Mplus Market Pulse - 25 Oct 2024

MalaccaSecurities

Publish date: Fri, 25 Oct 2024, 09:15 AM

Revisiting Export Stocks Amid Weaker Ringgit

Market Review

Malaysia: Tracking the weaker performance on Wall Street and regional benchmark indices, the FBMKLCI (-0.57%) ended the day on a negative note, dragged down by selected banking heavyweights like CIMB (-5.0 sen). While all sectors were in red, Telco & Media (+0.48%) extended its gains.

Global markets: TSLA (+21.92%) posted a better-than-anticipated set of earnings, buoying the trading activities on S&P500 and Nasdaq. The European market closed higher, while Asian market ended the day on mixed note amid the rising concerns of the US economy.

The Day Ahead

Sentiment on the local front remained negative, mirroring the performance of regional markets, though selected Telco & Media and Healthcare stocks closed significantly higher. In the US, despite good set of economic data like (i) unemployment claims came in below expectations, (ii) both Flash manufacturing and services PMI exceeded forecasts, and (iii) new home sales rose to 738k in September (vs. 709k in August), trading tone was mixed; the Dow retraced another session, but the S&P 500 and Nasdaq rallied, supported by Tesla's post-earnings surge. In the commodities market, Brent crude oil continued to decline despite rising geopolitical tensions in the Middle East. Meanwhile, gold prices rebounded as the USD weakened after lower-than-expected unemployment claims. CPO prices traded above RM4,600, reaching a two-year high before closing at RM4,589.

Sector Focus: Given the weaker ringgit at RM4.345/USD, we believe traders will shift towards export-oriented stocks like Gloves and Technology; certain glove stocks are poised for a breakout. Also, following news of Gamuda securing contracts in Taiwan few days back and reassessing opportunities within Budget 2025, we see potential upside in the Construction, Property, and Renewable Energy sectors. We also favour the Plantation sector as CPO prices have closed above two-year highs.

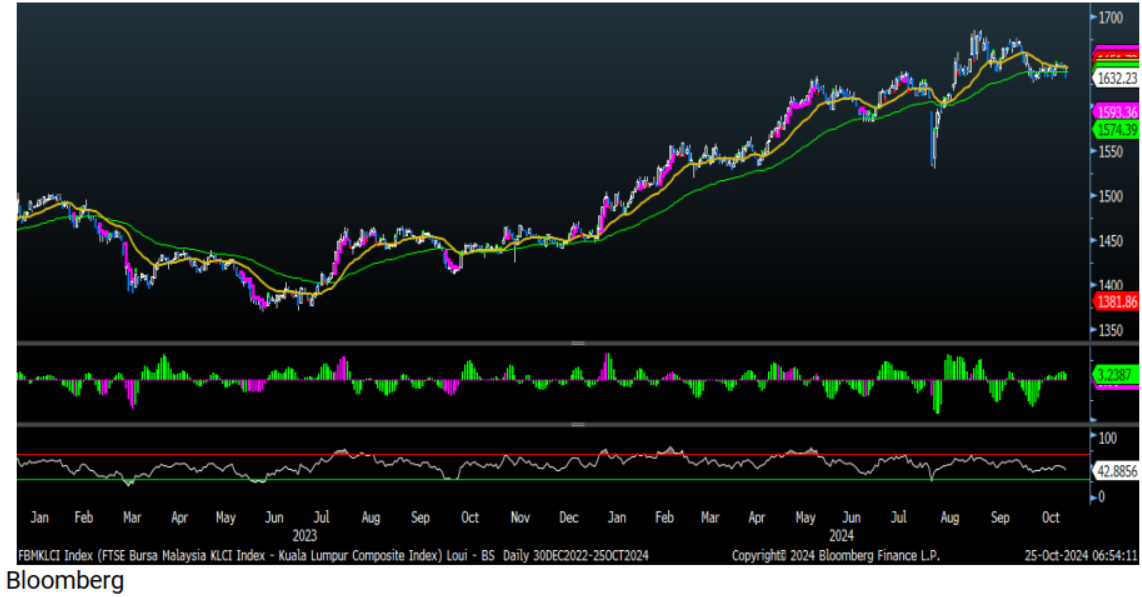

FBMKLCI Technical Outlook

The FBM KLCI index ended lower towards the 1,632 level. The technical readings on the key index were mixed, with the MACD histogram extended another positive histogram, but the RSI has trended below 50. The resistance is envisaged around 1,647-1,652, and the support is set at 1,612-1,617.

