FY2023 Q3 Result Notes - KGW Group Bhd

Chang Keit Siong

Publish date: Mon, 27 Nov 2023, 10:22 PM

KGW Group Bhd (“KGW”), the newly-listed logistics specialist, today posted their financial results for the third quarter of fiscal year 2023. This report provides a detailed analysis of KGW’s financial performance, focusing on key segments and factors influencing their earnings.

Figure 1: Revenue by business activities

During the reviewed quarter, KGW's ocean freight division continued to be the primary revenue driver, augmented by the warehousing and distribution segment. Notably, the ocean freight segment accounted for RM20.14 million in the third quarter and RM53.71 million over the first nine months of FY2023.

Despite apparent concerns over the company's net losses, it's important to note that KGW incurred a one-time listing expense of RM2.07 million and administrative costs amounting to RM2.56 million, largely attributed to its expansion efforts. Excluding these one-off expenses, KGW would have posted a profit before tax (PBT) of RM0.73 million for this quarter.

The report does not include year-on-year comparative statistics.

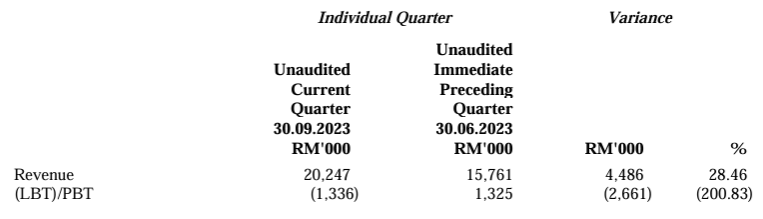

Figure 2: Comparison with Immediate Preceding Quarter’s Results

When compared to the immediate preceding quarter, KGW exhibited a revenue increase of RM4.49 million or 28.46%, reaching RM20.25 million. This growth is primarily fueled by the ocean freight segment. However, the one-off listing costs resulted in a loss before tax (LBT) of RM1.33 million, a contrast to the RM1.33 million PBT recorded in the previous quarter.

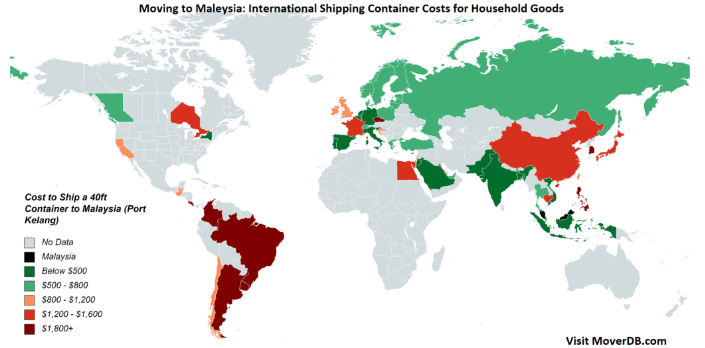

Figure 3: Shipping Container Costs Range to/from Malaysia

To comprehend KGW’s revenue generation model, it is essential to understand the basics of their pricing strategy:

Let X represent the base ocean freight rate.

KGW’s additional services are charged at 1.05 to 1.30 times X, denoted as R.

Y symbolizes KGW’s fixed costs.

Variable costs, indicated as Z, increase with the number of containers shipped.

Therefore, KGW’s revenue from the ocean freight segment (the largest contributor) is calculated as 1.175 (average of 1.05 and 1.30) times X.

This model implies that a higher base rate (X) leads to increased revenue (R), facilitating better coverage of fixed costs (Y) and management of rising variable costs (Z). Contrary to assumptions, a lower ocean freight rate does not necessarily equate to losses for KGW. With 2024 on the horizon and a resurgence in economic activities, KGW is poised for improved performance.

The third quarter of FY2023 can be viewed as a period of recalibration for KGW, absorbing one-off expenses and gearing up for increased demand, particularly during the holiday season in Western countries, which typically extends until the end of December.

In conclusion, we maintain a positive outlook on KGW's future prospects, underpinned by strategic business operations and favorable market conditions.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Golden Eye

Created by Chang Keit Siong | Jan 07, 2024

As we dive into 2024, the buzz in Bursa Malaysia's first trading week has set a vibrant tone, particularly for stocks linked to the bustling Johor Bahru region.