Fintec: Misleading NTA? (updated)

BLee

Publish date: Fri, 01 Oct 2021, 01:12 PM

Below is my discussion of ideas in i3investor with two forumers asking a very good question. My opinion might not be correct and some details can only be presented in an article; therefore I would like to prepare this article for sharing purposes only.

'@Forumer1: BLee, I am new here. What do you mean by "Only problem will be at least one quarter most likely a few hundreds million 'paper loss' due to the Focus D investment retreating from around 65sen to today of 5.5sen still not accounted for in any QR." In other word, NTA of RM0.3626 is not true, right?

30/09/2021 5:38 PM

BLee: @Forumer1, the quarter reporting includes major investment of Focus D priced in the period end March (65sen) vs end June 2021 (4sen) beside other investments.

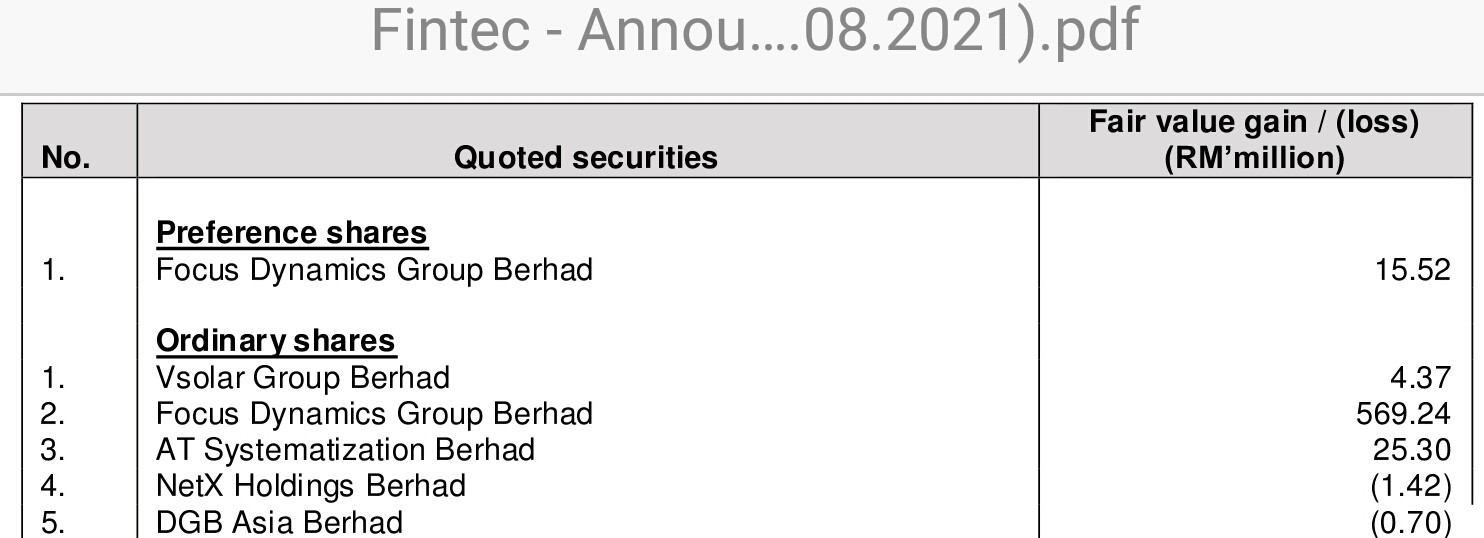

Below is an example of comparison of 2 different period profit/loss as extracted in one of Fintec report.

