5 common mistakes for forex beginners

vcplus

Publish date: Thu, 22 Dec 2022, 04:24 PM

Forex trading is popular because it’s easy to enter and requires low capital to start. But being easy to start doesn't mean it’s easy to master forex trading!

Here are the 5 common mistakes that all forex beginners need to watch out for and avoid!

- Never do any research

- Taking more risks than you can afford

- Trading with emotions

- Not placing limits

- Spent too much money to trade, even if you're new

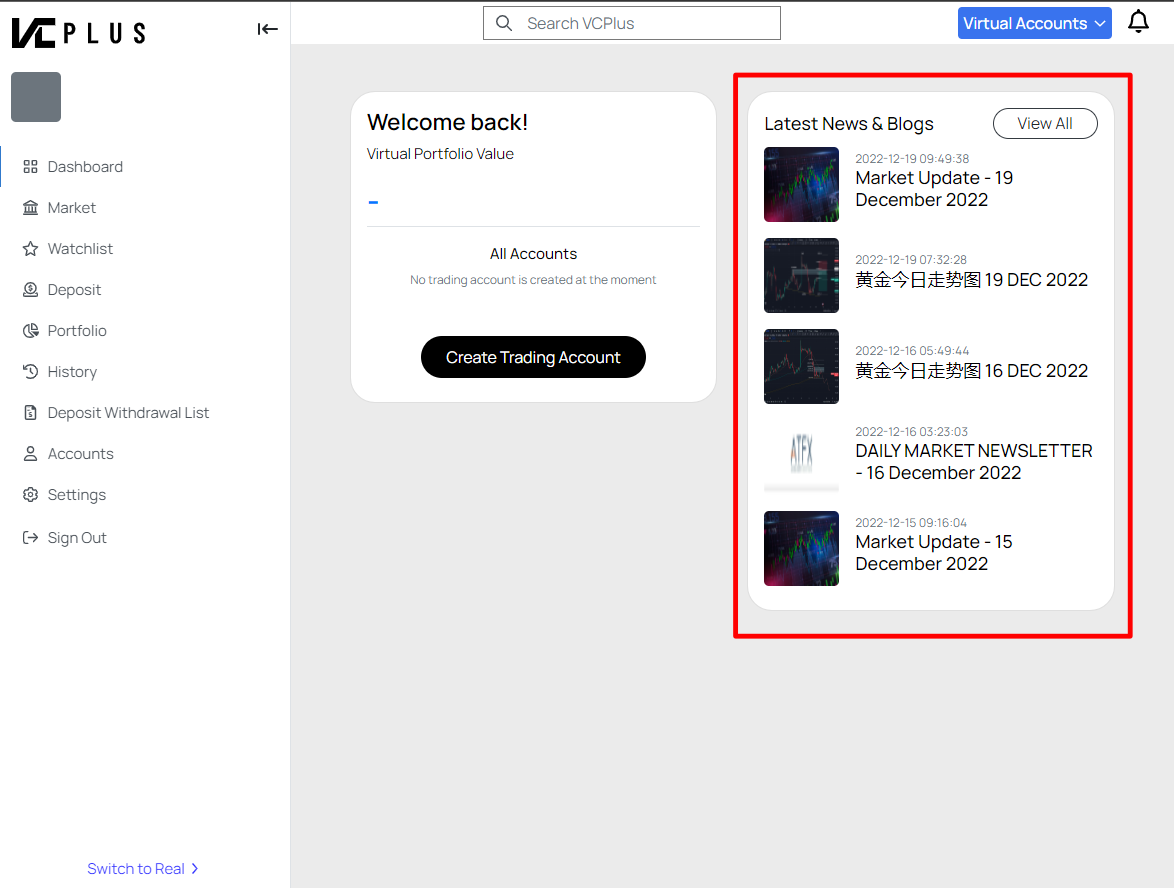

1. Never do any research

Forex is affected by a lot of factors. They are also trading 24 hours a day, seven days a week, which means there is always something going on that moves the market. Hence, adequate research is important before engaging in a trade. You need to be aware of any upcoming events that may impact your trading, and anticipate how these events may impact the overall market as well.

