IPO - Richtech Digital Berhad (Part 1)

MQTrader Jesse

Publish date: Fri, 31 Jan 2025, 11:55 AM

Tentative Date(s):

- Opening of application - 21 January 2025

- Closing of application - 31 January 2025

- Balloting of applications - 04 February 2025

- Allotment of IPO shares to successful applicants - 13 February 2025

- Tentative listing date - 17 February 2025

Company Background

The company was incorporated in Malaysia under the Act on 21 September 2023 as a public company under the present name of RichTech Digital Berhad. The company is principally an investment holding company. Through its subsidiary, they are principally involved in the distribution of electronic reloads as well as the provision of bill payment services via its SRS platform.

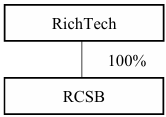

The company Group structure as at the LPD is as follows:

Use of proceeds

- Marketing and promotional activities - 32.93% (within 24 months)

- Acquisition of New Office - 21.95% (within 24 months)

- General working capital - 21.95% (within 12 months)

- Estimated listing expenses - 23.17% (immediately)

Marketing and promotional activities - 32.93% (within 24 months)

The company intends to expand its user base which comprises SRS corporate users and SRS end-users. In the past, the company Group’s sales efforts have been mainly targeted at SRS corporate users. During the Financial Years/Period Under Review, the SRS end-users contributed less than 2.0% of the company Group’s Gross Sales.

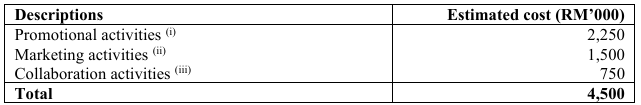

In order to expand the SRS end-user base, the company plans to intensify its marketing and promotional activities with the proposed utilization of RM4.50 million or 32.93% of the total gross proceeds to be raised from the Public Issue over the next 24 months in the following manner:

- Promotional activities

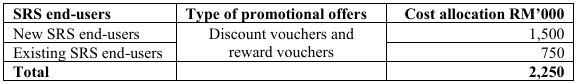

The company intends to invest in promotional activities through offering rewards such as discount vouchers and reward vouchers) to encourage more new and existing SRS end-users to use the SRS platform. The breakdown costs for the promotional activities allocated for new and existing SRS end-users as follows:

The company plans to offer 200,000 discount vouchers and 100,000 discount vouchers worth RM5.00 each to the new SRS end-users and existing SRS end-users respectively, based on a minimum spending per transaction to be determined later. Similarly, the company also plans to offer 100,000 reward vouchers and 50,000 reward vouchers worth RM5.00 each to the new SRS end-users and existing SRS end-users respectively, based on accumulated spending for a given period to be determined later.

- Marketing activities

The company intends to invest in marketing activities through:

- search engine optimization to increase visibility and traffic to the corporate website; and

- social media platform advertisements such as Instagram and TikTok to promote the SRS platform,

to be managed by the company Group’s business development personnel.

- Collaboration activities

The company intends to collaborate with retailers that own chain stores to promote the SRS App and SRS Portal by conducting promotional activities and placing relevant banners at their retail stores. Incidental expenses under these collaboration activities include advertisements on billboards and printed media as well as printing of banners. As at the LPD, the company has only incurred expenses for the printing of banners following the signing of the Collaboration Agreement with Hari-Hari amongst others. Moving forward, the company will continue to seek collaborations with other retailers who own chain stores.

In the event the estimated costs for the marketing and promotional activities are lower than budgeted, the excess will be used for the company Group’s general working capital purposes. Conversely, if the actual costs for the marketing and promotional activities are higher than budgeted, the shortfall will be funded from the company Group’s internally generated funds.

Acquisition of New Office - 21.95% (within 24 months)

As at the LPD, the company is currently renting two (2) separate office premises (“Rented Offices”). The company intends to have a larger office area that could accommodate its headquarters and branch office under one roof, for corporate profiling as well as ease of administration. Hence, the company plans to acquire a New Office with an estimated built-up area of 5,000 sq. ft. to 6,000 sq. ft. and located within a 10km radius from the Rented Offices. This serves to minimize disruption to the company’s daily operations as well as the associated relocation logistics and costs.

