What happened to EVERGRN (KLSE: 5101) Share Price?

pearltt

Publish date: Mon, 21 Feb 2022, 12:13 AM

Let’s all start with the beautiful share price chart of EVERGRN before we even begin the discussion.

Dated 16th February 2022, the share price of EVERGRN had slumped from a high of RM0.595 to a lowest point of RM0.490, representing a 17.6% drop in share price without any kind of material announcement. I wonder why Bursa have not issued them UMA as investors are being trap at the top by the malicious intent of “interested party” in this very much planned sell down.

On this fateful day for EVERGRN, close to 37 million shares exchanged hands, which represents a 4.4% shareholding change, in one single day.

Obviously, this was an act by the so-called operators to dump the shares since their accumulation in October 2021 to February 2022.

Yes, they are laughing to the bank, but this had left countless retail investors trap in the counter.

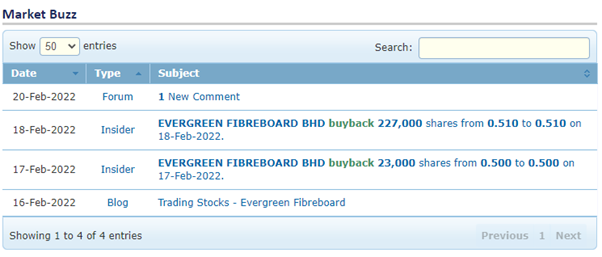

What’s more interesting is the timing of share buyback by the company. After a huge slash in the share price, the company immediately buy back the shares between RM0.500 to RM0.510, which is also the key support level of the company.

Is this a good intent by the company to protect the share price, or is it just a coincidence, or are they preparing for the next wave?

Anyhow, there are surely some dangerous parties left in EVERGRN at the moment. Despite we know that the company is likely to have good results coming – which, in this juncture may not materialize since the sell down could be insider trading to move away from the share before announcement of bad results, we think investors should really consider other companies.

For example, my favourite pick will be HEVEA (KLSE: 5095) which is cheaper by comparison to EVERGRN, and is showing much less steep share movement, hence higher potential upside. My secondary pick will be SERNKOU (KLSE: 7180), which is likely to have very, very good results in the next quarter.

I urge investors to be really careful against EVERGRN moving forward, as the timing of share buyback, slump in share price and quarterly results to be announced is all too good to be just a coincidence.

Remember, protecting your capital is crucial in a highly volatile market like now. As Warren Buffett urged timelessly, the number 1 rule of investing is to not lose money.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|