AWC -STREAM (Malaysia BOLEH Product)

Wonder88

Publish date: Sun, 18 Sep 2016, 08:08 PM

A)Company Background

The company was formerly known as AWC Facility Solutions Berhad and changed its name to AWC Berhad in June 2009 to

better reflect the current activities and future business direction of the company. AWC Berhad was incorporated in 2001 and is

based in UEP Subang Jaya, Malaysia

AWC Berhad, through its subsidiaries, provides

i)Integrated facilities management (IFM)

The company's IFM division provides facility management, managing agent, facility management consultancy, and waste

management services to government, common user buildings, and commercial education and industrial buildings.

ii)Electrical and mechanical engineering

The M&E provides engineering and consultancy services comprising building automation systems; heating, ventilation, and air-

conditioning control; supply and installation works; firefighting services; plumbing and sanitary services; lift systems; and also

industrial motors and transformer maintenance. This division is also involved in the design, installation, and maintenance of

central vacuum systems and central refuse collection systems for residential, commercial, and industrial properties; the

development of microelectronics and software products; and manufacture and distribution of consumer electronics and

security related products, such as digital video recorders systems, security access wide card systems, and smart card systems.

(Quoted fr Isaham)

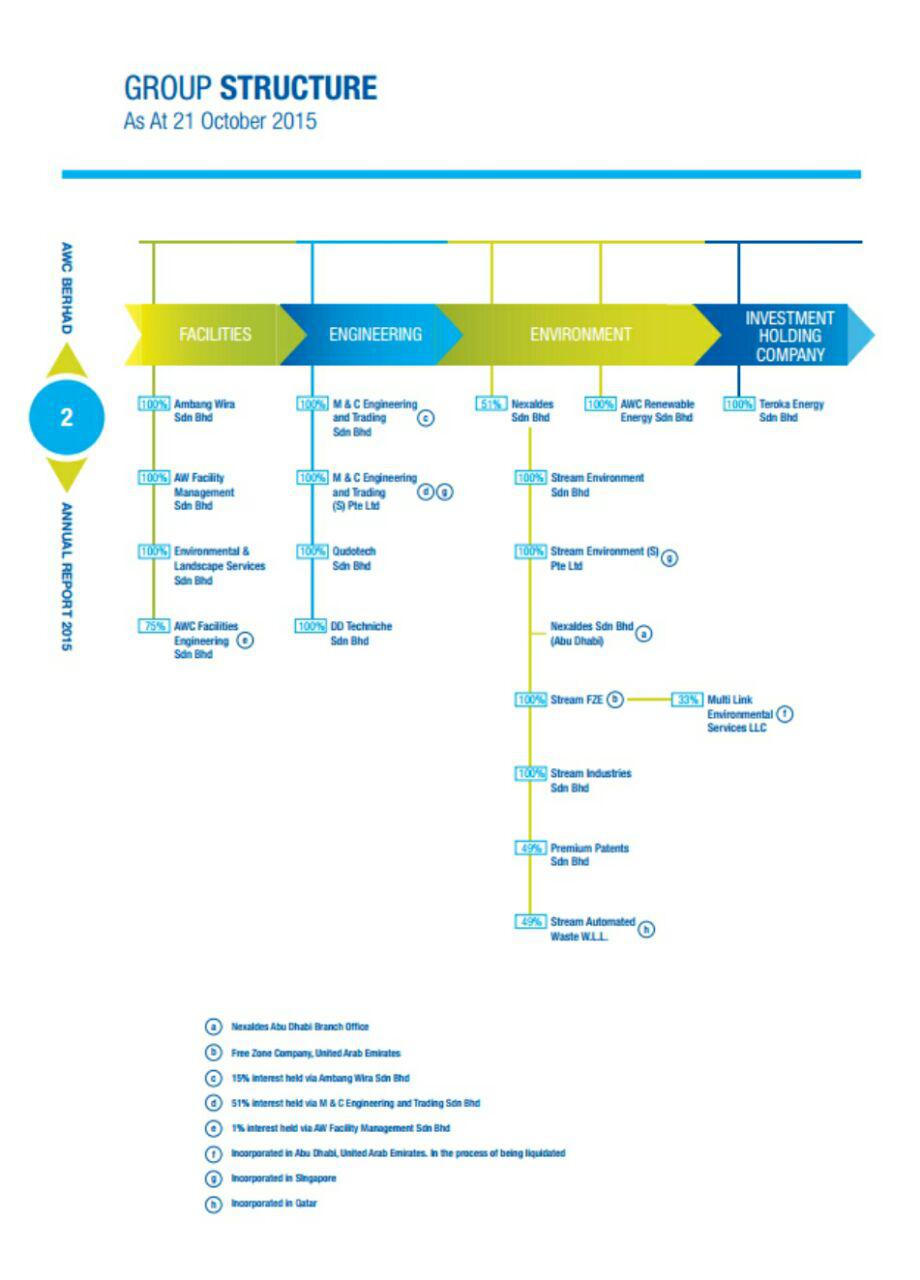

B)Company Structure

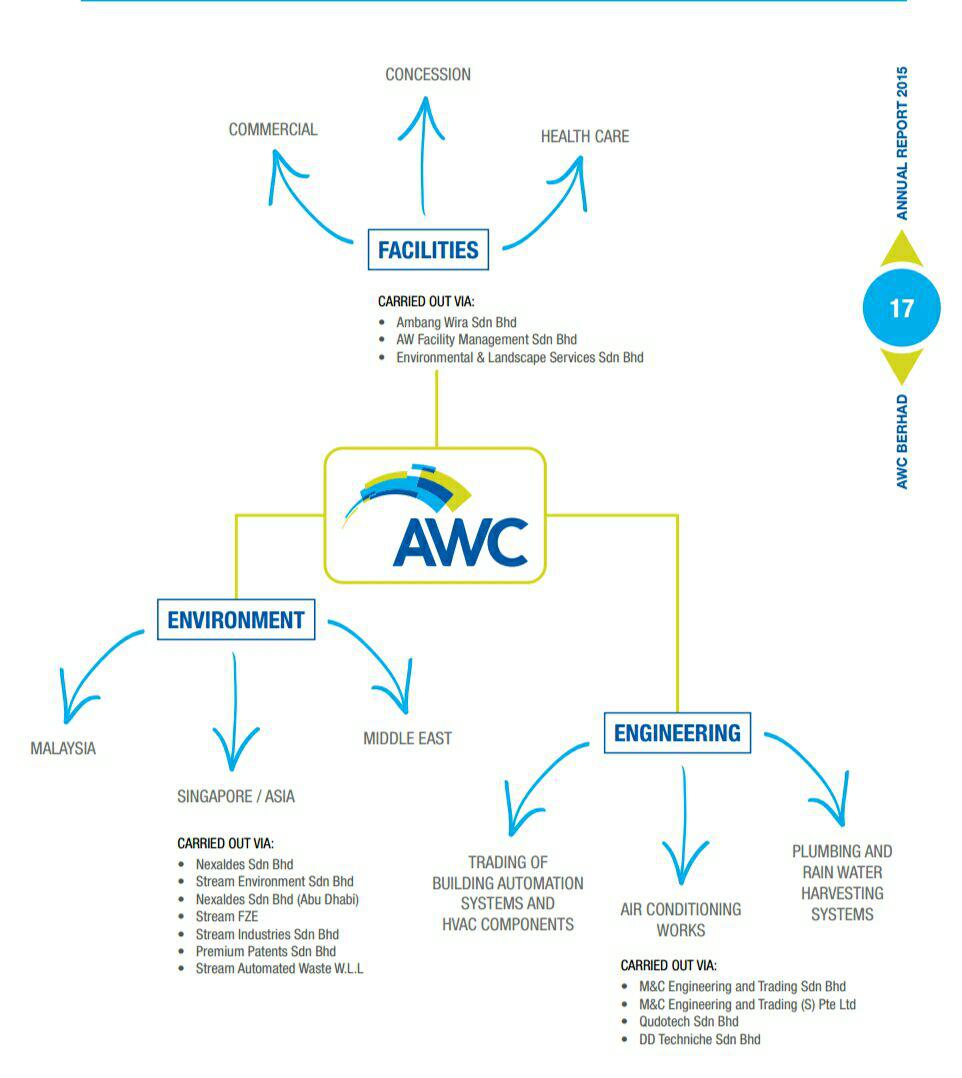

C)Company Activities

i)Facilities Division

Concession from Federal Government to provides IFM services the Southern Region(Comprises state of Johor, Malacca, Negeri

Sembilan) and Sarawak State

ii)Environment Division

Design, supply, Installation, testing and commissioning of Made-in-Malaysia automated pneumatic

waste collection system under the proprietary brand of "STREAM" ("STREAM ACWS) with on-going