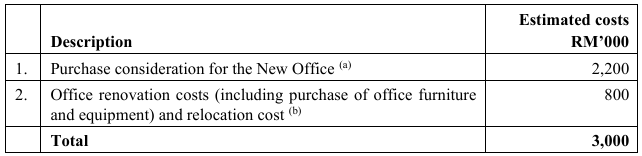

The company has earmarked RM3.0 million or 21.95% of the total gross proceeds to be raised from the Public Issue for the acquisition of the New Office as follows:

In the event the estimated costs for the acquisition of the New Office are lower than budgeted, the excess will be used for the company’s general working capital purposes. Conversely, if the actual costs for the acquisition of the New Office are higher than budgeted, the shortfall will be funded from bank borrowing to be procured and/or the company’s internally generated funds.

General working capital - 21.95% (within 12 months)

A total of RM3.00 million or 21.95% of the total gross proceeds to be raised from the Public Issue has been earmarked for the purchase of stocks for electronic reload services, such as mobile airtime reloads, mobile data reloads, prepaid digital TV reloads, games credits, application credits, and eWallet credits, in tandem with the expected growth of the company’s sales. The purchase of stocks for electronic reload services accounted for approximately 72.40% to 77.29% of the company Group’s purchases during the Financial Years/Period Under Review.

The company intends to strategically procure the stocks towards year-end to leverage the advantageous offers and discounts typically available during that period.

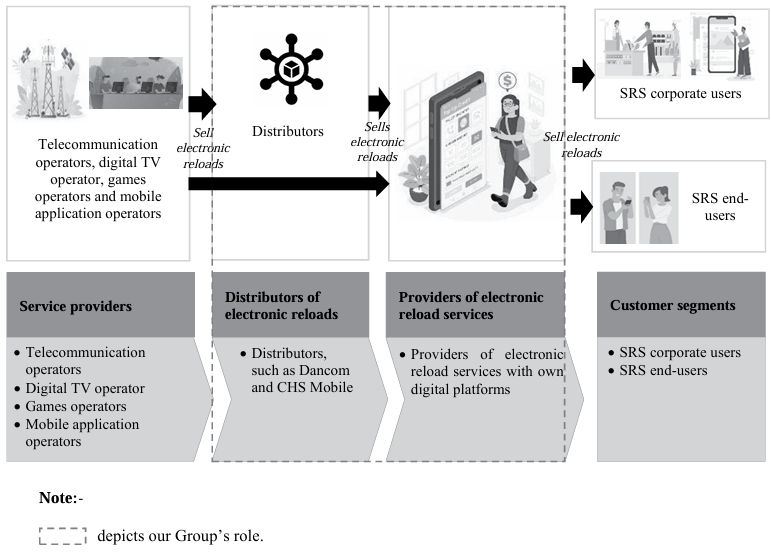

Business Model

The company SRS platform enables electronic reloads for a variety of services, including mobile airtime and data reload, prepaid digital TV reloads, games credits, application credits, and eWallet credits. It also facilitates the payment of bills for postpaid mobile network services, water and electricity utilities as well as maintenance services of national sewerage systems, postpaid digital TV, internet services, quit rent and assessment payment as well as education loan and installment plan payment.

The company Group mainly earns a margin as commission revenue from providing electronic reload services. Meanwhile, the company earns an incentive (where a full amount of the bill payment made will be immediately deducted from the deposits or credit pool placed by the company with the payment solution providers and an incentive will be given by them at the end of a billing cycle to the company Group) or commission (where an amount of the bill payment made after netting off a commission will be immediately deducted from the deposits or credit pool placed by us with the payment solution providers) from facilitating bill payments via the SRS platform.

The company user base comprises:

- SRS corporate users, refer to reload retailers (such as resellers, mobile phone shops, sundry shops, and apparel shops) and third-party mobile application operators who are operators of consumer applications. They utilize the SRS platform to distribute electronic reloads to and perform bill payment services for their own users.

- SRS end-users refer to users who use the electronic reload and bill payment services for personal use through either the SRS App or the SRS Portal.

The company Group’s role in the industry value chain for this business segment is illustrated in the diagram below:

Click here to continue the IPO - Richtech Digital Berhad (Part 2)

Looking for flat 0.05% brokerage?

Get started: https://bit.ly/mqamcash

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

More articles on Initial Public Offering (IPO)