KGroup: Growth from PP, SIS and RI?

BLee

Publish date: Wed, 29 Sep 2021, 12:44 PM

Below is my discussion of ideas in i3investor with one of the Forumer:

'@Forumer_w: KGROUP

Total issued shares = 2,554,309,534

WC = 982,103,848

Will KGROUP directors issue more shares to raise more fund to buy more penny stocks ?

Maybe should do share buy-back to boost current share price (0.03)

===========================

TAYOR

28/09/2021 12:10 PM

BLee: Hi Forumer_w, which is which? Issue more shares and share buy-back is exactly opposite.. I have written an article on 'Rich penny stocks acquiring beat down penny stocks' taking KGroup as one of the example. If I am not too busy, I might do more coverage on KGroup recent AR (non-accountant view, only very basic double entry and balance sheet knowledge). Have a very good trading days ahead and TradeAtYourOwnRisk.

28/09/2021 12:42 PM'

This Forumer is very good at tracking all the PP, ESOS, SIS, RI etc of some penny stock counters. I am happy someone is doing this extra service for our knowledge in case I did miss some of this issuance.

Since this Forumer touch on KGroup, I will take the initiative to cover the recent AR report as I have gone through the report earlier for another article I have written.

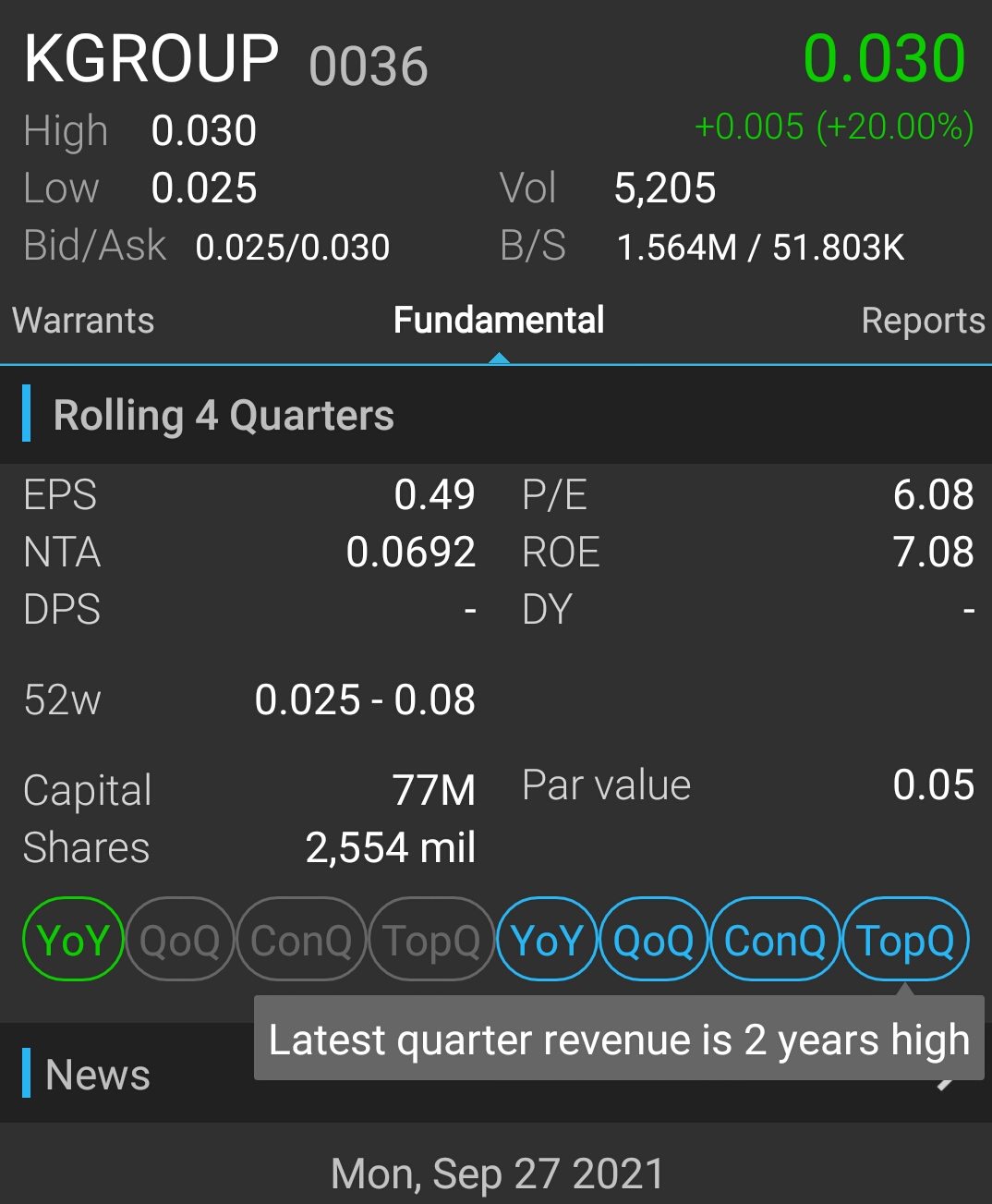

Detail No. 1: KGroup fundamental as shown in klsescreener screenshot. This is one page I always look at before I make a purchase. The bottom 'Traffic Lights' will guide me go or no go!! Caution: This traffic lights changes very fast.