projects in the countries such as

a)Malaysia

1)Icon Residences Project for the Mah Sing group in Kuala Lumpur

2)Puteri Habour, Johor by UEMS

3)Tropez project by Tropicana

On-going Project

4)KL Ecocity development by SP Setia Group

5)High end residential condominiums like the Loft in Penang

Item 6 is the latest project News fr The Edge Financial Daily Sept 14. 2016

6)KL118 Tower Project, awarded by Samsung C&T Corp UEMS Construction JV Sdn Bhd

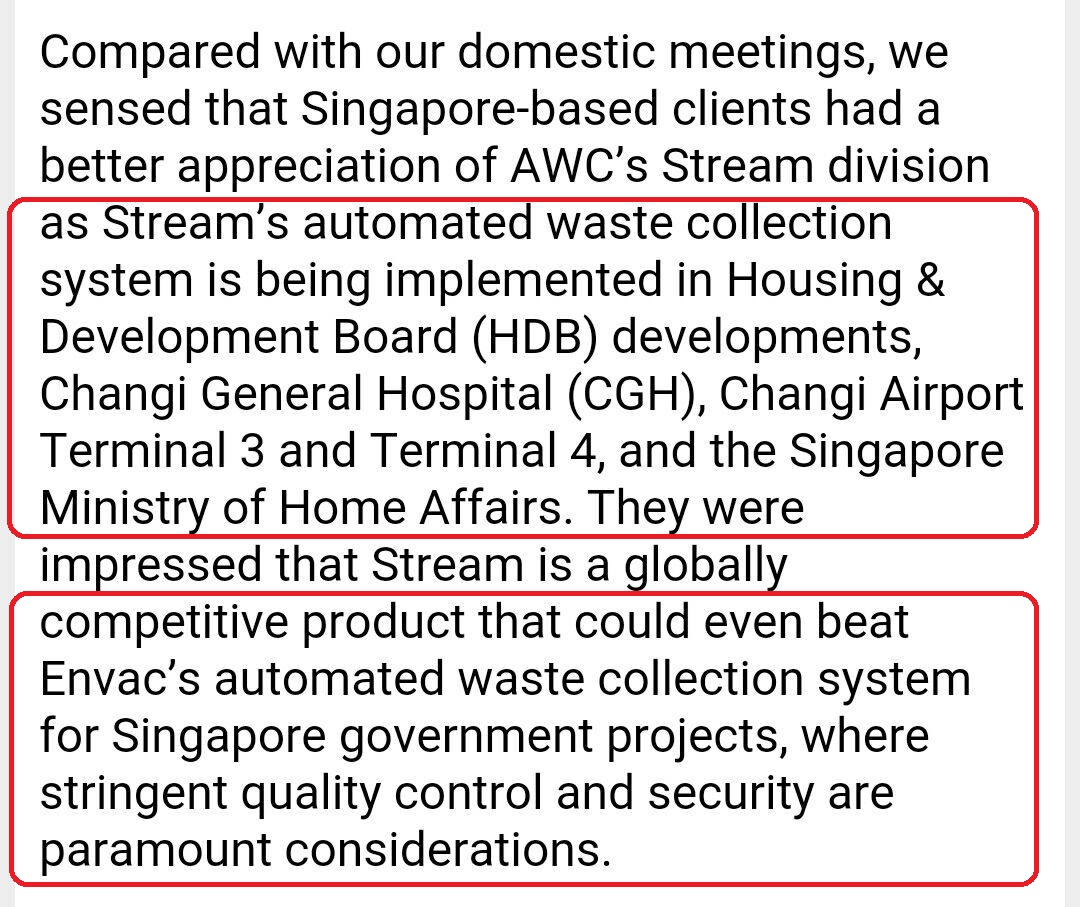

b)Singapore

http://www.envac.com.sg/

Note : Fr The Edge Financial Daily, on June 7, 2016

c)Hong Kong

Cathay Pacific Catering Phase 2

d)Middle East

Al Raha Beach Project for Aldar

Item (e) & (f) is the latest project news fr The Edge Financial daily on Sept 14, 2016

e)Taiwan

In-Flight Catering facility at Taoyuan International Airport, awarded by Evergreen Sky Catering

f)India

STREAM AWCS project Awarded by Shapoorji Pallonji and Co Pte Ltd

iii)Engineering Division

Distributor of several international brand of building controls and engineering components for heating, ventilation & air

conditioning (commonly known by the acronym "HVAC") system and provider of building management system in

i)Malaysia

ii)Singapore

The acquisition of two new companies :

i)Qudotech Sdn Bhd

-is a renowned player in the plumbing industry, having in active in the field since 1995 and also have undertaken several

significant projects since then.

ii)DD Technique Sdn Bhd

-holds two execlusive dealerships for the distribution of Rainwater Harvesting Components and Products ("RHCP") in Malaysia

-undertake the design, supply and installation of RHCP for all new and refurbished buildings.

