We made our money in GD Express but is it time to exit now?

Redstart

Publish date: Tue, 23 May 2017, 03:29 PM

*note - post publishing of this article, GD Express shares have been further dulited to around 5.7bil shares. Please consider this adjustment into the figures provided in the article.

We have been following GD Express since 2014 when we made our first batch of profits when it was trading at around RM0.80 to around RM1.40 when we partially exited. Since then, we have had an existing position in GD Express and increased our holdings in early August 2016 till today.

This is our viewpoint on GD Express

Macroview in 2014

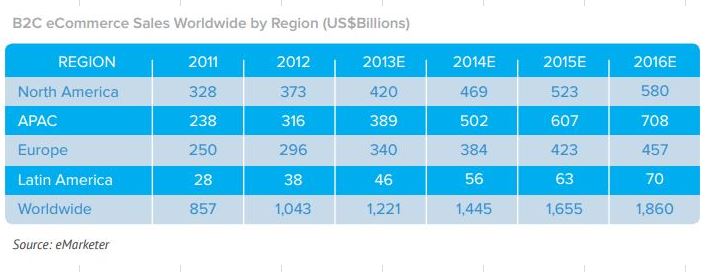

Our initial investment in a logistic player in 2014 and specifically why GD Express was because our interest in tapping into the retail ecommerce market. Based on a report by e-Marketer, Asia Pacific B2C e-commerce sales was expected to exceed North America

and continued to grow to about $708billion in 2016.

GD Express with its regional connections, growing revenue and profits was an apt selection at that moment compared peers to take advantage of the growth in this area.

We made some quick valuation projections and there was tremendous value in the stock at that time.

Why add to your position in 2016?

When we add to our position, it usually requires a more focused investment rather than just a strong macro view. We have to see additional catalysts that we haven't considered or to make a more detailed correlation between a company and how much projected benefits from its growth prospects. From a macro view, the industry was still growing with a report from Transport Intelligence indicating eCommerce Logistics spending in Asia growing to about $175bil in 2016 from $83bil in 2012.

Malaysia accounts for 4% of this spend and GD Express in 2016 had between 6-8% of the logistics market share in Malaysia. Although it is a very competitive market with more than 100 logistic players just in Malaysia, GD Express hadcompetitive advantages with partnerships with regional and global partners such as FedEx, UPS, POS Indonesia and shareholders in Singapore Post (Alibaba proxy) and Yamato (Rakuten proxy).

This however didn't change our postion - what swayed our position was the revenue ratio of GD Express where business to business (B2B) transactions accounted for 80% of revenue and business to consumer revenue(B2C) accounted for 20%.

Initially we focused on the B2C perspective and focused on the growth of online retailing. But unaware to most retail investors, B2B is a far larger market. The B2B eCommerce market is twice the size of B2C and just to provide a better viewpoint, the 20th largest B2B retailer is as large as the 5th largest B2C retailer from a revenue perspective.

Growth in the B2B ecommerce sector which covers wholesales, distribution, organizational selling and sales to resellers was not at the pace of retailing. Typically, companies do not want to purchase online because of security concerns, requirements of companies to be more transparent with their pricing and its limited customer service experience.

However investments to boost this sector have doubled compared to retail in 2016 and with GD Express having 80% of their revenue from B2B with their logistics network, we firmly believed that they would be also able to grow their revenues and profits much more than our initial forecast.

Another look at their financials and margins yielded a much higher value taking into consideration this scenario. We took an additional position at 1.52.

In 8 months with it appreciating +87.5%, even with the boost of Jack Ma setting up a regional centre here, we are now looking to exit this investment. Why now where there seems to be an even bigger catalyst?

We will cover more of this in part 2. In the meantime, please do visit our website for more insights and articles at www.laburlah.com

Disclaimer : This article represents the viewpoint of the author. It does not represent an advice to buy or sell a stock. Please use your own judgement before making any investments.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Axel's Market Outputs

Created by Redstart | May 25, 2017

Discussions

my fren is the seller in lzd. the delivery options after kick skynet are only gdex and poslaju. Natwide is out the list.

2017-05-23 18:16

The latest information I have, Lazada has roughly about 10% market share of online transaction in Malaysia. Mudah is the largest at about 20%. Zalora about the same at about 10%. Lelong and eBay less at 8%. The rest like Amazon, Groupon and Taobao has 5% or less. Can google check the report by Bain Capital on this info. Even if exclusive partner of Lazada, not enough really. Have to be a true regional player to sustain uptrend pricing.

2017-05-23 19:11

Lim HangKok

lazada has kicked skynet out(start june), skynet no longer their 3rd party delivery partner. gdex and poslaju are the beneficiary

2017-05-23 16:32