Company Brief

Two major shareholders of Rexit Bhd (REXIT) were sentenced to jail in a Singaporean court for participating in a conspiracy to illegally obtain data of over 9,000 people. According to a report by The Straits Times, Datuk Seow Gim Shen and Kong Chien Hoi pleaded guilty to one charge each of conspiring with Chinese national Sun Jiao to have the personal information of 9,369 unknown individuals supplied to them for gambling operations. The Singapore’s publication reported that Sun was allegedly linked to a global syndicate that conducted malicious cyber activities. Both Seow and Kong were each sentenced to 14 weeks’ jail on Thursday. (The Edge)

Plastic material and resin manufacturer Luxchem Corp Bhd’s (LUXCHEM) net profit for the third quarter fell by more than 26%, mainly due to higher administrative expenses. Net profit for the three months ended Sept 30, 2024 (3QFY2024) was RM6.67m, compared with RM9.07m a year ago. However, revenue rose by 18.29% to RM196.09m from RM165.78m, thanks to both the trading and manufacturing segments. No dividend was declared for the quarter. (The Edge)

Technology company ViTrox Corp Bhd (VITROX) saw its net profit for the third quarter ended Sept 30, 2024 (3QFY2024) fall 32.5% to RM22.45m from RM33.25m a year earlier amid a weak US dollar, which led to a notable unfavourable foreign exchange loss. Quarterly revenue saw a marginal 2.2% drop to RM146.7m from RM150m a year earlier, due to slow demand recovery, causing ViTrox to experience temporary soft demand for automated board inspection. No dividend was proposed for the quarter under review. (The Edge)

Pavilion Real Estate Investment Trust (PAVREIT) saw its net property income rise 8.65% to RM131.86m for the third quarter ended Sept 30, 2024 (3QFY2024), from RM121.35m a year ago, due to lower property operating expenses, primarily driven by the reversal of doubtful debts provision. Quarterly revenue grew 4% to RM207.26m from RM199.21m, mainly contributed by higher rental income and income from marketing events and the exhibition centre at Pavilion Bukit Jalil. The distribution per unit increased to 2.38 sen per unit, from 2.15 sen per unit in the corresponding period last year. This raised total DPU for the nine months ended Sept 30, 2024 to 6.91 sen, compared with 6.56 sen previously. (The Edge)

CapitaLand Malaysia Trust (CLMT) posted a 6.3% increase in its third quarter net property income (NPI) from last year’s corresponding period, underpinned by better NPI from Gurney Plaza, Queensbay Mall, East Coast Mall and Valdor Logistics Hub. CLMT's NPI for the third quarter ended Sept 30, 2024 (3QFY2024) increased to RM61.99m from RM58.32m in 3QFY2023, while gross revenue grew 5.4% to RM109.24m from RM103.64m. Gross revenue was higher due to positive rental reversions and higher occupancies. The real estate investment trust (REIT) announced a distribution of 1.07 sen per unit, up from 1.05 from last year, raising its DPU for the first nine months of FY2024 (9MFY2024) ended Sept 30 to 3.43 sen, compared with 2.98 sen in 9MFY2023. (The Edge)

DXN Holdings Bhd (DXN) reported a 13.2% drop in net profit for the second quarter ended Aug 31, 2024 (2QFY2025) to RM65.97m, from RM76.01m a year ago, hurt by foreign exchange losses, as well as higher employee benefit costs and shipping costs. For the quarter under review, the health and wellness direct selling company, which was listed in May 2023, posted a record high in quarterly revenue of RM488.43m. This marked a 6.6% increase, compared with RM458.31m in revenue reported last year. The revenue growth was driven by sales increases in Peru and Bolivia, as direct sales members pulled forward purchases ahead of a scheduled price hike. The company declared a dividend per share of 0.8 sen for 2QFY2025, lower than the 0.9 sen announced a year ago, payable on Nov 29. (The Edge)