No worries, you can follow the latest news & blogs on the VC plus website to get the latest updates on the market!

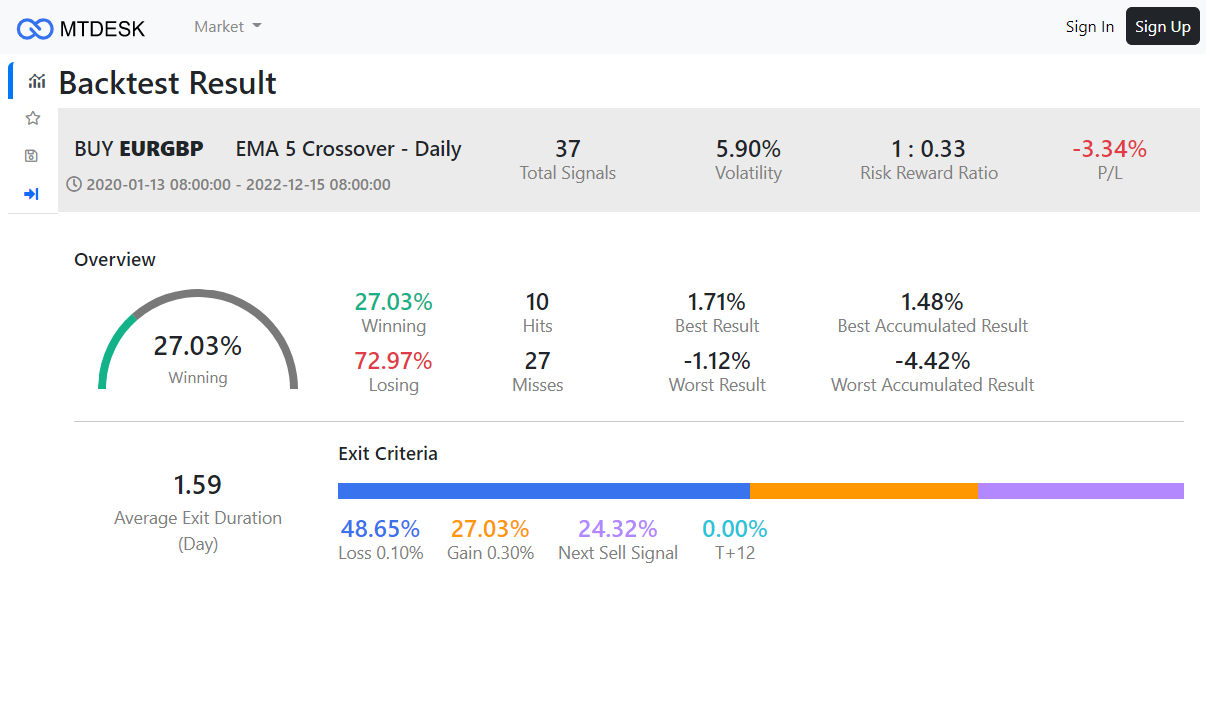

2. Taking more risks than you can afford

Another common mistake made by new traders is not setting a budget on how much capital you’ll be using for trading. This is a huge mistake as you should always avoid risking a huge portion of your savings. This happens not only in forex trading but in any sort of investment as well. It is a must to set a budget to trade, and never use more than that!

Another way to decrease your risk is to refer to MTdesk backtest results of trading strategies based on historical data before you initiate your trade. (information includes winning rate, volatility, risk reward ratio, average exit duration day and etc)

Sign up and get backtest results with just 1 click. (free)

3. Trading with emotions

Trading with emotions is commonly known as revenge trading. Many traders are victims of this, especially when they just lost a trade. If you let personal feelings and emotions influence your decisions in trading, most of the time it will only cause more pain and losses to you. The common scenarios that are caused by emotions are selling low and buying high. If this behavior goes unchecked, it will be difficult to achieve any profits for trading in the long term.

Capture trading signals with just 1 click on VC Plus! (free)

As you can see in the image, a trader who trades rationally and follows the sell signal would exit early to avoid the downtrend.

