Picking the winners

Biden Tariffs: This First Solar Supplier Is Poised to Benefit

Axelrod

Publish date: Mon, 20 May 2024, 06:33 AM

Note: this post is not intended to be investment advice, just for knowledge sharing purposes.

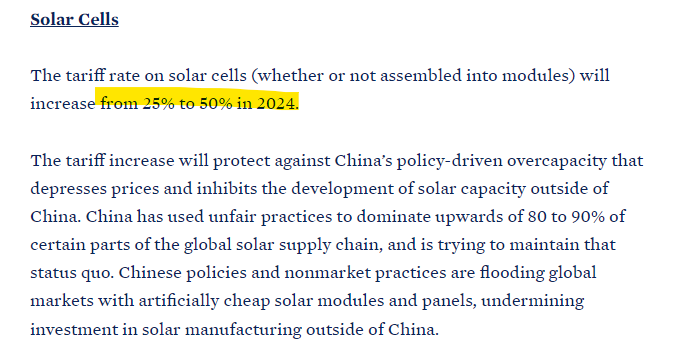

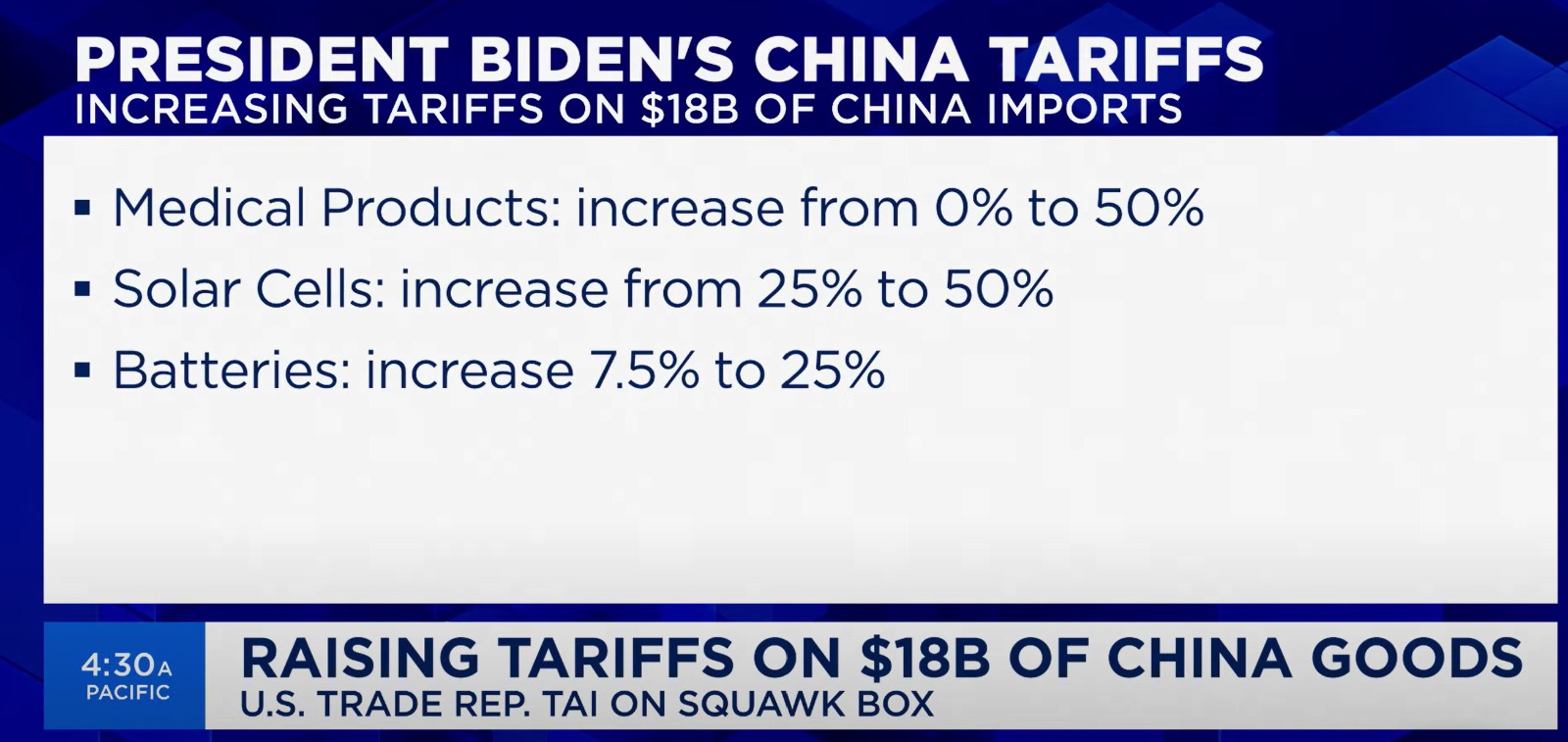

Glove (higher tariff in 2025) and solar (higher tariffs start now in 2024) companies have surged after Biden announced new tariffs on China.

