Fintec: The pendulum swing.

BLee

Publish date: Sun, 10 Oct 2021, 10:50 AM

Below is my discussion of ideas with 2 forumers on Fintec major paper loss for the QR30.06.2021.

"@Forumer1: When you multiply a negative 10 with a negative 10 , u get positive 100. So when a loss making company buys another loss maker, u get a profit generator. Lol.

08/10/2021 12:17 PM

BLee: @Forumer1, good mathematics. The paper loss reporting was as at end June 2021. If you calculate the investment shareholdings for both companies as at end Sept. 2021 (the next QR cut off period), your mathematics could be correct. Happy trading

08/10/2021 12:51 PM

@Forumer2: Yes true. I may have failed my Accounting bad time but I clearly know Fintec can made RM720 Mil at one time, Fintec can also lose it anytime around in the future. As long as Fintec is still holding all its share holdings of all the public listed entities and not selling them, one day it will bounce back Big Time too. Afterall, The Accounting of Profits and Losses of all Public Listed Entities nowadays are all based on Current Market Valuation Method and not based on Historical Cost alone. Hope you all get what I mean. A PLC who knows how to write off Bad Debts and Obsolete Stocks is a prudent entity, while an entity keeps reporting fake profits year after year without any provision for bad debts and obsolete stocks is not prudent company but a dangerous one indeed. Just my thought.

09/10/2021 4:57 PM"

BLee: TQ to Forumer1 and Forumer2 in believing the pendulum can swing higher from the low point and won't stop at the low point.

I am waiting for the price pendulum upswing for both Fintec and Focus D after the Focus D rapid down swing causes Fintec to lose RM980.166mil in QR30.06.2021. Since Fintec last QR reported at the end Sept. 2021 which is the cut-off for the next QR, I can roughly calculate the pendulum position with respect to QR30.06.2021.

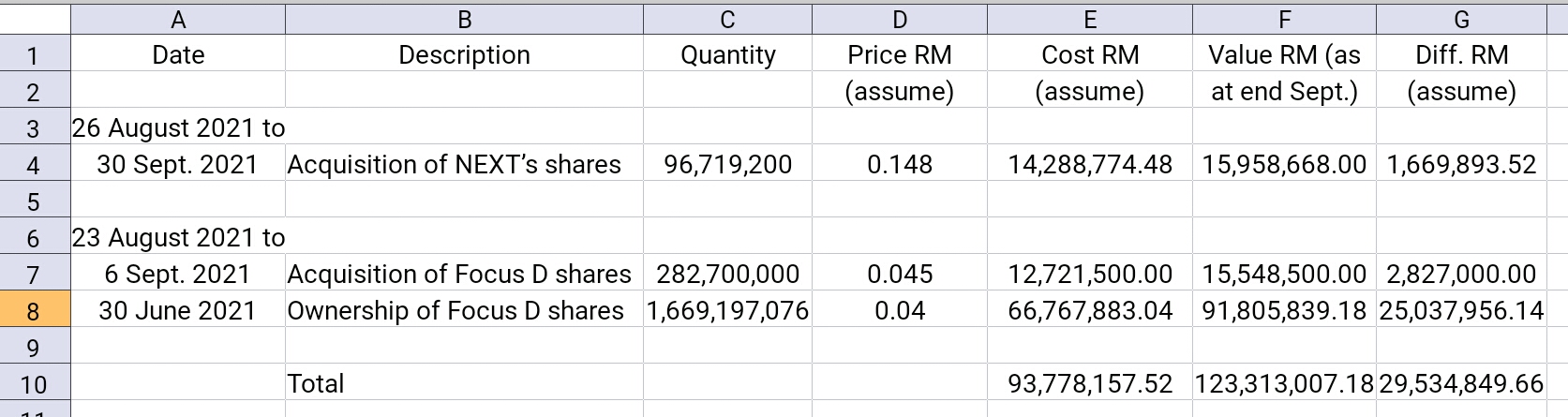

Details No. 1: Fintec QoQ investment in NETX and Focus D.

- with only 2 counters calculated, the recovery is already in the positive region over 1QoQ.

Below are details of NETX and Focus D shares acquisition:-

The Board of Directors of FINTEC wishes to announce that its wholly-owned subsidiary, Fintec Global Limited (“FGL”), that is principally involved in the investment of marketable securities, had on 29 September 2021 acquired in aggregate 96,719,200 shares of NetX Holdings Berhad (“NETX”), representing approximately 11.57% equity stake in NETX, from the open market for an aggregate consideration of RM14,288,774.48 (“Acquisition Consideration”) in cash (hereinafter referred to as the “Acquisition”).

My summaries of Fintec Global Limited holding of Focus D as at 6th Sept. 2021:-

Indirect/deemed interest (%): 30.631

Total no of securities after change: 1,951,897,076

Total: 282,700,000 Shares collected within 10 days. Major collection, most probably patiently at 4 to 5.5 sen only!!

Total collected/Total traded over last 10 days:

282,700,000 / 483,156,776 = 58.5%

How undervalue is Fintec? I have calculated based on available data for cash position w.r.t. QR30.06.2021 vs Fintec market Capitalisation value of RM78mil in one of my articles.

Since I have new data as shown in Details No. 1, let me calculate the new value.

New calculated Cash and cash equivalent position: RM109.996mil - RM 27.010mil = RM82.986mil

The new calculated Shares holding value based on NETX and Focus D only as at end Sept.2021: RM123.313mil

Fintec Share and cash details:-

(Info only: Number Of SHares (NOSH): 5,230mil

Quantity by funds exercises: 3,945,664,575 as at 30 June 2021- 969,873,355 as at 30 June 2020 = 2,975,791,220

Percentage by exercises: 75.42%)

Capital: RM78mil as at 1st Oct. 2021

Cash/Capital: 82.986/78 = 1.064

Cash+calculated shares holding/Capital: ( 82.986+123.313)/78=2.645

Sources: i3investor, klsescreener and other internet surfing.

Happy trading and TradeAtYourOwnRisk.

Disclaimer: The above opinion does not represent a buy, hold or sell recommendation; just a personal opinion and for sharing purposes only. Any offences and errors are unintentional; my apology in advance.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|