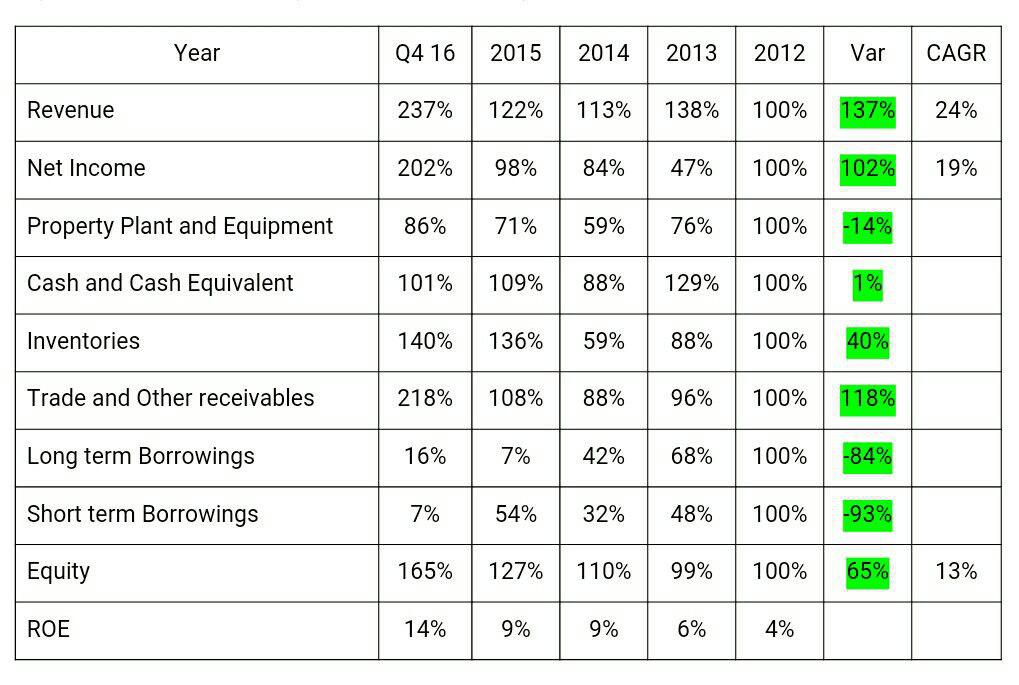

D)Company Performance (from 2002 to Q4 2016)

From the table above, the analysis as below:

a)The Revenue increases 137% and the CAGR is 24%.

b)The Net Income increases 102% and the CAGR is 19%

b)The Cash and Cash equivalent is sustained and maintain at RM50mil

c)The Trade and other receivables increases 118%, however Long and short term borrowing reduce tremendously by

84% and 93% respectively.

d)The Equity increases 65% and CAGR is 13%

The above data shows that the company is in the RIGHT and GOOD direction and the ROE is 14% in Q4 2016 which doube

confirm the Excellent Managment.