Detail No. 2: KGroup Company profile and business. Cloud Storage and Medical Equipment most likely will be a growth area. This is reflected in the 4 revenues criteria lighted up in detail No. 1

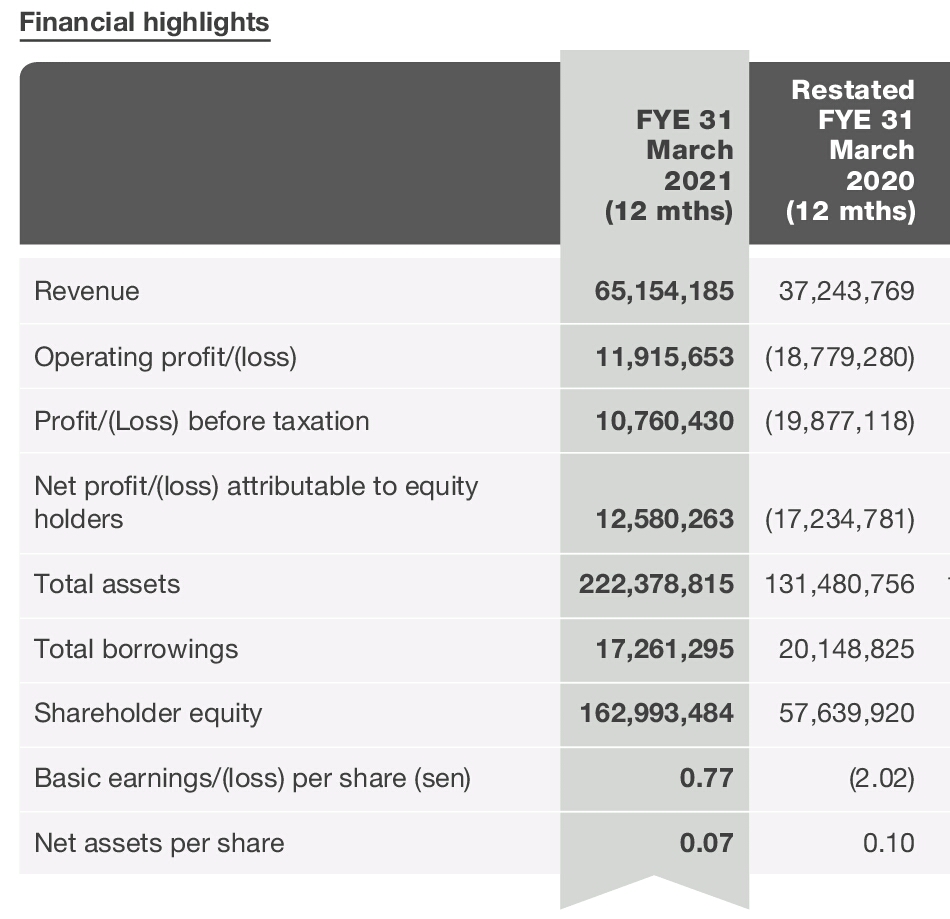

Detail No. 3: KGroup Financial Highlights. I have seens the growth substantially increase over the last one year.

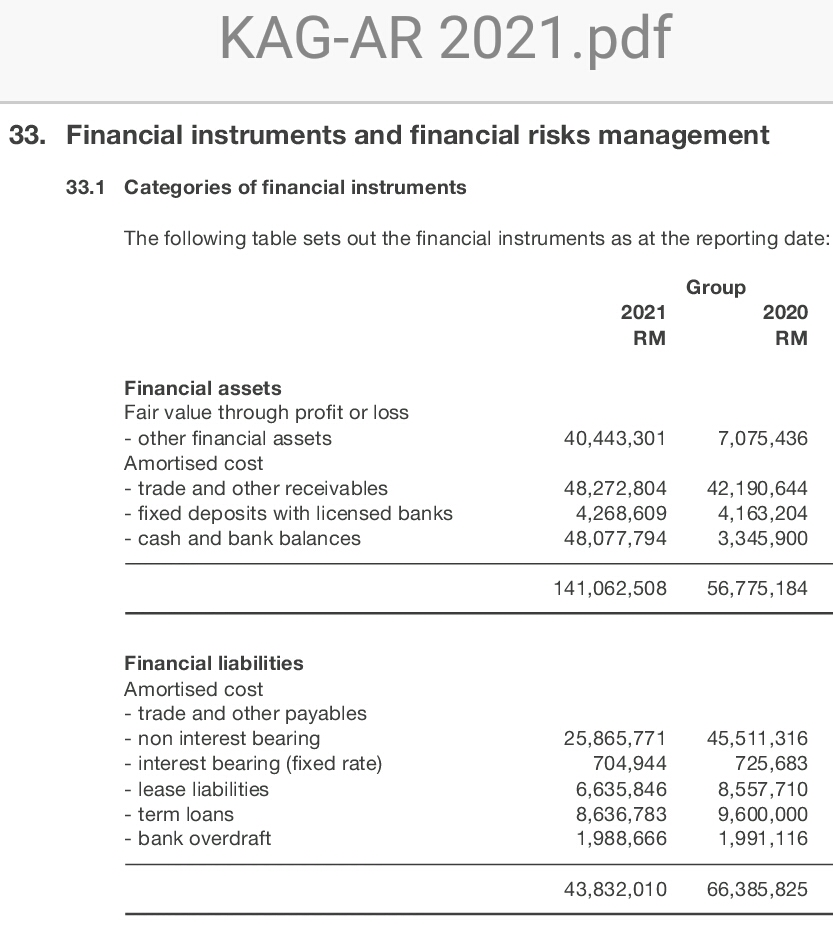

Detail No. 4: Financial Assets vs Financial Liabilities. It seems no problem as Assets substantially more than Liabilities.

