AirAsia AGM 2017 - What I learned from 2017 AirAsia AGM

kelvin_ik4u

Publish date: Thu, 21 Jun 2018, 10:20 AM

What I learn from Airasia AGM 2017 - Key Highlights

---------------------------------------------------------------------------

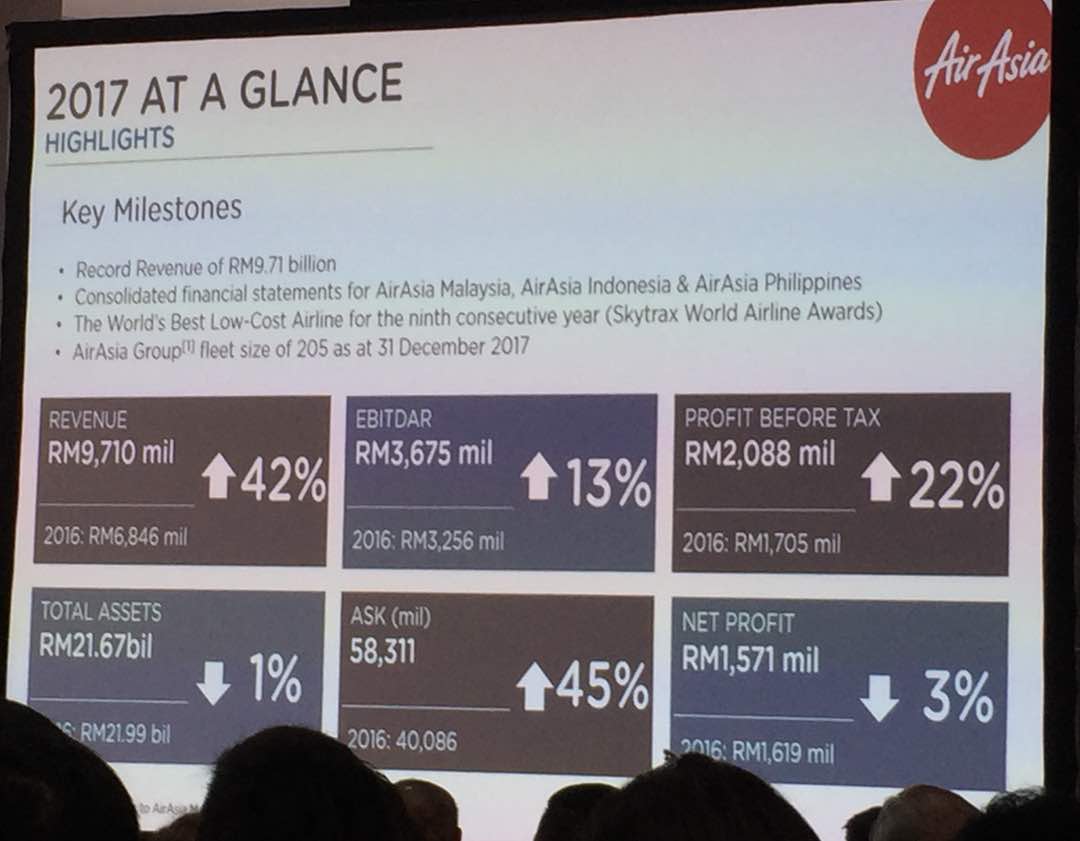

2017 at Glance - Key Milestones:

-----------------------------------------------

1) Revenue: Up 42%; RM9,710mil (2017) vs RM6,846mil (2016)

2) EBITAR: Up 13%; RM3,675mil (2017) vs RM3,256mil (2016)

3) PBT: Up 22%; RM2,088mil (2017) vs RM1,705mil (2016)

4) Total Asset: Down 1%; RM21.67bil (2017) vs RM21.99 (2016)

5) ASK (mil): Up 45%; 58,311 (2017) vs 40,086 (2016)

