Stock on Radar - Homeritz Corporation

AmInvest

Publish date: Thu, 02 May 2024, 10:34 AM

Company Background. Homeritz Corporation (Homeritz) is a leading manufacturer of upholstered home furniture in Malaysia. The group operates primarily as an integrated original design manufacturer (ODM) and original equipment manufacturer (OEM), producing a complete range of upholstered home furniture products. Its main activities include the design, manufacturing and sale of upholstered home furniture, with its customers mainly consisting of overseas wholesalers and retailers. Currently, the group exports its products to more than 40 countries worldwide, spanning Europe, Australasia, North & South America, Asia and Africa.

Prospects. (i) Strengthen research & development to innovate and improve existing designs while developing new, innovative products, (ii) Invest in upgrading equipment and machinery to enhance efficiency, productivity and product quality, (iii) Diligently seek and test new raw materials to facilitate the production of high-quality products at competitive costs, (iv) Continuously diversify and introduce new products to meet evolving client needs and expand market reach, (v) Adopt aggressive marketing strategies and collaborate closely with clients to secure larger market segments, and (vi) Enhance production efficiency to increase competitiveness in pricing and effectively meet market demand.

Financial Performance. In 1HFY24, Homeritz posted higher revenue of RM111.3mil (+41.4% YoY) with a PAT of RM18.3mil (+54% YoY). This was mainly attributed to the increase in volume sold, greater economies of scale, quicker time-to-market, effective cost management and favorable foreign currency exchange.

Valuation. Homeritz is trading at an attractive FY24F P/E of 8.7x, versus Bursa Consumer Index’s 5-year forward average of 17.7x. As a comparison, Spring Art Holdings and Wegmans Holdings, both also involved in the furniture sector, trade at much higher trailing P/Es of 17.8x and 15x respectively.

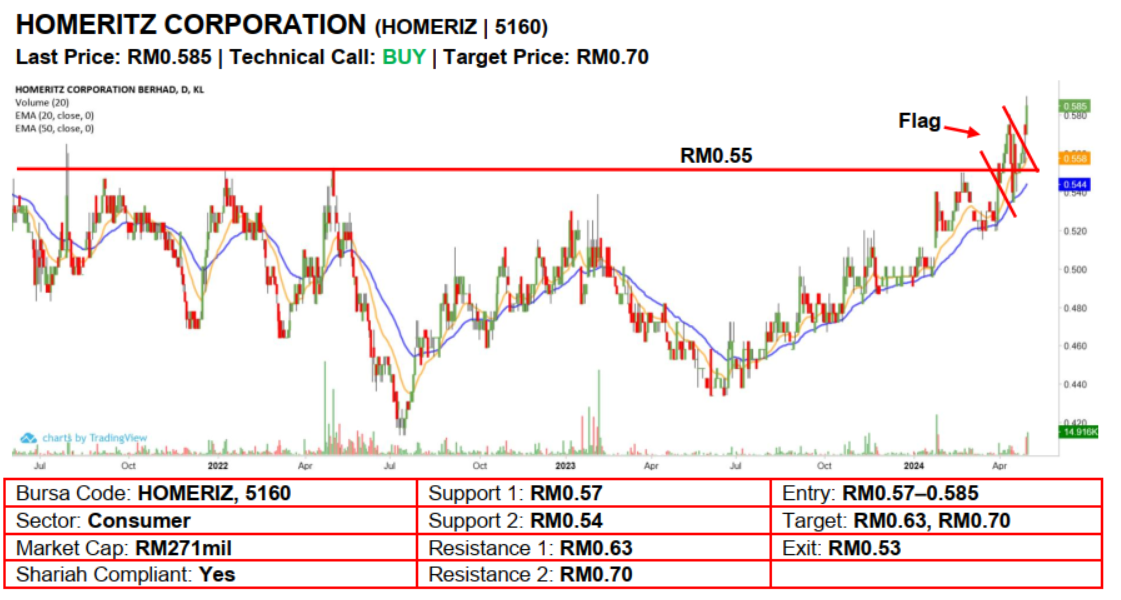

Technical Analysis. We expect further upside for Homeritz after it surged to a new 3-year high with a long white candle on Tuesday. The stock’s move above the RM0.55 resistance coupled with rising EMAs indicate that the near term upward momentum may persist. A bullish bias may emerge above the RM0.57 level with stop-loss set at RM0.53, below the 50-day EMA. Towards the upside, nearterm resistance level is seen at RM0.63, followed by RM0.70.

Source: AmInvest Research - 2 May 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on AmInvest Research Reports

Created by AmInvest | Jan 22, 2025

Created by AmInvest | Jan 22, 2025

Created by AmInvest | Jan 22, 2025