Jaya Tiasa-Good time to invest? (2)

13Research

Publish date: Thu, 30 Nov 2017, 12:55 AM

Jaya Tiasa has released its Q1 FY2018. Its Q1 revenue +3.82% YOY while net profit +45.45% YOY. Everything seems good? Let’s have a deeper analysis before we come out with conclusion.

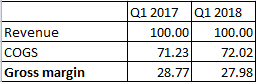

1. Gross profit margin has drops from 28.77% in Q1 17 to 27 98% in Q1 18.

2. PBT in Q1 2017 has included one-off expenses which is fair value loss on derivative assets RM2.151m and impairment of receivables RM3m. Excluded these one-off charges, PBT for Q1 2017 should be RM34.502m. That is, PBT in Q1 2018 is increasing by 22% but not 44% as what we see in P&L statement.

3. From performance review in quarter report, we can see that PBT for timber segment is RM1.599m compared to RM7.657 loss in Q1 17.

Many say that that is a recovery sign for timber segment in Jaya Tiasa. That is actually wrong. Why? Let’s have a look at chart below to have better understanding.

As we can see, timber segment has recorded PBT of around RM10m in previous quarter in FY2017. Bear in mind that this is achieved even before the impairment loss of RM65m done in Q4 2017. However, timber segment only achieved PBT of RM1.6m in Q1 2018 which is a huge drop from RM9.5m in Q4 2017. Since timber segment is not affected by seasonal effect as in palm oil segment, we can conclude that timber segment’s operation is badly affected as discussed in my previous article. (http://klse.i3investor.com/blogs/13Research/136559.jsp)

Moreover, there is no separation analysis between logs division and wood processing division in latest quarter report which was done in previous quarter report. Obviously, this is a trick done by management to hide the fact that their wood processing division is in a big loss so that they can create a positive outlook for investors. Just my opinion:)

Anyway, palm oil division is doing well in Q1 2018. However, I am conservative on the performance in palm oil segment as we can see there is a rapid drop in CPO price from RM2700+ to RM2478 now due to overproduction in FFB.

*Just my own 20 cent opinion. Please do your own homework before invest. Happy investing

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

YLR33

Good write up.

2017-11-30 05:56