Detail No. 5: Cash Flow substantially increases over the last one year (from RM1.354M to RM46.089M), sign of increasing growth...

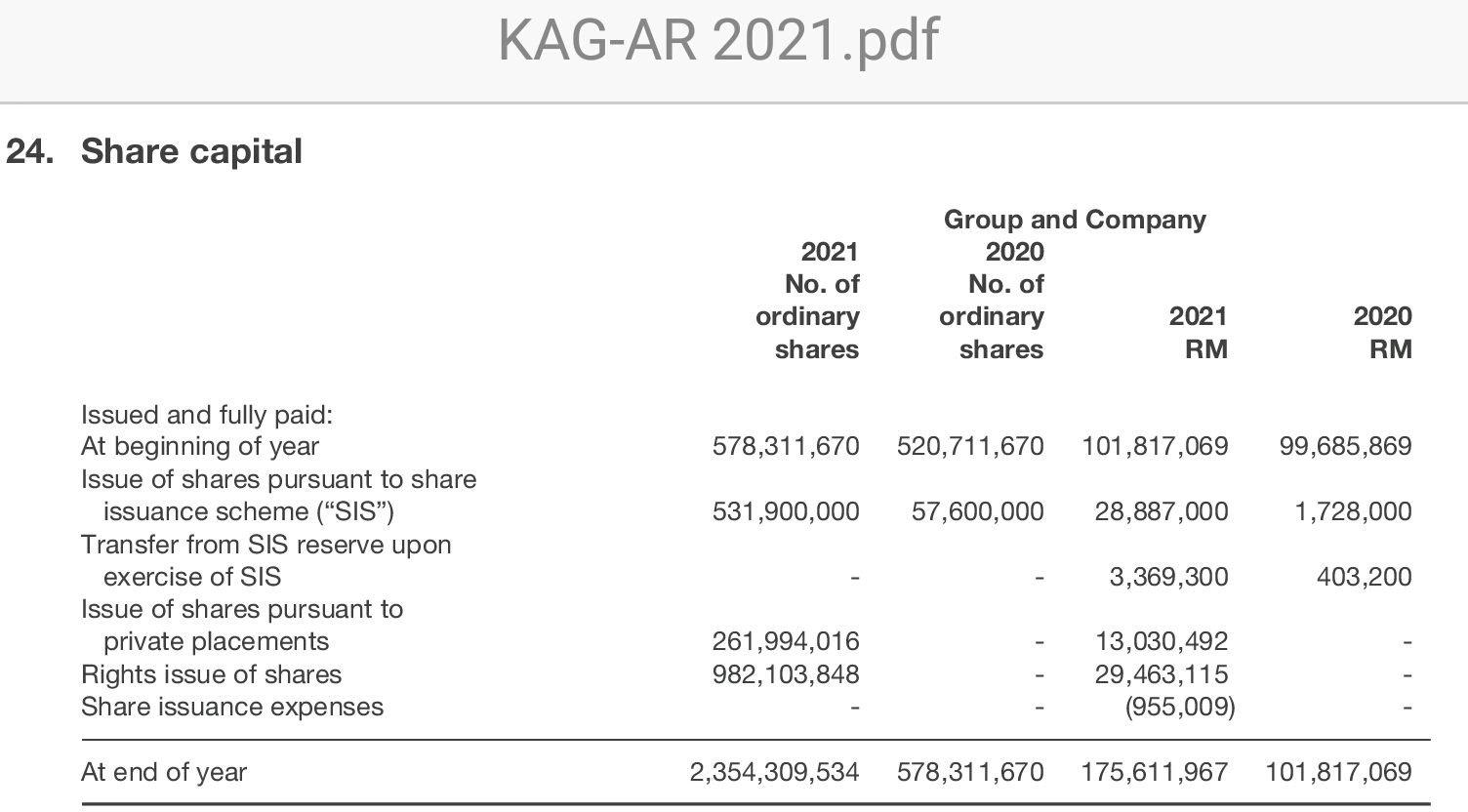

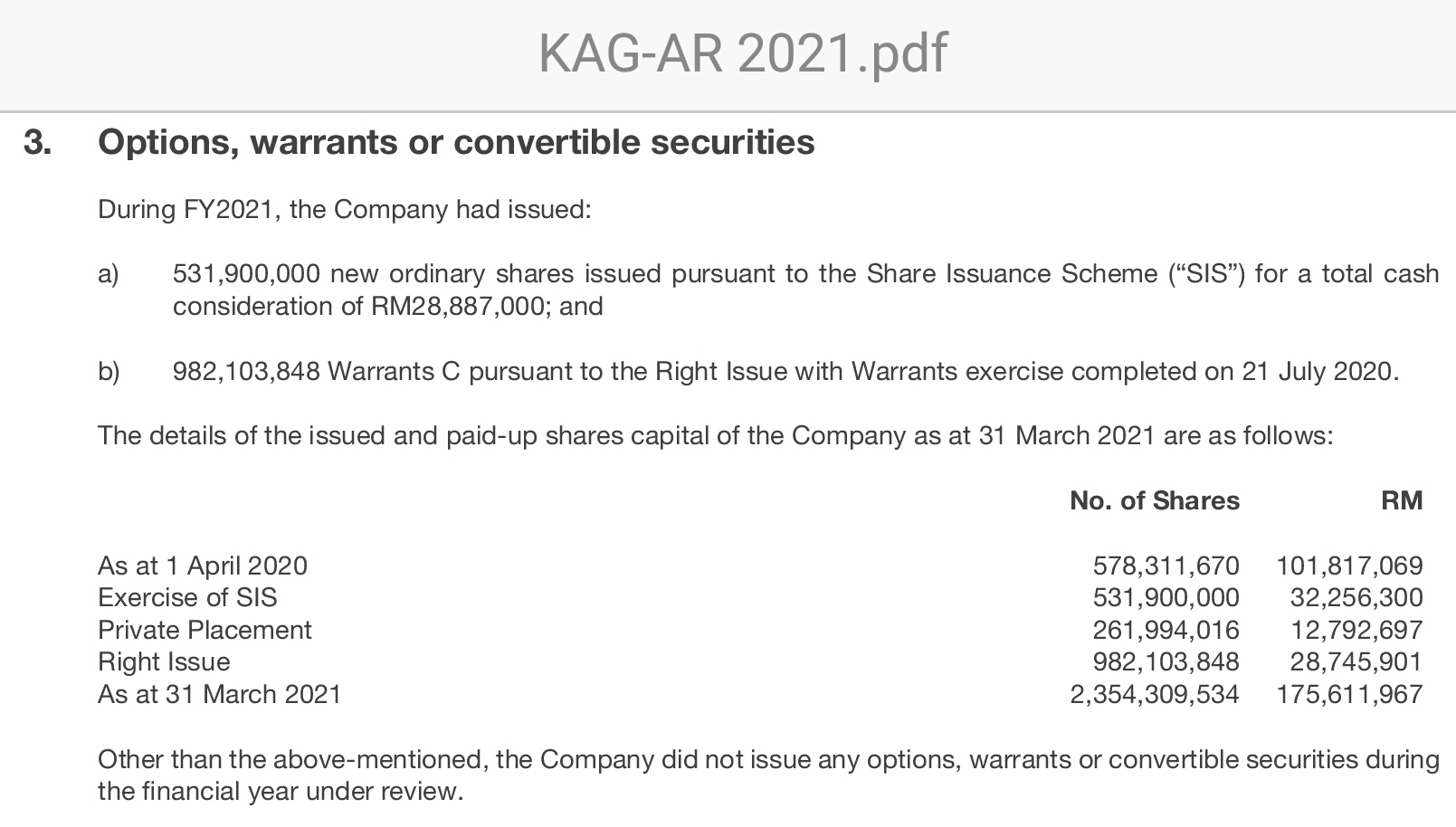

Detail No. 6: Share Capital

Corporate Exercises

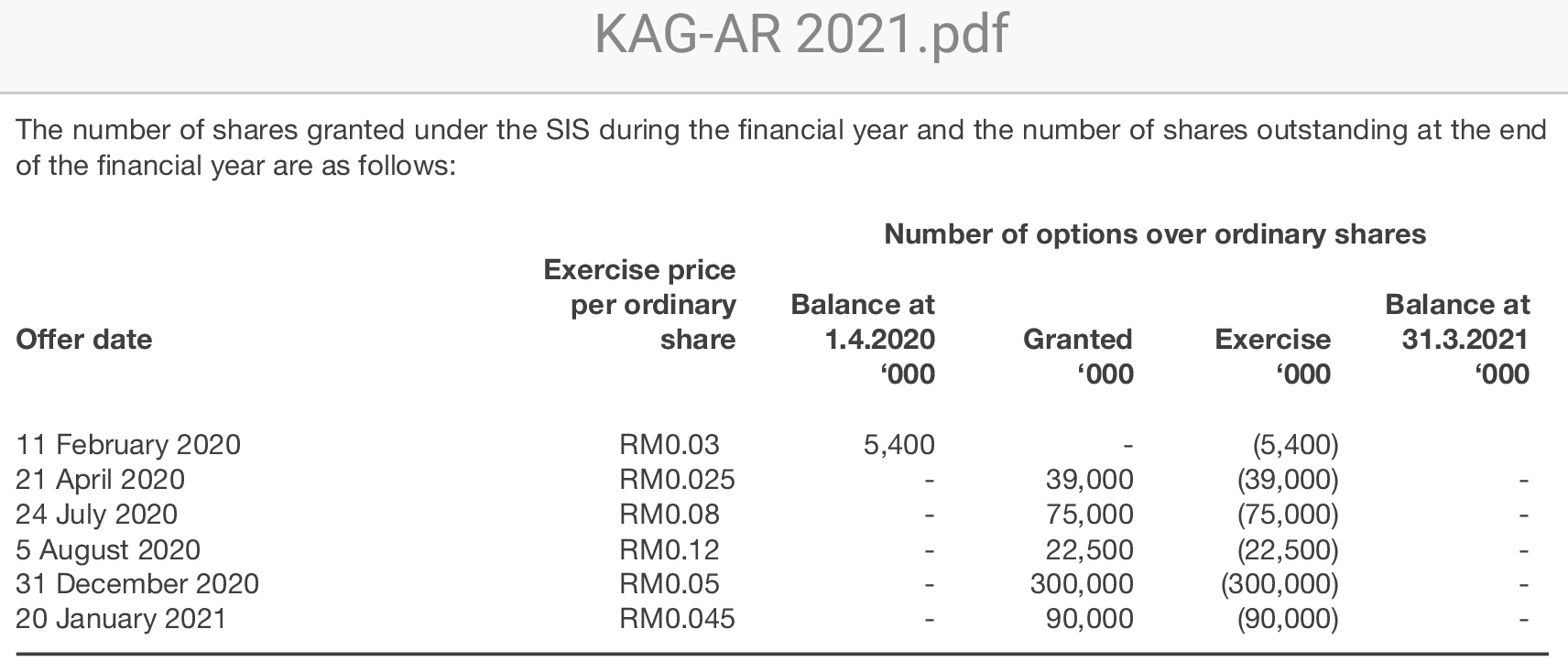

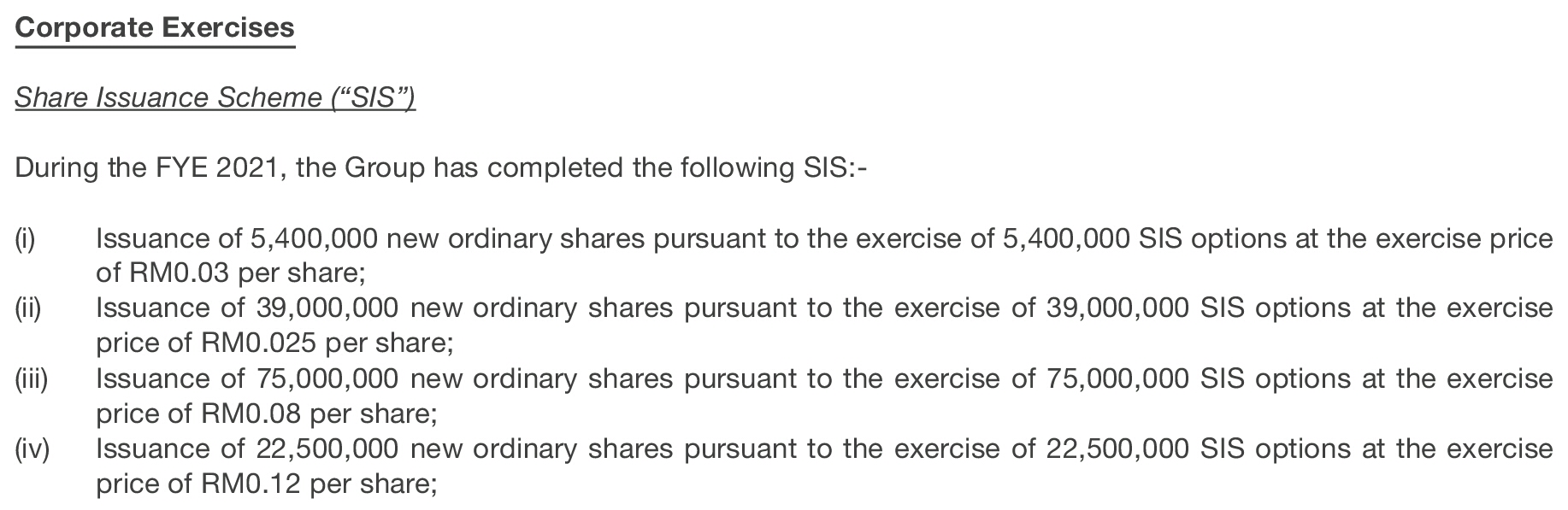

Share Issuance Scheme (“SIS”)

During the FYE 2021, the Group has completed the following SIS:-

(i) Issuance of 5,400,000 new ordinary shares pursuant to the exercise of 5,400,000 SIS options at the exercise price of RM0.03 per share;

(ii) Issuance of 39,000,000 new ordinary shares pursuant to the exercise of 39,000,000 SIS options at the exercise price of RM0.025 per share;

(iii) Issuance of 75,000,000 new ordinary shares pursuant to the exercise of 75,000,000 SIS options at the exercise price of RM0.08 per share;

(iv) Issuance of 22,500,000 new ordinary shares pursuant to the exercise of 22,500,000 SIS options at the exercise price of RM0.12 per share;