6) Net Profit: Down 3%; RM1,571mil (2017) vs RM1,619mil (2016)

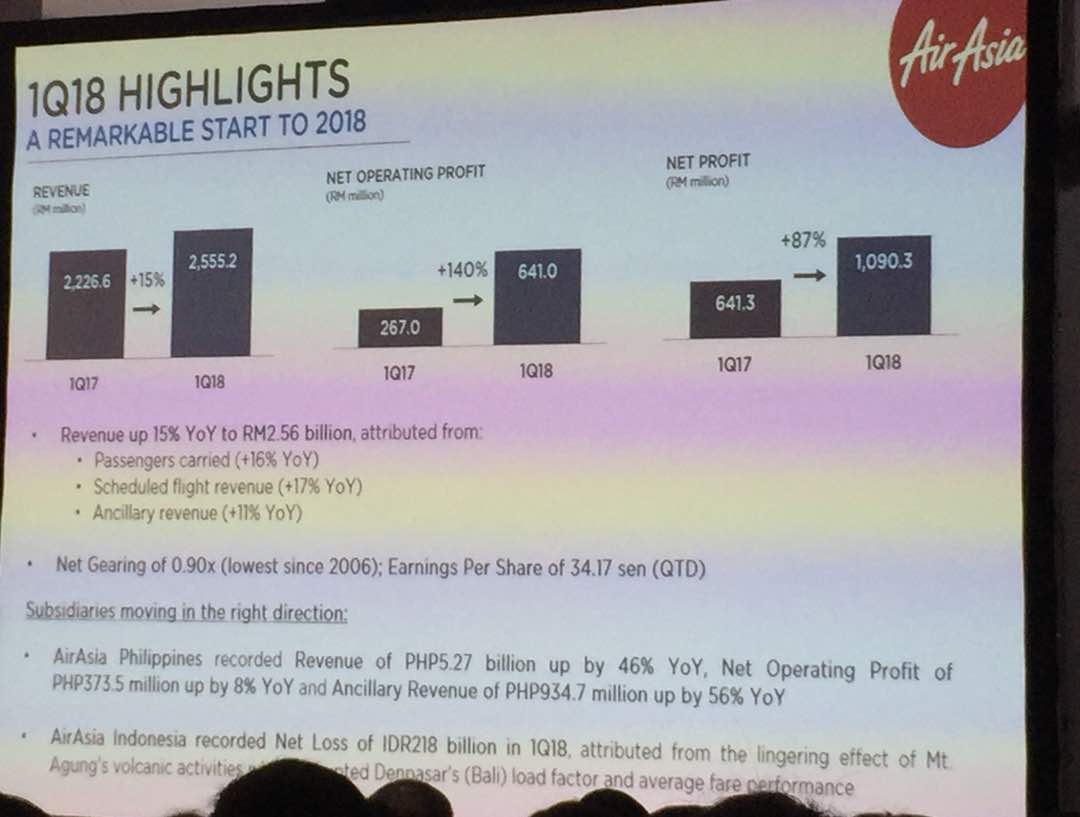

1Q18 Key Highlight:

--------------------------------

1) Revenue up 15% YoY to RM2.56bil, attributed by

a) Passenger carried (+16% YoY),

b) Scheduled flight revenue (+17% YoY)

c) Ancillary revenue (+11% YoY)

2) Net gearing 0.9x (lowest since 2006), Earning per share 34.17sen (QTD)

3) Subsidaries move in right direction:

a) Airasia Philipine: Recorded revenue Up 47% to PHP5.27bil YoY, Net Operating Profit PHP373.5mil up 8% YoY, Ancillary revenue Up 56% to PHP934.7mil YoY.

b) Airasia Indonesia: Net loss IDR218bil due to effect Mt Agung volcanic activities affect load factor & average fare performance (natural disaster)