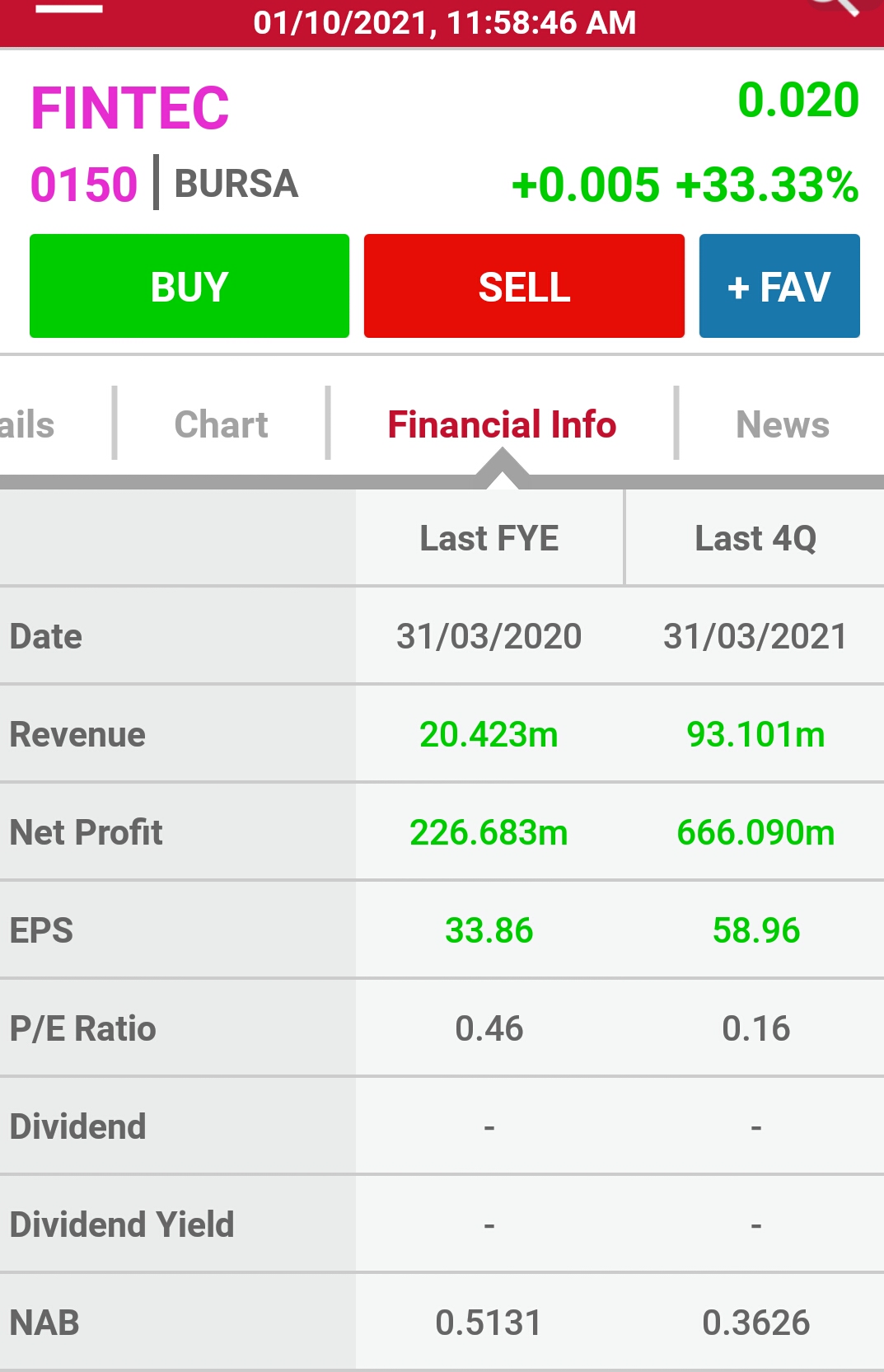

'(i) 12-month FPE 31 March 2021 vs FYE 31 March 2020

The Group’s revenue for 12-month FPE 31 March 2021 increased by 357.00% to RM93.10 million as compared to FYE 31 March 2020. The higher revenue was mainly due to higher sale of marketable securities as a result of higher value of trading activities undertaken by the Group.

The Group recorded a higher GP margin 54.96% in 12-month FPE 31 March 2021 as compared to 2.85% in FYE 31 March 2020 mainly due to higher gain from the sale of marketable securities.