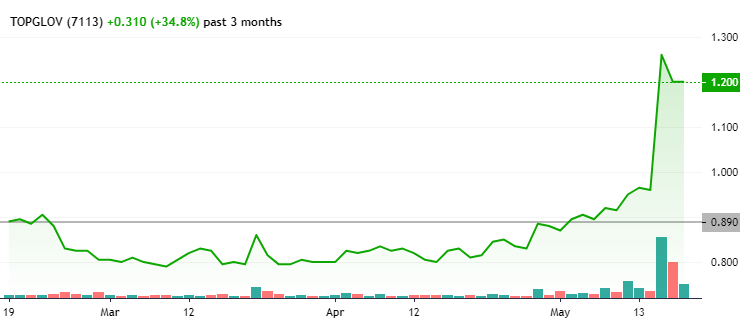

Topglove

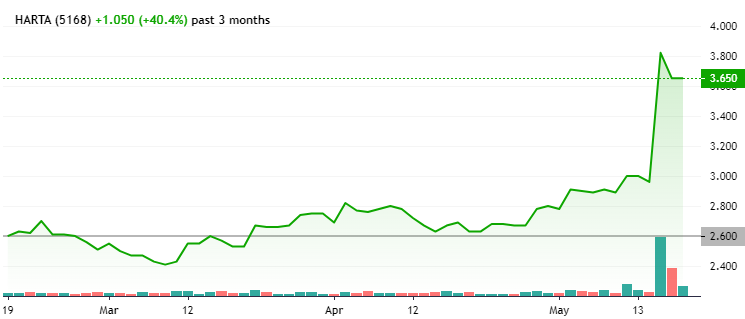

Hartalega

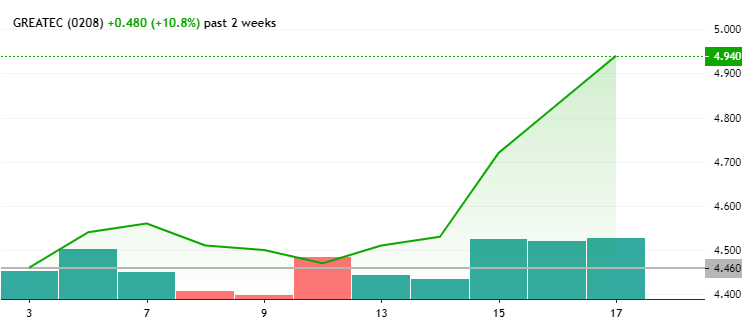

Greatech

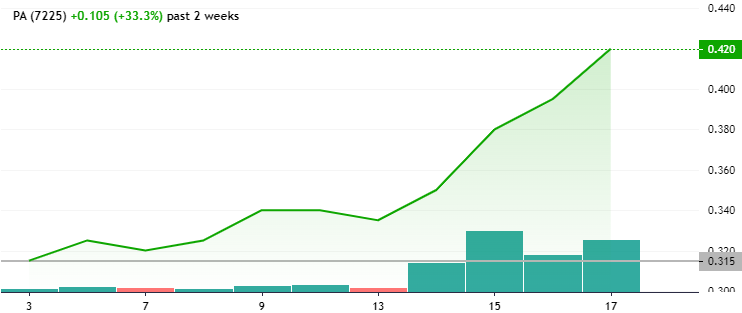

PA Resources

Let me tell you one hidden gem that has not moved 30-40% yet. But will benefit greatly from the tariffs.