4) Developing Platforms - Moving into Amazon alike digitalization business

a) Airasia.com

- Ticketing & Booking

- Merchandise

- Online Retail Portal & Duty Free

- Ancillary

- Santan

- RedTix

b) Travel360

- Vidi - TripAdvisor/Traveloka

- Travel & Lifestyle Content Platform

- e-Magazine

- Travel Portal

- Ticketing

- Holiday Series

c) BIG Loyalty

- Co-branding with ASEAN banks

- Collecting loyalty point from credit card spend

- BIG Points redemption:

--- flight tickets, ancillary, inflight & online purchase

- BIG Coin (ICO)

- BIG Pay (e-commerce marketplace purchase)

FY2018 & Beyond:

----------------------------------

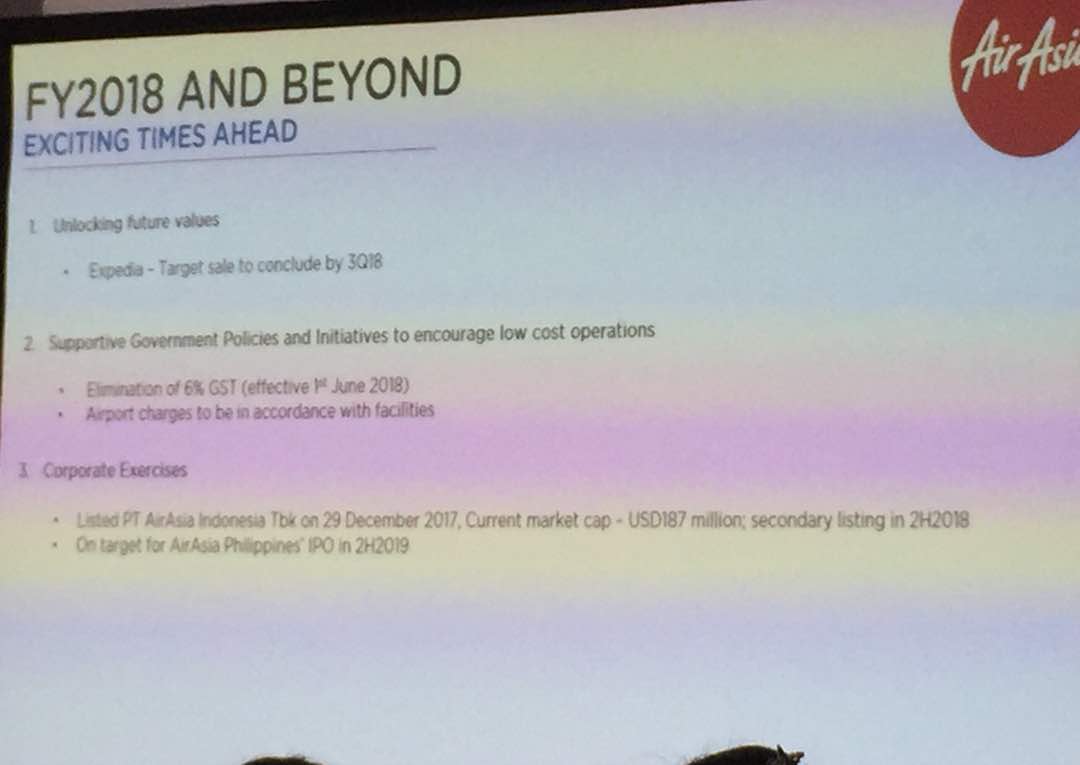

1) Unlocking future value:

a) Sale of leasing arm, AAC, finally sealed and signed

AirAsia sell 100% of AAC for an equity valuation of US$1,185m; big dividend payout will announce soon.

Analyst projection :

Expected US$183.2m will be paid directly by BBAM to Airbus on four new A320neo deliveries, while US$901.8m (RM3.5bn) will be received by AirAsia. RM788m will be set aside to prepay borrowings, RM112m to pay expenses.