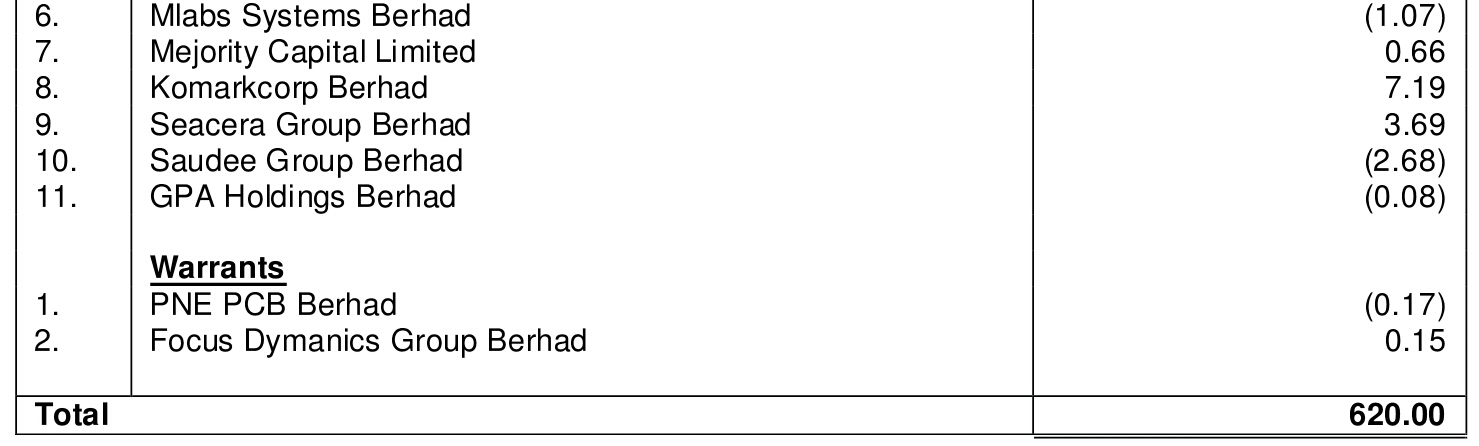

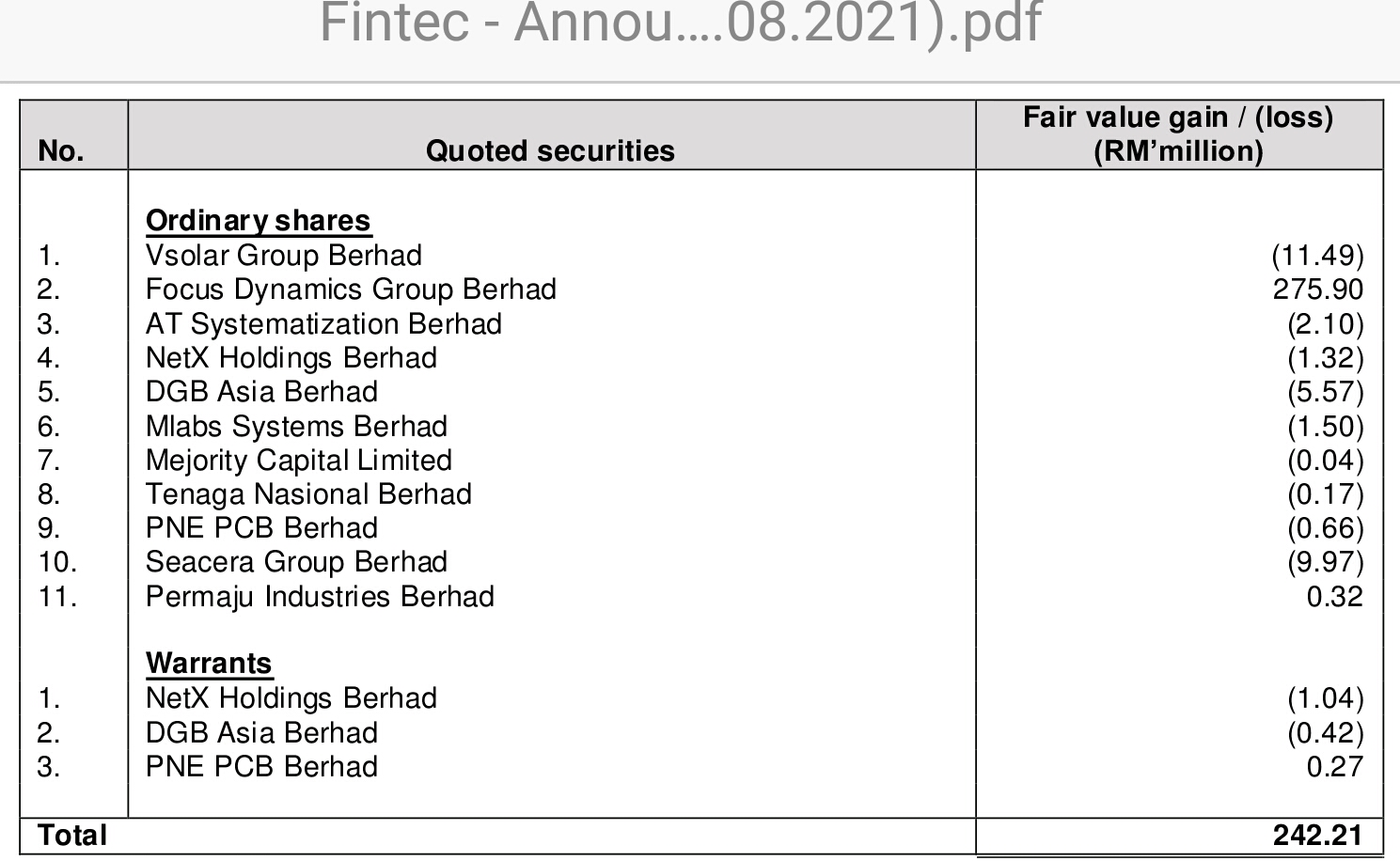

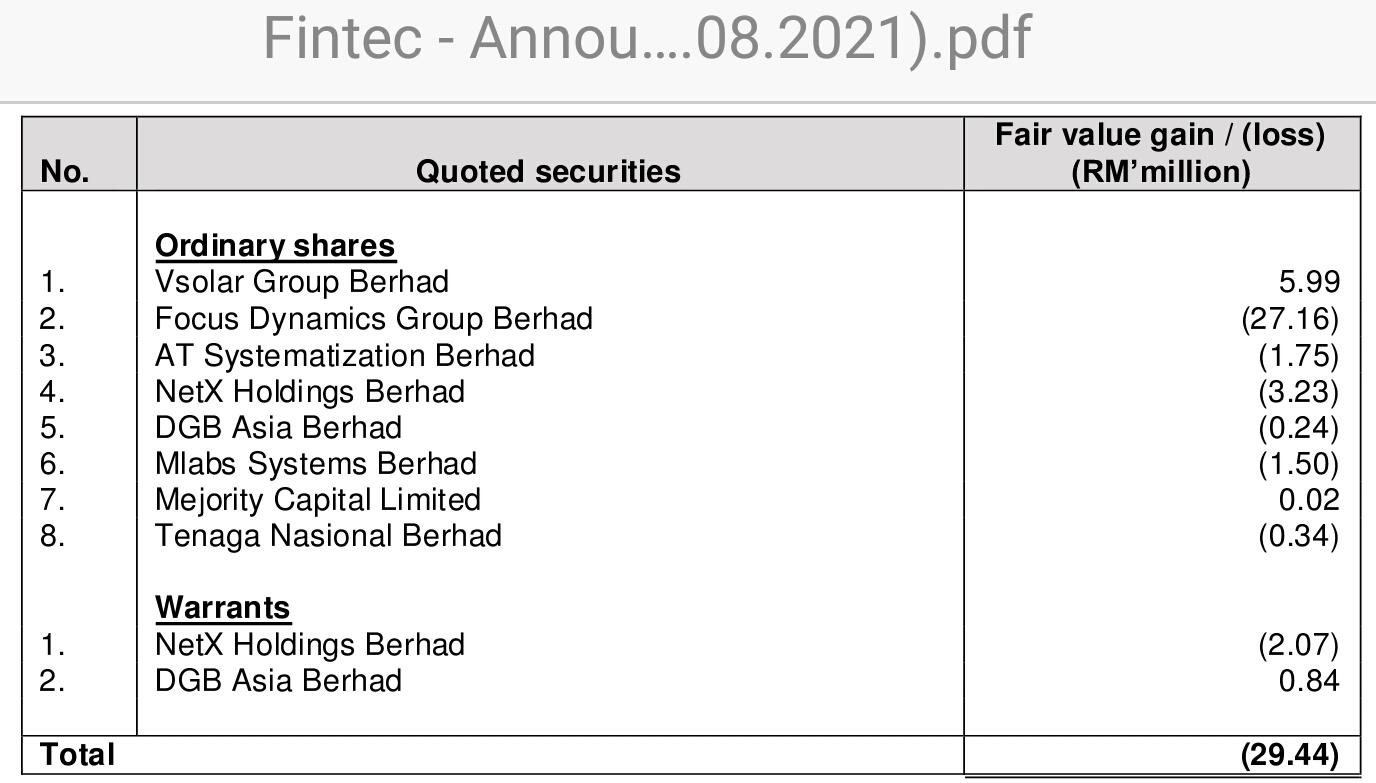

The Group recorded a PAT of RM666.09 million in 12-month FPE 31 March 2021 as compared to RM226.03 million in FYE 31 March 2020, representing an increase of 194.69%. The higher PAT was mainly due to fair value gain on quoted securities held by the Group of RM620.00 million (FYE 31 March 2020: RM242.21 million) arising from the increase in market prices of such quoted securities:-.'

2. Focus Dynamics Group Berhad: fair value gain / (loss) (RM’million) 569.24

During the bull market, Focus D contributed RM569.24M in Fintec reporting (paper gain). I have expected at most, the contribution at bear market will be around RM500M (paper loss). Today QR reporting a loss of RM980.2M is a surprise to me.

As NTA is calculated with respect to period reporting; it is correct at the period of reporting. Usually this NTA is 1 quarter plus 2 months in preparation i.e. around 5 months from the previous actual NTA. Example: Focus D price at end March of 65sen vs end of June of 4sen vs Today of 5.5sen...Hope my explanation makes sense. Happy trading and TradeAtYourOwnRisk.

30/09/2021 10:27 PM'

The full tabulation presented below:-

(i) 12-month FPE 31 March 2021 vs FYE 31 March 2020

(ii) FYE 31 March 2020 vs FYE 31 March 2019

(iii) FYE 31 March 2019 vs FYE 31 March 2018

Link to above details: https://www.klsescreener.com/v2/announcements/view/3407375

Focus D during item (iii) already in the red, now most likely also in the red.