Nestlé (Malaysia) Bhd's (NESTLE) net profit fell 36.12% to RM85.41m for the third quarter ended Sept 30, 2024 (3QFY2024), from RM133.7m a year earlier, due to lower revenue caused by a drop in domestic sales. This is the second straight quarter that the group's net profit has dropped below the RM100m-mark, after reporting a 48.27% year-on-year drop to RM93.6m for 2QFY2024. In the first quarter, net profit was down by a marginal 0.8% at RM195.51m. Domestic sales were impacted by consumer hesitancy amid cautious spending and affordability concerns, the consumer goods group said. Quarterly revenue dropped 18.4% year-on-year to RM1.45bn from RM1.77bn. Nestle declared a second interim dividend of 35 sen per share, half the 70 sen dividend paid a year earlier. The dividend will be paid on Dec 12, and brings the year-to-date payout to RM1.05 sen per share, compared with RM1.40 previously. (The Edge)

Plastic material and resin manufacturer Luxchem Corp Bhd’s (LUXCHEM) net profit for the third quarter fell by more than 26%, mainly due to higher administrative expenses. Net profit for the three months ended Sept 30, 2024 (3QFY2024) was RM6.67m, compared with RM9.07m a year ago. However, revenue rose by 18.29% to RM196.09m from RM165.78m, thanks to both the trading and manufacturing segments. No dividend was declared for the quarter. (The Edge)

Engineering services provider AWC Bhd (AWC), via its wholly-owned subsidiary Ambang Wira Facilities Sdn Bhd, has bagged a RM9.4m contract from the Melaka Public Works Department to provide facilities management and maintenance service for the immigration, custom, quarantine and security complex in Sungai Melaka. The contract is for 60 months, commencing from Nov 1, 2024 to Oct 31, 2029. (The Edge)

Construction outfit SC Estate Builder Bhd (SCBUILD) said the termination of a contract worth RM4.3m to build affordable houses with solar power on the roofs by Merchant Esteem Sdn Bhd (MESB) was due to a decision by MESB's new management, which has acknowledged that ongoing uncertainties in the commercial property market and low demand would impact the construction and sales of shophouses. "The percentage of completion of the contract to date is 20%. There is no payment due to SC Estate Builder by MESB," it said. The mutual termination of the contract is not expected to have a material impact on SC Estate Builder's earnings and net assets for the financial year ending July 31, 2025. (The Edge)

Source: Mplus Research - 25 Oct 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2025-01-21

DXN2025-01-21

NESTLE2025-01-20

NESTLE2025-01-20

PAVREIT2025-01-20

PAVREIT2025-01-19

SCBUILD2025-01-17

CLMT2025-01-17

NESTLE2025-01-17

NESTLE2025-01-17

PAVREIT2025-01-17

PAVREIT2025-01-17

SCBUILD2025-01-17

SCBUILD2025-01-16

CLMT2025-01-16

PAVREIT2025-01-16

REXIT2025-01-16

REXIT2025-01-16

REXIT2025-01-16

SCBUILD2025-01-16

SCBUILD2025-01-16

SCBUILD2025-01-16

SCBUILD2025-01-16

SCBUILD2025-01-15

CLMT2025-01-15

CLMT2025-01-15

LUXCHEM2025-01-15

LUXCHEM2025-01-15

LUXCHEM2025-01-15

LUXCHEM2025-01-15

SCBUILD2025-01-14

VITROX2025-01-13

DXN2025-01-13

DXN2025-01-13

DXN2025-01-13

DXN2025-01-13

DXN2025-01-13

DXN2025-01-13

LUXCHEM2025-01-13

LUXCHEM2025-01-13

LUXCHEM2025-01-13

LUXCHEM2025-01-13

NESTLE2025-01-13

PAVREIT2025-01-13

PAVREIT2025-01-10

AWC2025-01-10

AWC2025-01-10

AWC2025-01-10

AWC2025-01-10

AWC2025-01-10

PAVREIT2025-01-10

REXITMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Jan 08, 2025