L&P BERHAD:

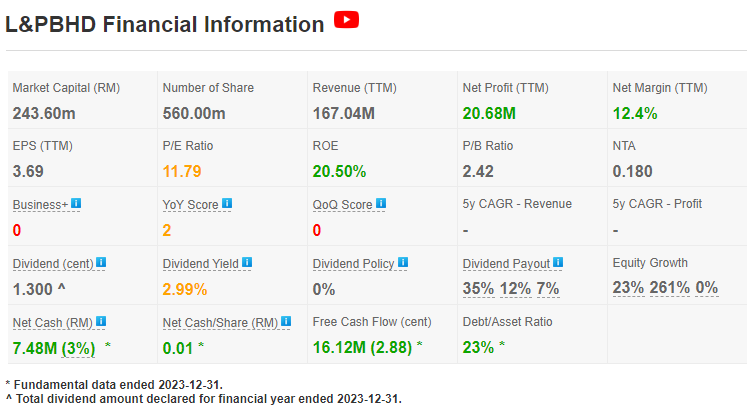

L&P has an undemanding PE of 11.79x, high ROE of 20.50% and net cash of RM7.48m. The company generates free cash flow and pays 3% dividend yield.

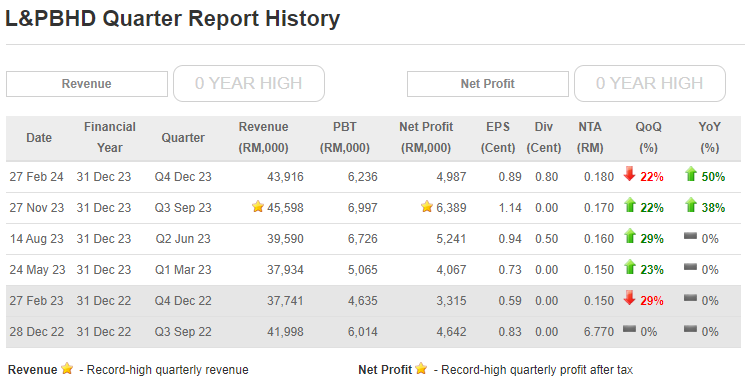

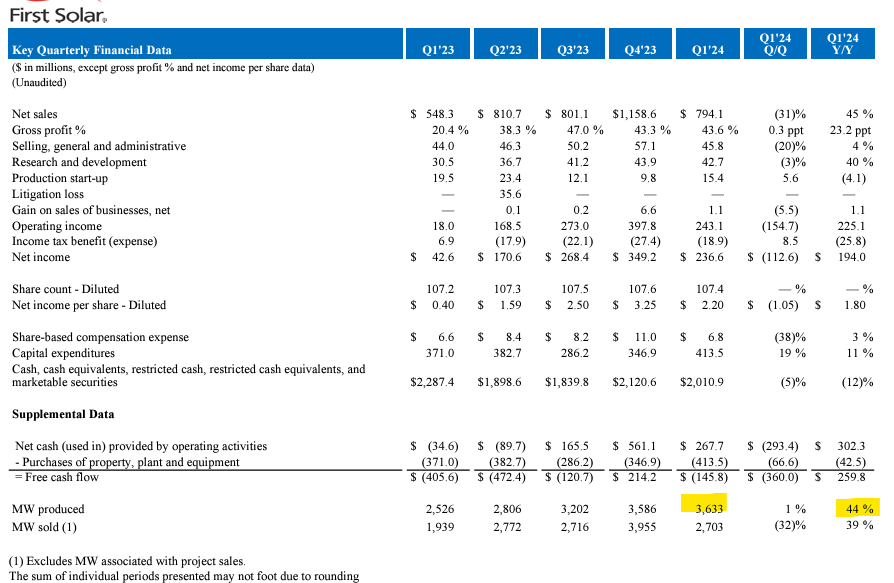

Net profits grew 38-50% year-on-year in 3Q and 4Q of 2023. With profit margin of 14% and 11%. 3Q revenue and net profits new records.