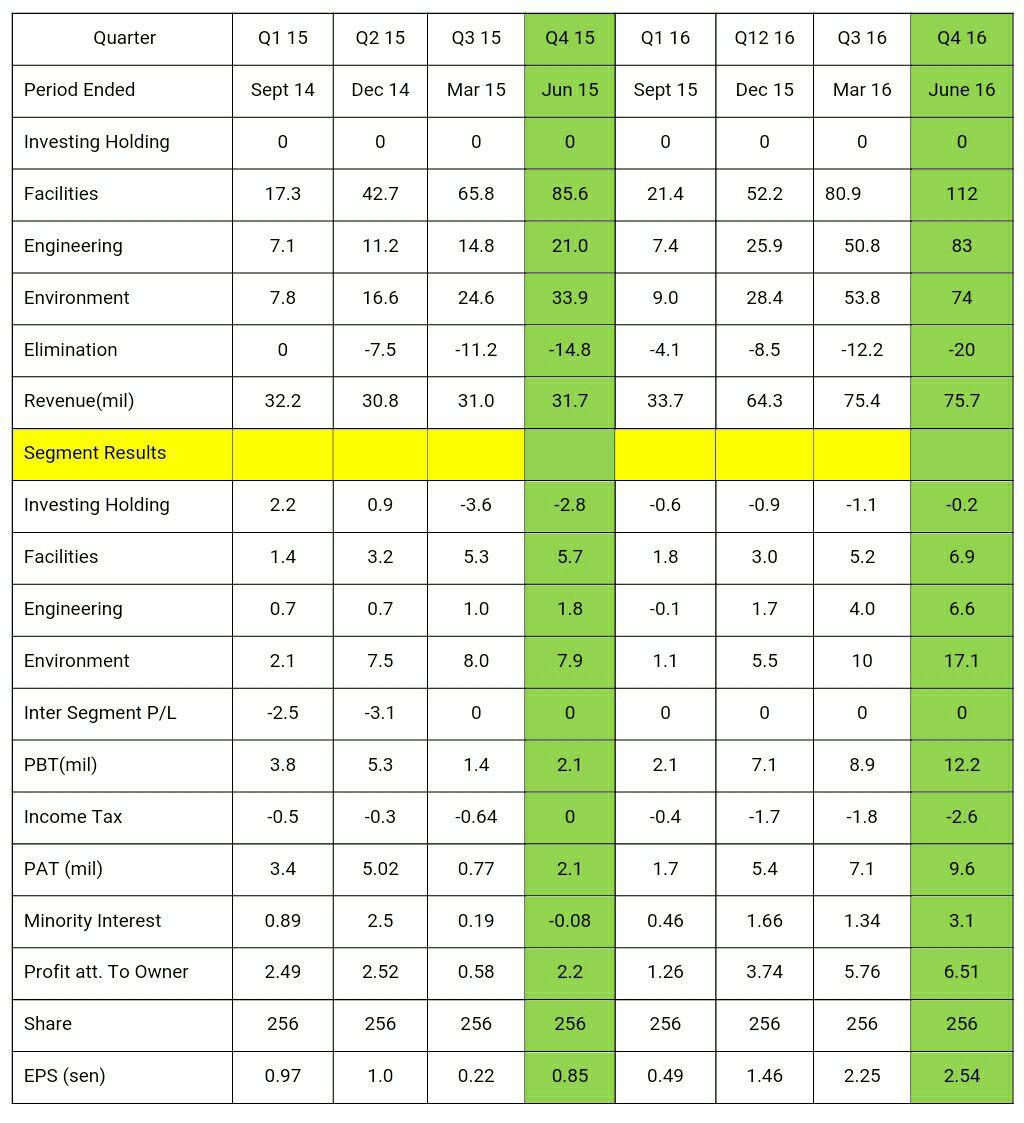

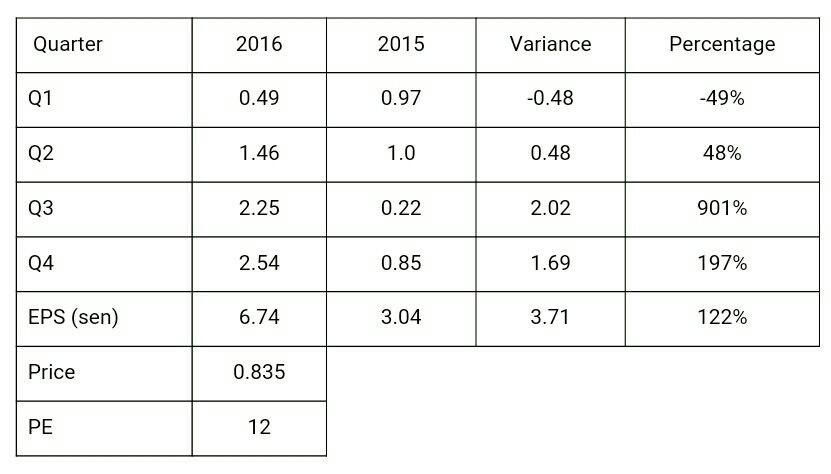

E)Quarterly Performance

From the table above, we can see that the Net profit for Q4 16 vs Q4 15 increases as below:

i)Facilities 20%

ii)Engineering 274% (STREAM Automated Waste Collection System)

iii)Enivronment 116%

Wow, the Engineering data shows that the Design, supply, Installation, testing and commissioning of Made-in-Malaysia

automated pneumatic waste collection system, give GREAT contribution to the Net Profit in Q4 16.

So, What is so BIG deal with the STREAM system, let us have some information here:

Note :

For those interested to know more detail about Our Malaysia Made product, STREAM, please refer to the link as below

