Forget MBSB, look at RHB instead! Strong Technical Tailwind Ahead!

InvestingPlaybook

Publish date: Fri, 08 Apr 2022, 01:48 PM

The recent merger talks between MBSB and MIDF has brought about significant interest for MBSB. A merger in the Malaysian financial sector is rather rare in recent times. Hence, it is inevitable that the market will be excited over such development. However, unperturbed by this excitement, we have analysed MBSB and found that there is another candidate that deserves your attention and that is RHB.

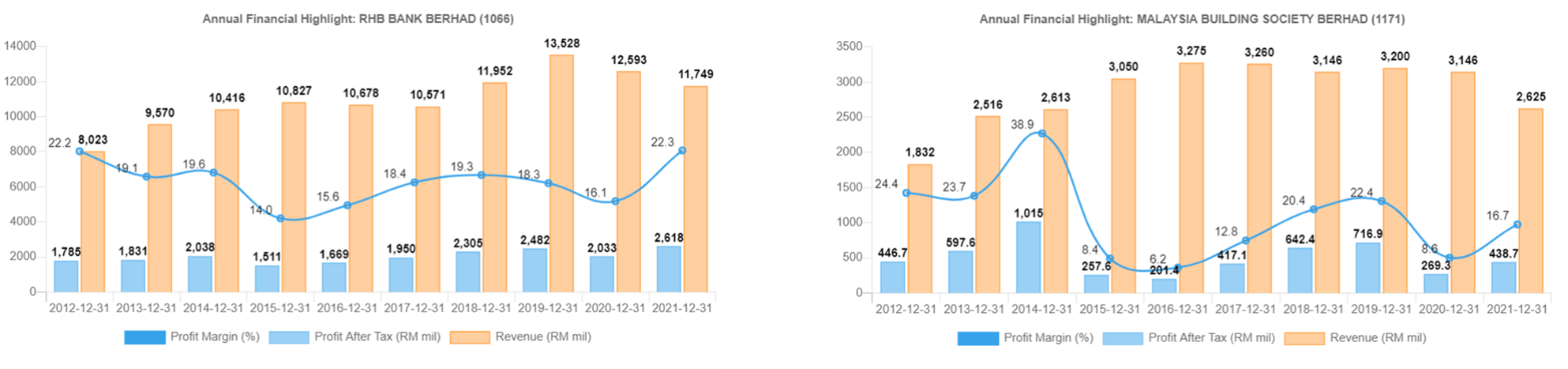

Upward trending earnings

When RHB is placed side-by-side MBSB, it is clear that RHB displays more significant stability in its earnings. In fact, outside of FY2020, a year where COVID has severely impacted the banking sector, the bank has recorded a continuous earnings growth, CAGR of 9.6%, for 6 years. This contrasts with MBSB which recorded only 4 years of earnings growth over the same period of time.

