Will PRLEXUS catching MAGNI rally?

intelligentinvesting

Publish date: Sun, 04 Jun 2017, 08:42 PM

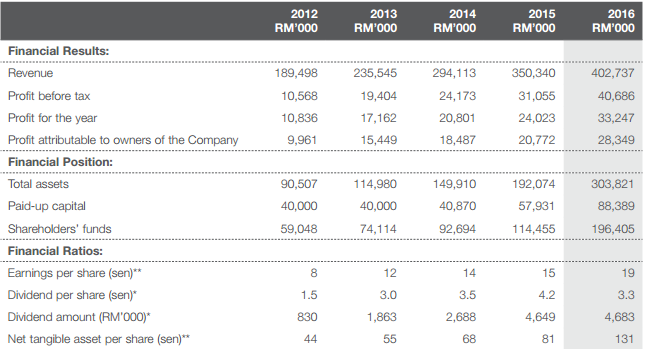

1.Prolexus’ business is mainly involved in the manufacturing of apparels and provision of apparel manufacturing services to its customers. Over the years, it has established itself as a reputable manufacturer of quality garment for international renowned brands. Since the last 5 years, revenue and net profit has been improving tremendously.

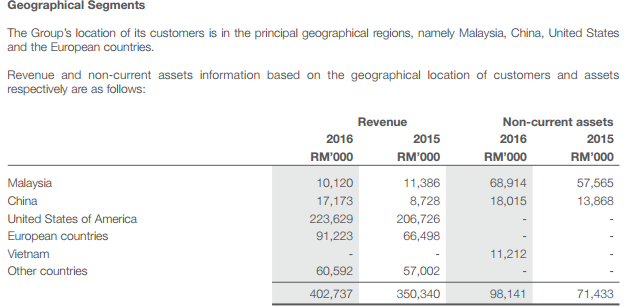

2. Prlexus major customer from America and next European countries. With US consumer price index improving tremendously, there is high chance that demand for Prlexus 's product will be strong as well. Its customer including well branded names such as Nike, Armour, Fila, Disney, Umbro and others.

3.Smart money accumulation as in the photo. EPF (10.36Million share) and Manulife (8.7Million share) are buying since early of this year.

4.Due to syariah related issue, Prlexus dropped from RM1.67 to RM1.48 lowest while warrant dropped from highest RM0.71 to RM0.55 (- 22.5%), both in oversold condition but last few days there was some buying activity. Bursa annoucement showed that EPF is accumulating on weakness.

5.While competitor Magni is breaking new high, Prlexus is still struggling.

6.Recent quarter report shows that Cash & FD total at whopping RM122Million ( 45% of market cap at RM271M)

7.The Group is exciting with two plants expansion which going to be completed in financial year 2018. With new plant operation, it will raise existing production capacity by 30%.

Disclaimer: This is a personal weblog, reflecting my personal views and not the views of anyone or any organization, which I may be affiliated to. All information provided here, including recommendations (if any), should be treated for informational purposes only. The author should not be held liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

shareinvestor88

MWE is another similar company

2017-06-04 21:15