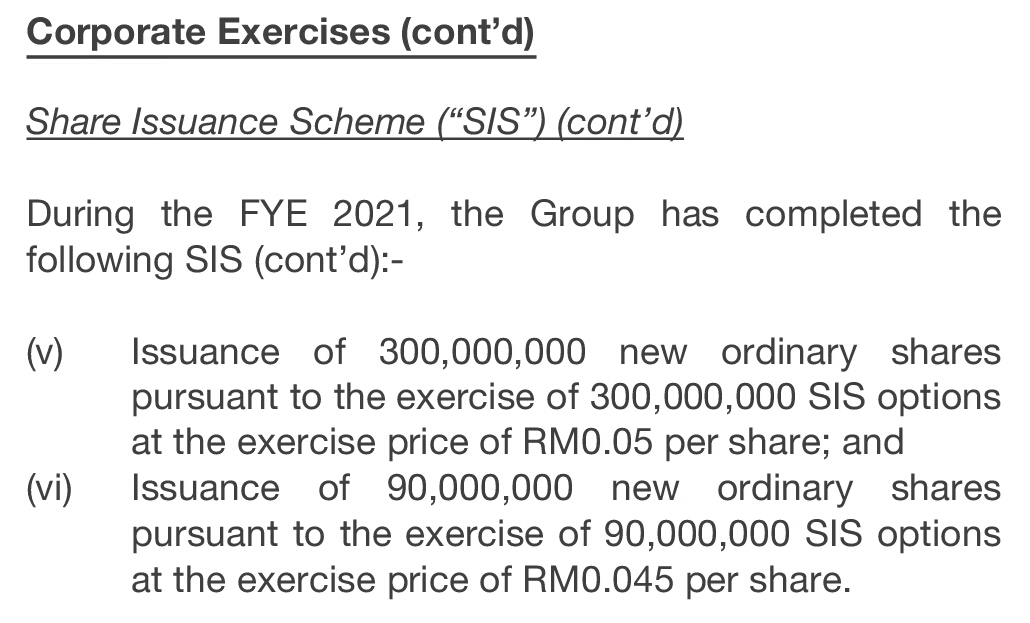

(v) Issuance of 300,000,000 new ordinary shares pursuant to the exercise of 300,000,000 SIS options at the exercise price of RM0.05 per share; and

(vi) Issuance of 90,000,000 new ordinary shares pursuant to the exercise of 90,000,000 SIS options at the exercise price of RM0.045 per share.

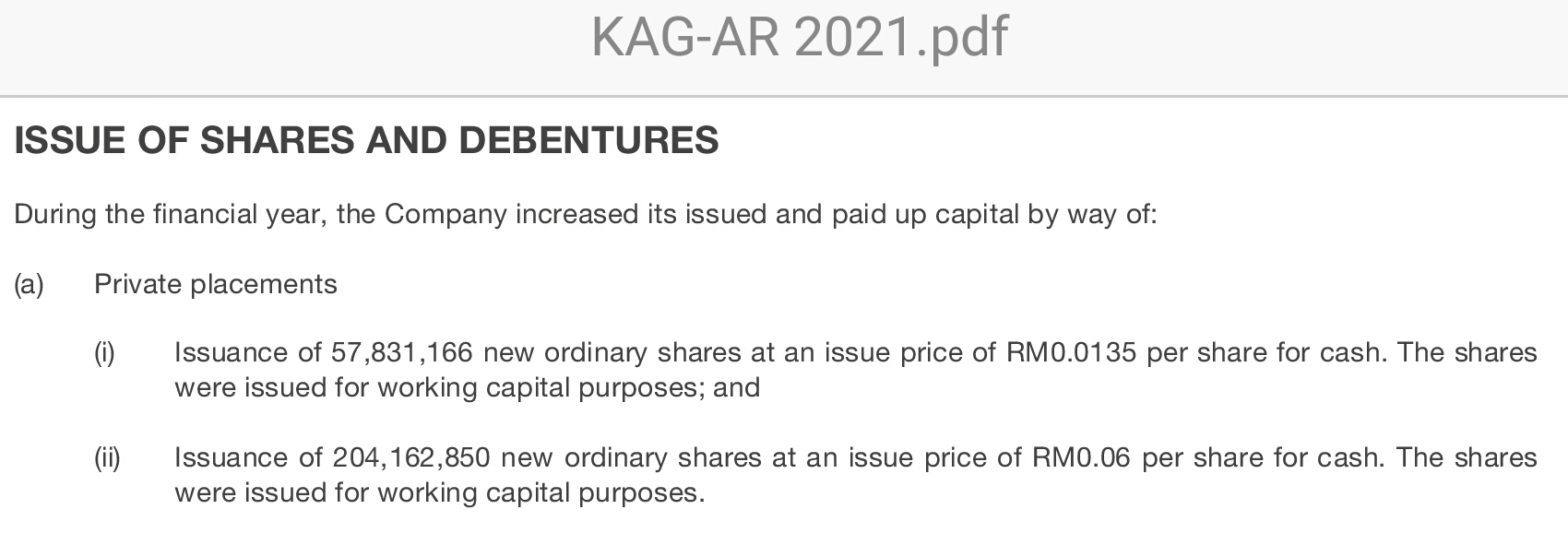

Private placement I

Dated: 21 July 2020

Issuance size: 204,162,850 placement shares

Purpose: Expand and upgrade the existing data centre by building an internet exchange point (“IXP”)

Private placement II

Dated: 11 February 2021, approved the listing and quotation of up to 609,451,510 Placement Shares.

Delayed: Bursa Securities had, vide its letter dated 27 July 2021, resolved to grant the Company an extension of time of 6 months from 11 August 2021 until 10 February 2022 to complete the PP.

Private placement III

Dated: 28 April 2021, approved the listing and quotation of:-

a) up to 789,172,978 new KAG Shares to be issued pursuant to the Proposed Private Placement III (outstanding); and

b) 200,000,000 new KAG Shares to be issued pursuant to the Proposed Acquisition (completed).