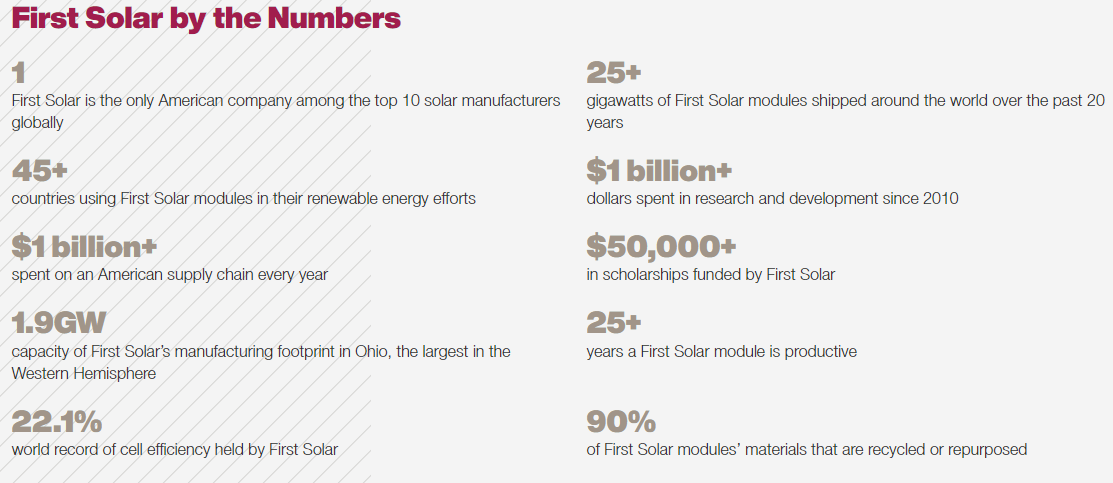

First Solar is the ONLY American company among global top 10 solar manufactuers. First Solar has received billions of Dollars in incentives from the Biden Administration.

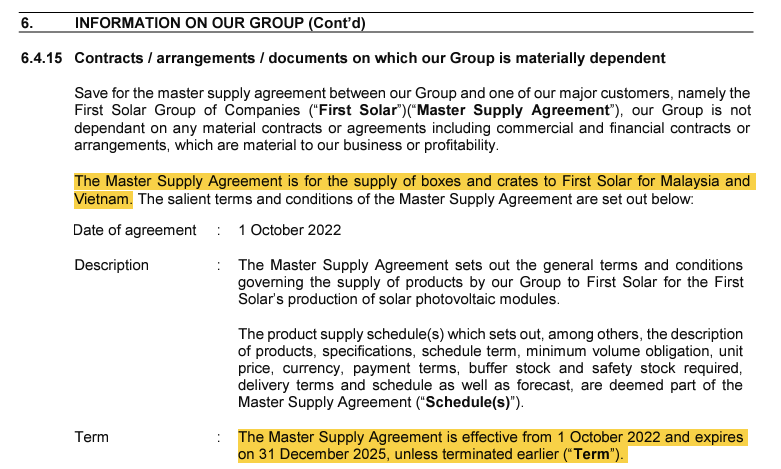

L&P has a master supply agreement to First Solar until 2025.

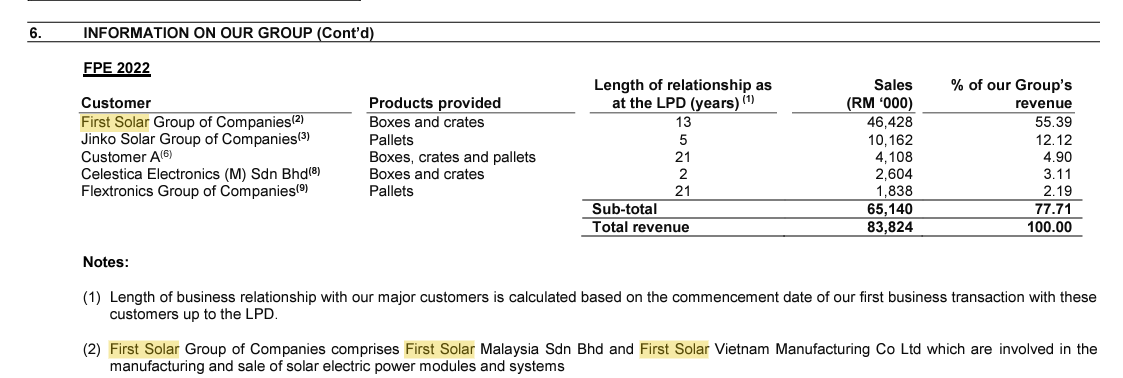

In fact, First Solar is L&P's largest customer with a relationship of 13 years.

Key products are boxes, crates and pallets that are recyclable and sustainable, which is very important for the renewable energy/green industry.