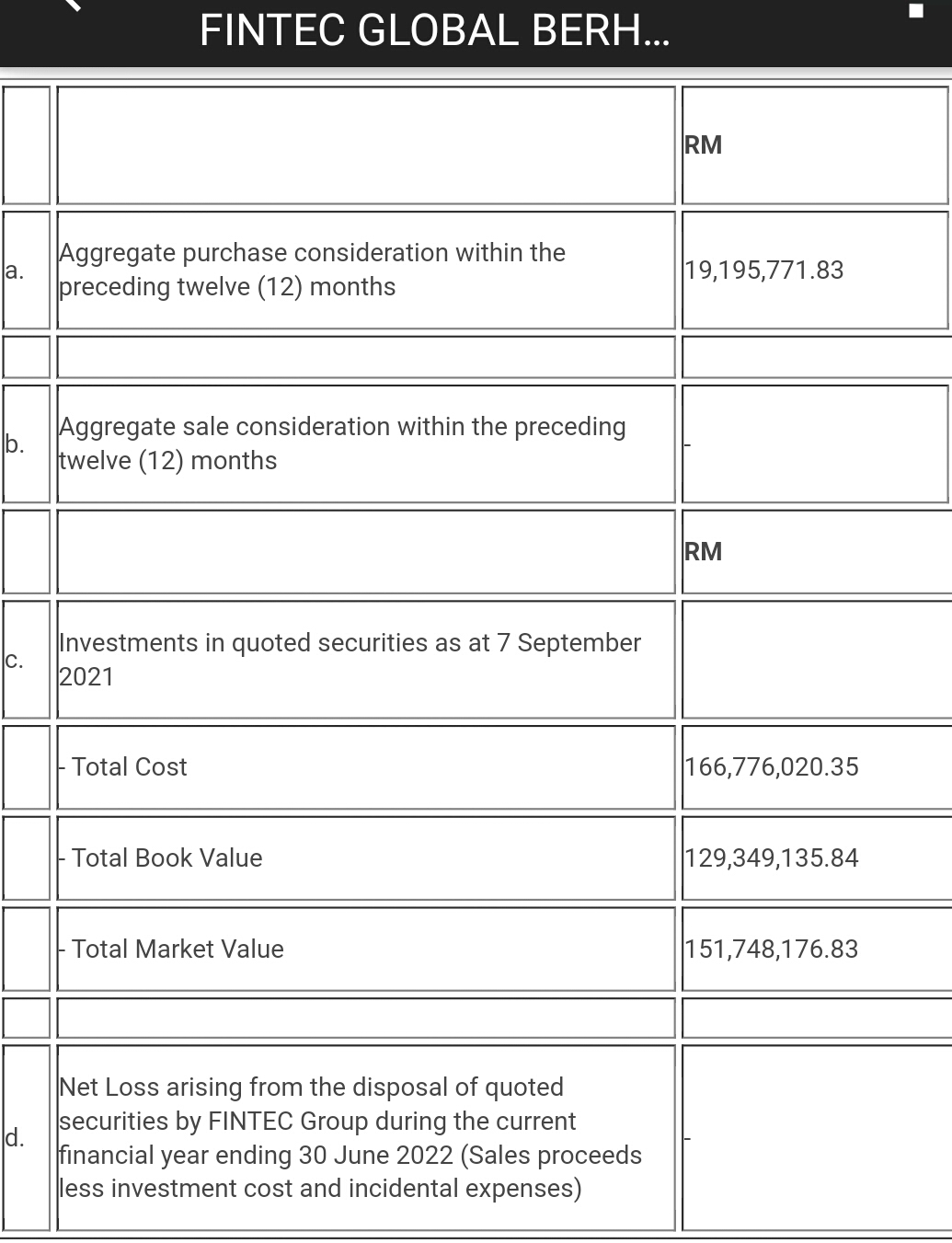

Below, another tabulation of interest.

Link to above tabulation: https://www.klsescreener.com/v2/announcements/view/3421501

From the tabulation, the actual losses are most likely either using book value (fixed) or market value (fluid) minus total investment cost. Any comments?

Caution: Reading from tabulation could be misleading as data are very fluid which can be changed within minutes. Example as below screen shot today not reflecting yesterday QR reporting (4 rolling quarters?). Please also take note, Fintec still trading within range of 1.5 to 2sen, not affected by yesterday QR...

Updated discussion of ideas with a second forumer for sharing of misleading QRs.

"Oct 16, 2021 6:28 PM

@Forumer2: No more penny stock for me, caught trapped because of cash rich with 720 millions. End up lost 80%, sad:(

16/10/2021 4:54 PM

BLee: Hi @Forumer2, Fintec Cash and cash equivalent as below, RM720.5mil only consists of 'paper gain' as at QR reporting.

Although QR30.06.21make a loses of RM-980.2mil consists of 'paper loss', the Cash and cash equivalents increased to a much healthier QR as shown (cash flow reporting).

Cash position during QR30.09.20:-

Profit: RM720.5mil

Cash and cash equivalents: RM23.166mil

Cash position during QR30.06.21:-

Loses: RM-980.2mil

Cash and cash equivalents: RM109.996mil

When we invest in stocks, the timing is very important and QR reporting is almost 5 months behind time i.e. 3 months coverage and 2 months for preparation. We shall follow the current 'news' and counters shares holding; and NOT at old history. Please correct me if I make a mistake.

Happy trading and TradeAtYourOwnRisk.

Source: klsescreener Fintec QR"

Sources: i3investor, klsescreener, KIBB and other internet surfing.

Happy trading and TradeAtYourOwnRisk.

Disclaimer: The above opinion does not represent a buy, hold or sell recommendation; just a personal opinion and for sharing purposes only. Any offences and errors are unintentional; my apology in advance.

More articles on Fintec: Private Placement

Discussions

@ahbah: A fun stock .. just main main for fun onli.

01/10/2021 1:55 PM

BLee: Yes, @ahbah. I think well supported at around 1.5 to 2sen. Now on solid land, the most can end up wash to the sea. If more adventurous, can climb up Gunung Tahan, kinabalu or even Everest. Happy trading and TradeAtYourOwnRisk.

2021-10-01 15:18

ahbah

A fun stock .. just main main for fun onli.

2021-10-01 13:55