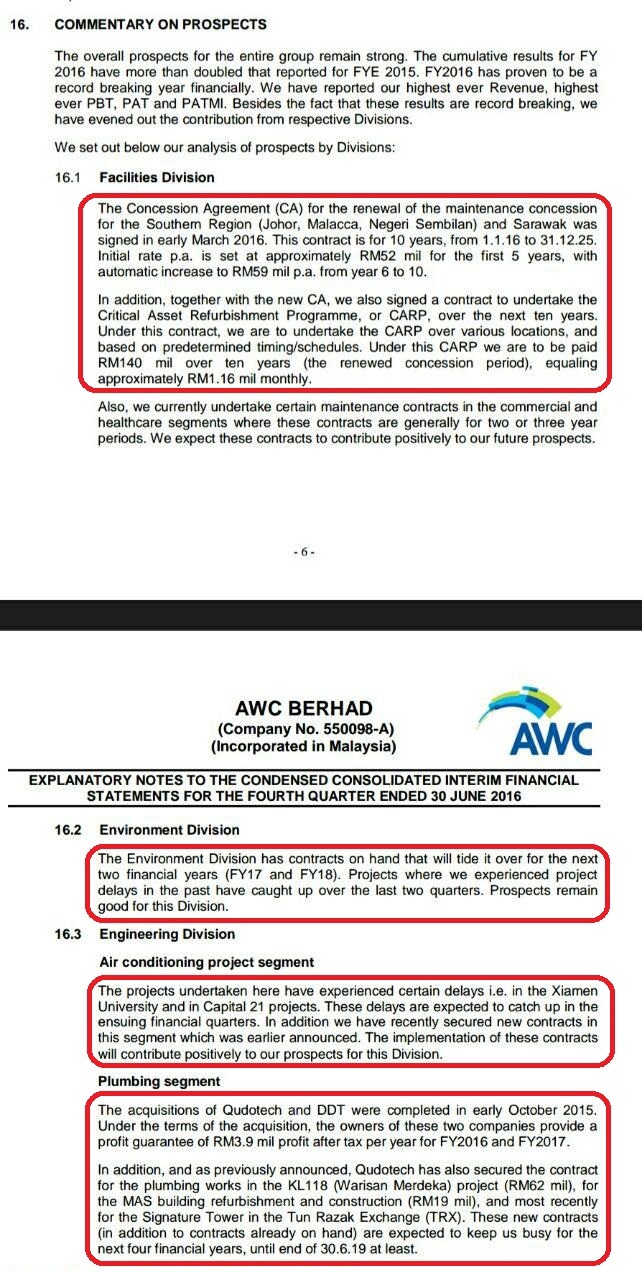

F)Commentary on Prospects

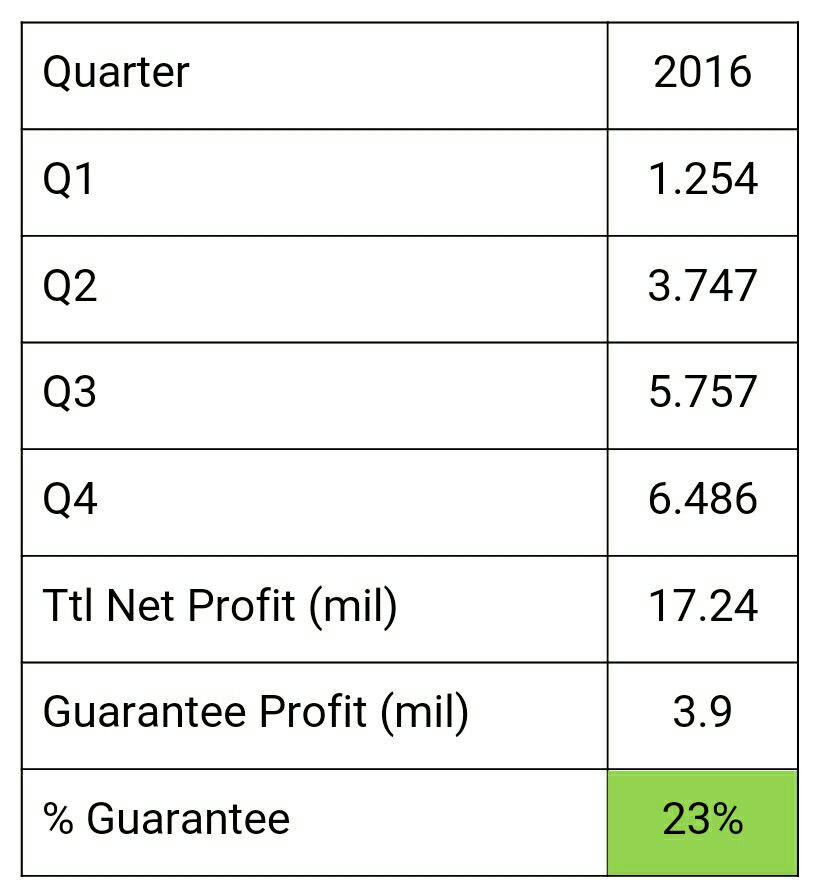

Net Profit Guarantee from Qudotech and DDT for FY2016 & 2017

It is approximately 23% of Financial Yr 2016

Projects quoted in the Prospect

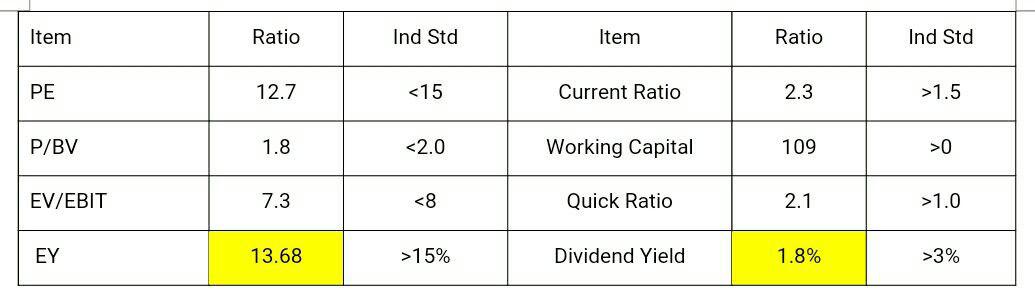

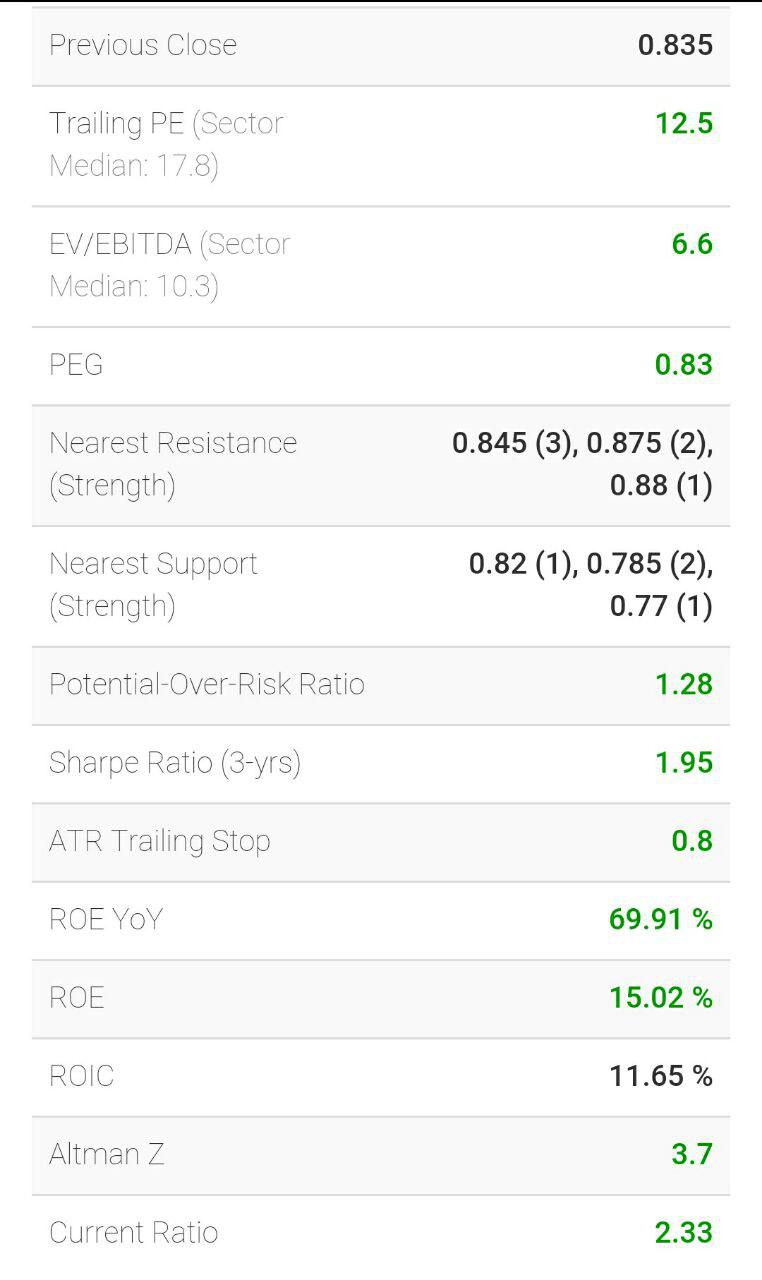

G)Valuation at Price : 0.835 & Target Price for FY16

From Isaham and My calculation , valuation at price, 0.835

1)PE =12.5 < 17.5 sectior Median

2)P/BV = 1.8 < 2.0 Ind Std.

3)EV/EBITDA = 6.6 < 10.3 Sector Median

So, it is fair to invest at current price.

Based on EPS/Quarter=2.54, Assumption made for Total EPS for FY16 is 10.2 sen

Based on PE = 12, the Target price is around RM1.20 which is around 30% upside for FY2016

