Malayan Flour Mills Berhad - Win Win deal between MFM and Tyson Food (TheProfessors777)

TheProfessor

Publish date: Sat, 06 Mar 2021, 11:12 AM

Extract from AmInvest analyst report:-

We expect a strong earnings rebound of more than twofold in FY21F underpinned by the following:-

(1) Higher selling prices of poultry due to lower supply. We understand that a few producers of poultry products in Malaysia have reduced their production as raw material costs have risen. Since the middle of last year, US soybean price has surged by 54.7% to about US$13.83/bushel while US corn price has climbed by 41.1% to roughly US$5.32/bushel.

You guys may refer to gov.dvs for live bird price update.

http://www.dvs.gov.my/index.php/pages/view/2951

(2) Lower exposure to the live bird market. MFM is currently selling more processed chicken products instead of live birds. The difference in the selling prices of processed poultry and live birds ranges from RM2.00 to RM3.00/kg. Selling prices in the processed poultry products are also less volatile compared with live birds. Currently, MFM only sells 10% (vs. 50% previously) of its poultry products to the live bird segment while the larger 90% are processed products sold to the HORECA segment.

This is very true, previously DPDC sell 50% of live bird to DPP. MFM’s poultry processing is doing quite well and it is profitable, the only killer part is live bird sector because the selling price is fix by the government. Some other will say WHY other player like LEONG HUP, HUAT LAI, CAB can do better than MFM? The reason is because MFM only carter Malaysia market, and no export. So the depress of live bird price cause huge losses to Mflour. Lesser exposure to open market definitely a good strategy for them. Why poultry processing is a guarantee profit business? It is because the company can control their finish product price and but not by the government.

In the longer term, we reckon that MFM would benefit from:

(1) Tyson’s partnership. MFM has a long-term off-take agreement with Tyson. Through Tyson’s global network, MFM would be able to export halal poultry products to Singapore and the Middle East in the future. This would boost MFM’s sales volumes and customer reach. We understand that the long-term value of MFM’s 51% stake in the poultry division with Tyson on board could be worth more than MFM holding a 100% shareholding.

“We are pleased to partner with Tyson Foods to expand MFM’s long-established poultry business,” said Teh Wee Chye, managing director for MFM.

As mention above currently MFM only serve local demand, MFM able to expand their poultry business to oversea via Macfood/Tyson connection. Definitely it is a win-win for both company.

Why Tyson choose Mflour but not other company like LHI, HUAT LAI and CAB since there are bigger than Dindings?

I believe most of the investor out there do not know this, in the past 3 years MFM invest RM550 to build an automated poultry processing plant. “This is Malaysia FIRST automated poultry processing plant” by Marel poultry technology.

(2) Diminishing live bird market in Malaysia. The market for processed products is expected to grow as more states mull exiting the live bird market. Buying live birds in the wet market is deemed unsanitary and unhygienic. There would not be any live bird market in Penang in FY22F while Petaling Jaya is mulling doing the same. As MFM’s integrated poultry plant in Lumut has a processing capacity of 240,000 birds per day, the group is expected to benefit.

Currently the utilisation rate is about 38%, when utilisation rate hit 85-90% supported by demand from export market. Profit guarantee as stated in the agreement is feasible.

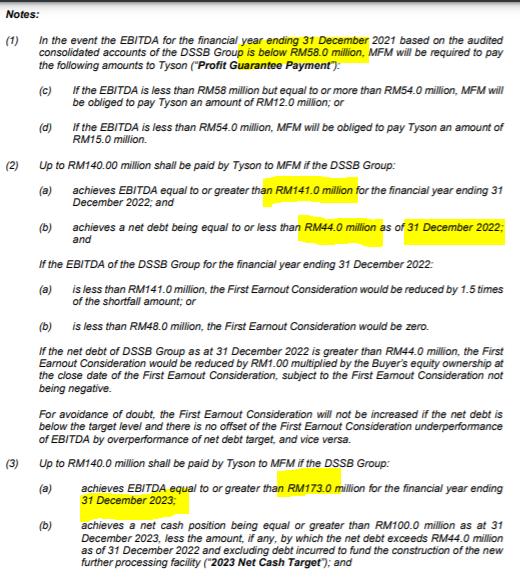

Profit Guarantee:-

Disclaimer: The material provided herein is for informational purposes only. It does not constitute an offer to buy or sell any securities. We accept no liability whatsoever for any direct or consequential loss arising from any use of information in this report.

I do not hold a position with the issuer such as employment, directorship, or consultancy.

I and/or others I advise may buy/hold/sell the mentioned securities at any time without further notice.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Rising Star

Created by TheProfessor | Aug 19, 2021

Created by TheProfessor | Apr 21, 2021

Created by TheProfessor | Dec 09, 2020

.png)