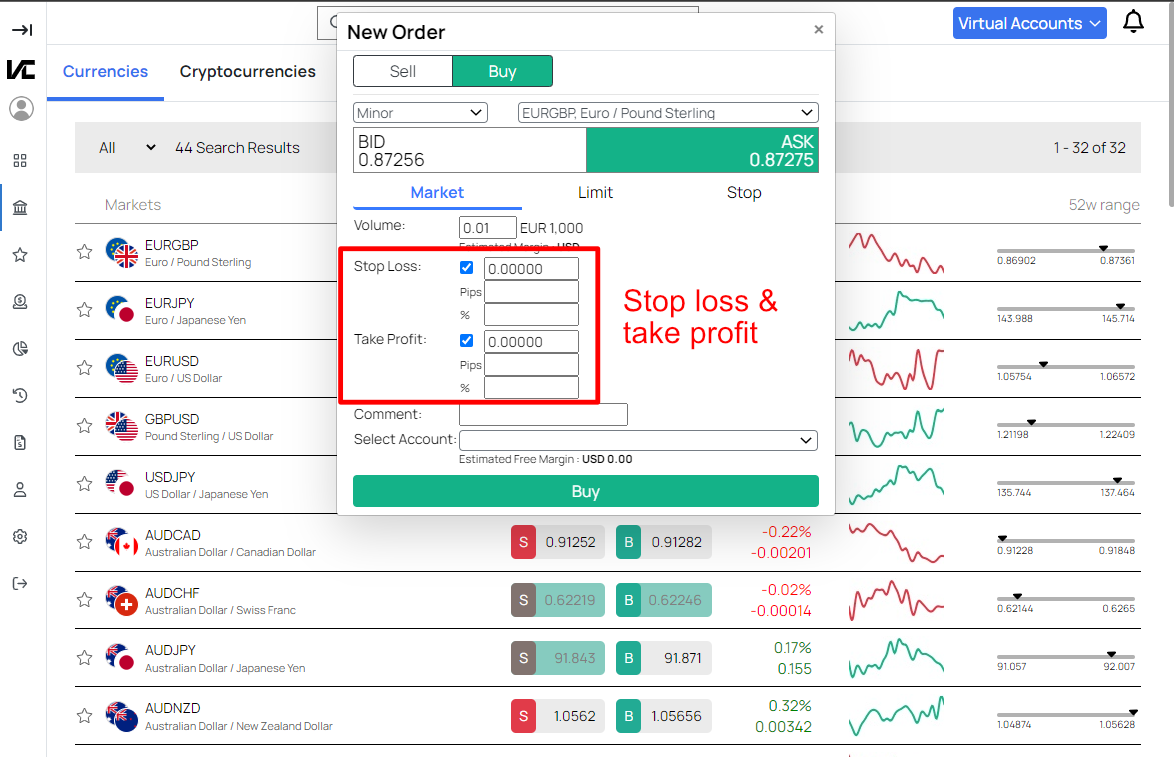

4. Not placing limits

Forex market operates 24 hours, but you’re not. You can’t follow your orders every second. Stop and limit orders allow you to enter and exit the market automatically when it reaches a specific price point. This allows you to place orders at prices you want without having to monitor them every second, it also sets as an automatic exit point for your trades.

Here’s how you set stop loss and take profit in VC Plus.

5. Spent too much money to trade, even if you’re new

Because of the potential for profit, some new traders may be tempted to trade large sums of money. This impulsive behavior will put you at high risk, especially if you are new to trading, leading to some people losing money quickly and blaming the market.

You can try out a demo trading account first, then after opening a live trading account with real money, trade in small amounts first to get a feel for it.

The more time you spend on trading, the more experienced you will become, and the easier it will be to maximize your profit from any trading opportunities! Practice is the key to success!

Try out the virtual/demo account at VC Plus. (free sign-up)

Click here to sign up for free and grab your *$100 welcome credit now!

*T&C applies.

More articles on VC Education Series

Created by vcplus | Nov 23, 2023