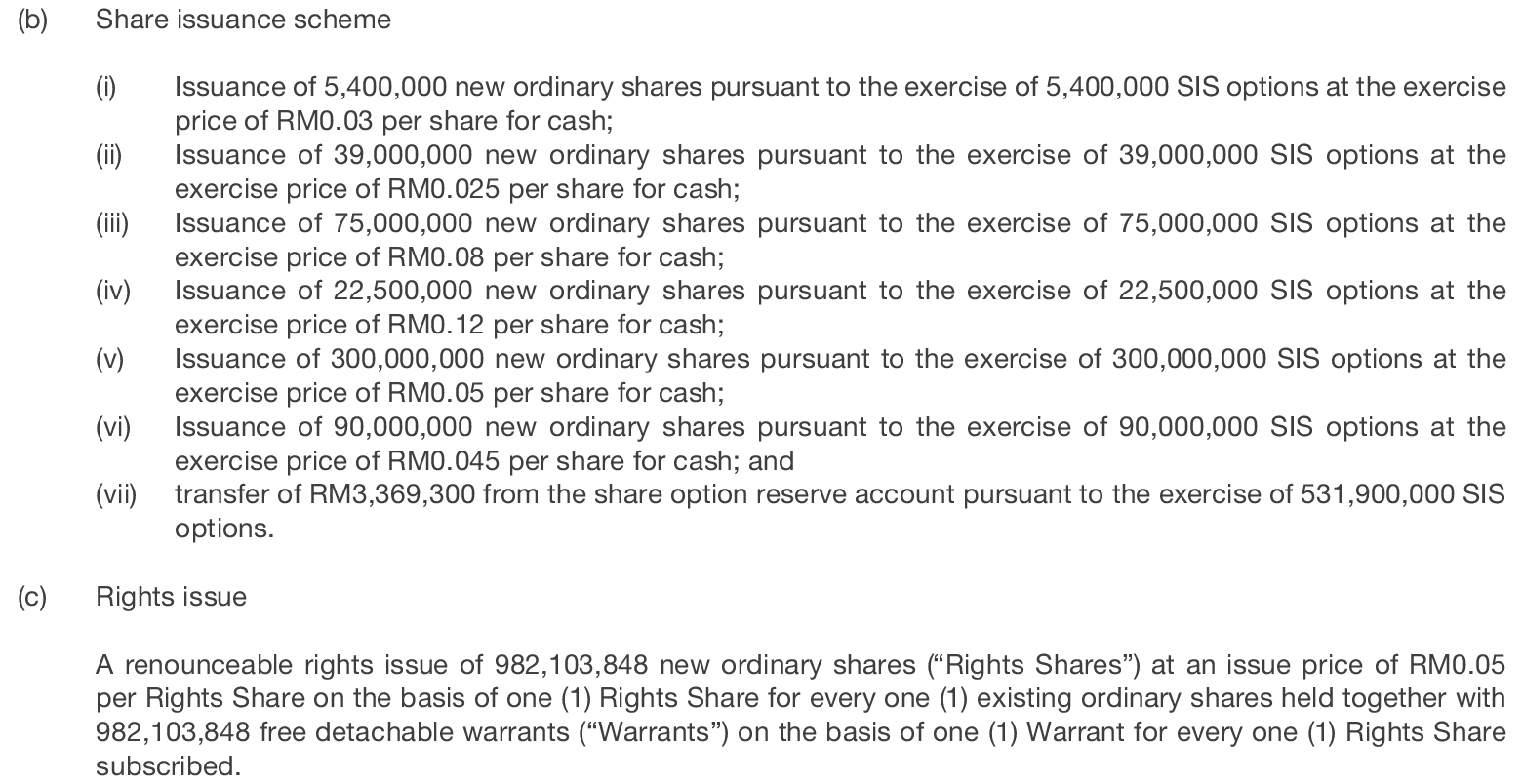

Multiple Proposals - Rights issue with free warrants and Proposed Diversification.

Date: 20 November 2020

Rights Issue of 982,103,848 Rights Shares and 982,103,848 Warrants issued. (Completed)

Purpose: Diversification of the Company’s existing principal activities to include the marketing, distribution and trading of medical equipment, devices, and related products and accessories.

Detail No. 7: Summaries of completed SIS, PP and RI in the financial year.

Detail No. 8: Another version of Summaries of Shares Issuing exercise.

I have written 2 articles on the topic of 'rubbish' or 'con-stock'; I would like to touch on KGroup and continue to take the article below as a yardstick.

https://klse.i3investor.com/m/blog/savemalaysia/2021-08-10-story-h1569679847-Beware_of_rights_issue_galore_MSWG_reminds_newbie_investors.jsp

How many points did KGroup meet the criteria given?

1) KGroup proposed 3 Private Placements, with one completed and two approved pending to complete the exercises. The PP II and PP III was proposed after "Enhanced Rights Issue Mandate which was introduced in November last year." Legalised 1st con? PP II and PP III not fully implemented yet?

2) KGroup did have a huge share base and with decent earnings (See fundamental listing in Details No. 1 to No. 6). Huge share base due to the purpose of PP I, RI and issuing shares as payment for acquiring other company shares.

3) KGroup did issue lots of shares under SIS or under a private placement, thus diluting minority shareholdings. Legalised 2nd con?

4) KGroup did undertake a huge rights issue exercise to raise funds from shareholders. Legalised 3rd con?

5) KGroup has had significant financial instruments that would have a shareholding-dilution effect in the future, such as warrants. Yes, only a very small shareholding-dilution as warrants still not exercise, and a very much smaller fraction for retailers...

6) KGroup did frequently announce numerous memorandums of understanding (MOUs) or collaborative agreements. Most of these either did not fizzle-off or are terminated or take an unreasonably long time for completion. Acquisition completed and on the right track for growth, no issue?

7) KGroup frequently churned out announcements of business ventures, joint ventures (JVs) to create interest and excitement. Good companies will not do this – they produce good results without hyping-up interest and excitement. KGroup did produce good results as shown in increase in revenue.

8) KGroup did not show profit quarter after quarter, but overall still profitable for the 4 rolling quarters.

9) KGroup did use large portions of the company’s funds to acquire core assets and new growth areas. The acquisition has improved revenues.

