone. These plants may not operate at full capacity because of the oversupply situaton and the additional overheads will further depress Supermax's earnings.

2022-03-04 08:59

I wonder whether the company does the market research whether the drop of ASP and supply would drop eventually.

Besides, they should focus rewarding the shareholder to ensure they hold firmly during the downs time.

I just feel bursa stocks are quite selfish in term of rewarding the shareholder and their focus is "own pocket" only.

Eventually, everyone is here to goreng only. It means Bursa is not meant for long term and becoming for active trader.

2022-03-21 15:25

sutp

Your analysis is quite compelling. But what if the analysts are wrong and Supermax goes into the red like Careplus and other glove companies?

2022-03-04 08:52