PENSONIC (9997)

严重低估的PENSONIC (PART 3)

valuestock

Publish date: Sun, 26 Jul 2015, 10:26 AM

分析公司财政报告 (以最近一季报告为参考)

公司每年营业额都在增长,今年为RM 388 million. 今年净利更是创新高,为RM 17 million.

公司拥有很好的现金流,operating cash flow处在 (+)。公司有进一步的投资在新生产线与新工厂,所以会看到investing cash flow是 (-)。

Balance sheet 也很健康,债务不算高,现金有RM36million.有能力继续派发高股息。今年公司派发了3.5仙的股息。我们用50仙股价来计算,你就是拿到了7%的股息。银行才给3.5%,PENSONIC给你7%。

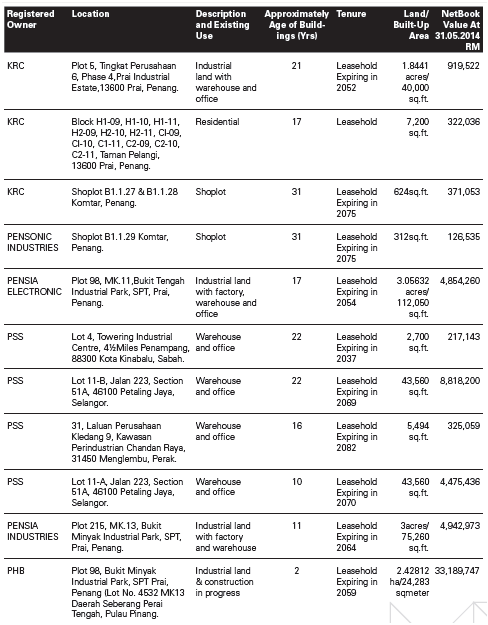

接着我们看公司资产,公司拥有很多地皮,成本都很便宜。有两片地在雪兰莪,在会计报告里可看到一片才RM100/sqft,另一片才RM200/sqft. 其实市价都差不多RM800-900/sq ft了。他们没做revaluation,假如他们做了revalution或卖出去,肯定赚大钱。单单那两片在雪兰莪就可以赚RM73million. 别忘了公司市值才RM64million. 除了这些,他们还拥有另9个资产也处在成本相当的便宜。

以下是公司11个资产:

上图从年度报告取得

所以公司所显示的Net Tangible Asset是和市值有很大的出入。计算这11片地可为公司赚取RM 100million的话,Net Tangible Asset Per Share 应该差不多是RM1.62。

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on PENSONIC (9997)

Discussions

Be the first to like this. Showing 0 of 0 comments