RM2.6bn as remaining proceeds which is intended to be largely paid out as dividends. Convert to average of 75 to 80 sen/share declared as special dividends, assumed that 75 sen/share will be paid.

b) Expedia - Target sale to conclude by 3Q18

2) Supportive Government Policies and Initative

a) Elimination of 6% GST

b) Airport charge to be in accordance with facilities

3) Corporate Exercise

a) Listed PT Airasia Indonesia on 29th Dec 2017, current market cap USD187mil, 2nd listing in 2H2018

b) On target for Airasia Philipines IPO 2H2019

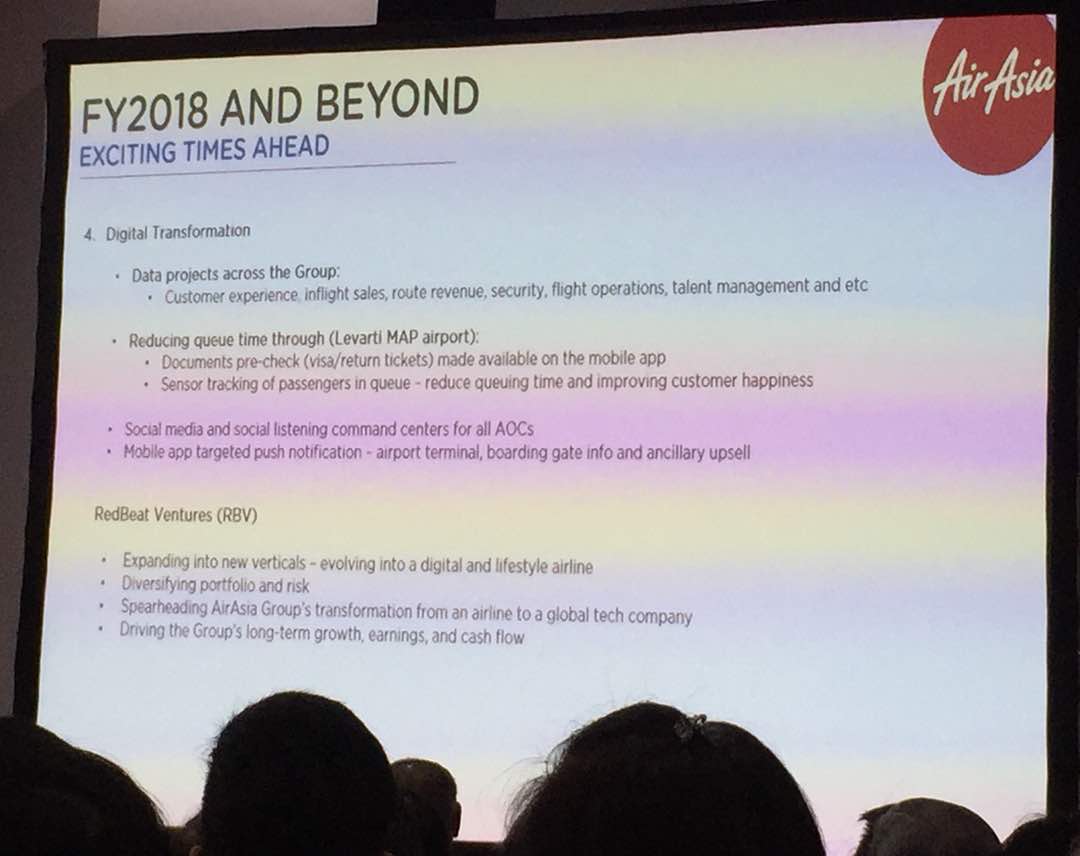

4) Digital Transformation, RedBeat Ventures (RBV)

- Expanding into new verticals - evolving into digital & lifestyle airline

- Diversifying portfolio & risk

- Spearheading Airasia Group transformation from an airline to a global tech company

- Driving Group's long term growth, earning & cash flow

Happy Investing!

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|