AK's Long Term View to Investing Rationale....

Value Investor Coo1eo

Publish date: Fri, 09 Mar 2018, 05:46 PM

Greetings Fellow Investors / Readers,

I want to continue from where I stopped in my last blog. Previously I tried explain the difference between "investing" and "speculating"

In this post, I want to discuss "Long Term" - what I believe is a long term view in Investing.

I believe that the ONLY way be successful as an "investor" is to have a long term view to the business (companies) that you are investing in.

Let's start by first defining "Long Term" - People always ask : How long is long term in the stock market?

1 year? 3 years? 5 years? 10 or even 20 years?

According to Investopedia, an investment (for a company) qualfies as "long term" if the company it intends to hold for more than a year. This investment resides in the asset side of a company's balance sheet and is classified as "investments" which may includ stocks, bonds, real estate and even cold hard cash.

That for a company, but what for an individual retail investor like you and me in the stock market? When we buy a share for "long term" how long should we hold on to the share?

There is no correct answer to me. However having a long term view to me is to look beyond the day to day, month to month, quarter to quarter fluctuations in the price and FOCUS on the business.

Long term view is to understand the performance of the company for past 5-10 years and ask yourself if that company will still be in business 10-20 years from now? and if you answer is "yes" then as yourself why do you beleive it is the case.

Recently, I was talking about investing and the share market to a distant relative who is a dentist.

This dentist "Uncle J" has a well established dental practice and is very successful financially (rich la!). Over the years he also acquired many properties in prime locations which has appreciated very well. (well invested)

He in his now in his 60s and semi retired. Empty nester - 2 kids are overseas working and also doing well.

"Uncle J" tells me he is no longer in the market, or rather he does not "play shares" anymore. Back in the 1990s he was trading in the market and like many people he also got burnt and lost a lot of money. He sweared that one cannot make money in the market and it is better to invest in property. He say that he will pass down his properties to his children children. Whereas shares is not a viable investment for long term.

I tried to explain to "Uncle J" that if he invest and not "play" shares the market can be a good place to also invest and build sustainanble long term income, which can pass down to his children. He told me,what is say is true for US markets, but not in Bursa.

I asked him if he has heard of "Maybank" - he said "of course",

In fact, Maybank he told me is his primary bank where he manages all his money from his personal and clinic account, including clinic and staff payroll etc"

I then asked him " Uncle J, do you think that in the future, say 20-30 years from now you can imagine that you children and maybe even your grandchildren will also be banking in Maybank?"

He said "it is liklely"

So I answered to him " There you go, Maybank is then a company that you can consider investing in, with a long term view. It is the biggest bank in Malaysia, 4th biggest in ASEAN and the company with the largest market cap on bursa today. Also pay a decent dividend. Not only Maybank, there are many such companies like this listed on Bursa..."

Uncle J went silent....and then slowly nodded to confirm that he understood my point.

Coming back to my "long term" investing style -

Whenever I analyse financials of a company, or appraise my shre investments, I always look at the annual figures. I also calculate my returns per annum. It is a better reflection of the business then to compare quarter on quarter.

So, the plan is to buy and hold for AT LEAST 1 year. Anything less, and you will allow the sentiments, and all the other "noises" and the crazy "Mr Market" mess with you mind and you and you will make decisions that you will regret later.

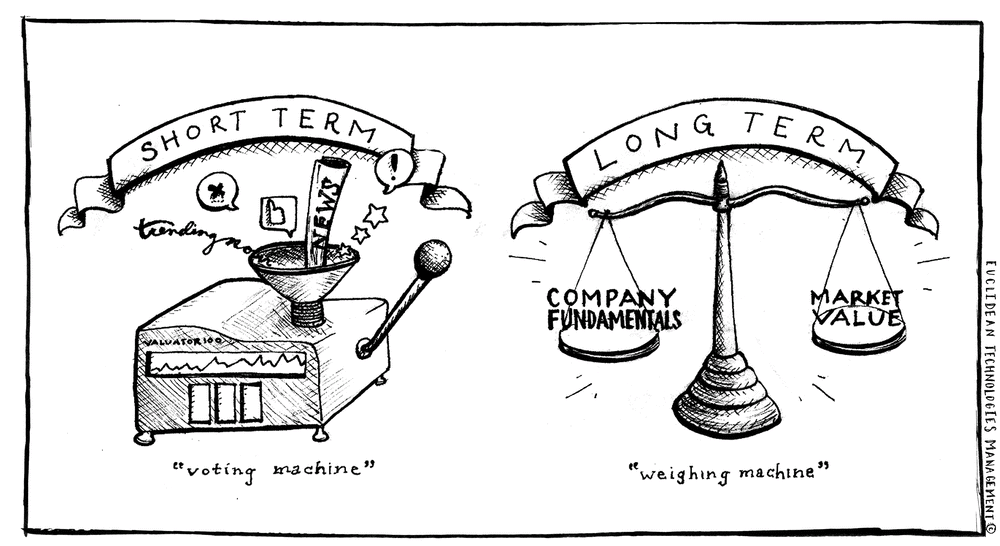

"In the short run the stock market is a voting machine, but in the long run it is a weigthing machine" Benjamin Graham.

So, if you have done your homework and invested in a good company with a decent margin of safety, you have nothing to fear and it is best to hold on to your investments, come bull or bear. Do not be swayed by whatever anyone tells you or any "analyst" reports.

By the way, (just a side note).... most of these "analyst" from various investment houses who come up with the Reports and Price Targets are young punks and fresh grads rookies working for the IBs. To me they have no long term sense of assessing a business. Most of the time they cover a company because of certain agenda. Are you planning to listen to them and make investment decisions? Personally I have spotted so many mistakes and flaws in their models and assumptions. Beware!

Opportunitstic value investor know how to also take advantage of the market fluctuation to accumlate more shares when there is a weakness in price. This is different from the common concept of "averaging down". While you buy cheaper price, you are bringing down your average price of a share, but the intention is solely to accumulate and own more shares of this good company at a discount, and not to average down per se. Did i confuse you?

The opposite is also true. If the share price of this good company you invested in starts to surge upwards, and if you have a long term view of a company you should also consider accumumating more as the surge in price is a sign that the market has also started to recognising the value of this company. You can buy more and "average up" ; but do ensure you are mindful of the valuations and not pay too much for the share.

You may then ask, how long to hold and when do you sell?

I typically buy with the intention never to sell. On average, I hold a company for more than 5 years This excludes the investment in which I made a mistake and have to cut loss.

When I sold (in the years of 2013-2017) it always is because of the following reasons.

1. The business fundamentals or management focus changed and not aligned with my beliefs - example YTL Power, Boustead

2. The company share price is much more higher than the intrinsic value and the valuations are no longer justifiable - example Karex, Pharmaniaga

3. The dividend yield is no longer attractive, I have recovered my capital and made a good profit, and there is a better investment opportunity -example Maxis, TM , PublicBank

Comments, critique and questions are welcome....

Have a good weekend......AK

More articles on Consistent Dividend-Focus Long term Investing

Created by Value Investor Coo1eo | Feb 23, 2018