Airasia - Oppurtunity to Accumulate before it really Fly

kelvin_ik4u

Publish date: Mon, 03 Sep 2018, 01:55 PM

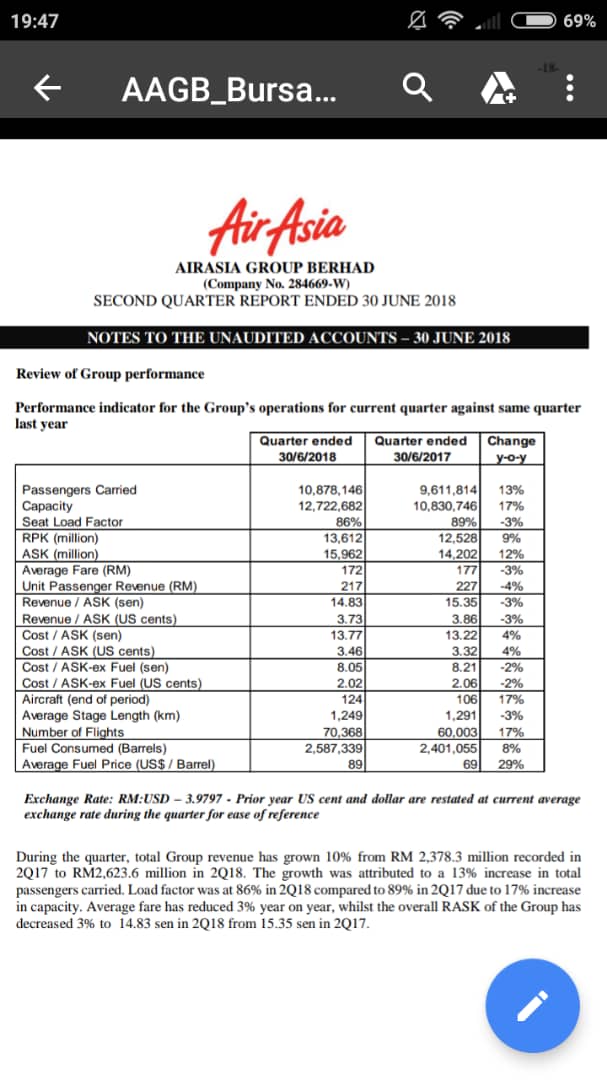

Quick Analysis on AirAsia:

Share Price Analysis:

Assessing the Market Outlook by Analyst:

The research firm said AirAsia's stock has been oversold, and presents a good buying opportunity when oil prices and the Ringgit Malaysia stabilize — even though it has limited fuel hedging and most of its overseas joint venture carriers were loss-making

Risk associated to Airasia that affect its earning results:

1) Higher fuel jet price

2) Local Currency fluctuation

3) Geo-political market sentiment - US China trade war

Latest Bursa announcement on AAC sell off- dated 3rd Sept 2018:

The Company wishes to announce the completion of the transfer of an additional number of aircraft pursuant to the Incline B SPA and the FLY SPA on 30 August 2018. The total number of aircraft involved under the abovementioned transfer is 15 aircraft and AAGB has received USD201.5 million in gross proceeds in the form of USD151.5 million as cash consideration and 3,333,333 FLY Equity issued at USD15.00 per FLY Depository Share to AAGB in accordance with the FLY Subscription Agreement.

To date, the cumulative number of aircraft transferred is 54 aircraft and AAGB has already received gross proceeds totalling USD703.1 million.

AAGB is still on track to complete the disposal of the remaining 30 aircraft and 14 aircraft engines under the Incline B SPA and FLY SPA as planned.

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5903361

Happy Invest!

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Discussions

Analyst prediction from CIMB, not from AAGB...

" Separately, AAGB recently completed the sale of the residual 25% stake in AAE Travel to Expedia on 14 Aug 2018 for US$60m, or 7 sen/share, which we expect will be paid out as special dividends before end-2018F"

"The sale of 84 planes to BBAM is partly complete, with 39 aircraft transferred up to 8 Aug 2018, and another 45 transfers to be completed by Nov 2018F, in AAGB’s estimate. We estimate that special dividends of up to 75 sen may be declared. According to AAGB’s verbal guidance during the results conference call, the special dividends related to the BBAM transaction may be declared during the release of the 3Q18F results in late-Nov, and be paid in 4Q18F or 1Q19F"

2018-09-03 15:32

sean_limkh

Thanks for the analysis!

2018-09-03 14:05