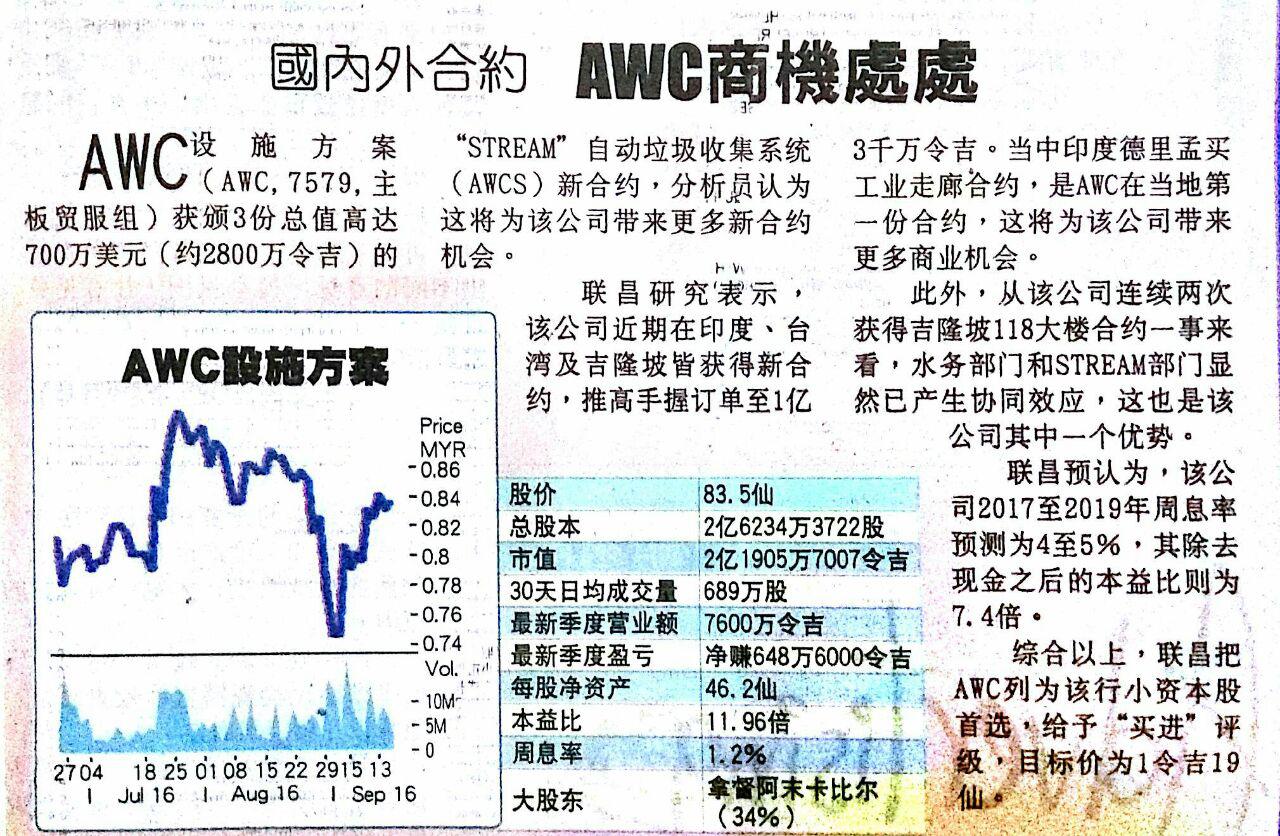

H)Recent Related Articles

1)http://www.thestar.com.my/business/business-news/2016/08/22/awc-poised-to-ride-on-iot-wave/

2)http://www.theedgemarkets.com/my/article/awc%E2%80%99s-outstanding-order-book-estimated-rm500m

3)http://www.theedgemarkets.com/en/node/300265

4)http://www.theedgemarkets.com/en/node/303271

Note :

1)The Business amount in link no 3 is delayed but not affect FY2016 and FY2017 Revenue

2)The Business amount in link no 4 is not very BIG/HUGE, but GOOD NEWS is start to penetrate into Taiwan and India

The reasons why mentioned by Sin Chew Jit Poh, AWC has Business Potential at EVERYWHERE

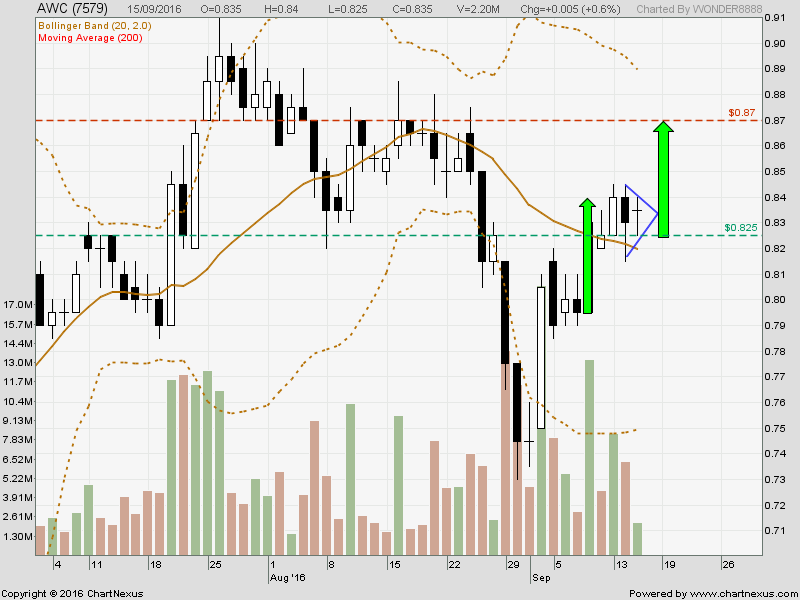

H)Technical Chart

Is it forming Pennant? The price movement will tell you!

Disclaimer

This is not a buy/sell call, hence invest with own risk.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

VenFx

Another Good Defensive counter.

2016-09-18 20:31