10) KGroup did use company funds to invest/speculate in listed stocks. Consider 4th con?

With 4 out of 10 con ratings, will it be considered as a Half 'rubbish' or 'con-stock'?? Please do own due diligence.

KGroup performance as at 29/09/2021 (Rolling 4Q)

Profit/ (loss) : RM12.596M

EPS : 0.49sen, NTA : 0.0692

Dividend PS : RM0.00

Dividend Yield : RM0.00

Dividend Payout Rate : 0.000

Ex Div Date : -

ROE : 7.08

As at: 29/09/2021(not verified)

Market Cap : RM77M

P/E : 6.08

Profit/(loss), NTA for the 5 period Ending:

1) 31 Mar 2021: (RM-16.028M),0.0692

2) 31 Dec 2020: (RM-10.579M),0.0835

3) 30 Sep 2020 : RM28.921M, 0.1277

4) 30 Jun 2020 : RM10.282M, 0.1118

5) 31 Mar 2020 : (RM-6.713M), 0.1147

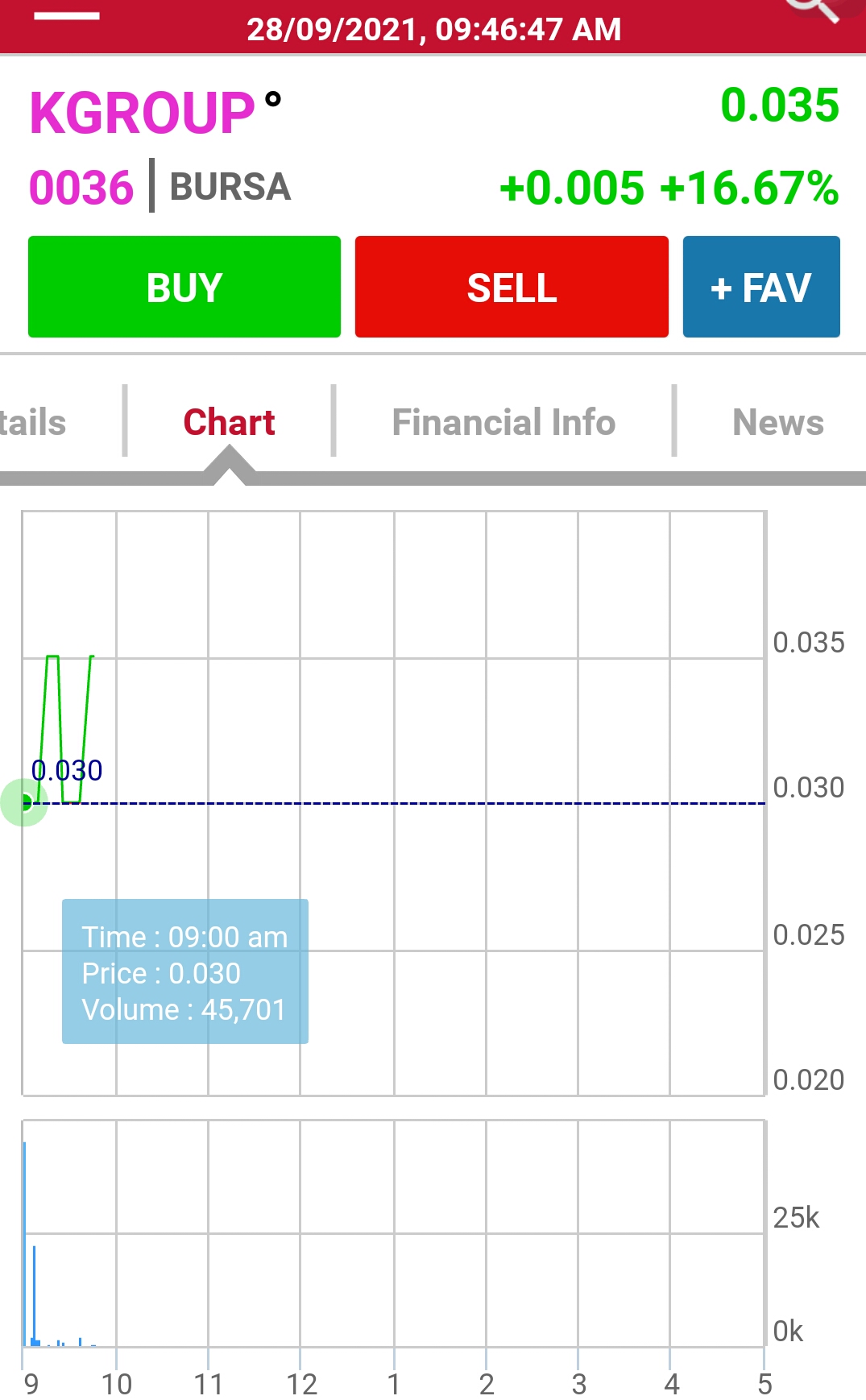

Detail No. 9: Early morning 28 Sept. 2021 of unusual high volume, what next?

For information, KGroup caught my attention last week when I started writing on another article, jumping into it at around 3sen. Therefore this article is a bit biased on the positive movement.

Sources: klsescreener, KGroup AR, KIBB and various internet surfing.

Happy Trading and TradeAtYourOwnRisk.

Disclaimer: The above opinion does not represent a buy, hold or sell recommendation; just a personal opinion and for sharing purposes only. Any offences and errors are unintentional; my apology in advance.