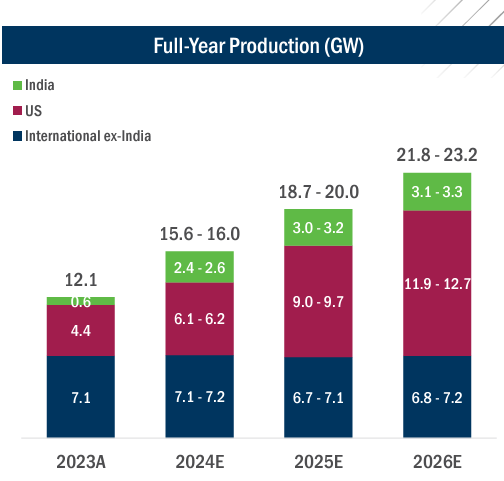

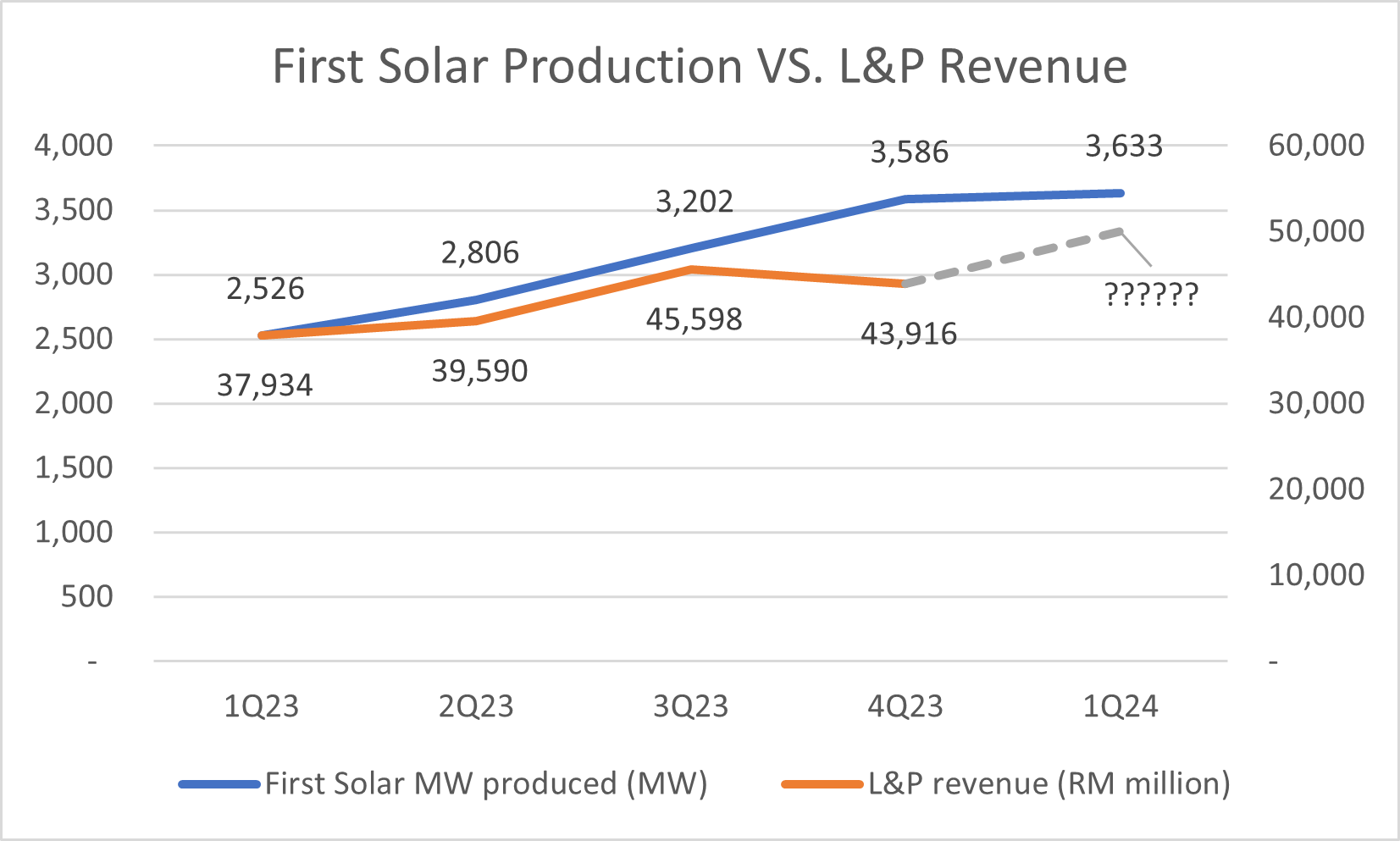

L&P's revenue depends on First Solar's production in Malaysia and Vietnam which is around half of forecasted production for 2024.

And with strong growth in First Solar production of 44% year-on-year in 1Q24, it will be interesting to see L&P results.

Here is how L&P revenue has trended against First Solar MW produced in the past 4 quarters.

This is not even including Biden's latest round of tariff increases yet. If Topglove and Hartalega can rally 30-40% even when tariffs start only in 2025, then L&P might have a lot of catching up to do.

Discussions

Be the first to like this. Showing 0 of 0 comments