Stock on The Move - Y.S.P. Southeast Asia Holding

AmInvest

Publish date: Wed, 16 Nov 2022, 08:57 AM

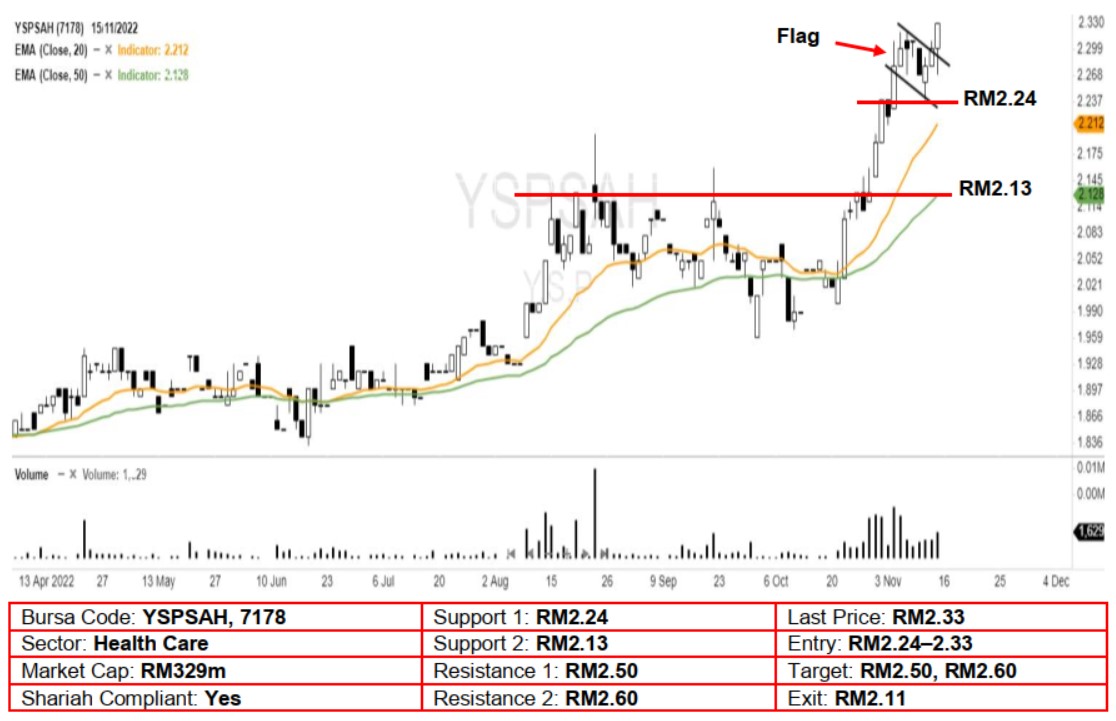

Technical Analysis. Y.S.P. Southeast Asia Holding broke out from a 1-week bullish flag pattern yesterday, implying that its previous uptrend may have resumed. The stock also posted 3 white candles in a row and hit a new 52-week high, likely suggesting that upward momentum is picking up further. A bullish bias may emerge above the RM2.24 level, with a stop-loss set at RM2.11, below the 50- day EMA. Towards the upside, the near-term resistance level is seen at RM2.50, followed by RM2.60.

Company Background. Y.S.P. Southeast Asia Holding (YSPSAH) is a healthcare company involved mainly in the trading and manufacturing of pharmaceutical products. Its product ranges from a wide array of pharmaceutical, over-the-counter (OTC), and veterinary and aquatic products. The group currently has a presence in many countries in ASEAN, Middle East, Africa, Australia and New Zealand, and is still expanding its markets.

Prospects. (i) Growing its product portfolio to achieve continuous market expansion (As at FY21, the group has a total of 478 product licences in Malaysia, including 383 pharmaceutical products and 95 veterinary products). (ii) Invested in various facility enhancements including new production equipment and systems to improve operational efficiency. (iii) Launched eGreenBeans online shopping platform in 2019 - mainly to bring the group’s products to the online market and reach out to a wider population.

Financial Performance. In 1HFY22, the group recorded total revenue of RM158.6m (+16.2% YoY) with a PAT of RM17.9m (+2.4x YoY). This was attributed to an increase in demand from local and overseas market, improvement in productivity, the resumption of economic activities and high demand for pharmaceutical products from post-Covid-19 pandemic.

Source: AmInvest Research - 16 Nov 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on AmInvest Research Reports

Created by AmInvest | Jul 26, 2024

Created by AmInvest | Jul 26, 2024

Created by AmInvest | Jul 26, 2024