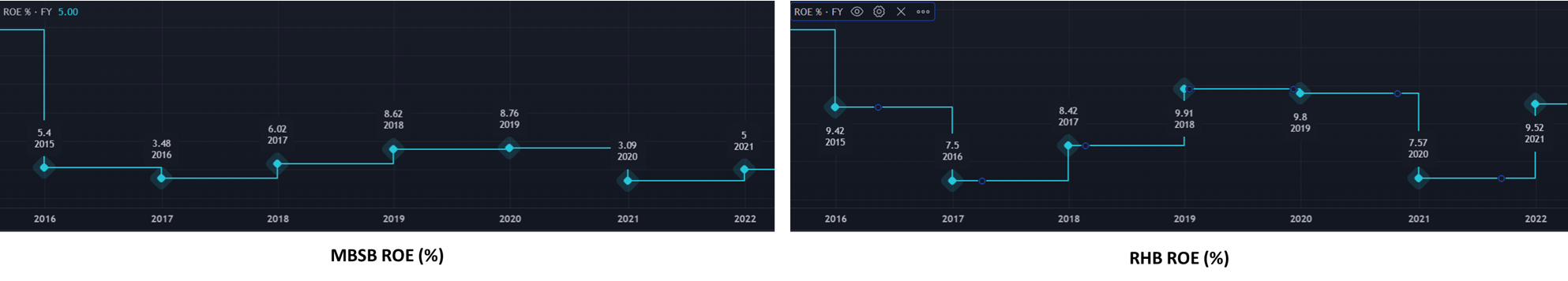

Far Higher ROE

In terms of ROE, which is one of the most important metrics to analyze a bank’s efficiency and returns generating potential, RHB has consistently outperformed MBSB from FY2015 to FY2021. In fact, the average ROE for RHB for those 6 years was 8.87% which is 1.5x of MBSB’s average of 5.78%. A higher ROE translates to better earnings growth profile for RHB compared to MBSB.

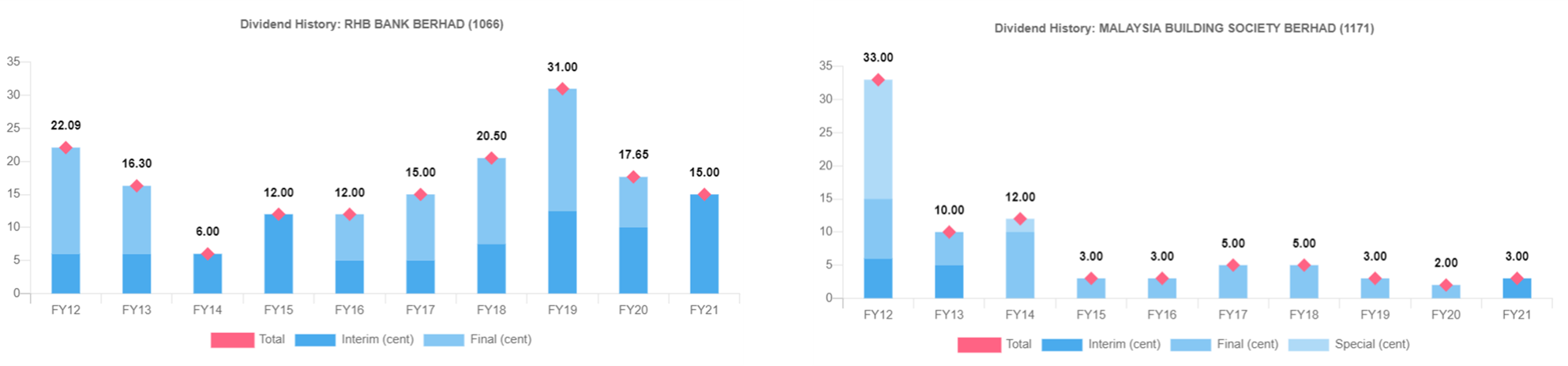

Growing Dividend Distribution

In terms of Dividend, RHB has displayed a more significant growth profile compared to MBSB. Outside of the COVID-19 Pandemic RHB has charted a consistent and strong dividend per share growth from FY2015 to FY2019. This compares with MBSB which has shown a rather muted growth of dividend per share.

MBSB's Merger Risk

While the merger MBSB and MIDF, if materialized, may present growth potential and value synergy for MBSB, the downside from this merger is also very material. In terms of cost, a merger of this large size will largely involve significant integration cost. This may translate to dampened earnings for the near term. Additionally a merger of this size also carries very significant execution risk. A failure to execute the merger according to plan may translate to failure to realize any value creation.

Technical Tailwind for RHB

Besides RHB’s superiority in financials & fundamentals, another reason for a strong RHB buy is its price pattern. At RM6, the share is about to break a strong resistance level that has formed since 2015. This resistance level has also accumulated a heavy transaction volume from the past. Breaking this resistance level means the bulls for the stock has overpowered past “Bag Holders” giving the stock a strong tailwind. Also, there is very little resistance level with heavy historical transaction volume for price levels above RM6. This means there is very selling volume that will prevent RHB from rising further.

More articles on Undervalued Gems in Bursa Malaysia

Created by InvestingPlaybook | Mar 03, 2022

.png)

sensonic

Post removed.Why?

2022-04-09 22:16