The Silent Winner of Strong USD Appreciation.

pearltt

Publish date: Wed, 06 Apr 2022, 03:11 AM

The Silent Winner of Strong USD Appreciation.

How far could USD MYR go in the future?

No one knows.

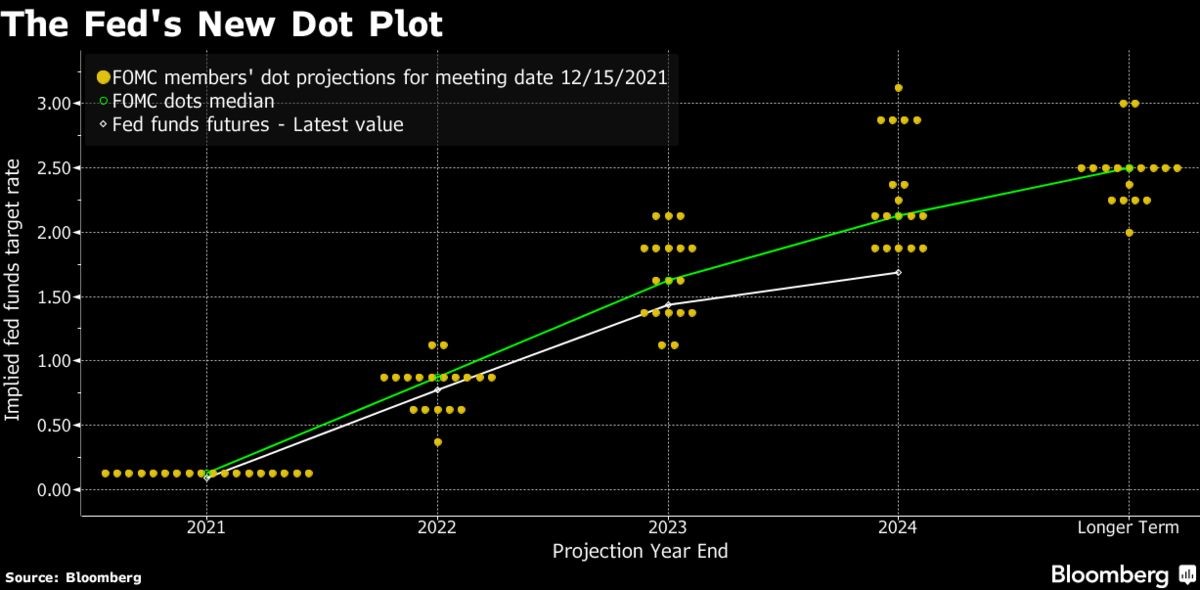

We are now seeing USD appreciation due to upcoming rate hike, an obvious act by the USD Fed to control the inevitable inflation.

To be frank, I don’t think that could help the exportation of US products. Instead, the strong USD movement may attract sharp increase in importation.

Especially for furniture, which the citizens of US are suffering greatly due to lack of supply for furniture.

Just look at how furniture stocks performed back in 2015 era, back when USD prices are super strong against MYR.

LII HEN INDUSTRIES BERHAD

POH HUAT RESOURCES HOLDINGS BERHAD

HOMERITZ CORPORATION BERHAD

The period is without a doubt – a furniture mania.

Once again, the brilliant US had of course noticed how much these furniture companies are making, and now they are pretending heroes by citing forced labour issues.

He who controls the media is always the hero, right?

Like it or hate it, headwinds are always additional risks for investors to consider while selecting investment vehicle.

I had selected a hidden champion under the strong USD and strong furniture demand theme.

Which is SERN KOU RESOURCES BERHAD

For your information, Sern Kou is involved in the midstream wood processing business and had some minor involvements in the downstream furniture manufacturing business. The focus on the company remains to be a supplier for furniture companies who needs the raw material, which is jumping in price in the local market now.

The company had secured RM3.61 million in profit after tax for the financial period ended 31st December 2022, which is very impressive given how some of the peers are actually in red for the same period.

The beautiful uptrend in share price basically means that investor had been noticing Sern Kou for the longest time.

I believe this hidden gem will shine once USD MYR moves stronger, and this is a very good proxy to invest in as compared to ESG-ridden furniture companies.

This is truly a diamond in the rough.