Why a second Special Dividend and more - Airasia

1HitRampage

Publish date: Wed, 20 Feb 2019, 12:00 PM

In June 2016, Airasia announces selling AAC, a wholly owned subsidiary holding aircrafts.

In Aug 2016, Tony Fernandes and Kamarudin Maranun announces Private Placement to inject RM1 billion into Airasia for 559 million shares.

TF and KM applied for extention of 6 months and the Private Placement was completed in early 2017.

Airasia was selling AAC, after long wait, deal reached with BBAM for 1.15b USD for 75 aircrafts plus engines. All transactions were completed by Dec 2018.

Market expects special dividend from the deal to be between RM0.75 to RM1.25, based on the needs of TF and MK to repay their loan results from the private placement.

Tony Fernandes also mentioned the proceeds from Expedia will be used to fund digital ventures.

A surprise RM0.40 special dividend was announced in Q3 2018.

AIRASIA - Notice of Book Closure

| AIRASIA GROUP BERHAD |

SPECIAL DIVIDEND OF 40 SEN PER SHARE.

Kindly be advised of the following :

1) The above Company's securities will be traded and quoted "Ex - Dividend” as from: 12 Dec 2018

2) The last date of lodgment : 14 Dec 2018

3) Date Payable : 28 Dec 2018

However, note that ending Q3 2018, the AAC deal wasn't completed yet.

The Company wishes to announce the completion of the transfer of an additional number of aircraft pursuant to the Incline B SPA and the FLY SPA on 27 and 28 September 2018. The total number of aircraft involved under the abovementioned transfer is 19 aircraft and AAGB has received USD233.5 million in gross proceeds. To date, the cumulative number of aircraft transferred is 73 aircraft and AAGB has already received gross proceeds totalling USD936.6 million.

AAGB is optimistic that the transfer of the last 11 aircraft and 14 spare engines under the Proposed Disposals in order to complete the Incline B SPA and the FLY SPA will take place on or before 31st October 2018. A further announcement will be made accordingly.

This announcement is dated 1 October 2018.

The Company wishes to announce the completion of transfers of six aircraft and 14 aircraft engines during the period from 23 October 2018 to 30 October 2018 pursuant to the Incline B SPA and the FLY SPA. Also as part of the Proposed Disposals, the Company has also completed the Red 4 Sale Share by AACL to Fly Acquisition III Limited on 25 October 2018. For this latest batch of transfers, the gross proceeds received amounted to US$148.89 million.

This announcement is dated 31 October 2018.

There are two more proceeds, USD233.5m and USD148.89m received.

At the exchange rate of 4.08, that amounted to RM1,560.00m.

A RM0.40 dps for 3342m shares outstanding will cost around RM1,336.8m, only.

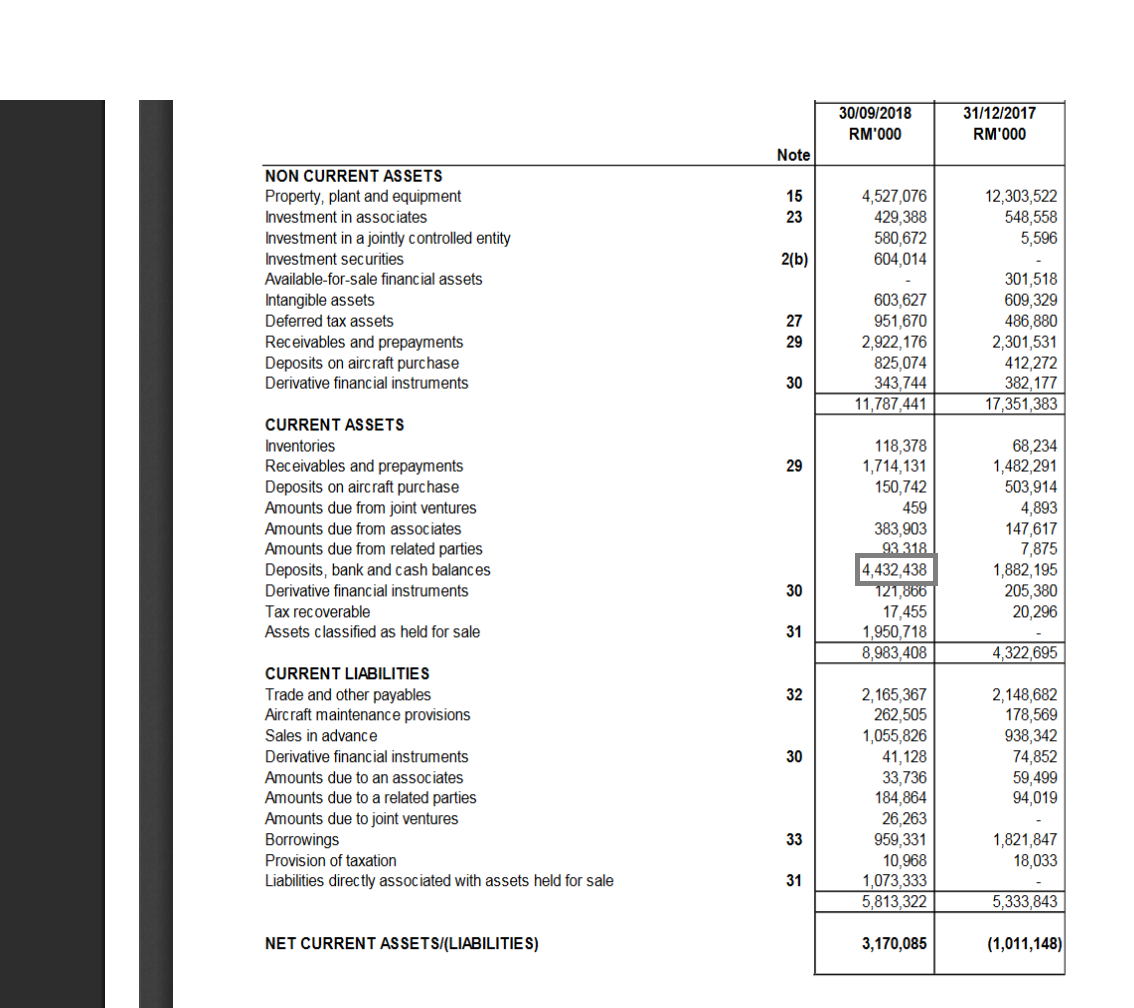

Note that as at 30/9/18, cash on hand is RM4,432m. Last two proceeds from AAC RM1,560m. That's RM6,092m. SIX BILLION CASH!!!!

You really think Airasia will keep all those cash? What will Tony do? What will you do?

This article is describing facts only. BUY or sell, your call.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Mythical

Dear 1HitRampage, cash balances as at 30 September 2018 haven't reflect payout of special dividend on 28 December 2018 and others related expenses.Lets wait for next quarter result.

2019-02-20 12:58