IQGROUP - Turn Around Story (TheProfessors777) GEM

TheProfessor

Publish date: Wed, 21 Apr 2021, 10:03 AM

Background

It is a manufacturer of lighting products and sensors (infrared as well as motion). It sells its lighting products together with the sensors, or sensors on standalone basis to customers.

In the past, IQ manufactures for customers as Original Equipement Manufacturer or Original Design Manufacturer.

But lately IQ starts selling under its own brand - LUMIQS.

Perhaps you can refer the link on their product review.

https://www.youtube.com/watch?v=Td5sLg5802Y

Financial Performance

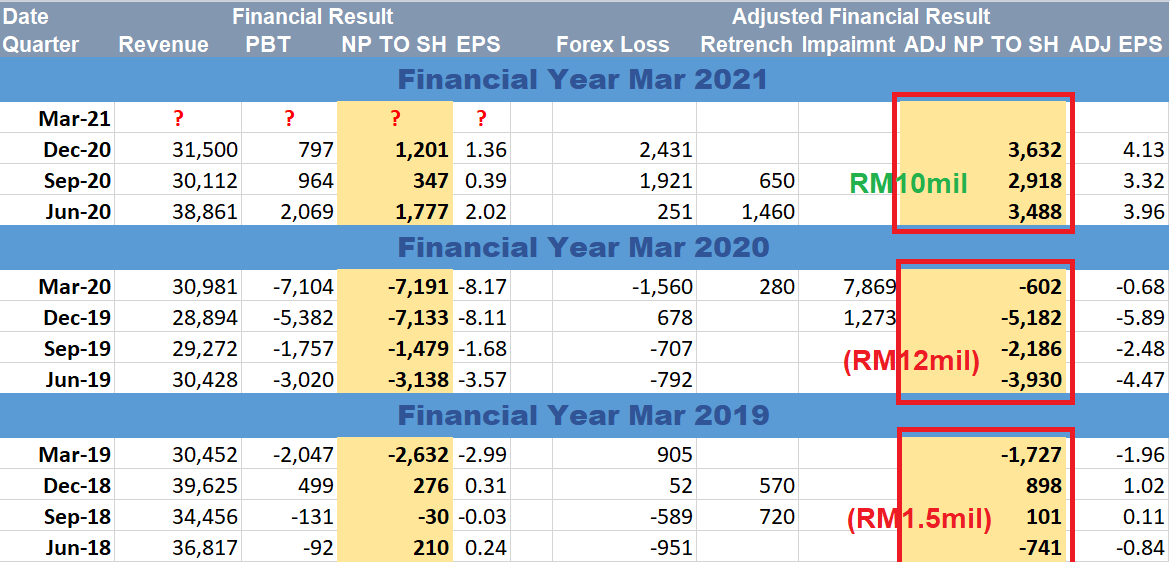

A quick check shows that in the past.

For 9th month end Dec 20, IQ post adjusted net profit to shareholder about RM10mil. Assume IQ able to maintain the same result in quarter 4, so annual profit is about RM14mil (EPS 15.9).

For FY 2021 the result is affected due to US Dollar weakening from 4.31 to 3.99, you can find it in the book.

FOREX LOSS of RM 4.5mil as at DEC 20.

PE 10 = RM 1.59

PE 12 = RM 1.91

PE 15 = RM 2.38

PE 20 = RM 3.18

Two major initiatives were previously accomplished in FY18/19, i.e. the exercise of moving the majority of IQ Malaysia’s manufacturing to our established facility in China (IQ Dongguan) and the subsequent step of establishing manufacturing operations further inland within China (IQ Wuning).

Since FY19/20, subsequent arrangements were set in motion to transfer manufacturing from IQ Dongguan to IQ Wuning such that all of our China based manufacturing is consolidated to our Wuning operation, thereby further reducing costs and enhancing efficiency.

This 2 initiative drag the performance of the group for FY 2019 and FY 2020. So it is bumper year for year 2021 onward.

General Lighting Market Research

“The global general lighting market reached a value of nearly $102.5 billion in 2019, having grown at a compound annual growth rate (CAGR) of 6.73% since 2015, and is expected to grow at a CAGR of 9.75% to nearly $148.7 billion by 2023.”

Disclaimer: The material provided herein is for informational purposes only. It does not constitute an offer to buy orsell any securities. We accept no liability whatsoever for any direct or consequential loss arising from any use of information in this report.

I do not hold a position with the issuer such as employment, directorship, or consultancy.

I and/or others I advise may buy/hold/sell the mentioned securities at any time without further notice.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Rising Star

Created by TheProfessor | Aug 19, 2021

Created by TheProfessor | Apr 21, 2021

Created by TheProfessor | Mar 06, 2021

Created by TheProfessor | Dec 09, 2020

Steve Ooi

Meaning to say coming quarter will no need affect by Forex any more since USD appreciate? So can I say there will be a reverse in forex losses coming quarter?

Since last quarter forex losses about 2.4 mil, so coming quarter will reverse all this out or reverse entire 4.5 mil forex, kindly advice.

2021-04-21 15:45